Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As a working professional, you may have noticed a Medicare tax deduction on your paycheck every pay period. It’s a small percentage, but it can add up over time. You may be wondering, “Why am I paying Medicare tax?” The answer is simple: Medicare is a government-run health insurance program that provides coverage for people who are 65 or older, as well as those with certain disabilities.

Why Am I Paying Medicare Tax?

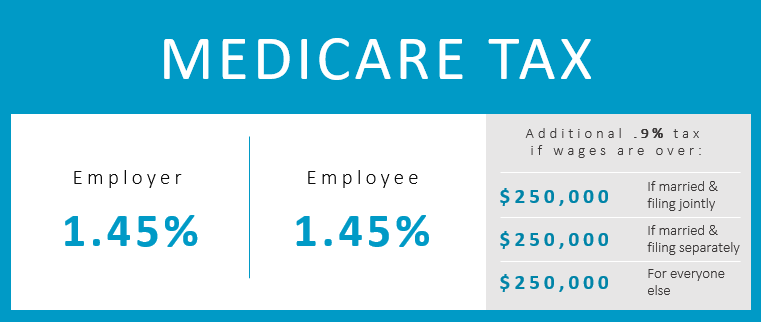

Medicare tax is a federal tax that is deducted from your paycheck to fund the Medicare program. The Medicare program provides healthcare benefits for individuals over the age of 65, as well as those with certain disabilities or chronic conditions. The tax rate is currently set at 1.45% of your earnings, with an additional 0.9% tax for high-income earners. This tax is mandatory for all employees and employers, as it helps support the healthcare needs of millions of Americans.

Why Am I Paying Medicare Tax?

Medicare is a government-funded social insurance program that provides medical coverage to individuals who are 65 years of age or older, or those who have certain disabilities. Medicare is funded through taxes, which are collected from employees and employers. In this article, we will explore why you are paying Medicare tax and the benefits you can expect to receive.

What is Medicare Tax?

Medicare tax is a payroll tax that is imposed on all employees and employers in the United States. The tax is used to fund the Medicare program, which provides medical coverage to eligible individuals. The current tax rate for Medicare is 1.45% of an employee’s wages, which is matched by their employer. If you are self-employed, you are responsible for paying both the employee and employer portion of the tax, which is currently 2.9%.

There is no income cap for Medicare tax, which means that all income earned by an employee is subject to the tax. However, there is a cap on the Social Security tax, which is also collected from employees and employers. In 2021, the Social Security tax is capped at $142,800 of income.

What are the Benefits of Medicare?

Medicare provides medical coverage to eligible individuals who are 65 years of age or older, or those who have certain disabilities. The program is divided into several parts, which provide different types of coverage:

- Part A: Hospital Insurance

- Part B: Medical Insurance

- Part C: Medicare Advantage Plans

- Part D: Prescription Drug Coverage

Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and home health care. Part B covers medically necessary services, such as doctor’s visits, outpatient care, and preventive services. Part C is an optional program that provides coverage through private insurance companies. Part D covers prescription drugs.

How Does Medicare Compare to Private Insurance?

Medicare provides coverage to eligible individuals at a lower cost than private insurance. The program is funded through taxes, which means that beneficiaries do not have to pay premiums for Part A coverage. The cost of Part B coverage is based on income, with most beneficiaries paying a monthly premium of $148.50 in 2021.

Private insurance, on the other hand, requires individuals to pay premiums, deductibles, and copayments. The cost of private insurance can vary widely depending on the individual’s age, health status, and coverage needs.

Can I Opt Out of Medicare?

If you are eligible for Medicare, you are not required to enroll in the program. However, if you choose not to enroll in Medicare when you are first eligible, you may face penalties if you decide to enroll later. The penalty for late enrollment in Part B is 10% for each year that you were eligible but did not enroll.

It is important to carefully consider your options before deciding whether to enroll in Medicare or to opt out. If you have other medical coverage, such as through an employer-sponsored plan, you may be able to delay enrollment in Medicare without facing penalties.

The Bottom Line

Medicare tax is a payroll tax that funds the Medicare program, which provides medical coverage to eligible individuals. The program is divided into several parts, which provide different types of coverage. Medicare provides coverage at a lower cost than private insurance and is funded through taxes, which means that beneficiaries do not have to pay premiums for Part A coverage. If you are eligible for Medicare, it is important to carefully consider your options before deciding whether to enroll in the program.

Frequently Asked Questions

Why am I paying Medicare Tax?

Medicare tax is a payroll tax that is meant to fund the Medicare program. This program provides health insurance to people aged 65 and above and those with certain disabilities. If you are an employee, you are required by law to pay a portion of your wages toward Medicare tax, and your employer is also required to contribute. The tax is automatically deducted from your paycheck, and you will see it listed as “Medicare” on your pay stub.

It’s important to note that Medicare tax is different from Social Security tax, which also comes out of your paycheck. While both taxes help fund government programs that support senior citizens and people with disabilities, they are separate programs with different funding sources.

How much Medicare tax do I have to pay?

The amount of Medicare tax you owe depends on your income. If you are an employee, you pay 1.45% of your wages toward Medicare tax, and your employer is required to match this amount. If you are self-employed, you are responsible for paying both the employee and employer portions of the tax, which adds up to 2.9% of your net earnings. In addition, if you earn more than $200,000 as an individual or $250,000 as a married couple, you will be subject to an additional 0.9% Medicare tax.

What benefits do I get from paying Medicare Tax?

By paying Medicare tax, you are contributing to a program that provides health insurance to millions of Americans. Once you reach the age of 65 or become eligible due to disability, you can enroll in Medicare and receive coverage for a variety of healthcare services, including hospital stays, doctor visits, and prescription drugs. Medicare also offers preventive services like flu shots and cancer screenings. Even if you are not currently eligible for Medicare, your contributions help ensure that the program will continue to be available to others who need it in the future.

Can I opt out of Medicare Tax?

No, as an employee, you are required by law to pay Medicare tax. If you are self-employed, you are also required to pay Medicare tax on your net earnings. There are some limited exceptions to this rule, such as for certain religious groups or for foreign workers who are not eligible for Social Security benefits. However, in general, if you are working in the United States, you will be subject to Medicare tax.

Is there any way to reduce my Medicare Tax liability?

If you are self-employed, you may be able to reduce your Medicare tax liability by deducting half of your self-employment tax on your income tax return. Additionally, if you earn more than $200,000 as an individual or $250,000 as a married couple, you may be able to reduce your liability by taking steps to lower your taxable income, such as contributing to a tax-deferred retirement account. However, it’s important to consult a tax professional to understand your options and ensure that you are complying with all applicable laws and regulations.

Medicare Tax: How to stop the Medicare Taxes from being taken out of your checks!

In conclusion, the Medicare tax is an essential contribution that every American worker makes towards the healthcare system. Even though it may seem like an extra burden on your paycheck, it ensures that you and your loved ones have access to medical care when you need it the most. The Medicare tax is a symbol of solidarity, where everyone in the workforce contributes a little bit to benefit the collective whole.

Moreover, Medicare tax is a vital part of our social safety net that helps protect the most vulnerable members of our society. It ensures that low-income families and senior citizens can access healthcare without the fear of going bankrupt. By paying your Medicare tax, you are helping to ensure that everyone, regardless of their income, can receive the medical care they deserve.

Lastly, paying your Medicare tax is not just a legal obligation but also a moral responsibility. It is a way of showing that you care about the welfare of your fellow citizens and are willing to do your part to ensure that everyone has access to quality healthcare. In short, paying your Medicare tax is a small sacrifice that goes a long way in building a stronger, healthier, and more equitable society.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts