Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage for millions of Americans who are aged 65 and above, as well as those with certain disabilities. Medicare is divided into four parts – A, B, C, and D. While Medicare Part A covers hospital stays and hospice care, many people wonder who pays for this coverage. In this article, we’ll explore the funding sources for Medicare Part A and how it affects beneficiaries.

If you or a loved one are approaching retirement or have a disability, understanding the ins and outs of Medicare can be confusing. With the rising cost of healthcare, many people are left wondering who pays for Medicare Part A. Whether you’re a long-time beneficiary or new to the program, it’s important to understand how this part of Medicare is funded and who is responsible for paying for it.

Medicare Part A is generally free for most Americans who have worked and paid into the Social Security system for at least 10 years. This includes hospital stays, skilled nursing facility care, and some home health care. However, if you haven’t worked long enough to qualify, you may have to pay a monthly premium. Additionally, there are some out-of-pocket costs, such as deductibles and coinsurance, that beneficiaries are responsible for paying.

Who Pays for Medicare Part A?

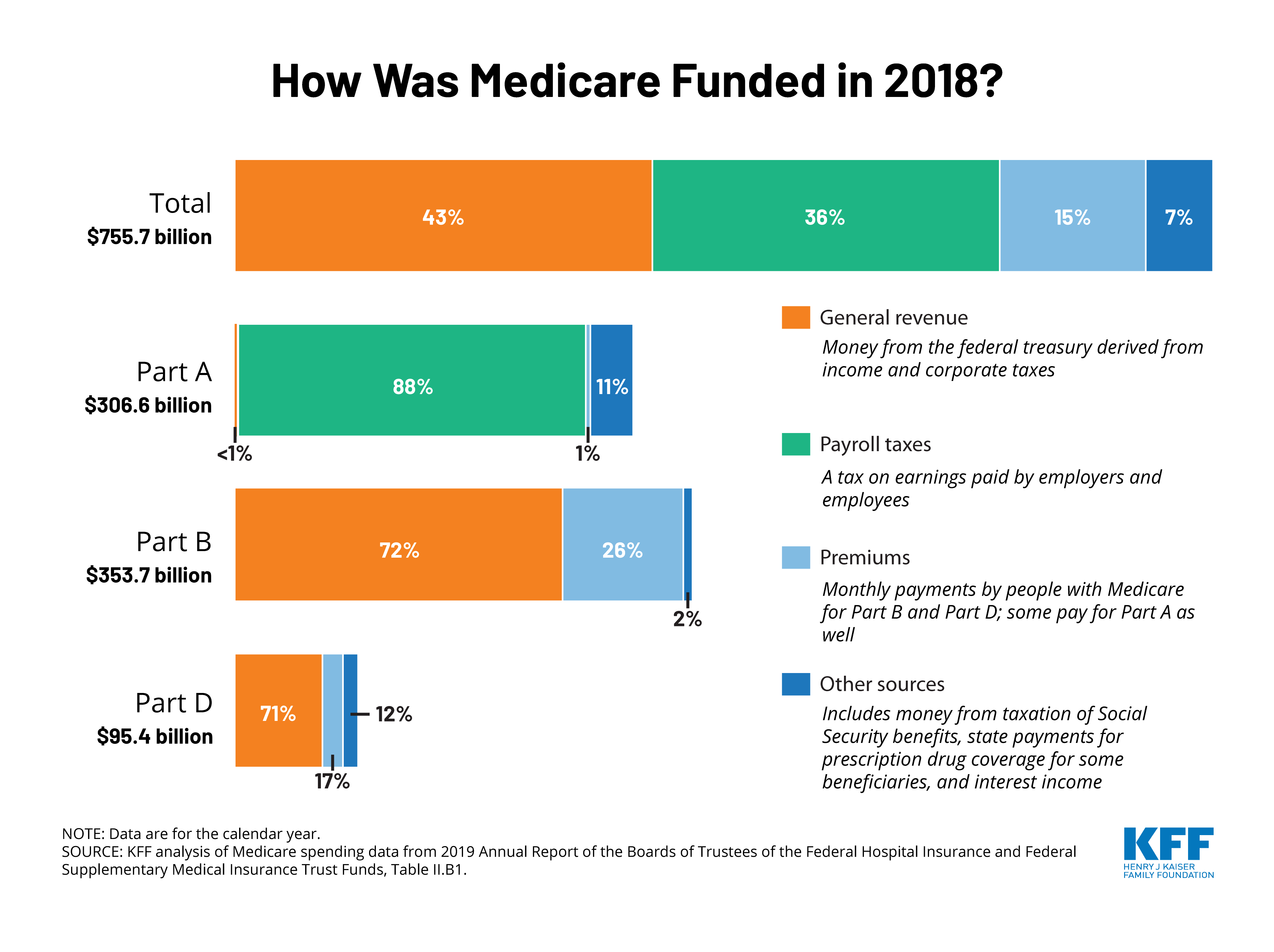

Medicare Part A is a health insurance program that covers hospital stays, skilled nursing facility care, hospice care, and some home health care. It is funded by payroll taxes paid by employees and employers during a person’s working years. However, not everyone pays for Medicare Part A, and the amount each person pays can vary. In this article, we will take a closer look at who pays for Medicare Part A and how much they pay.

Employment and Medicare Part A

If you worked and paid Medicare taxes for at least 10 years, you are eligible for premium-free Medicare Part A. This means that you will not have to pay a monthly premium for your Medicare Part A coverage. You will still have to pay deductibles, coinsurance, and copayments for certain services, but your basic coverage will not cost you anything.

If you did not work and pay Medicare taxes for at least 10 years, you can still get Medicare Part A, but you will have to pay a monthly premium. In 2021, the standard monthly premium for Medicare Part A is $471 per month. However, some people may pay less or more than this amount depending on their work history.

Spouses and Medicare Part A

If you are married and your spouse worked and paid Medicare taxes for at least 10 years, you may be eligible for premium-free Medicare Part A as well. This is called a “spousal benefit.” To be eligible, you must be at least 62 years old and your spouse must be eligible for Medicare Part A.

If you are not eligible for premium-free Medicare Part A based on your spouse’s work history, you may be able to get it by paying a monthly premium. The amount you will have to pay depends on how long your spouse worked and paid Medicare taxes.

Disability and Medicare Part A

If you are under 65 years old and have a disability, you may be eligible for Medicare Part A without having to pay a premium. To be eligible, you must have received Social Security Disability Insurance (SSDI) for at least 24 months or have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS).

If you have a disability and are not eligible for premium-free Medicare Part A, you may be able to get it by paying a monthly premium. The amount you will have to pay depends on how long you worked and paid Medicare taxes.

Benefits of Medicare Part A

Medicare Part A provides coverage for many important health services, including hospital stays, skilled nursing facility care, hospice care, and some home health care. It also covers some preventive services, such as flu shots and mammograms.

One of the biggest benefits of Medicare Part A is that it can help protect you from high healthcare costs. Without insurance, a hospital stay or nursing home stay can cost thousands of dollars per day. With Medicare Part A, you will have some coverage for these services, which can help ease the financial burden.

Medicare Part A vs. Other Insurance

Medicare Part A is not the only type of health insurance available to seniors. Other options include Medicare Part B, Medicare Advantage (Part C), and private insurance plans.

Medicare Part A covers hospital stays and some other services, while Medicare Part B covers doctor visits, outpatient care, and some preventive services. Medicare Advantage plans combine Parts A and B, plus sometimes include additional benefits like prescription drug coverage.

Private insurance plans can also provide coverage for healthcare services, but they may have different requirements and costs than Medicare. It’s important to compare your options carefully to choose the plan that best meets your needs and budget.

Conclusion

Medicare Part A is an important health insurance program that provides coverage for hospital stays, nursing home care, hospice care, and some home health care. It is funded by payroll taxes paid by employees and employers during a person’s working years. Eligibility for premium-free Medicare Part A depends on a person’s work history, while eligibility for premium-based Medicare Part A depends on a person’s work history and other factors. By understanding who pays for Medicare Part A and how much they pay, you can make informed decisions about your healthcare coverage.

Contents

Frequently Asked Questions

Here are some common questions and answers about who pays for Medicare Part A.

1. What is Medicare Part A?

Medicare Part A is a type of health insurance for people who are 65 years or older, or who have certain disabilities or health conditions. It covers hospital stays, skilled nursing facility care, hospice care, and some home health care services.

Medicare Part A is funded by payroll taxes that you and your employer pay during your working years. If you or your spouse didn’t work enough to qualify for premium-free Part A, you may have to pay a monthly premium.

2. Who pays for Medicare Part A?

As mentioned, Medicare Part A is funded by payroll taxes. Specifically, the taxes are 1.45% of your gross wages, and your employer pays an equal amount. If you’re self-employed, you pay both portions. If you or your spouse didn’t work enough to qualify for premium-free Part A, you may have to pay a monthly premium.

It’s worth noting that Medicare Part A is not means-tested, meaning that you’re eligible for the same benefits regardless of your income or assets.

3. Do I need to pay for Medicare Part A if I already have other insurance?

It depends on the type of insurance you have. If you have health insurance through your employer or union, that insurance may pay first for your health care costs. In that case, you may not need to enroll in Medicare Part A right away, but you should still sign up for Medicare Part B.

If you have retiree health insurance or COBRA coverage, Medicare will generally pay first for your health care costs. In that case, you should enroll in Medicare Part A when you’re first eligible, to avoid any gaps in coverage.

4. What happens if I don’t enroll in Medicare Part A?

If you’re eligible for premium-free Medicare Part A and don’t enroll when you’re first eligible, you may have to pay a late enrollment penalty if you enroll later. The penalty is 10% of the premium amount for twice the number of years you were eligible but didn’t enroll.

If you have to pay a premium for Medicare Part A and don’t enroll when you’re first eligible, you may also have to pay a late enrollment penalty if you enroll later. The penalty is 10% of the premium amount for each full 12-month period you were eligible but didn’t enroll.

5. Can I get help paying for Medicare Part A?

If you have limited income and resources, you may be eligible for help paying for Medicare Part A. The Medicare Savings Programs help pay for Medicare premiums, deductibles, coinsurance, and copayments for people with limited income and resources.

In addition, if you qualify for Supplemental Security Income (SSI), you’ll automatically be enrolled in Medicare Part A and may be eligible for help paying for Medicare Part B.

Medicare Basics: Parts A, B, C & D

In conclusion, Medicare Part A is a crucial component of the overall Medicare program, covering hospital stays, skilled nursing care, hospice care, and some home health care services. While most individuals do not pay a premium for Medicare Part A, some may be required to pay deductibles or coinsurance. The funding for Medicare Part A primarily comes from payroll taxes paid by both employers and employees. It is important to understand the costs and funding sources for Medicare Part A, as it can impact your healthcare coverage and financial planning for retirement. Overall, Medicare Part A provides an essential safety net for millions of Americans who rely on it for their healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts