Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, it’s important to understand the ins and outs of our healthcare coverage. One question that often arises is who pays first between VA and Medicare. It’s a complex issue that requires a bit of knowledge and understanding, but we’re here to break it down for you in simple terms.

In this article, we’ll explore the differences between VA and Medicare, how they work together, and ultimately, who pays first. Whether you’re a veteran, a Medicare beneficiary, or just curious about how these programs interact, we’ve got you covered. So, let’s dive in and learn more about who pays first, VA or Medicare.

If you are a veteran and have both Medicare and VA benefits, Medicare pays first. Medicare will pay for services and items that are covered under Medicare Part A and B. VA benefits will cover services and items that are not covered by Medicare, such as dental care and hearing aids. However, if you receive treatment at a VA facility, VA benefits will cover those services first and Medicare will cover any additional costs.

Who Pays First: VA or Medicare?

When it comes to healthcare coverage for veterans, the question of who pays first between VA and Medicare can be confusing. Both programs offer coverage, but understanding which one should be billed first is crucial to avoid any potential financial issues. In this article, we’ll take a closer look at how VA and Medicare work together and who pays first.

Understanding VA Healthcare Coverage

The Department of Veterans Affairs (VA) provides healthcare services to eligible veterans. VA healthcare covers a wide range of medical services, including preventative care, emergency care, and mental health services. Veterans can receive care at VA medical facilities or from providers in the VA network.

VA healthcare is comprehensive and covers most medical services. However, there are some limitations. For example, VA healthcare does not cover services that are not medically necessary or deemed experimental. Additionally, veterans may be required to pay copayments for some services.

How Medicare Works with VA Healthcare

Medicare is a federal health insurance program that provides coverage for people over the age of 65, as well as certain younger people with disabilities. If a veteran is eligible for both VA healthcare and Medicare, the programs can work together to provide comprehensive coverage.

In general, VA healthcare is considered the primary payer, meaning that it pays first for any medical services received. If the veteran has Medicare, it can act as a secondary payer, covering any costs that VA healthcare does not cover.

When to Bill VA Healthcare First

In most cases, VA healthcare should be billed first for any medical services received by a veteran who is eligible for both VA and Medicare. However, there are some exceptions to this rule.

If the veteran is receiving emergency care from a non-VA provider, Medicare should be billed first. Additionally, if the veteran is receiving care for a service-connected disability, VA healthcare should be billed first.

It’s important to note that billing errors can occur if the wrong payer is billed first. To avoid any potential issues, providers should always verify a veteran’s eligibility and coverage before submitting any claims.

Benefits of VA and Medicare Coverage

When a veteran is eligible for both VA healthcare and Medicare coverage, there are several benefits. First, the veteran has access to a wider network of providers. While VA healthcare is comprehensive, it can be limited to VA medical facilities and providers in the VA network. With Medicare, veterans can see any provider that accepts Medicare.

Additionally, having both VA and Medicare coverage can help reduce out-of-pocket costs. VA healthcare does require copayments for some services, but Medicare can help cover these costs.

VA Healthcare vs. Medicare

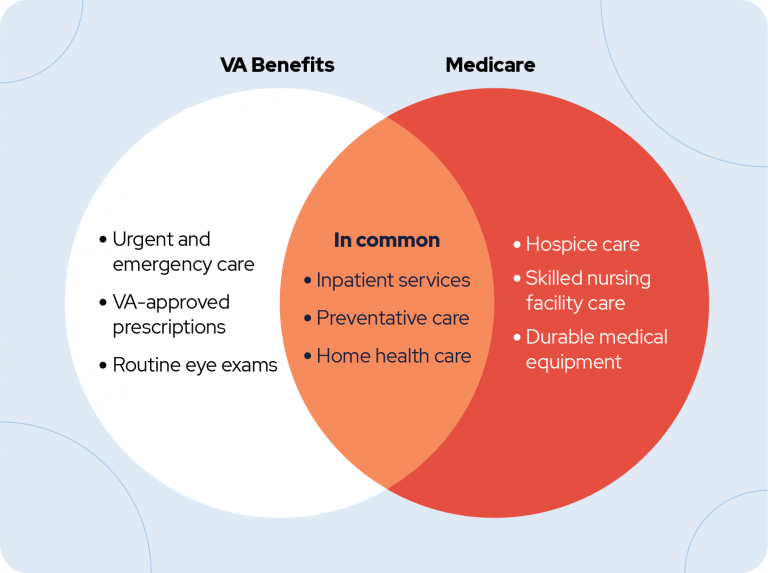

While VA healthcare and Medicare both offer healthcare coverage, there are some key differences to consider.

VA healthcare is specifically designed for veterans and provides comprehensive coverage for most medical services. However, there are limitations to coverage, and veterans may be required to pay copayments for some services.

Medicare, on the other hand, is available to anyone over the age of 65 and certain younger people with disabilities. It offers comprehensive coverage for a wide range of medical services, but there are also costs associated with the program, including premiums, deductibles, and coinsurance.

The Bottom Line

When it comes to healthcare coverage for veterans who are eligible for both VA healthcare and Medicare, understanding who pays first is crucial. In most cases, VA healthcare should be billed first, but there are exceptions to this rule. By understanding the benefits and limitations of both programs, veterans can make informed decisions about their healthcare coverage. Providers should also be aware of the proper billing procedures to avoid any potential issues.

| VA Healthcare | Medicare |

|---|---|

| Designed for veterans | Available to anyone over 65 and certain younger people with disabilities |

| Comprehensive coverage for most medical services | Comprehensive coverage for a wide range of medical services |

| Limitations to coverage | Costs associated with the program, including premiums, deductibles, and coinsurance |

- VA healthcare is considered the primary payer in most cases

- If a veteran has both VA healthcare and Medicare coverage, they have access to a wider network of providers

- Providers should always verify a veteran’s eligibility and coverage before submitting any claims

Frequently Asked Questions

Who Pays First Va or Medicare?

When a military veteran is eligible for both Medicare and VA benefits, it is important to know which one will pay first. In most cases, Medicare will be the primary payer, and VA benefits will be secondary. This means that Medicare will pay for any eligible medical expenses first, and then VA benefits will cover the remaining balance.

However, there are some exceptions to this rule. If a veteran has a service-connected disability that requires ongoing treatment, the VA may be the primary payer. Additionally, if a veteran is treated at a VA facility, the VA will be the primary payer for those services. It is important to understand the specific circumstances of each veteran’s situation to determine which program will be the primary payer.

What Happens If I Have Other Insurance?

If a veteran has other insurance in addition to Medicare and VA benefits, such as a private insurance plan, the order of payment may be different. The primary payer will always be the insurance plan that is responsible for covering the medical expenses first according to coordination of benefits rules. Medicare or VA benefits will then cover any remaining balance.

It is important to inform all insurance providers of any other insurance coverage to ensure that claims are processed correctly and that the veteran does not face any unexpected medical bills. In some cases, the coordination of benefits rules may change depending on the specific insurance policies involved, so it is important to check with each insurance provider for their specific rules.

What Is Coordination of Benefits?

Coordination of benefits is a process that determines which insurance plan is responsible for covering the medical expenses first when a person has multiple insurance plans. This process helps to ensure that the person does not receive more benefits than the actual medical expenses incurred.

When a veteran has both Medicare and VA benefits, coordination of benefits rules will determine which program is responsible for paying first. The primary payer will always be the insurance plan that is responsible for covering the medical expenses first according to coordination of benefits rules. Medicare or VA benefits will then cover any remaining balance.

What Medical Expenses Are Covered?

Both Medicare and VA benefits cover a range of medical expenses, including hospital stays, doctor visits, and prescription medications. However, there may be some differences in coverage between the two programs.

Medicare generally covers a wider range of medical services, including some services that are not covered by VA benefits. VA benefits may be more limited in scope, but they may also cover some services that are not covered by Medicare. It is important to understand the specific benefits of each program to determine which one will provide the best coverage for a veteran’s medical needs.

Can I Use Both Programs at the Same Time?

In most cases, a veteran can use both Medicare and VA benefits at the same time. However, it is important to understand the coordination of benefits rules to ensure that claims are processed correctly and that the veteran does not face any unexpected medical bills.

If a veteran receives treatment at a VA facility, the VA will be the primary payer for those services. If a veteran receives treatment outside of a VA facility, Medicare will be the primary payer in most cases. It is important to understand the specific circumstances of each veteran’s situation to determine which program will be the primary payer.

VA or Medicare? Do you need both?

In conclusion, navigating the healthcare system can be daunting, especially when it comes to determining who pays first between VA and Medicare. However, understanding the rules and regulations can make the process much smoother.

It’s important to note that in most cases, VA benefits take precedence over Medicare. This means that if you’re eligible for both, VA will cover the cost of your medical care before Medicare. However, there are some exceptions to this rule, such as for certain prescription drugs.

If you’re a veteran with VA benefits and Medicare coverage, it’s important to work with both agencies to ensure you’re receiving the maximum benefits available to you. By doing so, you can minimize your out-of-pocket expenses and receive the care you need to stay healthy.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts