Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you nearing the age of 65 and wondering when to get Medicare supplemental insurance? It’s a common question among seniors who are transitioning to Medicare. Medicare supplemental insurance, also known as Medigap, can help cover costs that original Medicare doesn’t. However, the timing of when to enroll can affect your coverage options and costs. In this article, we’ll explore the factors to consider when deciding when to get Medicare supplemental insurance.

You can enroll in a Medicare Supplement plan during your open enrollment period, which is the six-month period that begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this time, you have a guaranteed issue right to purchase any Medicare Supplement plan offered in your state, regardless of your health status. If you miss this period, you may still be able to enroll in a plan, but you may be subject to medical underwriting and may not be able to get the plan you want.

Contents

- When to Get Medicare Supplemental Insurance?

- Frequently Asked Questions

- What is Medicare Supplemental Insurance?

- When should I enroll in Medicare Supplemental Insurance?

- What types of Medicare Supplemental Insurance policies are available?

- Can I switch Medicare Supplemental Insurance policies?

- How much does Medicare Supplemental Insurance cost?

- Medicare Supplemental Insurance – Best Medicare Supplement Plans for 2023

When to Get Medicare Supplemental Insurance?

Medicare is a government-sponsored health insurance program for Americans aged 65 and older. While Medicare covers many healthcare services, it doesn’t cover everything. That’s where Medicare Supplemental Insurance, also known as Medigap, comes in. Medigap policies can help pay for some of the costs that Medicare doesn’t cover. But when is the right time to get Medigap insurance? Here are some key considerations.

When You First Enroll in Medicare

The best time to enroll in Medigap insurance is during your initial enrollment period, which begins when you turn 65 and enroll in Medicare. During this period, you have a guaranteed issue right, which means that insurance companies can’t deny you coverage or charge you more for pre-existing conditions. This is the best time to enroll in Medigap insurance because you’ll have the most options and the lowest premiums.

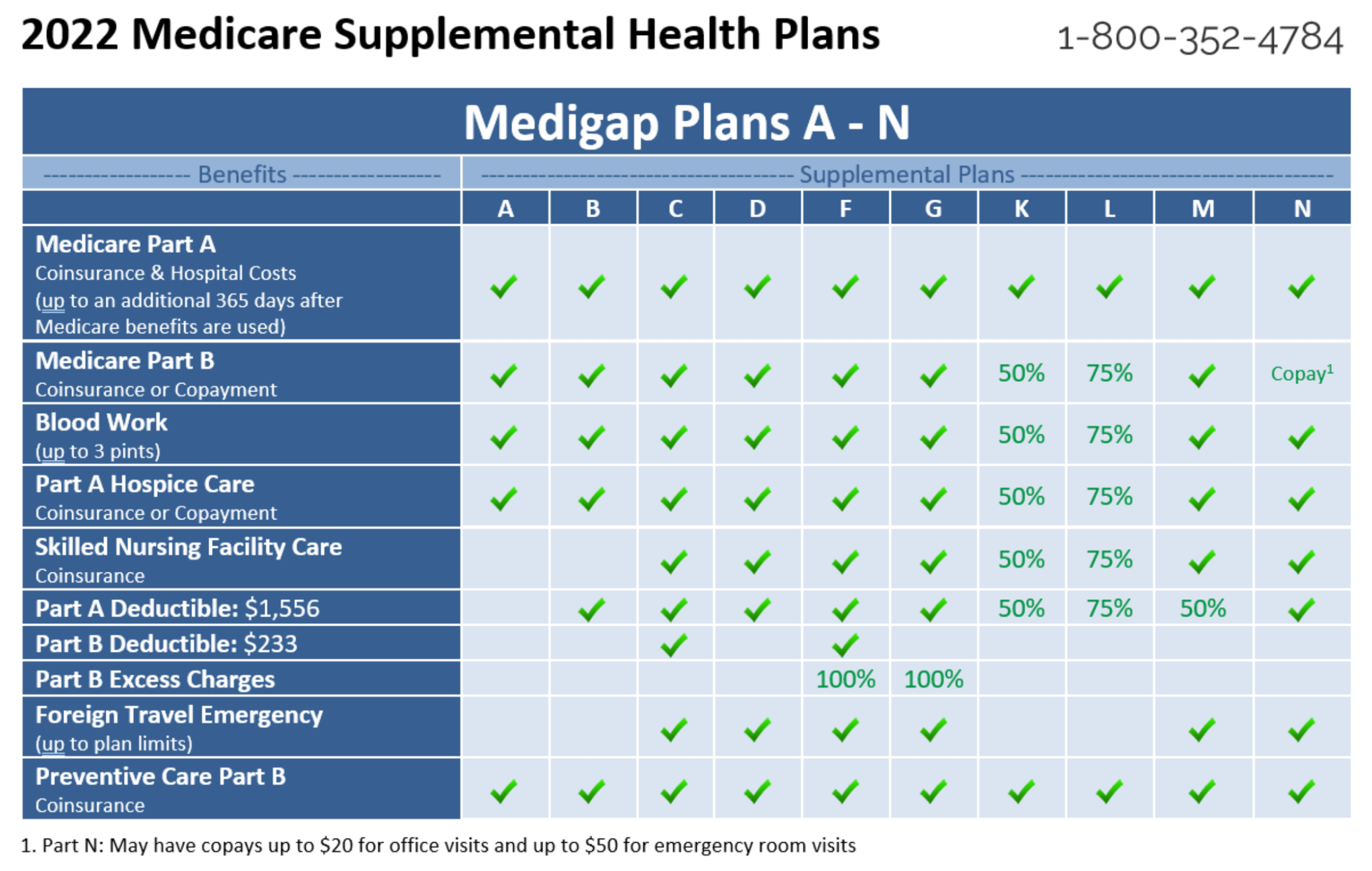

When you enroll in Medigap insurance, you’ll need to choose a plan that fits your needs. There are ten different Medigap plans, labeled A through N. Each plan offers different benefits, so it’s important to choose the one that best fits your healthcare needs and budget.

When Your Health Changes

If you don’t enroll in Medigap insurance during your initial enrollment period, you may still be able to enroll later. However, insurance companies may be able to deny you coverage or charge you more based on your health status. If you have a pre-existing condition or your health changes, you may want to consider enrolling in Medigap insurance.

When your health changes, you may need more healthcare services than you did before. Medigap insurance can help cover some of the costs of these services, such as deductibles, copayments, and coinsurance.

When You’re Traveling Abroad

Medicare doesn’t cover healthcare services outside of the United States, except in limited circumstances. If you’re planning to travel abroad, you may want to consider enrolling in Medigap insurance. Some Medigap plans offer coverage for emergency healthcare services when you’re traveling outside of the United States.

When you’re traveling abroad, it’s important to know what healthcare services are covered by your insurance plan. You may need to pay for healthcare services out of pocket and then seek reimbursement from your insurance company.

When You’re on a Fixed Income

If you’re on a fixed income, you may be concerned about the cost of healthcare services. Medigap insurance can help you manage these costs by covering some of the expenses that Medicare doesn’t cover. However, Medigap premiums can be expensive, so it’s important to choose a plan that fits your budget.

When you’re on a fixed income, it’s important to consider all of your healthcare expenses, including premiums, deductibles, copayments, and coinsurance. You may want to compare the costs of different Medigap plans to find the one that’s most affordable for you.

Benefits of Medigap Insurance

Medigap insurance offers several benefits, including:

– Coverage for some of the costs that Medicare doesn’t cover, such as deductibles, copayments, and coinsurance

– Guaranteed issue rights during your initial enrollment period

– The ability to keep your own doctor and visit any healthcare provider that accepts Medicare

– Portable coverage that travels with you anywhere in the United States

– The ability to enroll in a Medigap plan at any time, even if you have a pre-existing condition

Medigap vs. Medicare Advantage

Medicare Advantage plans are another option for people who want additional healthcare coverage. Unlike Medigap plans, Medicare Advantage plans are offered by private insurance companies and replace your original Medicare coverage. Medicare Advantage plans often include additional benefits, such as dental, vision, and prescription drug coverage.

When choosing between Medigap and Medicare Advantage, it’s important to consider your healthcare needs and budget. Medigap plans offer more flexibility and the ability to keep your own doctor, but they can be more expensive. Medicare Advantage plans may be more affordable, but they often have restrictions on which healthcare providers you can see.

How to Choose a Medigap Plan

When choosing a Medigap plan, it’s important to consider your healthcare needs and budget. Here are some key factors to consider:

– The benefits offered by each plan

– The cost of the plan, including premiums, deductibles, copayments, and coinsurance

– The insurance company’s reputation and financial stability

– Whether the plan offers any additional benefits, such as coverage for traveling abroad

– Whether the plan fits your healthcare needs, including any prescription drugs you take

Conclusion

Medicare Supplemental Insurance, or Medigap, can help cover some of the costs that Medicare doesn’t cover. The best time to enroll in Medigap insurance is during your initial enrollment period, but you may still be able to enroll later if your health changes. When choosing a Medigap plan, it’s important to consider your healthcare needs and budget. Medigap insurance offers several benefits, including guaranteed issue rights during your initial enrollment period and the ability to keep your own doctor.

Frequently Asked Questions

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance, also known as Medigap, is a private insurance policy that can help you pay for some of the healthcare costs that Original Medicare doesn’t cover, such as deductibles, copayments, and coinsurance. These policies are available from private insurance companies and can help you save money on your healthcare expenses.

If you’re enrolled in Original Medicare and you’re struggling to pay for some of your healthcare costs, a Medicare Supplemental Insurance policy might be a good option for you. These policies can help you save money on your out-of-pocket expenses and give you peace of mind knowing that you’re covered if you need medical care.

When should I enroll in Medicare Supplemental Insurance?

The best time to enroll in Medicare Supplemental Insurance is during your open enrollment period, which lasts for six months and begins on the first day of the month in which you turn 65 and are enrolled in Medicare Part B. During this time, you have a guaranteed issue right, which means that you can’t be denied coverage or charged higher premiums based on your medical history.

If you miss your open enrollment period, you may still be able to enroll in Medicare Supplemental Insurance, but you may be subject to medical underwriting, which means that the insurance company can consider your medical history when deciding whether to offer you coverage and how much to charge you for it.

What types of Medicare Supplemental Insurance policies are available?

There are 10 standardized Medicare Supplemental Insurance policies available, labeled A through N. Each policy offers a different combination of benefits, with Plan A being the most basic and Plan F being the most comprehensive. The benefits of each plan are standardized across all insurance companies, so you can compare policies and prices to find the one that best fits your needs and budget.

Some states may offer additional Medicare Supplemental Insurance policies that aren’t standardized, so it’s important to check with your state insurance department to see what options are available to you.

Can I switch Medicare Supplemental Insurance policies?

Yes, you can switch Medicare Supplemental Insurance policies at any time. However, if you’re outside of your open enrollment period, you may be subject to medical underwriting, which means that the insurance company can consider your medical history when deciding whether to offer you coverage and how much to charge you for it.

It’s important to compare policies and prices before you switch, as the benefits and premiums can vary widely between policies and insurance companies.

How much does Medicare Supplemental Insurance cost?

The cost of Medicare Supplemental Insurance varies depending on the plan you choose, where you live, and the insurance company you buy the policy from. Premiums can range from a few hundred dollars to over a thousand dollars per year.

It’s important to shop around and compare policies and prices to find the one that best fits your needs and budget. Keep in mind that the most comprehensive policies, such as Plan F, may have higher premiums but can save you money in the long run by covering more of your healthcare costs.

Medicare Supplemental Insurance – Best Medicare Supplement Plans for 2023

In conclusion, if you are approaching the age of 65 or have already passed it, Medicare Supplemental Insurance can be a wise investment. This insurance can help cover the gaps in your Medicare coverage and protect you from unexpected medical expenses.

It is important to understand the enrollment periods for Medicare Supplemental Insurance and to consider your individual health needs when choosing a plan.

Ultimately, the decision to purchase Medicare Supplemental Insurance is a personal one that should be made after careful consideration. By doing so, you can have peace of mind knowing that you have additional coverage to protect your health and finances.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts