Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federally funded health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. But when should a person apply for Medicare? Many factors come into play when determining the right time to enroll, and it can be overwhelming to navigate the complex system. In this article, we will explore the different scenarios in which a person should apply for Medicare, and what options are available for those who miss their initial enrollment period.

Understanding the nuances of Medicare can be a daunting task, but with the right information, you can make informed decisions about your healthcare coverage. Whether you’re approaching your 65th birthday or have a qualifying disability, it’s important to know the ins and outs of Medicare enrollment. In this article, we’ll break down the eligibility requirements, enrollment periods, and available options, so you can confidently choose the best time to apply for Medicare.

A person should apply for Medicare three months before their 65th birthday, even if they are not ready to start receiving retirement benefits. If a person does not apply for Medicare during their initial enrollment period, they may face a late enrollment penalty and a gap in coverage. However, if a person is still working and has insurance through their employer, they may be able to delay enrollment in Medicare.

When Should a Person Apply for Medicare?

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, as well as for some individuals with disabilities or certain medical conditions. However, deciding when to apply for Medicare can be a confusing and overwhelming process. In this article, we will discuss when a person should apply for Medicare and what factors they should consider.

Turning 65

If you are 65 years old or older, you are eligible for Medicare. It is recommended that you apply for Medicare during your Initial Enrollment Period (IEP), which begins three months before your 65th birthday and ends three months after your birthday. Applying during your IEP ensures that you will have coverage as soon as possible and avoid any late enrollment penalties.

If you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Parts A and B during your IEP. However, if you are not receiving Social Security benefits, you will need to manually enroll in Medicare through the Social Security Administration.

Disability

If you are under 65 years old and have been receiving Social Security Disability Insurance (SSDI) for at least 24 months, you will automatically be enrolled in Medicare Parts A and B. However, if you have a disability and have not been receiving SSDI for 24 months, you will need to manually apply for Medicare.

End-Stage Renal Disease (ESRD)

If you have ESRD, you are eligible for Medicare regardless of your age. You can apply for Medicare by contacting the Social Security Administration.

Medicare Advantage vs. Original Medicare

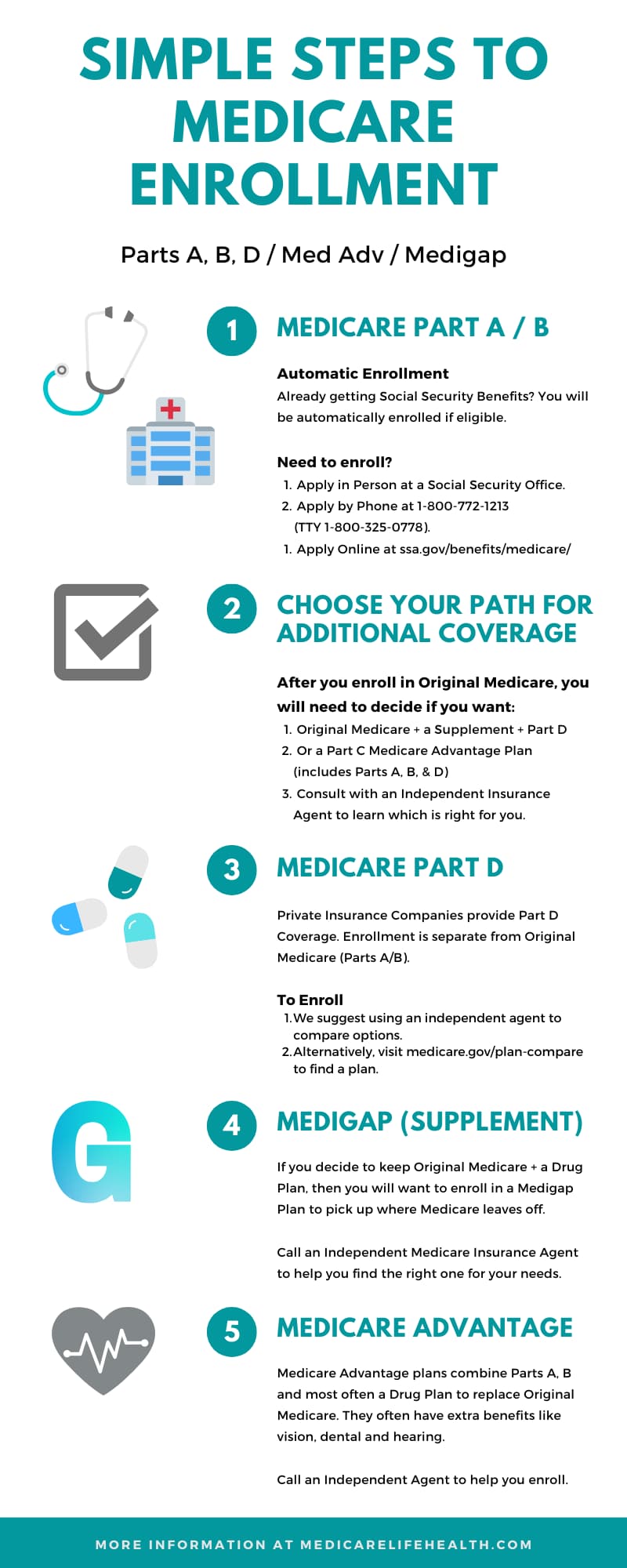

When you apply for Medicare, you have the option to enroll in Original Medicare (Parts A and B) or a Medicare Advantage plan (Part C). Original Medicare is a fee-for-service program that allows you to go to any doctor or hospital that accepts Medicare. Medicare Advantage plans are offered by private insurance companies and provide all of the coverage of Original Medicare, plus additional benefits such as prescription drug coverage, dental and vision care, and wellness programs.

Before you make a decision, it’s important to compare the costs and coverage of each option. Medicare Advantage plans may have lower out-of-pocket costs, but they may also have more restrictions on which doctors and hospitals you can use.

Prescription Drug Coverage

Medicare Part D provides prescription drug coverage, and you can enroll in a Part D plan when you first become eligible for Medicare. If you don’t enroll in Part D when you are first eligible, you may have to pay a late enrollment penalty.

Medigap Plans

Medigap plans are supplemental insurance policies that can help pay for the out-of-pocket costs of Original Medicare, such as deductibles, copayments, and coinsurance. You can enroll in a Medigap plan during your six-month Medigap Open Enrollment Period, which starts the month you turn 65 and are enrolled in Medicare Part B.

Employer Coverage

If you are still working and have employer-sponsored health insurance, you may be able to delay enrolling in Medicare without paying a late enrollment penalty. However, it’s important to understand the rules and deadlines for enrolling in Medicare when you have employer coverage.

Retirement

If you retire after age 65 and lose your employer-sponsored health insurance, you will need to enroll in Medicare to avoid a gap in coverage. You can enroll in Medicare during a Special Enrollment Period (SEP) that lasts for eight months after your employer coverage ends.

Income-Related Monthly Adjustment Amount (IRMAA)

If your income is above a certain threshold, you may have to pay an additional amount for your Medicare premiums. This is called the Income-Related Monthly Adjustment Amount (IRMAA), and it applies to Medicare Parts B and D. You can find more information about IRMAA on the Medicare website.

Conclusion

Deciding when to apply for Medicare can be a complex process, but understanding the rules and deadlines can help you make an informed decision. Whether you’re turning 65, have a disability, or are retiring, there are different factors to consider when applying for Medicare. By doing your research and comparing your options, you can find the right Medicare plan for your needs and budget.

Frequently Asked Questions

When is the right time to apply for Medicare?

The best time to apply for Medicare is during the initial enrollment period, which starts three months before your 65th birthday and ends three months after your birthday month. If you miss your initial enrollment period, you can still sign up during the general enrollment period, which runs from January 1 to March 31 each year. However, if you delay signing up for Medicare, you may face late enrollment penalties.

It’s important to note that if you are still working and have health insurance through your employer, you may not need to sign up for Medicare just yet. In this case, you may be able to delay enrollment without facing penalties. However, it’s recommended that you speak with a Medicare representative to determine your specific situation and when to enroll.

What happens if I miss the initial enrollment period?

If you miss your initial enrollment period, you may face late enrollment penalties. The amount of the penalty varies depending on how long you waited to enroll in Medicare. The longer you wait, the higher the penalty will be. The penalty is added to your monthly premium and will last for as long as you have Medicare coverage.

If you missed your initial enrollment period because you were covered under an employer’s health plan, you may be eligible for a special enrollment period. This allows you to enroll in Medicare without facing a penalty. It’s important to speak with a Medicare representative to determine your eligibility and enrollment period.

Can I apply for Medicare if I am under 65?

Yes, you can apply for Medicare if you are under 65 but have a qualifying disability. You must have received Social Security Disability Insurance (SSDI) for at least 24 months or have a qualifying medical condition to be eligible for Medicare before turning 65.

If you have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS), you may be eligible for Medicare regardless of your age. It’s important to speak with a Medicare representative to determine your eligibility and enrollment period.

What is the difference between Medicare Part A and Part B?

Medicare Part A covers hospital stays, skilled nursing facilities, hospice care, and some home health care. Medicare Part B covers doctor visits, outpatient services, and some preventive services. Part A is typically premium-free for most people, while Part B has a monthly premium.

It’s important to note that there are some services that are not covered by either Part A or Part B, such as dental, vision, and hearing services. You may need to enroll in additional coverage, such as a Medicare Advantage plan or a standalone dental or vision plan, to receive these services.

How do I apply for Medicare?

You can apply for Medicare online, by phone, or in person at your local Social Security office. To apply online, visit the Social Security Administration’s website and follow the instructions. To apply by phone or in person, call your local Social Security office to schedule an appointment. You will need to provide some personal information, such as your Social Security number and birthdate, to complete the application. It’s important to apply for Medicare during your initial enrollment period to avoid late enrollment penalties.

When to Enroll in Medicare | Medicare Initial Enrollment Period

In conclusion, the question of when a person should apply for Medicare depends on a variety of factors. Generally, it is recommended that individuals apply for Medicare three months before their 65th birthday. However, if you have a qualifying disability or medical condition, you may be eligible for Medicare before the age of 65.

It is important to consider your personal health needs and financial situation when deciding when to enroll in Medicare. If you are still working and have access to employer-sponsored health insurance, you may be able to delay enrollment in Medicare. However, it is crucial to understand the potential penalties for delaying enrollment.

Ultimately, it is recommended that you speak with a trusted healthcare professional or financial advisor to determine the best course of action for your individual situation. By carefully considering your options and weighing the pros and cons of each, you can make an informed decision about when to apply for Medicare.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts