Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides medical coverage to people aged 65 and above, as well as those with certain disabilities. However, there has been a lot of talk about the program’s financial sustainability in recent years. The question on everyone’s mind is, when will Medicare run out of money?

With the rising cost of healthcare and an aging population, concerns about the long-term viability of Medicare have become more pressing. In this article, we will explore the factors contributing to Medicare’s financial situation and examine what steps are being taken to ensure the program’s sustainability. Join us as we dive into this critical issue and uncover what the future holds for healthcare in the United States.

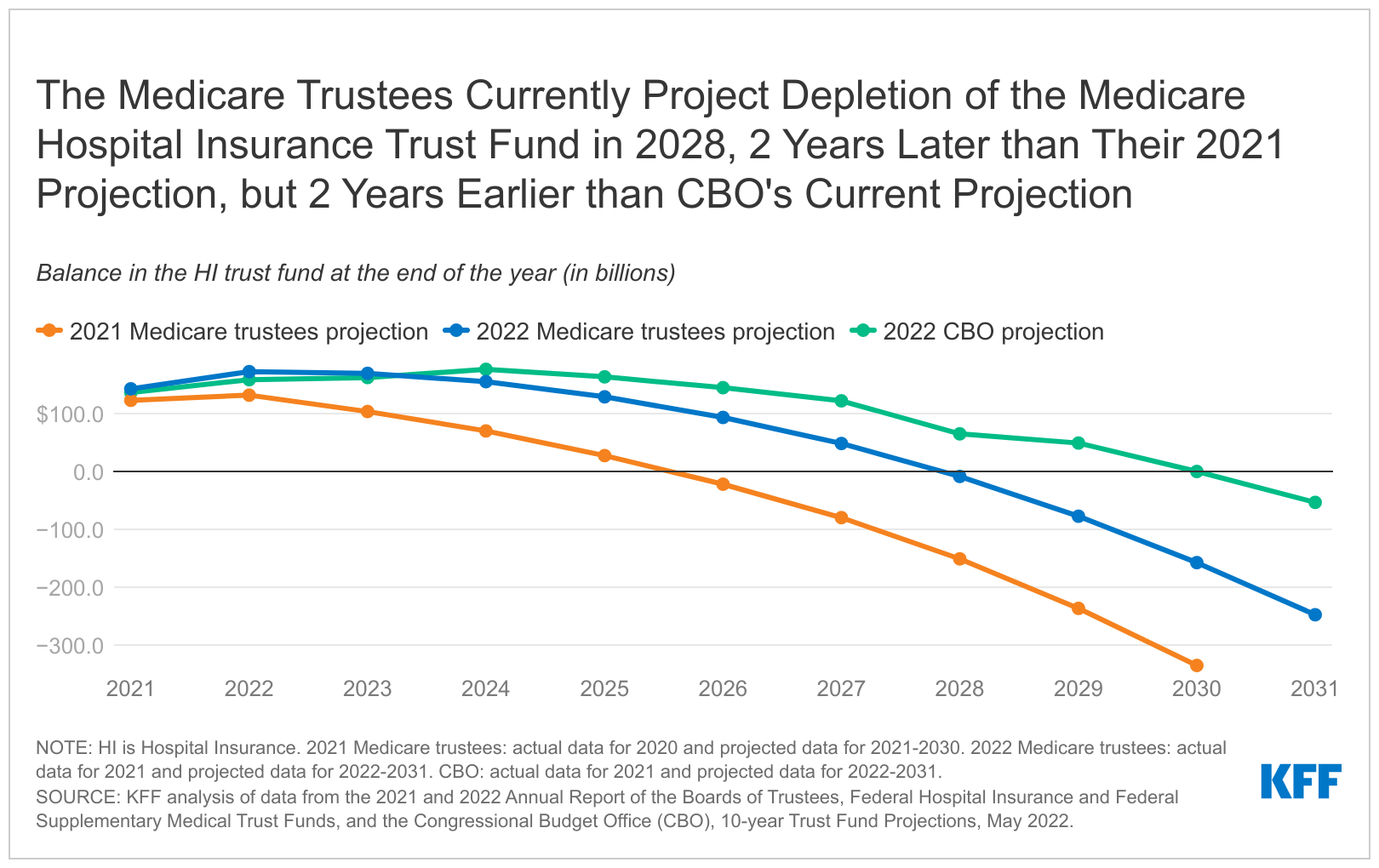

According to the latest report from the Medicare Board of Trustees in 2021, Medicare’s Hospital Insurance trust fund, also known as Part A, is projected to be depleted in 2026. However, Medicare Part B and Part D, which cover physician services and prescription drug benefits, are funded by general revenues and beneficiary premiums and are not projected to run out of money.

Contents

- When Does Medicare Run Out of Money?

- Frequently Asked Questions

- 1. When is Medicare projected to run out of money?

- 2. What factors are contributing to Medicare’s financial challenges?

- 3. What happens if Medicare runs out of money?

- 4. What are some potential solutions to Medicare’s financial challenges?

- 5. What can individuals do to prepare for potential changes to Medicare?

- Will Medicare Run Out of Money?

When Does Medicare Run Out of Money?

Medicare is a government-funded health insurance program that covers medical expenses for millions of Americans who are 65 years or older, as well as those with certain disabilities. However, there has been talk for years about the financial sustainability of the program. In this article, we will discuss when Medicare is projected to run out of money and what that means for beneficiaries.

Current Financial Status of Medicare

As of 2021, Medicare’s financial status is stable, but the program is still facing financial challenges. The program is funded through payroll taxes, premiums, and taxes on Social Security benefits. According to the Medicare Trustees’ report, the Hospital Insurance (HI) trust fund is projected to be depleted by 2026. After that, Medicare would only be able to pay 91% of the program’s costs. The Supplementary Medical Insurance (SMI) trust fund, which covers physician services and prescription drugs, is projected to remain adequately financed.

The COVID-19 pandemic has also impacted Medicare’s financial situation. The program has seen an increase in spending due to increased hospitalizations and the cost of vaccinations. However, the pandemic has also resulted in a decrease in revenue due to high unemployment rates and reduced payroll taxes.

Factors Contributing to Medicare’s Financial Challenges

Several factors have contributed to Medicare’s financial challenges, including:

Rising healthcare costs: Healthcare costs have been rising faster than the rate of inflation, putting pressure on the Medicare program.

Aging population: As the baby boomer generation ages, there are more beneficiaries in the program, increasing the demand for services.

Low birth rates: The birth rate has been declining, resulting in fewer workers paying into the program.

Longer life expectancy: People are living longer, which means they are using more healthcare services and collecting benefits for a longer period.

What Happens When Medicare Runs Out of Money?

If Medicare’s HI trust fund runs out of money, it would have significant consequences for beneficiaries. Medicare would only be able to pay 91% of the program’s costs, which means beneficiaries would have to pay more out of pocket for medical services. The cost of premiums and deductibles could also increase, putting a strain on beneficiaries’ finances.

To avoid this situation, policymakers need to take action to address Medicare’s financial challenges. This could include raising payroll taxes, reducing benefits, or implementing cost-saving measures, such as reducing fraud and waste.

What Can Beneficiaries Do?

Beneficiaries can take steps to prepare for potential changes to Medicare. This includes:

Educating themselves: Beneficiaries should learn about the program and how it works, as well as any potential changes that could impact their benefits.

Reviewing their coverage: Beneficiaries should review their coverage each year during the open enrollment period to ensure they have the best plan for their needs.

Planning for healthcare costs: Beneficiaries should plan for out-of-pocket healthcare costs by saving money or purchasing supplemental insurance.

Benefits of Medicare

Despite its financial challenges, Medicare provides significant benefits to millions of Americans. These benefits include:

Access to healthcare: Medicare provides access to necessary medical services for beneficiaries.

Financial protection: Medicare helps protect beneficiaries from the high cost of medical care.

Peace of mind: Medicare provides peace of mind for beneficiaries by ensuring they have access to necessary medical services.

Medicare vs. Private Insurance

While some people may choose to purchase private insurance instead of relying on Medicare, there are significant differences between the two. Private insurance may offer more flexibility and additional benefits, but it can also be more expensive. Medicare provides comprehensive coverage at a lower cost, making it a good option for many seniors and those with disabilities.

Conclusion

Medicare is a critical program that provides essential healthcare services to millions of Americans. While the program is facing financial challenges, there are steps that can be taken to address these issues and ensure the program’s continued sustainability. Beneficiaries can also take steps to prepare for potential changes and ensure they have the best coverage for their needs. Overall, Medicare remains an important program that provides significant benefits to those who need it most.

Frequently Asked Questions

Medicare is a federal health insurance program that provides coverage to Americans over the age of 65 and those with certain disabilities. With the increasing number of beneficiaries and rising healthcare costs, there are concerns about the program’s financial sustainability. Here are some frequently asked questions about when Medicare could run out of money:

1. When is Medicare projected to run out of money?

According to the latest report from the Medicare Trustees, the Hospital Insurance (HI) trust fund, which finances Medicare Part A, is projected to become insolvent by 2026. This means that the fund will only be able to pay out 90% of its expenses from that point forward.

The other parts of Medicare, which are financed through general revenue and beneficiary premiums, are not projected to become insolvent. However, their financing mechanisms could face challenges in the long run.

2. What factors are contributing to Medicare’s financial challenges?

There are several factors that are contributing to Medicare’s financial challenges, including the aging of the population, the increasing cost of healthcare, and the relatively low revenue streams that fund the program. Additionally, the COVID-19 pandemic has put a strain on the program’s finances, as it has resulted in increased hospitalizations and healthcare spending.

To address these challenges, policymakers will need to consider a range of options, such as increasing revenue sources, reducing costs, or adjusting benefits and eligibility requirements.

3. What happens if Medicare runs out of money?

If the HI trust fund becomes insolvent, it would not mean that Medicare would cease to exist. Instead, it would mean that the program would only be able to pay out a portion of its expenses from that point forward. This could result in reduced benefits, increased costs for beneficiaries, or changes to the program’s financing structure.

To avoid this scenario, policymakers will need to take action to shore up the program’s finances and ensure its long-term sustainability.

4. What are some potential solutions to Medicare’s financial challenges?

There are several potential solutions to Medicare’s financial challenges, including increasing the payroll tax rate that funds the program, raising the eligibility age, reducing payments to healthcare providers, or implementing means-testing for beneficiaries. However, each of these solutions has its own trade-offs and would require careful consideration and public debate.

In addition, policymakers may also consider broader reforms to the healthcare system that could reduce costs and improve the quality of care, which could have a positive impact on Medicare’s finances over the long run.

5. What can individuals do to prepare for potential changes to Medicare?

While individuals cannot control the broader policy decisions that will impact Medicare’s finances, there are some steps they can take to prepare for potential changes. This includes staying informed about the program and any proposed reforms, reviewing their healthcare needs and options, and considering supplemental insurance or savings to help cover out-of-pocket costs.

It is also important for individuals to advocate for policies that support the long-term sustainability of the program and ensure that it continues to provide high-quality, affordable healthcare to those who need it most.

Will Medicare Run Out of Money?

In conclusion, the looming question of when Medicare will run out of money is a cause for concern among millions of Americans. However, experts predict that this will not happen until 2026, at which point the program will still be able to cover 91% of its expenses.

Despite this, it’s important that we start thinking about ways to secure the future of Medicare sooner rather than later. This could involve implementing cost-saving measures such as negotiating drug prices and reducing fraud, waste, and abuse.

Ultimately, we must remember that Medicare is a vital safety net for older Americans and those with disabilities. It’s up to us to ensure that this program remains strong and sustainable for generations to come.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts