Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you nearing the age of 65 and wondering when the right time is to apply for Medicare supplemental insurance? You’re not alone. With so many options available, it can be confusing to know when to enroll and which plan to choose. In this article, we’ll discuss the eligibility requirements for Medicare supplemental insurance and help you determine the best time to apply. So, let’s dive in and learn more about this important topic!

Contents

- When Can You Apply for Medicare Supplemental Insurance?

- Initial Enrollment Period

- Guaranteed Issue Rights

- Annual Enrollment Period

- Open Enrollment Period

- Medicare Advantage Open Enrollment Period

- Special Enrollment Period

- Bonus: Benefits of Medicare Supplemental Insurance

- Bonus: Medicare Supplemental Insurance vs. Medicare Advantage

- Bonus: How to Choose a Medicare Supplemental Insurance Plan

- Conclusion

- Frequently Asked Questions

- When Can You Apply for Medicare Supplemental Insurance?

- Can You Apply for Medicare Supplemental Insurance if You Have Pre-Existing Conditions?

- How Can You Compare Medicare Supplemental Insurance Plans?

- What Does Medicare Supplemental Insurance Cover?

- Can You Change Your Medicare Supplemental Insurance Plan?

- When Can I Enroll in Medicare Supplement?

When Can You Apply for Medicare Supplemental Insurance?

If you are planning to enroll in Medicare Supplemental Insurance, you might be wondering when the right time to apply is. Medicare Supplemental Insurance, also known as Medigap, is a type of insurance that helps cover the gaps in Medicare coverage. Here, we will discuss the different times when you can apply for Medicare Supplemental Insurance.

Initial Enrollment Period

The Initial Enrollment Period (IEP) is the first time you can apply for Medicare Supplemental Insurance. It starts when you are 65 years old and enrolled in Medicare Part B. The IEP lasts for six months, during which you can sign up for any Medicare Supplemental Insurance plan without any medical underwriting.

During this period, insurance companies cannot deny you coverage or charge you higher premiums based on your health status. However, if you miss this period, you may have to go through medical underwriting, which could result in higher premiums or denied coverage.

If you are under 65 and have a disability, you may also be eligible for Medicare Supplemental Insurance during your IEP.

Guaranteed Issue Rights

If you miss your IEP, you may still be eligible for guaranteed issue rights. Guaranteed issue rights are situations where insurance companies cannot deny you coverage or charge you higher premiums based on your health status.

Some examples of guaranteed issue rights include losing employer coverage, losing Medicaid coverage, or moving out of a Medicare Advantage Plan’s service area. You have 63 days from the qualifying event to enroll in Medicare Supplemental Insurance.

Annual Enrollment Period

The Annual Enrollment Period (AEP) is from October 15th to December 7th. During this time, you can enroll in or switch Medicare Supplemental Insurance plans. The AEP is also the time when you can enroll in or make changes to your Medicare Part D drug coverage.

Open Enrollment Period

The Open Enrollment Period (OEP) is a one-time opportunity to switch Medicare Supplemental Insurance plans without medical underwriting. The OEP starts the month after you turn 65 and enroll in Medicare Part B and lasts for six months.

During the OEP, you can switch to any Medicare Supplemental Insurance plan without medical underwriting. This means insurance companies cannot deny you coverage or charge you higher premiums based on your health status.

Medicare Advantage Open Enrollment Period

The Medicare Advantage Open Enrollment Period (OEP) is from January 1st to March 31st. During this time, you can switch from a Medicare Advantage Plan to Original Medicare and enroll in a Medicare Supplemental Insurance plan.

Special Enrollment Period

If you experience a qualifying life event, such as moving or losing employer coverage, you may be eligible for a Special Enrollment Period (SEP). During an SEP, you have a 63-day window to enroll in Medicare Supplemental Insurance without medical underwriting.

Bonus: Benefits of Medicare Supplemental Insurance

Medicare Supplemental Insurance can help cover the gaps in Medicare coverage, such as deductibles, copayments, and coinsurance. It can also provide coverage for medical expenses incurred while traveling outside of the country.

Bonus: Medicare Supplemental Insurance vs. Medicare Advantage

Medicare Advantage Plans are an alternative to Original Medicare and provide the same benefits as Medicare Parts A and B. However, Medicare Advantage Plans have different rules, restrictions, and costs than Original Medicare.

Medicare Supplemental Insurance, on the other hand, works alongside Original Medicare and helps cover the costs that Medicare does not. While Medicare Advantage Plans may have lower premiums, they may also have higher out-of-pocket costs and limited provider networks.

Bonus: How to Choose a Medicare Supplemental Insurance Plan

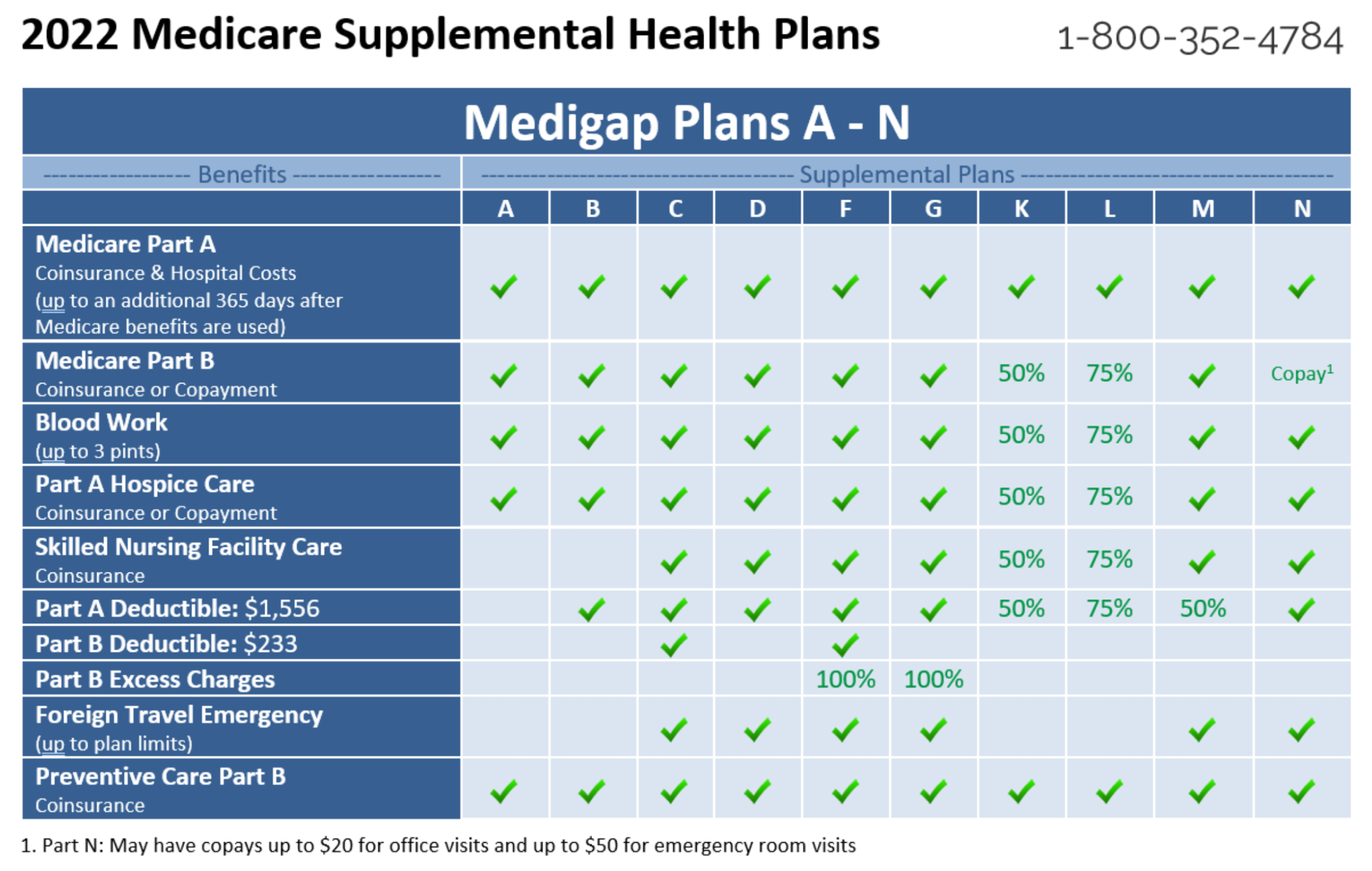

When choosing a Medicare Supplemental Insurance plan, it is important to consider your healthcare needs and budget. There are ten standardized Medigap plans, labeled A through N, each with different benefits and costs.

Comparing plans and shopping around for the best rates can help you find a plan that meets your needs and fits your budget. It is also important to consider the financial stability and customer service of the insurance company you choose.

Conclusion

Enrolling in Medicare Supplemental Insurance is an important decision that can help you cover the gaps in Medicare coverage. Knowing when you can enroll and understanding the different rules and options can help you make an informed decision. Remember to compare plans and shop around for the best rates to find a plan that meets your needs and budget.

Frequently Asked Questions

When Can You Apply for Medicare Supplemental Insurance?

If you are turning 65 and enrolling in Medicare for the first time, you have a six-month period called the Medicare Supplement Open Enrollment Period. During this time, you can enroll in any Medicare Supplement plan available in your area without being subject to medical underwriting. This means that you can’t be denied coverage or charged a higher premium based on your health status.

If you miss your Medicare Supplement Open Enrollment Period, you can still apply for a Medicare Supplement plan at any time. However, you may be subject to medical underwriting, which means that the insurance company can review your health history and deny you coverage or charge you a higher premium based on your health status.

Can You Apply for Medicare Supplemental Insurance if You Have Pre-Existing Conditions?

Yes, you can apply for Medicare Supplemental Insurance if you have pre-existing conditions. However, if you apply outside of your Medicare Supplement Open Enrollment Period, you may be subject to medical underwriting. This means that the insurance company can review your health history and deny you coverage or charge you a higher premium based on your health status.

If you have a pre-existing condition and are applying for Medicare Supplemental Insurance, it is important to understand the coverage options available to you. Some plans may offer more comprehensive coverage for certain conditions, while others may exclude coverage for pre-existing conditions altogether.

How Can You Compare Medicare Supplemental Insurance Plans?

To compare Medicare Supplemental Insurance plans, you can use the Medicare Plan Finder tool on the Medicare website. This tool allows you to compare plans based on their costs, coverage, and quality ratings. You can also contact a licensed insurance agent who can help you compare plans and determine which one is right for you.

When comparing plans, it is important to consider your individual health needs and budget. Some plans may offer more comprehensive coverage but have higher premiums, while others may have lower premiums but offer less coverage.

What Does Medicare Supplemental Insurance Cover?

Medicare Supplemental Insurance, also known as Medigap, helps cover the out-of-pocket costs associated with Original Medicare. This includes copayments, coinsurance, and deductibles. Medigap plans are standardized, meaning that each plan offers the same basic benefits, regardless of the insurance company offering the plan.

There are 10 different Medigap plans, labeled A through N. Each plan offers a different level of coverage, with Plan F being the most comprehensive. However, Plan F is no longer available to new Medicare beneficiaries as of January 1, 2020.

Can You Change Your Medicare Supplemental Insurance Plan?

Yes, you can change your Medicare Supplemental Insurance plan at any time. However, if you are outside of your Medicare Supplement Open Enrollment Period, you may be subject to medical underwriting. This means that the insurance company can review your health history and deny you coverage or charge you a higher premium based on your health status.

To change your Medicare Supplemental Insurance plan, you can contact a licensed insurance agent who can help you compare plans and determine which one is right for you. It is important to consider your individual health needs and budget when choosing a new plan.

When Can I Enroll in Medicare Supplement?

In conclusion, Medicare Supplemental Insurance is an excellent way to ensure that your healthcare needs are covered as you age. You can apply for this type of insurance during your initial enrollment period, which is typically around the time you turn 65 years old. However, there are some exceptions to this rule, such as if you have a qualifying disability or if you are receiving certain types of benefits from the government.

It’s important to remember that Medicare Supplemental Insurance is not the same as traditional Medicare coverage. Instead, it is designed to work alongside your existing Medicare plan to provide additional coverage for things like copayments, deductibles, and coinsurance. This can help to reduce your out-of-pocket expenses and give you peace of mind when it comes to your healthcare needs.

If you’re interested in applying for Medicare Supplemental Insurance, it’s important to do your research and compare different plans and providers to find the one that best meets your needs. With the right coverage in place, you can rest assured that your healthcare needs will be taken care of as you age, giving you the freedom to enjoy all that life has to offer.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts