Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we approach retirement age, one question that often comes to mind is when we can apply for Medicare benefits and how the process works. Medicare is a federal health insurance program that provides coverage for people aged 65 and older, as well as those with certain disabilities or medical conditions.

But when exactly are you eligible for Medicare, and what steps do you need to take to apply for benefits? In this article, we’ll explore the different enrollment periods for Medicare and provide some helpful tips to ensure you get the coverage you need when you need it.

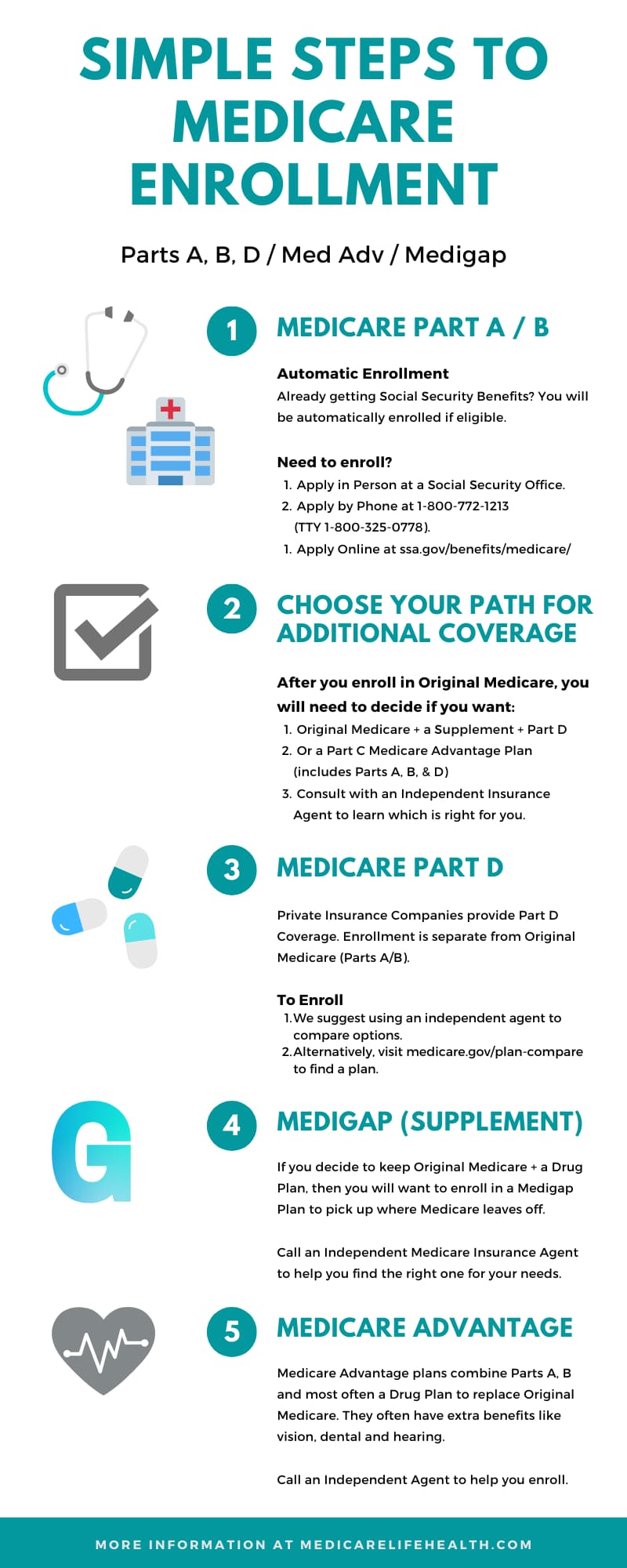

You can apply for Medicare benefits three months before the month you turn 65, and coverage can begin as early as the first day of that month. If you are receiving Social Security benefits when you turn 65, you will be automatically enrolled in Medicare. However, if you are not receiving Social Security benefits, you will need to apply for Medicare. You can apply online, by phone, or in person at your local Social Security office.

When Can You Apply for Medicare Benefits?

If you’re approaching retirement age, you may be wondering when you can apply for Medicare benefits. Medicare is a government-sponsored health insurance program that provides coverage to people over the age of 65, as well as to those with certain disabilities. Understanding when you can apply for Medicare benefits is crucial to ensure you have coverage when you need it most.

Initial Enrollment Period

The Initial Enrollment Period (IEP) is the first opportunity most people have to enroll in Medicare. It starts three months before you turn 65 and ends three months after your birthday. During this seven-month period, you can enroll in Medicare Part A, which covers hospital stays, and Part B, which covers doctor visits and other medical services.

If you miss your IEP, you may have to pay a penalty when you do enroll. So it’s important to mark your calendar and make sure you enroll during this time.

General Enrollment Period

If you miss your IEP, you can enroll in Medicare during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. However, if you enroll during the GEP, your coverage won’t start until July 1 of that year.

It’s important to note that if you miss your IEP and don’t enroll during the GEP, you may have to pay a penalty for late enrollment. So it’s best to enroll during your IEP if possible.

Special Enrollment Period

In some cases, you may qualify for a Special Enrollment Period (SEP) outside of the IEP or GEP. For example, if you or your spouse continues to work and has employer-sponsored health coverage, you may be able to delay enrolling in Medicare without penalty until that coverage ends.

Other situations that may qualify you for an SEP include moving to a new area, losing your current health coverage, or becoming eligible for Medicaid.

Medicare Advantage and Part D Enrollment Periods

If you’re interested in enrolling in a Medicare Advantage plan or a Part D prescription drug plan, there are specific enrollment periods you need to be aware of. The Annual Enrollment Period (AEP) for Medicare Advantage and Part D runs from October 15 to December 7 each year. During this time, you can enroll in or switch plans.

There’s also a Medicare Advantage Open Enrollment Period (OEP) from January 1 to March 31 each year. During this time, you can switch from one Medicare Advantage plan to another or switch from a Medicare Advantage plan back to Original Medicare.

Benefits of Medicare

Medicare provides a range of benefits to help you stay healthy and manage your healthcare costs. With Medicare Part A, you’ll have coverage for hospital stays, skilled nursing care, and hospice care. Medicare Part B covers doctor visits, lab tests, and other medical services. If you choose to enroll in a Medicare Advantage plan, you may have additional benefits like dental and vision coverage.

Medicare also offers prescription drug coverage through Medicare Part D. This can help you save money on your medications, and you can enroll in a Part D plan during your Initial Enrollment Period or during the Annual Enrollment Period.

Medicare vs. Medicaid

Medicare and Medicaid are both government-sponsored healthcare programs, but they’re designed to serve different populations. Medicare is for people over 65 and those with certain disabilities, while Medicaid is for people with low income and limited resources.

If you’re eligible for both Medicare and Medicaid, you can enroll in both programs to receive additional coverage and assistance with healthcare costs.

Conclusion

Understanding when you can apply for Medicare benefits is crucial to ensure you have coverage when you need it most. The Initial Enrollment Period is the first opportunity most people have to enroll in Medicare, but there are other enrollment periods and special circumstances that may qualify you for a Special Enrollment Period. Medicare provides a range of benefits to help you stay healthy and manage your healthcare costs, and it’s important to understand how it differs from other government healthcare programs like Medicaid.

Frequently Asked Questions

When Can You Apply for Medicare Benefits?

Medicare is a federal health insurance program that provides coverage to people who are 65 or older, as well as those who have certain disabilities. If you are approaching your 65th birthday, you may be wondering when you can apply for Medicare benefits.

You can apply for Medicare benefits three months before your 65th birthday, during the month of your birthday, and up to three months after your birthday. It’s important to note that if you don’t sign up for Medicare during this time, you may have to pay a penalty for late enrollment.

What Are the Different Parts of Medicare?

Medicare is made up of different parts that provide coverage for different services. Part A covers hospital stays, skilled nursing facility care, and some home health care. Part B covers doctor visits, outpatient care, and preventive services. Part C, also known as Medicare Advantage, is an alternative to Parts A and B and is offered by private insurance companies. Part D provides prescription drug coverage.

When you apply for Medicare, you can choose to enroll in Parts A and B, and you may also choose to enroll in Parts C and D. It’s important to carefully consider your options and choose the plan that best meets your needs.

How Much Does Medicare Cost?

The cost of Medicare varies depending on the parts you enroll in and your income. Most people do not have to pay a premium for Part A, but there is a monthly premium for Part B. In addition, if you enroll in Part C or D, you may also have to pay a premium. The amount you pay for premiums and out-of-pocket costs will depend on the plan you choose.

If you have a low income, you may be eligible for assistance with Medicare costs through programs like Medicaid or the Medicare Savings Program. It’s important to explore all of your options to ensure that you can afford the care you need.

What Is the Medicare Open Enrollment Period?

The Medicare Open Enrollment Period is a period of time each year when you can make changes to your Medicare coverage. This period lasts from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage plan, switch from one Medicare Advantage plan to another, or enroll in or change your Part D prescription drug coverage.

It’s important to review your coverage each year to ensure that it still meets your needs. If you don’t make any changes during the Medicare Open Enrollment Period, your coverage will remain the same for the following year.

What Are Medicare Supplement Plans?

Medicare Supplement plans, also known as Medigap plans, are private insurance plans that can help you pay for some of the out-of-pocket costs associated with Medicare. These plans are designed to supplement Original Medicare and can help cover costs like deductibles, copayments, and coinsurance.

There are 10 standardized Medigap plans available, each offering different levels of coverage. It’s important to carefully review each plan and choose the one that best meets your needs and budget.

When to Enroll in Medicare | Medicare Initial Enrollment Period

In conclusion, Medicare benefits are an important aspect of healthcare for older adults in the United States. Knowing when to apply for these benefits can help ensure that you receive the coverage you need to maintain your health and well-being.

Generally, individuals become eligible for Medicare at age 65, but there are certain circumstances under which you may become eligible earlier. It’s important to understand the eligibility requirements and the different types of Medicare coverage available so that you can make informed decisions about your healthcare.

Ultimately, applying for Medicare benefits is a straightforward process that can be done online or through the Social Security Administration. By staying informed and taking advantage of the benefits available to you, you can enjoy greater peace of mind when it comes to your healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts