Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you turning 65 soon or looking to switch your Medicare plan? With so many options available, it can be overwhelming to decide which plan is right for you. Two popular plans are Medicare Plan G and N, but what is the difference between them? In this article, we will break down the key features of each plan to help you make an informed decision about your healthcare coverage. So, let’s dive in and explore the differences between Medicare Plan G and N.

Understanding Medicare Plan G and N: What’s the Difference?

Introduction: Medicare Plan G and N Explained

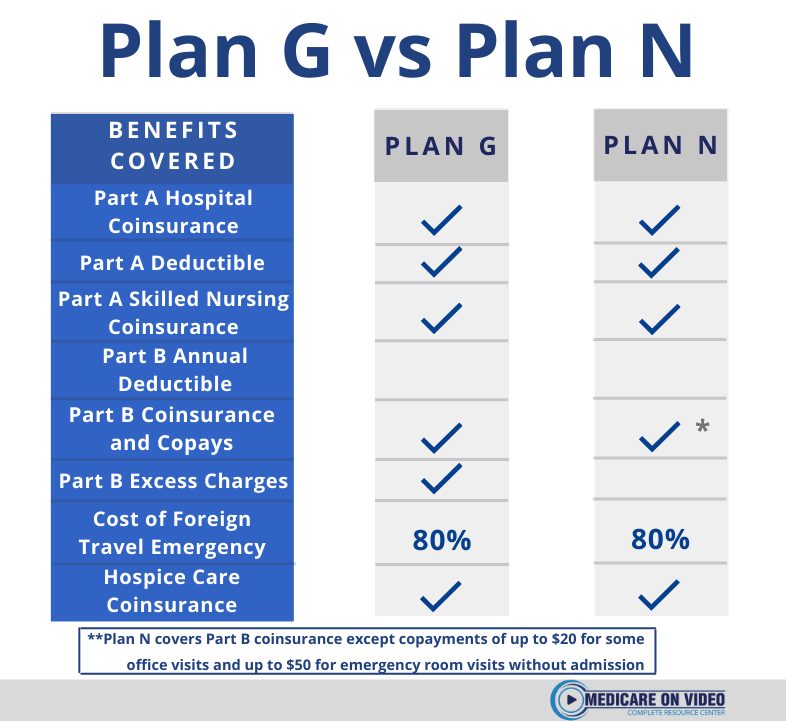

When it comes to Medicare, there are a lot of different options to choose from. Two of the most popular plans are Medicare Plan G and Plan N. Both of these plans cover a lot of the same things, but there are some key differences that you need to be aware of if you’re trying to decide which one is right for you. In this article, we’ll break down the differences between these two plans so that you can make an informed decision.

What is Medicare Plan G?

Medicare Plan G is a type of Medicare Supplement Insurance plan that helps cover some of the costs that Original Medicare doesn’t cover. This includes things like deductibles, copayments, and coinsurance. Plan G is often considered to be one of the most comprehensive Medicare Supplement plans available, as it covers almost all of the out-of-pocket costs that you might face with Original Medicare.

Some of the benefits of Medicare Plan G include:

- Full coverage of the Part A deductible

- Full coverage of skilled nursing facility coinsurance

- Full coverage of Part B excess charges

- Foreign travel emergency coverage

What is Medicare Plan N?

Medicare Plan N is another type of Medicare Supplement Insurance plan that helps cover some of the costs that Original Medicare doesn’t cover. However, there are some differences between Plan N and Plan G. Plan N typically has lower premiums than Plan G, but it also requires you to pay more out-of-pocket costs for certain things.

Some of the benefits of Medicare Plan N include:

- Full coverage of the Part A deductible

- Coverage for skilled nursing facility coinsurance

- Part B coinsurance coverage (except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits that don’t result in an inpatient admission)

- Foreign travel emergency coverage

Medicare Plan G vs. Plan N: Which One is Right for You?

So, which plan is right for you? It really depends on your personal situation and what you’re looking for in a Medicare Supplement plan. Here are some of the key differences between Medicare Plan G and Plan N:

Premiums

As mentioned earlier, Medicare Plan N typically has lower premiums than Plan G. If you’re on a fixed income, or if you just want to save some money, Plan N might be the better choice for you.

Out-of-Pocket Costs

While Plan N has lower premiums, it also requires you to pay more out-of-pocket costs for certain things, like office visits and emergency room visits. If you don’t go to the doctor very often, or if you have a Medicare Advantage plan that covers these costs, then Plan N might still be a good option for you.

Coverage

Overall, Medicare Plan G is considered to be more comprehensive than Plan N. With Plan G, you’ll have full coverage of the Part B excess charges, which can be a big benefit if you see a doctor who doesn’t accept Medicare assignment. However, if you don’t anticipate needing this coverage, then Plan N might still be a good choice for you.

Conclusion

In conclusion, both Medicare Plan G and Plan N are great options for anyone who wants to supplement their Original Medicare coverage. However, there are some key differences that you need to be aware of before you make a decision. By considering your personal situation and what you’re looking for in a Medicare Supplement plan, you can make an informed decision that will help you get the coverage you need at a price you can afford.

Frequently Asked Questions

What is the Difference Between Medicare Plan G and N?

Medicare Supplement Plan G and Plan N are two of the most popular Medicare supplement plans. While both plans offer similar benefits, there are a few differences between them. Plan G provides more comprehensive coverage than Plan N, but it also comes with a higher premium.

Plan G covers all of the same benefits as Plan N, plus it pays for the Medicare Part B deductible. This means that you won’t have to pay anything out of pocket for your doctor visits, lab tests, and other outpatient services. Plan N, on the other hand, requires you to pay a copayment for these services.

Another difference between the two plans is that Plan G does not have any copayments, while Plan N does. This means that if you choose Plan N, you will be responsible for paying a copayment for each doctor visit and other outpatient services. However, the copayments are typically low, so this may not be a significant factor for many people.

Overall, the choice between Plan G and Plan N comes down to your individual needs and budget. If you want more comprehensive coverage and don’t mind paying a higher premium, Plan G may be the better choice. However, if you’re looking for a more affordable option that still provides good coverage, Plan N may be the way to go.

What Does Medicare Plan G Cover?

Medicare Supplement Plan G is one of the most comprehensive Medicare supplement plans available. It covers all of the same benefits as Plan N, plus it pays for the Medicare Part B deductible. Here are some of the benefits that Plan G covers:

– Medicare Part A coinsurance and hospital costs

– Medicare Part B coinsurance and copayments

– Blood (first three pints)

– Part A hospice care coinsurance or copayment

– Skilled nursing facility care coinsurance

– Medicare Part A deductible

– Medicare Part B excess charges (in most cases)

With Plan G, you won’t have to worry about paying anything out of pocket for your doctor visits, lab tests, and other outpatient services. The only cost you will be responsible for is the monthly premium.

It’s important to note that Plan G does not cover prescription drugs. If you need prescription drug coverage, you will need to enroll in a separate Medicare Part D plan.

What Does Medicare Plan N Cover?

Medicare Supplement Plan N is a popular choice for people who want good coverage at an affordable price. While it doesn’t cover as much as Plan G, it still provides comprehensive coverage for most medical expenses. Here are some of the benefits that Plan N covers:

– Medicare Part A coinsurance and hospital costs

– Medicare Part B coinsurance and copayments (except for a copayment of up to $20 for some office visits and up to $50 for emergency room visits)

– Blood (first three pints)

– Part A hospice care coinsurance or copayment

– Skilled nursing facility care coinsurance

With Plan N, you will be responsible for paying a copayment for each doctor visit and other outpatient services. However, the copayments are typically low, so this may not be a significant factor for many people.

It’s important to note that Plan N does not cover the Medicare Part B deductible. This means that you will need to pay the deductible out of pocket before your coverage kicks in. Additionally, Plan N does not cover Medicare Part B excess charges in most cases. If you see a doctor who does not accept Medicare assignment, you may be responsible for paying these charges out of pocket.

Medicare Plan N vs Plan G! Choose WISELY!

In conclusion, understanding the difference between Medicare Plan G and N is vital for those seeking coverage for their healthcare needs. While both plans offer similar benefits, such as coverage for hospitalization and medical expenses, there are some differences that can make a significant impact on your overall healthcare costs.

Medicare Plan G is a comprehensive plan that covers almost all out-of-pocket costs, including deductibles, copays, and coinsurance. This plan is an excellent option for those who want maximum coverage and are willing to pay a slightly higher premium.

On the other hand, Medicare Plan N has lower premiums but requires more out-of-pocket costs, such as copays for doctor visits and emergency room visits. For those who do not anticipate needing medical care often, Plan N may be a more cost-effective option.

Ultimately, determining which plan is best for you depends on your individual healthcare needs and budget. Be sure to carefully evaluate your options and consult with a trusted healthcare professional to make an informed decision.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts