Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

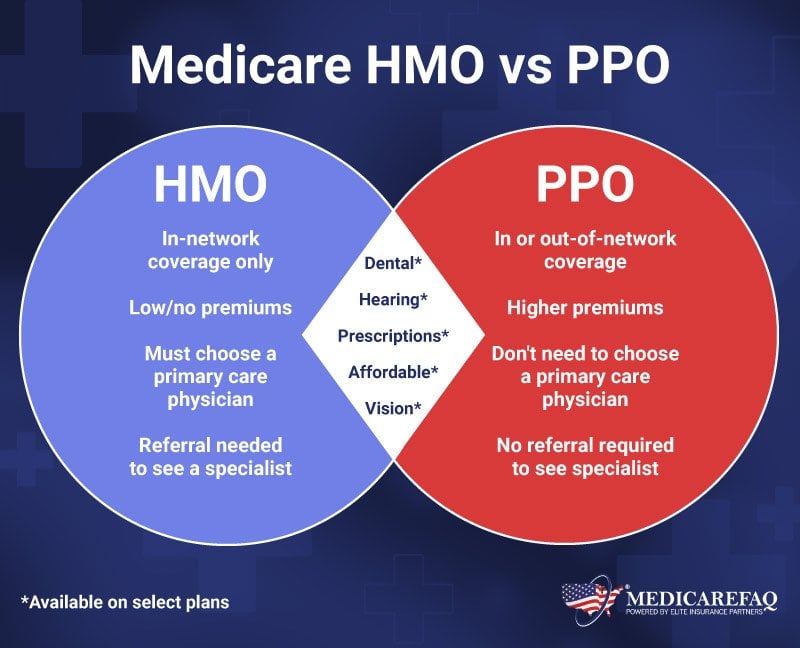

As we age, it’s important to ensure we have the right Medicare plan to suit our healthcare needs. Choosing between an HMO and PPO can be a daunting task, with both offering unique benefits and drawbacks. In this article, we’ll explore the differences between these two types of Medicare plans, so you can make an informed decision for your health and budget.

From understanding the network of healthcare providers to the costs associated with each plan, there are many factors to consider when choosing between an HMO and PPO Medicare plan. By the end of this article, you’ll have a better understanding of the key differences between these plans, and which one may be the best fit for your individual healthcare needs.

HMO Medicare plans typically have lower out-of-pocket costs and require you to choose a primary care physician within their network. PPO Medicare plans offer more flexibility in choosing doctors and typically have higher out-of-pocket costs. It’s important to consider your healthcare needs and budget when choosing between HMO and PPO Medicare plans.

Contents

- What is the Difference Between HMO and PPO Medicare Plans?

- Frequently Asked Questions

- What is the difference between HMO and PPO Medicare plans?

- What are the benefits of an HMO Medicare plan?

- What are the benefits of a PPO Medicare plan?

- How do I choose between an HMO and PPO Medicare plan?

- Can I switch between an HMO and PPO Medicare plan?

- Difference between Medicare Advantage HMO and PPO Plans

What is the Difference Between HMO and PPO Medicare Plans?

If you are approaching 65 or are already enrolled in Medicare, you may have heard of HMO and PPO plans. While both types of plans are available through Medicare, they have distinct differences that can affect your healthcare options and costs. In this article, we will explore the differences between HMO and PPO Medicare plans.

What is an HMO Medicare Plan?

An HMO, or Health Maintenance Organization, Medicare plan is a type of managed care plan. With an HMO, you select a primary care physician (PCP) who will be your main healthcare provider. Your PCP will manage your healthcare and provide referrals to specialists if necessary. You are generally required to stay within the HMO network for healthcare services, except in emergency situations.

One of the main benefits of an HMO Medicare plan is that it often has lower out-of-pocket costs. However, you may have limited options for healthcare providers and services, as you must stay within the HMO network. Additionally, you may need a referral from your PCP to see a specialist.

What is a PPO Medicare Plan?

A PPO, or Preferred Provider Organization, Medicare plan is also a type of managed care plan. However, with a PPO, you have more flexibility in choosing healthcare providers. You can generally see any provider within the PPO network without a referral, and you may be able to see providers outside of the network for an additional cost.

One of the main benefits of a PPO Medicare plan is the flexibility it offers in choosing healthcare providers. However, this flexibility often comes with higher out-of-pocket costs compared to HMO plans.

Benefits of HMO Medicare Plans

– Lower out-of-pocket costs compared to PPO plans

– Primary care physician manages your healthcare

– May include additional benefits, such as vision or dental coverage

Benefits of PPO Medicare Plans

– More flexibility in choosing healthcare providers

– No need for a referral to see a specialist

– May include additional benefits, such as prescription drug coverage

HMO vs. PPO: Which is Right for You?

When deciding between an HMO and PPO Medicare plan, consider your healthcare needs and preferences. If you prefer more flexibility in choosing healthcare providers and are willing to pay higher out-of-pocket costs, a PPO plan may be the right choice. However, if you are looking for lower out-of-pocket costs and are comfortable with a PCP managing your healthcare, an HMO plan may be a better fit.

It is important to note that not all healthcare providers accept all types of Medicare plans. Before enrolling in a plan, make sure your preferred providers are in the network.

Costs of HMO and PPO Medicare Plans

The costs of HMO and PPO Medicare plans can vary depending on the plan and the area in which you live. However, here are some general costs to consider:

HMO Medicare Plan Costs

– Monthly premium (if applicable)

– Deductible (if applicable)

– Co-payments for healthcare services

– Out-of-pocket maximum

PPO Medicare Plan Costs

– Monthly premium (if applicable)

– Deductible (if applicable)

– Co-payments for healthcare services

– Out-of-pocket maximum

– Additional costs for out-of-network services

Conclusion

In summary, HMO and PPO Medicare plans have distinct differences that can affect your healthcare options and costs. When deciding between the two, consider your healthcare needs and preferences, as well as the costs associated with each plan. It is important to review the plan details carefully and ensure your preferred providers are in the network before enrolling.

Frequently Asked Questions

What is the difference between HMO and PPO Medicare plans?

Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) are two types of Medicare Advantage plans that work differently. HMOs have a network of doctors, hospitals, and other healthcare providers that you must use in order to receive coverage. You usually need a referral from your primary care physician to see a specialist.

On the other hand, PPOs have a network of providers as well, but you have more flexibility in choosing which doctors and hospitals you want to use. You can see specialists without a referral, but you may pay more for out-of-network care. With a PPO, you also have the option to receive care from providers outside of the network, but it may cost more.

Overall, the main difference between HMO and PPO Medicare plans is the level of flexibility and choice that you have when it comes to healthcare providers.

What are the benefits of an HMO Medicare plan?

One of the main benefits of an HMO Medicare plan is that the out-of-pocket costs are typically lower than a PPO plan. You also have a primary care physician who coordinates your care and provides referrals to specialists within the network.

Another benefit is that HMO plans usually include additional benefits such as prescription drug coverage, vision, dental, and hearing services. Most HMOs also offer wellness programs and preventative care services at no extra cost to you.

However, the downside of an HMO plan is that you have less flexibility when it comes to choosing healthcare providers. You need to choose from the network of doctors and hospitals affiliated with the plan, and if you go out of network, you may have to pay more.

What are the benefits of a PPO Medicare plan?

One of the main benefits of a PPO Medicare plan is that you have more flexibility in choosing your healthcare providers. You can see any doctor or specialist within the network without a referral, and you also have the option to go out of network for care, although it may cost more.

PPO plans also typically have a wider range of providers to choose from, including specialists and hospitals. This can be especially beneficial if you have a complex medical condition that requires specialized care.

However, the downside of a PPO plan is that the out-of-pocket costs are usually higher than an HMO plan. You may also have to pay more for out-of-network care, and some PPO plans may not include additional benefits such as prescription drug coverage or dental services.

How do I choose between an HMO and PPO Medicare plan?

Choosing between an HMO and PPO Medicare plan depends on your individual needs and preferences. If you prefer lower out-of-pocket costs and don’t mind having less flexibility in choosing your healthcare providers, an HMO plan may be a good choice for you.

If you prefer more flexibility in choosing your doctors and specialists, and don’t mind paying higher out-of-pocket costs, a PPO plan may be a better fit. It’s important to review the plan’s network of providers, additional benefits, and out-of-pocket costs before making a decision.

Can I switch between an HMO and PPO Medicare plan?

Yes, you can switch between an HMO and PPO Medicare plan during the annual open enrollment period, which runs from October 15th to December 7th each year. You can also switch plans if you qualify for a special enrollment period due to a change in your circumstances, such as moving to a new area or losing your current coverage.

It’s important to review the plan’s network of providers, additional benefits, and out-of-pocket costs before making a decision to switch plans, and to ensure that your preferred healthcare providers are in the plan’s network.

Difference between Medicare Advantage HMO and PPO Plans

In conclusion, understanding the differences between HMO and PPO Medicare plans is crucial in making an informed decision about your healthcare coverage. While HMO plans may offer lower out-of-pocket costs and a primary care physician to manage your care, they also restrict your choice of providers and require referrals for specialist visits. On the other hand, PPO plans offer greater flexibility in choosing healthcare providers but typically come with higher out-of-pocket costs. Ultimately, the right choice for you will depend on your individual healthcare needs and priorities. By carefully weighing the pros and cons of each plan, you can choose the one that best fits your unique situation and ensures that you receive the healthcare coverage you need.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts