Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal insurance program that provides health coverage to millions of Americans over 65 years of age or with certain disabilities. However, many beneficiaries may wonder, “What is the copay for Medicare?” It’s an important question to ask to ensure that you understand your financial responsibilities when seeking medical care.

A copay is a fixed amount that you pay out-of-pocket for a covered service, such as a doctor’s visit or a prescription drug. The amount of your copay may vary depending on the type of service you receive and the Medicare plan you are enrolled in. Understanding your copay can help you budget for healthcare expenses and make informed decisions about your medical care. So, let’s dive in and learn more about the copay for Medicare.

Understanding the Copay for Medicare

Medicare is a federal health insurance program that covers individuals aged 65 and above, and those with certain disabilities and medical conditions. While Medicare covers a wide range of healthcare services, it does not cover everything. This is where the copay for Medicare comes in. In this article, we will explore what the Medicare copay is, how it works, and its benefits.

What is the Medicare Copay?

The Medicare copay, also known as coinsurance, is the amount that beneficiaries are required to pay out of pocket for healthcare services covered by Medicare. The copay varies depending on the healthcare service and the Medicare plan. For instance, there is a copay for doctor visits, hospital stays, and prescription drugs.

Doctor Visits Copay

For doctor visits, the copay is typically 20% of the Medicare-approved amount for the service. For instance, if the Medicare-approved amount for a doctor visit is $100, the copay will be $20. Some Medicare plans, such as Medicare Advantage, may have lower copays for doctor visits.

Hospital Stays Copay

For hospital stays, the copay depends on the length of stay. For the first 60 days, the copay is $0 for Medicare Part A beneficiaries. However, for days 61-90, the copay is $371 per day. For days 91 and beyond, the copay is $742 per day. Some Medicare plans may have lower copays for hospital stays.

Prescription Drugs Copay

For prescription drugs, the copay varies depending on the drug and the Medicare plan. Some plans have a flat copay for all drugs, while others have tiered copays based on the drug’s cost and type. Beneficiaries may also have a deductible for prescription drugs that they must meet before the copay kicks in.

Benefits of the Medicare Copay

While copays may seem like an added expense, they serve several benefits for Medicare beneficiaries. First, copays help control healthcare costs by incentivizing beneficiaries to use healthcare services only when necessary. Second, copays help prevent overutilization of healthcare services, which can lead to higher healthcare costs for everyone.

Medicare Copay vs. Deductible

It is essential to understand the difference between a copay and a deductible. While a copay is a fixed fee paid for each healthcare service, a deductible is the amount beneficiaries must pay out of pocket before Medicare kicks in. Once the deductible is met, beneficiaries may be required to pay a copay for each service.

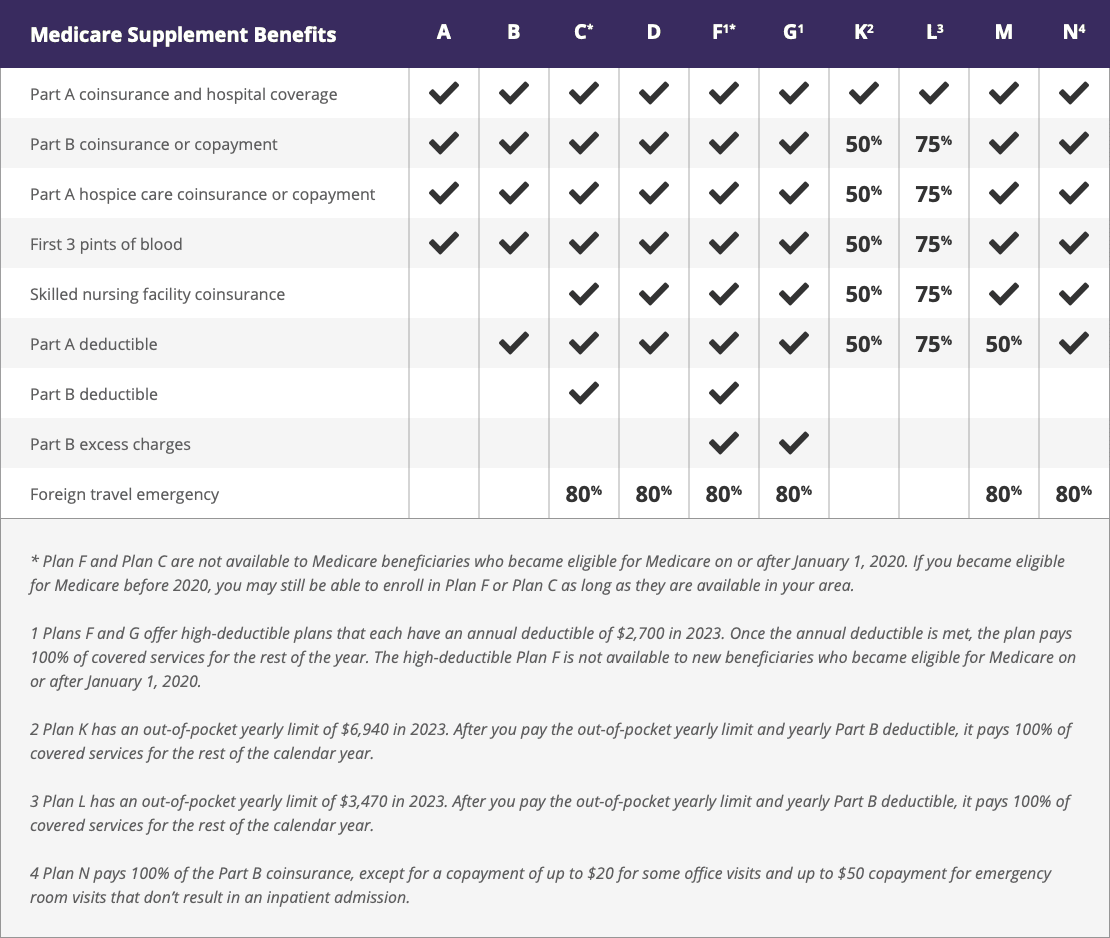

Medicare Copay vs. Supplemental Insurance

Medicare supplemental insurance, also known as Medigap, is private health insurance that covers the out-of-pocket costs not covered by Medicare, such as copays, deductibles, and coinsurance. While Medigap plans may cover copays, they do not cover prescription drug copays. Beneficiaries may need to purchase a separate Medicare Part D plan for prescription drug coverage.

Conclusion

In conclusion, the Medicare copay is a necessary expense that beneficiaries must pay for healthcare services covered by Medicare. While copays can be expensive, they serve several benefits, such as controlling healthcare costs and preventing overutilization of healthcare services. Understanding the copay and its benefits is essential for Medicare beneficiaries to make informed healthcare decisions.

Frequently Asked Questions

What is the Copay for Medicare?

Medicare is a federal health insurance program for people over 65 and people with certain disabilities or chronic conditions. The copay for Medicare is a fixed amount that you pay out of pocket for each medical service or prescription drug that you receive. It is usually a small percentage of the total cost of the service or drug.

The copay for Medicare varies depending on the type of service or drug you receive and the specific plan you are enrolled in. Some plans have low copays for preventative services, such as annual check-ups and cancer screenings, while others have higher copays for specialist care or prescription drugs. It is important to review your plan’s copays and benefits carefully to ensure that you are getting the coverage you need at a price you can afford.

How is the Copay for Medicare Calculated?

The copay for Medicare is calculated based on a number of factors, including the type of service or drug you receive, the specific plan you are enrolled in, and whether you have met your deductible or out-of-pocket maximum for the year. Generally, copays are fixed amounts that are set by Medicare or your plan and are paid at the time of service.

For example, if you receive a prescription drug that has a copay of $10, you will be responsible for paying that $10 out of pocket. If you see a specialist who has a copay of $50, you will be responsible for paying that $50 out of pocket. The copay amount may vary depending on the type of service or drug you receive, and some services may not have a copay at all.

Are There Limits to the Copay for Medicare?

Yes, there are limits to the copay for Medicare. Each year, Medicare sets a limit on the amount of copays and other out-of-pocket expenses that you can be responsible for. Once you reach this limit, known as the out-of-pocket maximum, your Medicare plan will cover the remaining costs of your medical care for the rest of the year.

The out-of-pocket maximum varies depending on the plan you are enrolled in and the type of medical services you receive. It is important to review your plan’s benefits and out-of-pocket costs carefully to understand what your maximum out-of-pocket expenses may be.

Can I Get Help Paying for My Medicare Copays?

Yes, there are several programs that can help you pay for your Medicare copays and other out-of-pocket expenses. One of the most common programs is Medicaid, which is a joint federal and state program that provides health insurance to people with low incomes.

In addition, some Medicare Advantage plans offer extra benefits, such as reduced copays and deductibles, that can help lower your out-of-pocket costs. You may also be eligible for other programs, such as the Medicare Savings Program or Extra Help, which provide financial assistance to help cover the cost of your Medicare premiums, deductibles, and copays.

How Do I Find Out What My Copays Are?

To find out what your copays are for your Medicare plan, you can review your plan’s benefits summary or contact your plan directly. You can also use the Medicare Plan Finder tool on the Medicare website to compare different plans and their copays and other out-of-pocket costs.

It is important to review your plan’s benefits and costs carefully to ensure that you are getting the coverage you need at a price you can afford. If you have questions or concerns about your copays or other out-of-pocket expenses, you can speak to a Medicare representative or a licensed insurance agent who can help you understand your options.

Do I Have To Pay A Copay With Medicare?

In conclusion, understanding the copay for Medicare is an essential part of managing your healthcare costs. By knowing the amount you are responsible for paying out of pocket, you can better plan for medical expenses and avoid unexpected bills. It is important to note that copay amounts can vary depending on the type of Medicare plan you have and the services you receive.

While copays may seem like an additional expense, they are often a small price to pay for the valuable healthcare services Medicare provides. Many Medicare beneficiaries find that the peace of mind that comes with having access to quality medical care is well worth the cost of copays. Additionally, some Medicare plans offer options for reducing or even eliminating copayments, so be sure to explore all of your options when selecting a plan.

Overall, understanding copays is just one piece of the puzzle when it comes to navigating the complex world of healthcare. By staying informed and taking advantage of the resources available to you, you can make the most of your Medicare benefits and enjoy a healthier, happier life.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts