Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program in the United States that provides coverage for people aged 65 and older, as well as those with certain disabilities. While it covers many healthcare expenses, there are still costs that beneficiaries are responsible for, such as deductibles. One of these is the Medicare yearly deductible, which can be confusing for many people.

The Medicare yearly deductible is the amount that beneficiaries must pay out of pocket before Medicare begins to cover their healthcare costs. It can vary depending on the type of Medicare coverage a person has, and it is important to understand how it works in order to avoid unexpected expenses. In this article, we will explore what the Medicare yearly deductible is, how it works, and what beneficiaries should know about it.

Understanding Medicare Yearly Deductible

Medicare is a federally funded health insurance program that provides coverage to people aged 65 and above, as well as those with certain disabilities or medical conditions. Part of the coverage offered by Medicare includes deductibles, which are the amount you pay out of pocket before Medicare starts paying for your healthcare expenses. One of these deductibles is the Medicare yearly deductible, which is an important part of the Medicare program. In this article, we’ll take a closer look at what Medicare yearly deductible is, how it works, and what it covers.

What is Medicare Yearly Deductible?

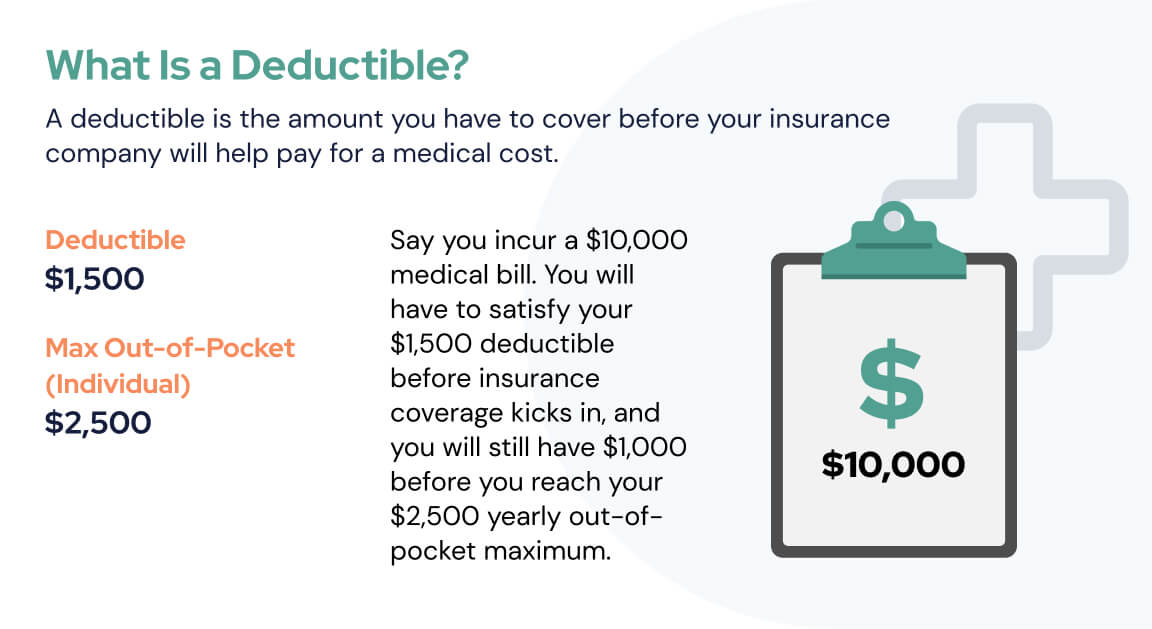

Medicare yearly deductible is the amount that you must pay out of pocket before your Medicare coverage begins. The deductible varies depending on the type of Medicare plan you have. For example, for Medicare Part A, the deductible in 2021 is $1,484, while for Medicare Part B, the deductible is $203.

Once you’ve paid the deductible, Medicare will begin to cover your healthcare expenses. However, it’s important to note that the deductible only applies to certain services, such as hospital stays and doctor visits. Other services, such as preventive care, may not require you to pay a deductible.

How Does Medicare Yearly Deductible Work?

Medicare yearly deductible works differently depending on the type of Medicare plan you have. For example, for Medicare Part A, the deductible applies to each benefit period, which is the amount of time you spend in the hospital. If you are admitted to the hospital twice in the same year, you will have to pay the deductible twice.

For Medicare Part B, the deductible applies to all Medicare-approved services, with the exception of preventive care. Once you’ve paid the deductible, Medicare will cover 80% of the approved amount, while you are responsible for the remaining 20%.

What Does Medicare Yearly Deductible Cover?

Medicare yearly deductible covers a wide range of healthcare services, including hospital stays, doctor visits, and medical tests. However, there are certain services that are not covered by the deductible, such as preventive care and some types of screening tests.

It’s important to note that some Medicare plans, such as Medigap, can help cover your Medicare deductibles, as well as other out-of-pocket expenses. These plans can be a great option for those who want more comprehensive coverage.

Medicare Yearly Deductible Benefits

One of the main benefits of Medicare yearly deductible is that it helps to keep your healthcare costs low. By requiring you to pay a deductible, Medicare encourages you to only seek medical care when it’s necessary, which can help to reduce unnecessary healthcare costs.

In addition, the deductible ensures that Medicare is able to provide coverage to those who need it most. By requiring those who can afford it to pay a deductible, Medicare is able to provide coverage to those who may not be able to afford healthcare otherwise.

Medicare Yearly Deductible Vs. Copay

While Medicare yearly deductible and copay are both out-of-pocket expenses, they work differently. Deductible is the amount you pay before Medicare starts paying for your healthcare expenses, while copay is the amount you pay after Medicare has paid its share.

For example, if you have a doctor’s appointment that costs $100 and your Medicare plan covers 80% of the cost, you would pay $20 in copay. If you haven’t met your deductible yet, you would also have to pay the deductible amount before Medicare would start covering the cost.

Conclusion

In conclusion, Medicare yearly deductible is an important part of the Medicare program that helps to keep healthcare costs low and ensure that Medicare is able to provide coverage to those who need it most. By understanding how Medicare yearly deductible works and what it covers, you can make informed decisions about your healthcare and ensure that you get the most out of your Medicare coverage.

Frequently Asked Questions

What is Medicare Yearly Deductible?

Medicare yearly deductible is the amount you pay for healthcare services before Medicare starts covering its share of the costs. The deductible amount varies depending on the type of Medicare plan you have. For example, in 2021, the Medicare Part A deductible for hospitalization is $1,484. If you have Original Medicare, you pay this deductible once per benefit period. If you have a Medicare Advantage plan, the deductible amount may vary depending on the plan.

The yearly deductible is an annual cost that you must pay out of pocket before Medicare coverage begins. Once you have paid the deductible, Medicare will begin covering its share of the costs for your healthcare services. It’s important to note that not all healthcare services require you to pay a deductible. For example, Medicare Part B does not have a deductible for preventive services, such as a flu shot or certain cancer screenings.

How does Medicare Yearly Deductible work?

Medicare yearly deductible works by requiring you to pay a set amount of money out of pocket before Medicare coverage begins. Once you have paid the deductible, Medicare will begin covering its share of the costs for your healthcare services. The deductible amount varies depending on the type of Medicare plan you have.

For example, if you have Original Medicare, you pay the Part A deductible once per benefit period. The benefit period starts the day you are admitted to a hospital or skilled nursing facility and ends when you have not received any inpatient hospital care or skilled nursing care for 60 consecutive days. If you are admitted to the hospital multiple times within the same benefit period, you only pay the Part A deductible once.

Is there a limit to how much I pay for Medicare Yearly Deductible?

There is no limit to how much you pay for Medicare yearly deductible. The amount you pay will depend on the type of Medicare plan you have and the healthcare services you receive. For example, if you have Original Medicare, you pay the Part A deductible once per benefit period. If you are hospitalized multiple times within the same benefit period, you may have to pay the deductible multiple times.

It’s important to note that some Medicare Advantage plans may have a yearly out-of-pocket maximum. This means that once you have paid a certain amount out of pocket for healthcare services, the plan will cover the rest of the costs for the year. However, not all Medicare Advantage plans have an out-of-pocket maximum, and the amount may vary depending on the plan.

Do all Medicare plans have a Yearly Deductible?

Not all Medicare plans have a yearly deductible. However, most Medicare plans do have some form of cost-sharing, which means you may have to pay a portion of the healthcare costs. Original Medicare has a yearly deductible for Part A, which covers hospitalization, and Part B, which covers doctor visits and outpatient services.

Medicare Advantage plans, also known as Part C, may have different cost-sharing requirements, which may include deductibles, copayments, and coinsurance. Some Medicare Advantage plans have a $0 deductible, but you may still have to pay copayments or coinsurance for healthcare services. It’s important to review the plan’s Summary of Benefits to understand the cost-sharing requirements for the plan.

When do I have to pay the Medicare Yearly Deductible?

You have to pay the Medicare yearly deductible when you receive healthcare services that require you to pay a deductible. The deductible amount varies depending on the type of Medicare plan you have and the healthcare services you receive. For example, if you are admitted to the hospital, you will have to pay the Part A deductible if you have Original Medicare.

It’s important to note that not all healthcare services require you to pay a deductible. For example, preventive services, such as a flu shot or certain cancer screenings, do not require a deductible with Original Medicare. Additionally, some Medicare Advantage plans may have different cost-sharing requirements, which may include copayments or coinsurance instead of a deductible.

What is the Medicare Deductible 2021

In conclusion, the Medicare yearly deductible is an important aspect of the Medicare program that beneficiaries should understand. While the deductible amount may change from year to year, it is an expense that beneficiaries must pay before Medicare coverage begins. This deductible applies to Medicare Part A and Part B services, and the amount may vary depending on the specific service received.

Understanding the Medicare yearly deductible can help beneficiaries plan for healthcare expenses and make informed decisions about their healthcare coverage. By knowing the amount of the deductible and when it applies, beneficiaries can budget for healthcare costs and avoid unexpected expenses.

Overall, the Medicare program provides vital healthcare coverage for millions of Americans, and the yearly deductible is just one aspect of this program. By staying informed and educated about Medicare benefits and costs, beneficiaries can make the most of their coverage and enjoy better health outcomes.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts