Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you confused about the deductions on your paycheck labeled “Medicare”? Wondering what it is and if it affects you? Look no further! Medicare is a federal program that provides health insurance to individuals aged 65 and older, as well as those with certain disabilities and chronic conditions.

The program is funded through payroll taxes, which are automatically deducted from your paycheck if you are employed. In this article, we’ll delve deeper into what Medicare is, how it works, and what it means for you. So, let’s get started and clear up any confusion you may have about Medicare on your paycheck!

Medicare is a federal health insurance program for people who are 65 or older, or have certain disabilities or medical conditions. It is funded by payroll taxes deducted from your paycheck. The Medicare tax rate is currently 1.45% for employees and 2.9% for self-employed individuals. Your pay stub should show the amount of Medicare tax deducted from your paycheck.

What is Medicare on My Paycheck?

Medicare is a government-sponsored health insurance program for people who are 65 years or older, younger people with disabilities, and people with end-stage renal disease. This program is funded by the federal government and is administered by the Centers for Medicare and Medicaid Services (CMS). Medicare provides health insurance coverage for medical services, hospital stays, and prescription drugs.

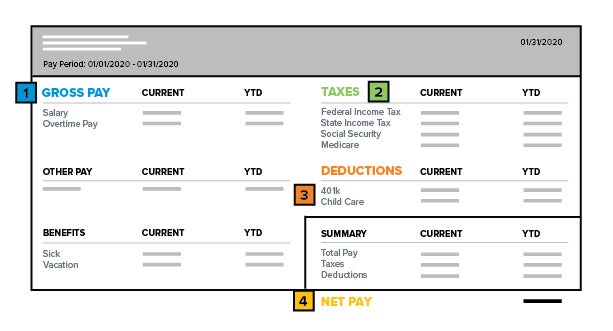

Understanding Medicare Deductions

If you are an employee, you may notice that Medicare deductions are taken out of your paycheck. These deductions are mandatory and contribute to your future Medicare benefits. The amount that is deducted from your paycheck depends on your earnings and the tax rate for Medicare.

The Medicare tax rate is currently set at 1.45% of your gross income. If you are self-employed, you will need to pay both the employee and employer portion, which is currently set at 2.9%. There is an additional 0.9% tax for high-income earners who earn over $200,000 for individuals or $250,000 for couples filing jointly.

Medicare Benefits

Medicare provides several benefits for eligible individuals, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and home health care. Part B covers doctor visits, outpatient services, and preventive care. Part D covers prescription drugs.

In addition, Medicare also offers Medicare Advantage (Part C) plans, which are offered by private insurance companies that are approved by Medicare. These plans offer the same benefits as Parts A and B, but may also include additional benefits such as dental, vision, and hearing coverage.

Medicare vs. Medicaid

Medicare and Medicaid are both government-sponsored health insurance programs, but they serve different populations. Medicare is for people who are 65 years or older, younger people with disabilities, and people with end-stage renal disease. Medicaid, on the other hand, is for people with low income and limited resources.

Medicaid provides coverage for medical services, hospital stays, and prescription drugs, as well as long-term care services such as nursing home care. Eligibility for Medicaid varies by state, but generally, individuals and families with low income and limited resources are eligible.

Enrolling in Medicare

If you are turning 65 years old or have a qualifying disability, you may be eligible to enroll in Medicare. You can enroll in Medicare during the initial enrollment period, which is a seven-month period that begins three months before your 65th birthday and ends three months after your 65th birthday.

If you do not enroll during the initial enrollment period, you may be subject to a late enrollment penalty. You can also enroll in Medicare during the annual open enrollment period, which runs from October 15th to December 7th each year.

Medicare Supplement Insurance

Medicare Supplement Insurance, also known as Medigap, is a private insurance policy that helps cover the out-of-pocket costs of Medicare. These costs may include deductibles, copayments, and coinsurance. Medigap policies are sold by private insurance companies and are standardized by the federal government.

There are 10 standardized Medigap plans, labeled A through N, each providing a different level of coverage. The benefits for each plan are the same regardless of which insurance company you choose, but the premiums may vary.

Conclusion

Medicare is an essential health insurance program for millions of Americans. Understanding how Medicare works and the benefits it provides is crucial for planning your future healthcare needs. By enrolling in Medicare, you can have peace of mind knowing that you are covered for medical services, hospital stays, and prescription drugs. If you need additional coverage, you may consider enrolling in a Medicare Advantage plan or purchasing a Medigap policy.

Frequently Asked Questions

What is Medicare on My Paycheck?

Medicare is a government-run health insurance program that provides coverage for people who are over 65 years of age or who have certain disabilities. The program is funded by taxes and premiums that are deducted from your paycheck.

Medicare provides coverage for a wide range of medical services, including doctor visits, hospital stays, and prescription drugs. It is important to understand how Medicare works and what it covers, especially if you are approaching retirement age or have a disability.

How is Medicare deducted from my paycheck?

Medicare taxes are deducted from your paycheck automatically, along with other taxes like Social Security. The amount that is deducted depends on your income. In 2021, the Medicare tax rate is 1.45% of your income, and there is no limit to the amount of income that is subject to this tax.

If you are self-employed, you will need to pay both the employee and employer portions of the Medicare tax. This means that you will need to pay a total of 2.9% of your income towards Medicare.

What are the different parts of Medicare?

Medicare is divided into different parts that provide coverage for specific medical services. Part A covers hospital stays and some forms of home healthcare, while Part B covers doctor visits and outpatient services. Part D provides coverage for prescription drugs, and Medicare Advantage (Part C) is an alternative to traditional Medicare that provides additional benefits.

It is important to understand the different parts of Medicare and what they cover so that you can choose the best coverage for your needs.

When can I enroll in Medicare?

You are eligible to enroll in Medicare when you turn 65 years old, as long as you or your spouse has worked and paid Medicare taxes for at least 10 years. You can also enroll in Medicare if you have a disability or certain medical conditions.

The initial enrollment period for Medicare is 7 months, starting 3 months before your 65th birthday. If you miss this enrollment period, you may be subject to penalties and may have to wait until the next enrollment period to sign up.

What are my options if I am not eligible for Medicare?

If you are not eligible for Medicare, you may be able to get health insurance through your employer or through the individual marketplace. It is important to research your options and choose a plan that provides the coverage you need at a price you can afford.

If you are over 50 years old and have a pre-existing medical condition, you may be eligible for coverage through the Affordable Care Act’s Pre-Existing Condition Insurance Plan. This plan provides coverage for people who have been denied coverage due to a pre-existing condition.

All you NEED to Know About your Paycheck Deductions in 4 Minutes

In conclusion, understanding Medicare on your paycheck is crucial to ensure that you are contributing to the program and reaping its benefits when you retire. Medicare is a federal health insurance program that provides coverage to individuals aged 65 and over, as well as those with certain disabilities or chronic conditions.

When you receive your paycheck, you will notice a deduction for Medicare taxes, which are a percentage of your earnings. These taxes go towards funding the program and ensure that it remains sustainable for future generations.

In summary, Medicare plays a significant role in the lives of millions of Americans and is a crucial component of our healthcare system. By understanding how it works and what it means for your paycheck, you can make informed decisions about your retirement and healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts