Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare Coinsurance is an important aspect of the Medicare program that can have significant financial implications for beneficiaries. It refers to the portion of healthcare costs that beneficiaries are responsible for paying after Medicare covers its share. This can include costs such as deductibles, copayments, and coinsurance.

Understanding Medicare Coinsurance is crucial for beneficiaries who want to make informed decisions about their healthcare. It can help them anticipate and plan for out-of-pocket expenses, and ensure they are not caught off-guard by unexpected costs. In this article, we will explore what Medicare Coinsurance is, how it works, and what beneficiaries can do to minimize their out-of-pocket expenses.

Contents

- Understanding Medicare Coinsurance: How It Works and Why It Matters

- Frequently Asked Questions

- What is Medicare Coinsurance?

- How is Medicare Coinsurance calculated?

- Is there a limit to how much I will pay in Medicare Coinsurance?

- What is the difference between Medicare Coinsurance and Medicare Deductibles?

- Do I have to pay Medicare Coinsurance if I have a Medicare Advantage plan?

- What is Your Medicare Part B and Coinsurance Amount? 🤔

Understanding Medicare Coinsurance: How It Works and Why It Matters

What is Medicare Coinsurance?

When it comes to healthcare costs, Medicare is designed to help seniors cover the expenses associated with their medical care. However, while Medicare can help cover a significant portion of your medical bills, it doesn’t cover everything. Coinsurance refers to the percentage of your medical expenses that you are responsible for paying after your deductible has been met.

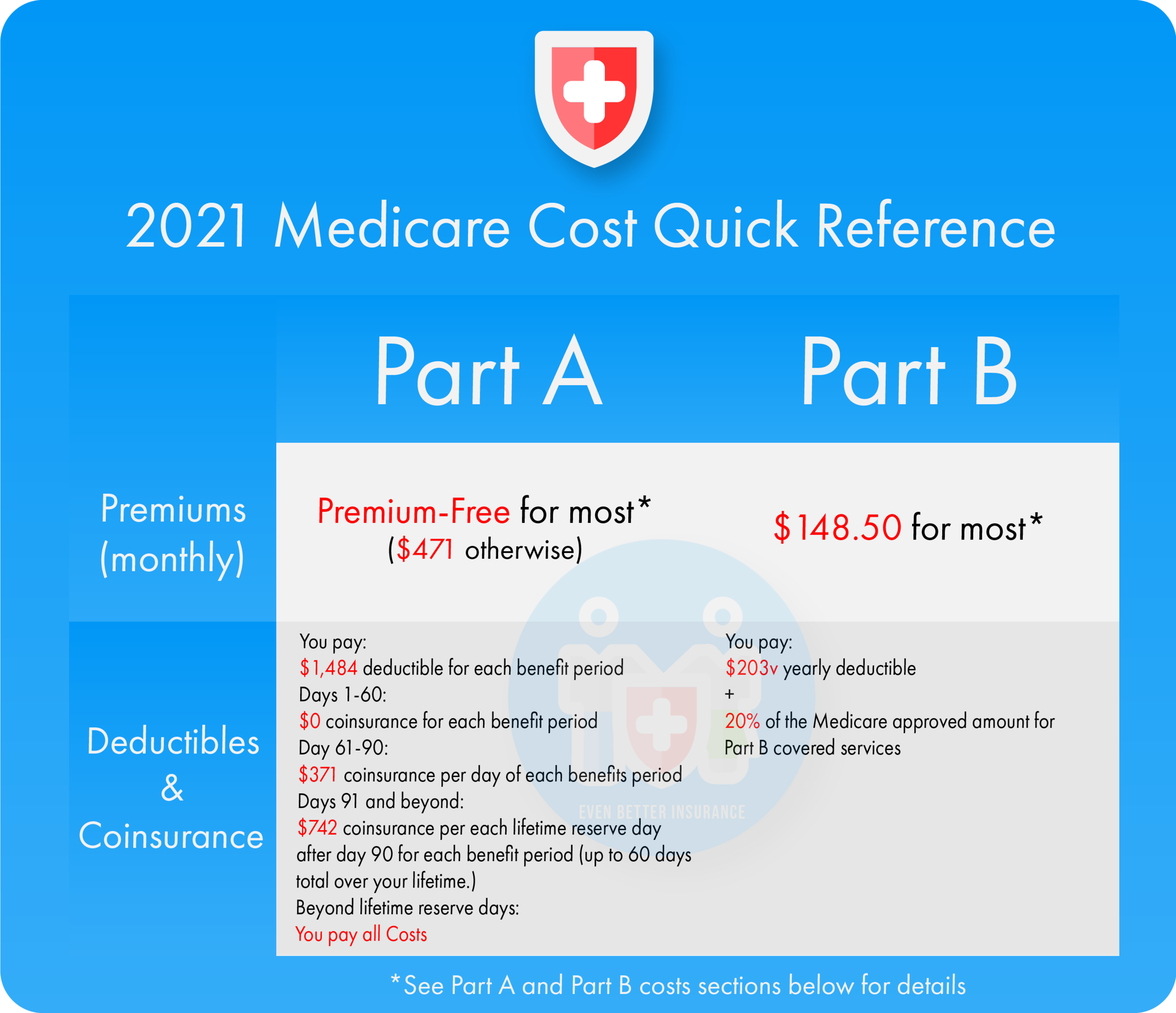

For example, if you have Medicare Part A, you might be responsible for 20% of the cost of any hospital stay after you’ve met your deductible. Likewise, if you have Medicare Part B, you might pay 20% of the cost of outpatient services like doctor visits and lab tests after you’ve met your deductible.

How Does Coinsurance Work?

Coinsurance is a cost-sharing arrangement between you and your insurance provider. After you’ve met your deductible, you’re responsible for paying a percentage of your medical bills, while your insurance provider pays the rest. The percentage you pay varies depending on the type of Medicare plan you have.

There are two types of coinsurance: Part A coinsurance and Part B coinsurance. Part A coinsurance applies to hospital stays and other inpatient care, while Part B coinsurance applies to outpatient care like doctor visits.

For example, let’s say you have a $10,000 hospital bill and you’ve already met your Part A deductible of $1,484. If your coinsurance rate is 20%, you’ll be responsible for paying $1,903 (20% of the remaining $9,516), while Medicare will pay the remaining $7,613.

Benefits of Medicare Coinsurance

While coinsurance may seem like an additional expense, it actually serves an important purpose. By requiring you to pay a percentage of your medical bills, coinsurance helps keep healthcare costs down for everyone. It also encourages patients to be more cost-conscious when making healthcare decisions.

Furthermore, coinsurance can help protect you from overusing medical services unnecessarily. If you had no out-of-pocket costs, you might be more likely to seek medical care for minor issues that could be resolved without medical intervention. By requiring you to pay a portion of your medical bills, coinsurance helps ensure that you only seek medical care when it’s truly necessary.

Coinsurance Vs. Copayments

While coinsurance and copayments might seem similar, they’re actually different types of cost-sharing arrangements. A copayment is a fixed amount you pay for a medical service, while coinsurance is a percentage of the total cost.

For example, let’s say you have a $100 doctor visit and your copayment is $20. You’ll pay $20 for the visit, and your insurance provider will cover the remaining $80. On the other hand, if your coinsurance rate is 20%, you’ll pay $20 (20% of the $100 cost) and your insurance provider will cover the remaining $80.

Coinsurance Vs. Deductibles

Coinsurance and deductibles are both types of cost-sharing arrangements, but they work differently. A deductible is the amount you pay out of pocket before your insurance provider starts covering your medical bills. Coinsurance, on the other hand, is the percentage of your medical bills that you’re responsible for paying after your deductible has been met.

For example, let’s say you have a $1,000 deductible and a 20% coinsurance rate. If you have a $5,000 medical bill, you’ll be responsible for paying the first $1,000 (your deductible) and then 20% of the remaining $4,000 ($800), for a total out-of-pocket cost of $1,800.

How to Reduce Your Coinsurance Costs

While you can’t eliminate coinsurance altogether, there are some ways to reduce your out-of-pocket costs. One option is to choose a Medicare Advantage plan, which often includes lower coinsurance rates than traditional Medicare plans.

You can also ask your doctor to prescribe generic medications, which tend to be less expensive than brand-name drugs. Additionally, you can shop around for medical services to find the best price. Many healthcare providers offer cost estimates for services upfront, so you can compare prices and choose the most affordable option.

Coinsurance and Supplemental Insurance

Some seniors choose to purchase supplemental insurance, or “Medigap” policies, to help cover the costs associated with coinsurance. Medigap policies are sold by private insurance companies, and they can help pay for some of the out-of-pocket costs associated with Medicare.

If you’re considering a Medigap policy, be sure to compare the different options carefully. Medigap policies are standardized, but the premiums can vary widely between providers. Additionally, not all Medigap policies cover all types of coinsurance, so it’s important to choose a policy that meets your specific needs.

Conclusion

Medicare coinsurance is an important aspect of healthcare cost-sharing. While it can be an additional expense, it helps keep healthcare costs down for everyone and encourages patients to be more cost-conscious when making healthcare decisions. By understanding how coinsurance works and exploring ways to reduce your out-of-pocket costs, you can make informed healthcare choices that are both cost-effective and beneficial for your health.

Frequently Asked Questions

What is Medicare Coinsurance?

Medicare coinsurance refers to the amount that you pay out of pocket for healthcare services after you have met your Medicare deductible. The coinsurance is usually a percentage of the Medicare-approved amount for the service. For example, if the Medicare-approved amount for a service is $100 and your coinsurance is 20%, you would pay $20 while Medicare would pay the remaining $80.

Coinsurance applies to Medicare Part A and Part B services, including hospital stays, doctor visits, and medical equipment. It is important to note that the coinsurance amount can vary depending on the service and whether you receive care from a provider that accepts Medicare assignment.

How is Medicare Coinsurance calculated?

Medicare coinsurance is calculated as a percentage of the Medicare-approved amount for the service. The percentage can vary depending on the service and whether you receive care from a provider that accepts Medicare assignment. In general, the coinsurance for Medicare Part A services is different from the coinsurance for Medicare Part B services.

For example, the coinsurance for a hospital stay under Medicare Part A is calculated based on the number of days you are in the hospital. For days 1-60, the coinsurance is $0. For days 61-90, the coinsurance is $352 per day. For days 91 and beyond, the coinsurance is $704 per day (up to 60 lifetime reserve days).

Is there a limit to how much I will pay in Medicare Coinsurance?

Yes, there is a limit to how much you will pay in Medicare coinsurance each year. This limit is known as the out-of-pocket maximum. Once you have reached this limit, Medicare will cover 100% of the cost for covered services for the rest of the year.

The out-of-pocket maximum for Medicare Part A services in 2021 is $1,484 per benefit period. The out-of-pocket maximum for Medicare Part B services in 2021 is $203 per year. It is important to note that the out-of-pocket maximum does not include the cost of prescription drugs under Medicare Part D.

What is the difference between Medicare Coinsurance and Medicare Deductibles?

Medicare coinsurance and Medicare deductibles are both forms of cost-sharing that require you to pay a portion of the cost for healthcare services. However, the main difference between the two is when you are required to pay.

With Medicare deductibles, you are required to pay a set amount of money before Medicare will start paying for your healthcare services. With coinsurance, you are required to pay a percentage of the Medicare-approved amount for the service after you have met your deductible. In general, Medicare deductibles are lower than coinsurance amounts.

Do I have to pay Medicare Coinsurance if I have a Medicare Advantage plan?

It depends on the specific Medicare Advantage plan that you have. Some Medicare Advantage plans may have lower coinsurance amounts or no coinsurance at all for certain services. However, it is important to note that Medicare Advantage plans may have different cost-sharing requirements than Original Medicare.

If you have a Medicare Advantage plan, you should review your plan documents or contact your plan provider to understand your coinsurance and other cost-sharing responsibilities.

What is Your Medicare Part B and Coinsurance Amount? 🤔

In conclusion, understanding Medicare coinsurance is crucial for those who rely on Medicare for their healthcare needs. It is the portion of the medical bill that the patient is responsible for paying after Medicare has paid its share. This can vary depending on the services received and the specific plan the patient has.

One important thing to keep in mind is that coinsurance can add up quickly, especially for those who require frequent medical services. It is important to budget for these costs and consider supplemental insurance plans that can help cover these expenses.

Overall, Medicare coinsurance is just one aspect of the complex healthcare system in the United States. By understanding how it works and planning accordingly, patients can ensure they receive the care they need without facing overwhelming financial burden.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts