Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federally-funded health insurance program that provides coverage for eligible individuals in the United States. It was established in 1965 under the Social Security Act and has since become a critical aspect of healthcare for seniors and some younger individuals with disabilities.

The program is divided into several parts, each covering different services such as hospital stays, doctor visits, prescription drugs, and more. Understanding the different components of Federal Medicare is crucial for anyone looking to enroll or make informed decisions about their healthcare coverage. Let’s dive in!

Federal Medicare is a health insurance program provided by the US government for individuals aged 65 and above, as well as those with certain disabilities or end-stage renal disease. It covers hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). Beneficiaries can choose to receive coverage through Original Medicare or through Medicare Advantage plans offered by private insurance companies.

Contents

What is Federal Medicare?

Federal Medicare is a national health insurance program that was introduced in 1965 to provide healthcare coverage for people aged 65 and older, as well as those with certain disabilities or chronic conditions. Medicare is funded by the federal government and is managed by the Centers for Medicare and Medicaid Services (CMS).

Eligibility for Federal Medicare

To be eligible for Federal Medicare, an individual must be a U.S. citizen or permanent legal resident who is either 65 years of age or older, or younger than 65 with certain disabilities or chronic conditions. Additionally, the individual must have paid into the Medicare system through payroll taxes for at least 10 years.

Medicare Parts A and B

Federal Medicare is divided into four parts, with Parts A and B being the most commonly used. Part A covers inpatient care in hospitals, skilled nursing facilities, and hospice care. Part B covers medical services such as doctor visits, outpatient care, preventive services, and some medical equipment.

Medicare Advantage and Part D

Medicare Advantage, also known as Part C, is an alternative to traditional Medicare that is offered by private insurance companies. Medicare Advantage plans provide all the benefits of Parts A and B, as well as additional benefits such as prescription drug coverage, dental, and vision care. Part D, also known as the Medicare prescription drug benefit, helps to cover the cost of prescription drugs.

Benefits of Federal Medicare

One of the most significant benefits of Federal Medicare is that it provides access to healthcare coverage for millions of Americans who might otherwise be unable to afford it. Medicare also offers a wide range of benefits, including hospital care, medical services, and prescription drug coverage. Additionally, Medicare provides peace of mind to individuals and families who are concerned about the high cost of healthcare.

Although Medicare and Medicaid are both government-funded healthcare programs, they differ in many ways. Medicare is primarily for individuals aged 65 and older, as well as those with certain disabilities or chronic conditions. Medicaid, on the other hand, is a needs-based program that provides healthcare coverage for low-income individuals and families.

Enrollment in Federal Medicare is typically automatic for individuals who are receiving Social Security benefits. However, individuals who are not receiving Social Security benefits must enroll in Medicare during the initial enrollment period, which begins three months before they turn 65 and ends three months after. Individuals who miss the initial enrollment period may face penalties and higher premiums.

Federal Medicare is a crucial healthcare program that provides coverage for millions of Americans. It offers access to hospital care, medical services, prescription drug coverage, and more. Understanding the different parts of Medicare and the eligibility requirements can help individuals make informed decisions about their healthcare coverage.

Frequently Asked Questions

What is Federal Medicare?

Federal Medicare is a national health insurance program that provides coverage for people who are 65 years or older, as well as individuals with certain disabilities or end-stage renal disease. Medicare is funded by federal taxes and premiums paid by beneficiaries and is administered by the Centers for Medicare and Medicaid Services (CMS).

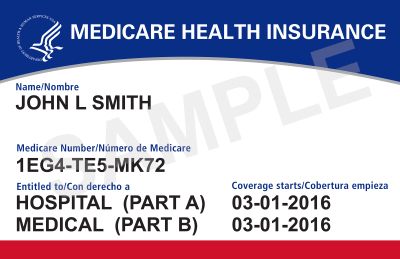

Medicare has four parts: Part A, which covers hospital stays and skilled nursing care; Part B, which covers doctor visits and outpatient services; Part C, which allows beneficiaries to receive their benefits through private insurance plans; and Part D, which covers prescription drugs.

Who is eligible for Federal Medicare?

To be eligible for Federal Medicare, you must be 65 years or older, or have a qualifying disability or end-stage renal disease. You must also be a U.S. citizen or permanent legal resident who has lived in the U.S. for at least five years. If you are eligible for Social Security or Railroad Retirement benefits, you are automatically enrolled in Medicare Part A and Part B.

What does Federal Medicare cover?

Federal Medicare covers a wide range of medical services, including hospital stays, doctor visits, outpatient services, preventive care, and prescription drugs. The exact coverage provided by Medicare depends on which parts of the program you are enrolled in, as well as any additional coverage you may have through a private insurance plan.

It is important to note that Medicare does not cover all medical expenses, and beneficiaries are responsible for paying certain out-of-pocket costs, such as deductibles, copayments, and coinsurance.

How do I enroll in Federal Medicare?

If you are eligible for Medicare, you can enroll during the initial enrollment period, which begins three months before your 65th birthday and ends three months after your birthday month. If you miss this initial enrollment period, you may be subject to a late enrollment penalty.

To enroll in Medicare, you can visit the Social Security website, call the Social Security Administration, or visit a local Social Security office. You will need to provide certain personal and financial information to complete the enrollment process.

Can I change my Federal Medicare coverage?

Yes, you can change your Medicare coverage during the annual open enrollment period, which runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage plan, or vice versa. You can also change your Part D prescription drug plan or enroll in a Part D plan if you do not currently have one.

It is important to review your Medicare coverage each year to ensure that it still meets your needs and that you are getting the best value for your money.

Medicare Basics: Parts A, B, C & D

In conclusion, Federal Medicare is a government-funded health insurance program that provides coverage for millions of Americans. It was established in 1965 to help people aged 65 and older pay for their medical expenses, but it has since been expanded to cover people with disabilities and those with certain chronic conditions.

One of the key benefits of Federal Medicare is that it provides access to a wide range of medical services, including preventive care, hospital stays, and prescription drugs. This can be particularly important for people with chronic conditions, who may require ongoing care and treatment.

Overall, Federal Medicare plays a crucial role in ensuring that people have access to the healthcare services they need. While there are certainly challenges and limitations associated with the program, it remains an important part of the safety net for millions of Americans.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts