Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Original Medicare is a health insurance program that covers millions of Americans. It is a federal program that provides basic coverage for a wide range of medical services. However, there are certain limitations to what Original Medicare covers and understanding these limitations is important for anyone who is eligible for the program.

At its core, Original Medicare covers many of the essential medical services that people need, such as hospital stays, doctor visits, and medical tests. But there are also plenty of services that are not covered by Original Medicare, including dental care, vision care, and prescription drugs. In this article, we will explore what Original Medicare covers and what it does not so that you can make informed decisions about your health care.

What Does Original Medicare Cover?

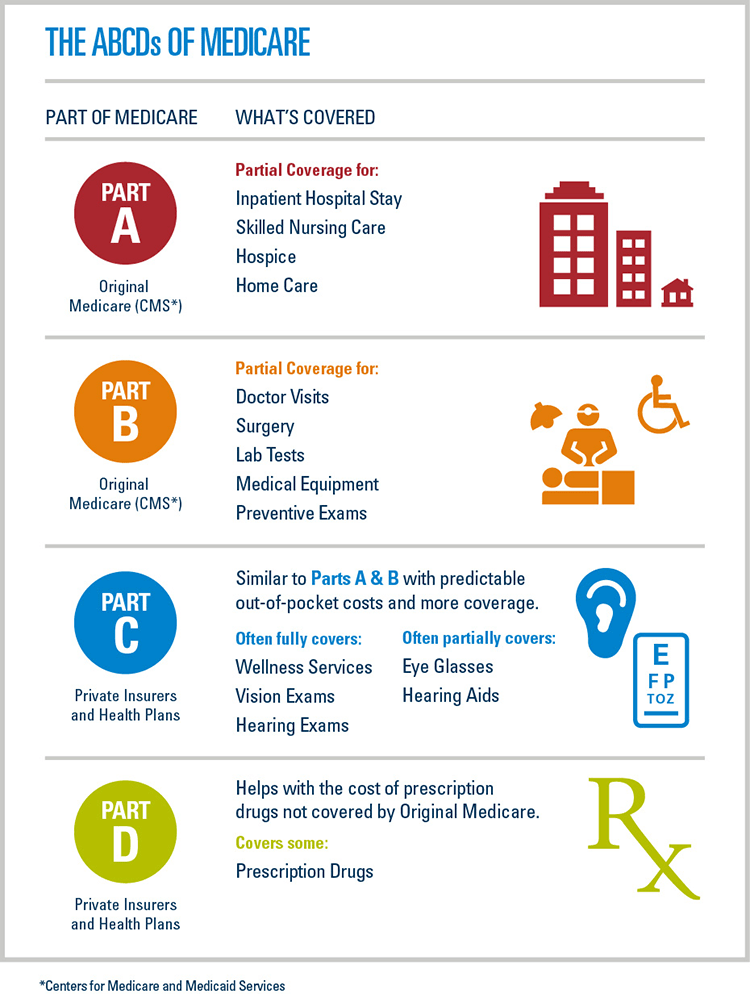

Original Medicare is a federal health insurance program that covers a wide range of health care services and supplies. It includes Part A (hospital insurance) and Part B (medical insurance). Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers doctor visits, outpatient services, preventive care, and medical equipment. However, Original Medicare does not cover everything, such as prescription drugs, dental care, and vision care. You may need to enroll in additional coverage, such as a Medicare Advantage plan or a prescription drug plan, to get these services covered.

What Does Original Medicare Cover?

Original Medicare is a government-funded health insurance program designed to provide coverage for American citizens and permanent residents of the United States who are 65 years of age or older, as well as younger individuals with qualifying disabilities. It consists of two parts: Part A and Part B. In this article, we will take a closer look at what these two parts cover.

Part A: Hospital Insurance

Part A of Original Medicare, also known as Hospital Insurance, covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care services.

If you are admitted to the hospital, Part A will cover your room, meals, nursing care, and other related services and supplies. However, it does not cover private-duty nursing, a private room, or personal care items like toothpaste and razors.

If you need skilled nursing care after a hospital stay, Part A will cover up to 100 days in a skilled nursing facility. However, you must meet certain conditions to qualify for this coverage.

Part A also covers hospice care for terminally ill patients who have a life expectancy of six months or less. This includes medical, social, and support services to help patients and their families cope with the end of life.

Finally, Part A covers some home health care services, such as intermittent skilled nursing care, physical therapy, speech therapy, and occupational therapy. However, you must meet certain conditions to qualify for this coverage, and there are limits on the amount of care you can receive.

Part B: Medical Insurance

Part B of Original Medicare, also known as Medical Insurance, covers medically necessary services and supplies, such as doctor visits, preventive care, outpatient care, and durable medical equipment.

If you need to see a doctor or other health care provider, Part B will cover their services and any necessary tests or procedures. Preventive care, such as flu shots and mammograms, is also covered.

Outpatient care, such as surgery and diagnostic tests, are covered under Part B as well. Durable medical equipment, such as wheelchairs and oxygen equipment, is also covered if it is medically necessary.

However, there are some services and supplies that Part B does not cover, such as long-term care, dental care, vision care, and hearing aids.

Benefits of Original Medicare

One of the biggest benefits of Original Medicare is that it provides coverage for a wide range of medical services and supplies. It is also accepted by most health care providers in the United States, so you have access to a large network of doctors and hospitals.

Another benefit of Original Medicare is that it has relatively low premiums and deductibles compared to other types of health insurance. This can help you save money on your health care costs.

Finally, Original Medicare does not require you to choose a primary care physician or get referrals to see specialists. You have the freedom to choose the health care providers you want to see.

Original Medicare vs. Medicare Advantage

While Original Medicare provides comprehensive coverage, some people choose to enroll in a Medicare Advantage plan instead. Medicare Advantage plans are offered by private insurance companies and provide all of the same benefits as Original Medicare, plus additional benefits like prescription drug coverage, dental care, and vision care.

However, Medicare Advantage plans often have limited networks of providers, which can restrict your choices when it comes to health care. They also typically have higher premiums and out-of-pocket costs than Original Medicare.

It’s important to weigh the pros and cons of both options before making a decision about which type of coverage is right for you.

Conclusion

In summary, Original Medicare provides coverage for a wide range of medical services and supplies, including hospital stays, doctor visits, and durable medical equipment. While there are some services and supplies that it does not cover, it is still a comprehensive and affordable option for many Americans.

If you are considering enrolling in Original Medicare, be sure to carefully review the coverage options and costs to ensure that it meets your health care needs and budget.

Frequently Asked Questions

What is Original Medicare?

Original Medicare is a federal health insurance program that covers eligible individuals aged 65 or older, as well as some younger people with disabilities. The program is comprised of two parts: Part A and Part B. Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and some home health care services. Part B covers doctor visits, outpatient care, preventive services, and some medical equipment and supplies.

What does Original Medicare cover?

Original Medicare provides coverage for a wide range of medical services, including hospital care, doctor visits, and preventive care. Part A covers hospital stays, skilled nursing facility care, hospice care, and some home health care services. Part B covers doctor visits, outpatient care, preventive services, and some medical equipment and supplies. However, there are certain medical services that Original Medicare does not cover, such as dental care, eyeglasses, and hearing aids.

Do I need to pay for Original Medicare?

Most people do not have to pay for Medicare Part A, as long as they or their spouse have paid Medicare taxes for at least 10 years. However, there is a monthly premium for Medicare Part B, which is based on income and can change from year to year. Additionally, there may be other out-of-pocket costs for services covered by Original Medicare, such as deductibles, copayments, and coinsurance.

Can I get additional coverage with Original Medicare?

Yes, there are several ways to get additional coverage with Original Medicare. One option is to enroll in a Medicare Advantage plan, which is a type of private insurance that provides the same benefits as Original Medicare, as well as additional services such as vision, hearing, and dental care. Another option is to purchase a Medicare Supplement plan, which is also known as Medigap, and can help pay for out-of-pocket costs not covered by Original Medicare.

How do I enroll in Original Medicare?

If you are turning 65 or have a disability, you will typically be automatically enrolled in Medicare Part A and Part B. If you are not automatically enrolled, you can enroll during the initial enrollment period, which is three months before your 65th birthday, the month of your 65th birthday, and three months after your 65th birthday. You can enroll in Medicare online, by phone, or in person at a Social Security office.

Does Original Medicare cover an annual routine physical exam?

In conclusion, Original Medicare provides coverage for a wide range of medical services and treatments. It covers hospital stays, doctor visits, and preventative care, among other things. However, there are gaps in coverage, such as prescription drugs, dental care, and vision care. It is important to understand what is covered by Original Medicare and what is not, and to consider additional insurance options to fill in these gaps. By doing so, you can ensure that you have comprehensive coverage for all of your healthcare needs. Remember to review your coverage annually to make sure it still meets your needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts