Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, the need for healthcare services becomes more and more important. However, Medicare coverage doesn’t always cover everything we need. That’s where Medicare Supplement Insurance, also known as Medigap, comes in.

Medicare Supplement Insurance is designed to help fill in the gaps left by Medicare coverage. But what exactly does it cover? In this article, we’ll explore the benefits and limitations of Medigap policies, so you can make an informed decision about your healthcare coverage.

Contents

- Understanding Medicare Supplement Insurance Coverage

- Frequently Asked Questions

- What does Medicare Supplement insurance cover?

- Can I choose which Medicare Supplement insurance plan to enroll in?

- Is Medicare Supplement insurance expensive?

- Can I enroll in Medicare Supplement insurance at any time?

- How do I enroll in Medicare Supplement insurance?

- What is Medigap? (Medicare Supplement Insurance Explained)

Understanding Medicare Supplement Insurance Coverage

Medicare Supplement Insurance, also known as Medigap, is a type of insurance policy designed to cover the gaps left by Original Medicare. Original Medicare consists of two parts: Part A (hospital insurance) and Part B (medical insurance), but it does not cover all medical expenses. Medicare Supplement Insurance policies are offered by private insurance companies to fill in the gaps left by Original Medicare.

What Does Medicare Supplement Insurance Cover?

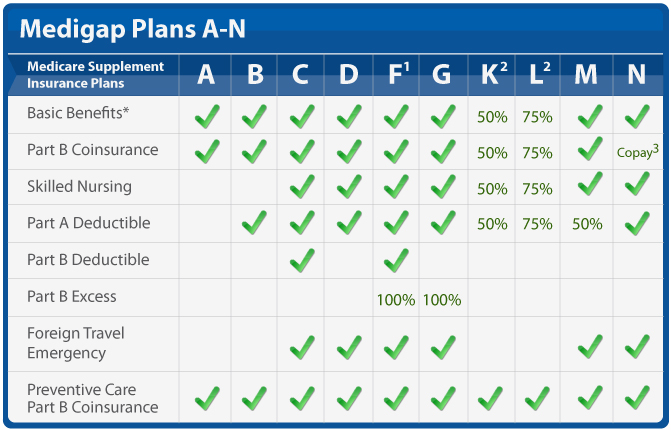

Medigap policies are standardized, which means that they offer the same benefits across all insurance companies. The benefits offered are identified by letters, ranging from A to N. The benefits may differ depending on the state you live in. Here is a summary of the benefits offered by each letter plan:

- Plan A: It covers basic benefits such as Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted.

- Plan B: It covers basic benefits plus Medicare Part A deductible.

- Plan C: It covers basic benefits plus skilled nursing facility care coinsurance, Medicare Part A deductible, Medicare Part B deductible, and foreign travel emergency coverage.

- Plan D: It covers basic benefits plus skilled nursing facility care coinsurance and foreign travel emergency coverage.

Plans F, G, and N are the most popular plans, offering comprehensive benefits.

- Plan F: It covers all basic benefits plus Medicare Part B deductible, Part B excess charges, and foreign travel emergency coverage.

- Plan G: It covers all basic benefits plus Medicare Part B excess charges and foreign travel emergency coverage.

- Plan N: It covers all basic benefits plus copayments of up to $20 for some office visits and up to $50 for emergency room visits.

Benefits of Medicare Supplement Insurance

Medicare Supplement Insurance provides a number of benefits, including:

- Lower Out-of-Pocket Costs: Medigap policies help reduce out-of-pocket costs by covering the gaps left by Original Medicare.

- Freedom to Choose Providers: Unlike Medicare Advantage plans, Medigap policies allow you to choose doctors and hospitals without network restrictions.

- Guaranteed Renewable: Medigap policies are guaranteed renewable, which means that insurance companies cannot cancel your coverage as long as you pay your premiums.

- Peace of Mind: Medigap policies provide peace of mind by offering additional coverage for medical expenses not covered by Original Medicare.

Medigap vs. Medicare Advantage

Medigap and Medicare Advantage are two different types of insurance policies that provide additional coverage beyond Original Medicare. Medicare Advantage plans, also known as Part C, are offered by private insurance companies and provide all the benefits of Original Medicare plus additional benefits such as vision, dental, and hearing.

One key difference between Medigap and Medicare Advantage is that Medigap policies do not cover prescription drugs. You will need to enroll in a separate Medicare Part D plan for prescription drug coverage if you have a Medigap policy. On the other hand, Medicare Advantage plans often include prescription drug coverage.

Another difference is that Medicare Advantage plans have network restrictions, which means that you need to choose doctors and hospitals within the plan’s network. Medigap policies do not have network restrictions, and you can choose any doctor or hospital that accepts Medicare.

In conclusion, Medicare Supplement Insurance policies provide additional coverage for medical expenses not covered by Original Medicare. The benefits offered by each plan are standardized, and you can choose the plan that best suits your needs. While Medigap and Medicare Advantage are both options for additional coverage, they differ in their coverage, network restrictions, and costs. It is important to research and compare both options before making a decision.

Frequently Asked Questions

Medicare Supplement insurance is a type of insurance policy that helps cover the gaps in Original Medicare. It is important to understand what is covered by Medicare Supplement insurance so that you can make informed decisions about your healthcare coverage. Here are five common questions and answers about what Medicare Supplement insurance covers.

What does Medicare Supplement insurance cover?

Medicare Supplement insurance, also known as Medigap, covers some of the costs that Original Medicare does not cover. These costs include deductibles, copayments, and coinsurance fees. Medigap policies may also cover healthcare services that Original Medicare does not cover, such as medical care received outside of the United States.

It is important to note that Medicare Supplement insurance does not cover long-term care, dental care, vision care, or hearing aids. Additionally, Medigap policies do not cover prescription drugs. If you need prescription drug coverage, you will need to enroll in a Medicare Part D plan.

Can I choose which Medicare Supplement insurance plan to enroll in?

Yes, you can choose which Medicare Supplement insurance plan to enroll in. There are ten standardized Medigap policies, labeled A through N. Each plan offers different levels of coverage, and the premiums for each plan may vary depending on your location and other factors. You can compare the benefits and costs of each plan to determine which one is right for you.

It is important to note that Medigap policies are only available to individuals who are already enrolled in Original Medicare. You cannot enroll in a Medigap policy if you are enrolled in a Medicare Advantage plan.

Is Medicare Supplement insurance expensive?

The cost of Medicare Supplement insurance varies depending on several factors, including your location, age, gender, and health status. In general, Medigap policies tend to be more expensive than other types of Medicare insurance, such as Medicare Advantage plans. However, Medigap policies may provide more comprehensive coverage, and they may be a good choice if you require a lot of medical care.

It is important to shop around and compare the costs and benefits of different Medigap policies before enrolling. You may also want to consider working with a licensed insurance agent who can help you find the best policy for your needs and budget.

Can I enroll in Medicare Supplement insurance at any time?

No, you cannot enroll in Medicare Supplement insurance at any time. There is a six-month open enrollment period that begins when you are enrolled in Part B of Original Medicare. During this period, you can enroll in any Medigap policy without being subject to medical underwriting. If you apply for Medigap coverage outside of the open enrollment period, you may be subject to medical underwriting, which means that the insurance company can charge you higher premiums or deny you coverage based on your health status.

It is important to enroll in a Medigap policy during the open enrollment period if you want to avoid higher premiums or being denied coverage.

How do I enroll in Medicare Supplement insurance?

To enroll in Medicare Supplement insurance, you will need to contact a licensed insurance agent or broker in your area. They can help you compare the costs and benefits of different Medigap policies and enroll in the policy that best meets your needs and budget. You can also use the Medicare website to search for Medigap policies in your area.

It is important to enroll in a Medigap policy during the open enrollment period to avoid being subject to medical underwriting. If you miss the open enrollment period, you may still be able to enroll in a Medigap policy, but you may have to pay higher premiums or be denied coverage based on your health status.

What is Medigap? (Medicare Supplement Insurance Explained)

In conclusion, Medicare supplement insurance, also known as Medigap, can be a valuable addition to traditional Medicare coverage. It can help cover costs such as deductibles, coinsurance, and copayments that may not be fully covered by Medicare alone.

However, it’s important to note that Medigap plans do not cover everything. For example, prescription drug coverage is not included in Medigap plans. Therefore, it’s important to carefully evaluate your healthcare needs and budget to determine if Medigap is right for you.

Overall, Medicare supplement insurance can provide peace of mind and additional financial protection for those who want comprehensive healthcare coverage. By understanding what is and isn’t covered, you can make an informed decision about your healthcare coverage and ensure that you are fully protected.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts