Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, our vision can deteriorate, making it difficult to perform daily tasks and enjoy life as we once did. That’s why it’s important to understand what Medicare covers when it comes to vision care.

Medicare is a federal health insurance program that covers a wide range of medical services, but when it comes to vision, coverage can be limited. Let’s take a closer look at what Medicare covers for vision and how you can make sure you’re getting the care you need.

Medicare Part B covers some vision-related services, such as annual eye exams and diagnostic tests for eye diseases. However, it does not cover routine eye exams, eyeglasses, or contact lenses. Medicare Advantage plans may offer additional vision benefits, including coverage for glasses and contacts. It’s important to check with your specific plan for details on what vision services are covered.

Contents

- What Does Medicare Cover for Vision?

- Frequently Asked Questions

- What vision services does Medicare cover?

- Does Medicare cover eye surgeries?

- Will Medicare cover the cost of my eyeglasses or contact lenses?

- Does Medicare cover treatment for age-related macular degeneration?

- Can I get a second opinion for my vision care under Medicare?

- Does Medicare Cover Vision Services? Learn about Medicare Vision Coverage at Medicare on Video

What Does Medicare Cover for Vision?

Medicare is a federal health insurance program that provides coverage for millions of Americans. While it covers many medical expenses, many people wonder what Medicare covers for vision. The answer is that it depends on the type of Medicare coverage you have.

Original Medicare Coverage for Vision

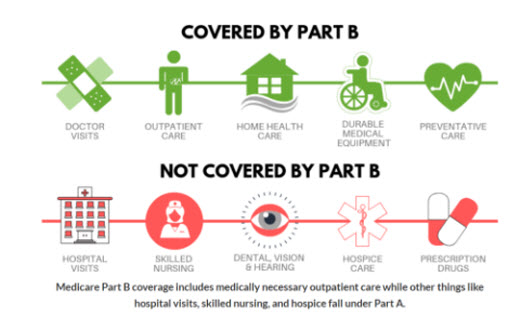

Original Medicare (Part A and Part B) does not typically cover routine eye exams for eyeglasses or contact lenses. However, it does cover some vision care in certain situations.

Medicare Part B may cover some diagnostic tests and preventive screenings related to eye health, such as glaucoma tests, if you are at high risk for the disease. Part B may also cover some treatment for eye diseases or conditions, such as cataracts, if deemed medically necessary.

Medicare Advantage Coverage for Vision

Medicare Advantage (Part C) plans are offered by private insurance companies and provide the same coverage as Original Medicare, but may also include additional benefits, such as vision care.

Many Medicare Advantage plans offer coverage for routine eye exams, prescription eyewear, and other vision-related services. Some plans may also cover treatment for certain eye conditions, such as macular degeneration and diabetic retinopathy.

What Vision Services are Covered by Medicare Supplement Plans?

Medicare Supplement (Medigap) plans are designed to help cover some of the out-of-pocket costs associated with Original Medicare. However, they do not typically cover vision care.

Some Medigap plans may offer limited coverage for certain vision-related services, such as eye exams and eyeglasses. However, it is important to check with your specific plan to determine what is covered.

Benefits of Vision Coverage

Having vision coverage can help you maintain healthy eyes and prevent vision problems from developing or worsening. Regular eye exams can detect early signs of eye diseases and conditions that may not have symptoms in their early stages.

Additionally, having vision coverage can help you save money on the cost of eye exams, prescription eyewear, and other vision-related services.

Vision Coverage Vs. Paying Out-of-Pocket

If you do not have vision coverage through Medicare or another insurance plan, you will need to pay out-of-pocket for routine eye exams and other vision-related services. This can be expensive, especially if you require prescription eyewear or have a vision condition that requires ongoing treatment.

While paying out-of-pocket may be an option for some, having vision coverage can provide peace of mind and help you save money in the long run.

How to Get Vision Coverage through Medicare

If you are enrolled in Original Medicare, you can purchase a standalone vision insurance policy to help cover the cost of routine eye exams and other vision-related services.

If you are enrolled in a Medicare Advantage plan, you may have vision coverage included in your plan. It is important to review your plan’s benefits and coverage to determine what vision services are included.

Conclusion

While Original Medicare does not typically cover routine eye exams and other vision-related services, there are options for obtaining vision coverage through Medicare Advantage plans or standalone vision insurance policies. Having vision coverage can help you maintain healthy eyes, detect early signs of eye diseases and conditions, and save money on the cost of vision care.

Frequently Asked Questions

What vision services does Medicare cover?

Medicare covers some vision services, such as annual eye exams, diagnostic tests, and contact lenses or eyeglasses after cataract surgery. However, routine eye exams to check for eyeglass or contact lens prescriptions are not covered. Some Medicare Advantage plans may offer additional vision benefits, such as coverage for routine eye exams or eyewear.

Does Medicare cover eye surgeries?

Medicare covers medically necessary eye surgeries, such as cataract surgery or certain treatments for glaucoma. However, cosmetic eye surgeries, such as eyelid surgery or LASIK, are not covered by Medicare. If you need an eye surgery, it’s important to check with your provider to see if it’s covered by Medicare.

Will Medicare cover the cost of my eyeglasses or contact lenses?

Medicare does not cover the cost of eyeglasses or contact lenses, except for after cataract surgery. However, some Medicare Advantage plans may offer additional coverage for eyewear. If you need new eyeglasses or contact lenses, you will need to pay for them out-of-pocket or through a separate vision insurance plan.

Medicare does cover some treatments for age-related macular degeneration, such as injections of certain drugs into the eye. However, the extent of coverage may vary depending on the specific treatment and your individual circumstances. It’s important to talk to your doctor and Medicare provider to see what treatments are covered.

Can I get a second opinion for my vision care under Medicare?

Yes, Medicare covers second opinions for vision care. If you’re unsure about a recommended treatment or diagnosis, you can ask your doctor for a referral to another provider for a second opinion. Medicare will cover the cost of the second opinion. However, it’s important to note that some providers may not accept Medicare or may charge additional fees.

Does Medicare Cover Vision Services? Learn about Medicare Vision Coverage at Medicare on Video

In conclusion, Medicare provides some coverage for vision services, but it is important to understand the limits of this coverage. While Medicare covers some basic eye exams for those with certain risk factors, it does not cover routine eye exams for those without these risk factors. Additionally, Medicare does not cover most eyeglasses or contact lenses, unless they are deemed medically necessary.

However, there are other options for those seeking more comprehensive vision coverage. Medicare Advantage plans often offer additional vision benefits beyond what is covered by original Medicare. Private vision insurance plans are also available for those who want more comprehensive coverage for routine eye exams and eyewear.

Ultimately, it is important to carefully review your options and choose the plan that best meets your individual needs and budget. By understanding your coverage options and taking advantage of available resources, you can ensure that you receive the vision care you need to maintain your overall health and well-being.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts