Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, healthcare costs become an increasingly important consideration. For many seniors, Medicare is a vital resource that helps cover the cost of medical treatment. But how are Medicare premiums determined? Understanding the factors that influence premium costs can help seniors make informed decisions about their healthcare coverage.

Medicare premiums are based on a variety of factors, including income, age, and the specific type of Medicare plan you choose. Whether you opt for Original Medicare, a Medicare Advantage plan, or a Medicare Supplement plan, the premiums you pay will depend on several key variables. In this article, we’ll take a closer look at the factors that determine your Medicare premiums and what you can do to manage your healthcare costs effectively.

Understanding Medicare Premiums: What Are They Based on?

Medicare premiums are a critical aspect of the Medicare program that individuals who are eligible for Medicare must understand. Medicare premiums are the amount that individuals must pay each month to receive certain Medicare benefits. These premiums are based on various factors and can vary depending on the coverage that individuals have. In this article, we will explore what Medicare premiums are based on, and how they are calculated.

Age and Premiums

Medicare premiums are based on several factors, including an individual’s age. The older an individual is, the higher their premiums are likely to be. This is because older individuals are at a higher risk of developing health problems and requiring medical care. Medicare premiums are also higher for individuals who have not worked and paid Medicare taxes for at least ten years.

In addition, Medicare premiums can vary depending on when an individual enrolls in Medicare. For example, individuals who enroll in Medicare during their initial enrollment period (IEP) or during a special enrollment period (SEP) may have lower premiums than those who enroll later.

Income and Premiums

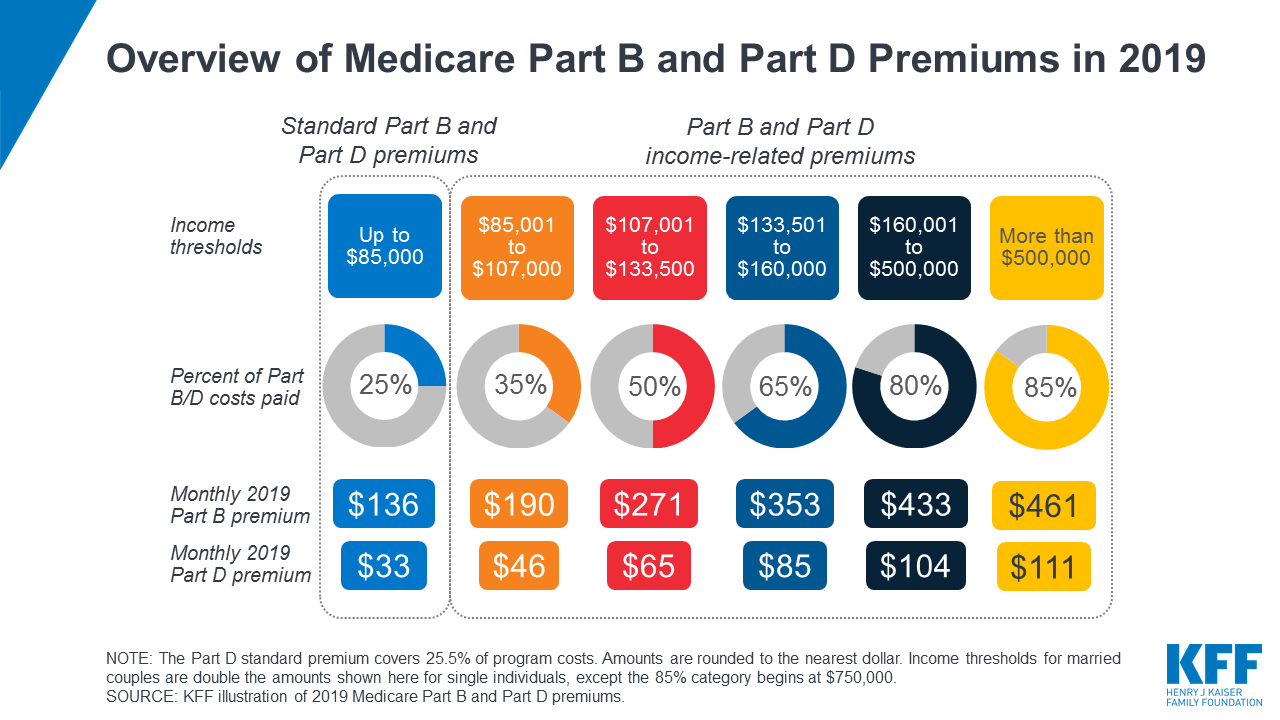

Income is another factor that can impact Medicare premiums. Individuals who have a higher income may be required to pay a higher premium for Medicare Part B and Part D. This is known as income-related monthly adjustment amounts (IRMAA). The IRMAA is based on an individual’s modified adjusted gross income (MAGI) from two years prior.

Medicare beneficiaries who have a MAGI of $88,000 or less ($176,000 or less for married couples) are not subject to IRMAA. However, those with a MAGI between $88,000 and $111,000 ($176,000 and $222,000 for married couples) may have to pay a higher Part B premium. Individuals with a MAGI above $111,000 ($222,000 for married couples) may have to pay an even higher premium.

Type of Coverage and Premiums

Medicare premiums can also vary depending on the type of coverage that individuals have. For example, individuals who have Medicare Advantage plans may have different premiums than those who have Original Medicare. Medicare Advantage plans are offered by private insurance companies and provide all the benefits of Original Medicare, plus additional benefits such as prescription drug coverage, dental, and vision coverage.

In addition, individuals who have Medicare Part D prescription drug coverage may also have to pay a premium. The Part D premium can vary depending on the plan that individuals choose and can change from year to year.

Benefits of Medicare Premiums

Medicare premiums provide individuals with access to a wide range of healthcare benefits. These benefits include coverage for hospital stays, doctor visits, preventive care, and prescription drugs. Medicare also provides coverage for certain medical equipment and supplies, such as wheelchairs and walkers.

In addition, Medicare premiums can be a cost-effective way for individuals to access healthcare services. Medicare premiums are often lower than private health insurance premiums, and they provide individuals with access to a broader network of healthcare providers.

Vs. Private Health Insurance Premiums

Compared to private health insurance premiums, Medicare premiums are often lower. This is because Medicare is a government-run program that is funded by taxes and premiums paid by beneficiaries. Private health insurance premiums, on the other hand, are often higher because insurance companies must generate revenue to cover their costs and make a profit.

In addition, private health insurance premiums can vary depending on an individual’s health status and medical history. This means that individuals with pre-existing conditions may have to pay higher premiums or may be denied coverage altogether. Medicare, on the other hand, is required to provide coverage to all eligible individuals, regardless of their health status.

Conclusion

In summary, Medicare premiums are based on several factors, including age, income, and type of coverage. Understanding these factors can help individuals make informed decisions about their Medicare coverage and ensure that they are getting the most out of their benefits. By taking the time to understand Medicare premiums, individuals can access the healthcare services they need to stay healthy and manage their medical conditions.

Frequently Asked Questions

What Are Medicare Premiums Based on?

Medicare premiums are based on a number of factors, including a person’s income and which parts of Medicare they choose to enroll in. Most people are automatically enrolled in Medicare Part A, which covers hospital stays and some other medical services. However, there is a monthly premium for those who do not meet certain eligibility requirements.

In addition to Part A premiums, there are also premiums for Medicare Part B, which covers doctor visits and medical services. These premiums are based on income and can vary from year to year. Medicare Part D, which covers prescription drugs, also has premiums that are based on income.

Do Medicare Premiums Increase Every Year?

Yes, Medicare premiums tend to increase every year. The exact amount of the increase can vary depending on a number of factors, including changes in the cost of healthcare services and prescription drugs. However, the government tries to keep premium increases as low as possible while still ensuring that the program remains financially stable.

It’s also worth noting that some people may be eligible for help paying their Medicare premiums if they have a low income. Programs like Medicaid and the Medicare Savings Program can help cover some or all of the costs of Medicare premiums for eligible individuals.

How Can I Pay My Medicare Premiums?

There are several ways to pay your Medicare premiums, depending on which parts of Medicare you’re enrolled in. If you’re enrolled in Medicare Part A and/or Part B, you can pay your premiums online, by mail, or by phone. You can also set up automatic payments through your bank account.

If you’re enrolled in a Medicare Advantage plan or a Medicare Part D prescription drug plan, you may need to pay your premiums directly to the plan provider. This can usually be done online or by mail, and some plans may also allow you to set up automatic payments.

Can I Change My Medicare Premiums?

Yes, you can change your Medicare premiums during certain times of the year. The Annual Enrollment Period, which runs from October 15 to December 7 each year, allows you to make changes to your Medicare Advantage or Part D plan. During this time, you can switch plans, add or drop coverage, and change your premiums.

Outside of the Annual Enrollment Period, you may still be able to make changes to your Medicare coverage if you experience a qualifying life event, such as moving to a new state or losing your employer-sponsored health insurance.

What Happens If I Can’t Afford My Medicare Premiums?

If you’re having trouble affording your Medicare premiums, there are several options available. You may be eligible for programs like Medicaid or the Medicare Savings Program, which can help cover some or all of the costs of Medicare premiums for eligible individuals.

You can also contact your state’s Health Insurance Assistance Program (SHIP) for help understanding your options and finding resources in your area. In some cases, you may be able to negotiate a payment plan with your Medicare provider or seek help from non-profit organizations that offer assistance with healthcare costs.

The Ultimate Guide to Medicare Premiums 2023 Edition! 💰

In conclusion, understanding how Medicare premiums are calculated is essential for people who are eligible for Medicare. The premiums are based on a variety of factors, including income, age, and disability status. Medicare beneficiaries should be aware of the different parts of Medicare and the premiums associated with each part.

It is important to remember that Medicare premiums can change from year to year, so it is crucial to stay up-to-date with any changes that may affect your coverage. Additionally, beneficiaries should take advantage of the open enrollment period each year to review their coverage and make any necessary changes.

Overall, Medicare premiums are an important aspect of healthcare for millions of Americans. By understanding how they are calculated and staying informed about any changes, beneficiaries can make informed decisions about their healthcare coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts