Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Introduction:

Social Security and Medicare are two of the most critical social welfare programs in the United States. They provide financial assistance to millions of Americans, especially the elderly and disabled. However, many people are unsure whether Social Security and Medicare are included in federal tax rates. In this article, we will discuss the federal tax rates and what they cover.

Paragraph 1:

When it comes to federal taxes, Social Security and Medicare are two of the most significant expenses that taxpayers face. However, whether they are included in the federal tax rate depends on the type of tax. For example, Social Security and Medicare taxes are separate from federal income taxes. While federal income taxes are based on your income, Social Security and Medicare taxes are calculated as a percentage of your total earnings.

Paragraph 2:

In general, federal tax rates cover a broad range of taxes, including income tax, payroll tax, and corporate tax. While Social Security and Medicare taxes are part of the payroll tax, they are not included in federal income taxes. Therefore, it is essential to understand the different types of taxes and how they are calculated to determine what is included in the federal tax rate.

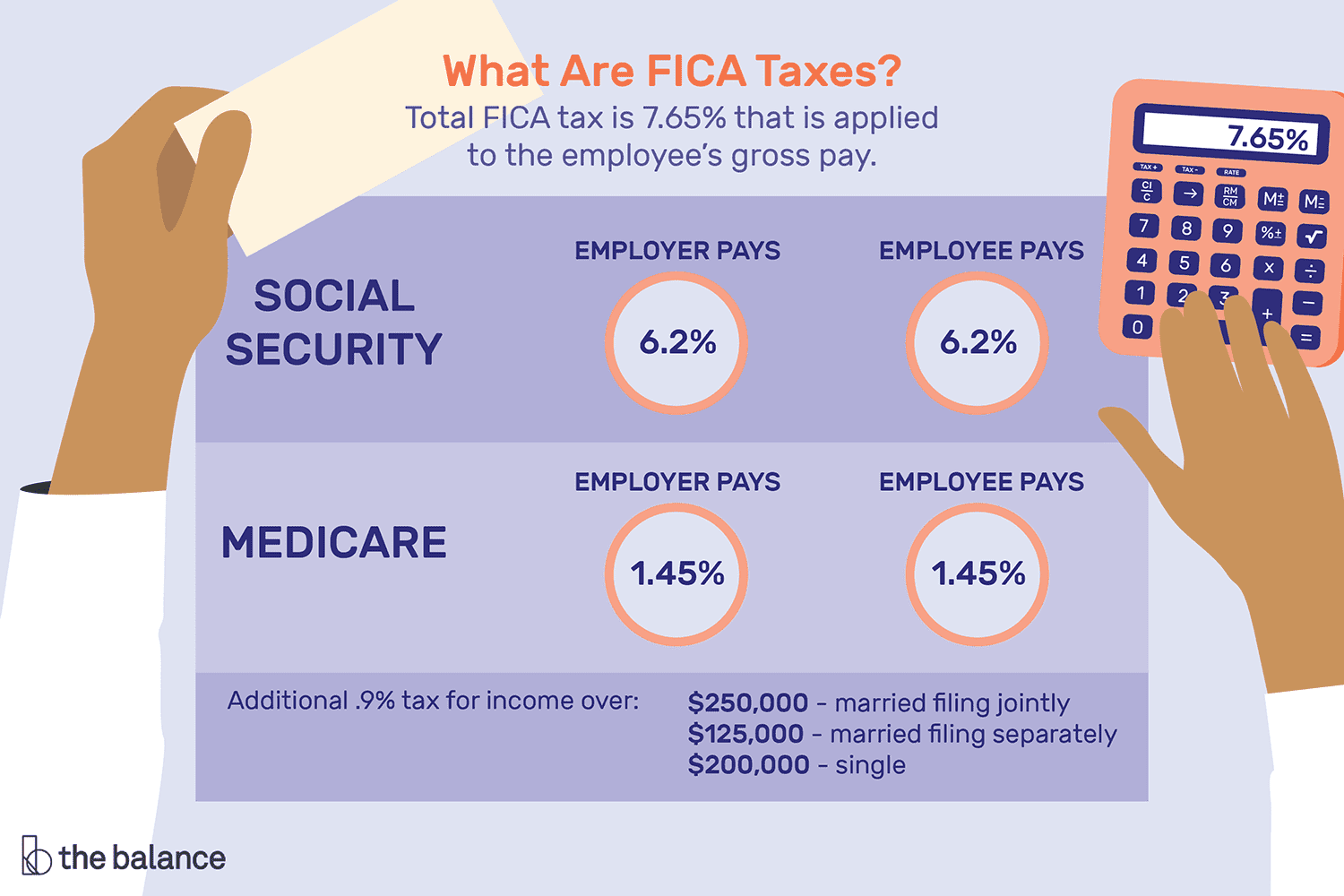

Yes, both Social Security and Medicare taxes are included in the federal tax rate. These taxes, collectively known as FICA (Federal Insurance Contributions Act) taxes, are taken out of your paycheck to fund Social Security and Medicare programs. For 2021, the FICA tax rate is 7.65% of your income, with 6.2% going towards Social Security and 1.45% towards Medicare. Self-employed individuals are responsible for paying the full 15.3% FICA tax rate.

Is Social Security and Medicare Included in Federal Tax Rate?

When it comes to federal taxes, there are several programs and benefits that taxpayers pay for. Two of the most essential programs are Social Security and Medicare. These programs are designed to provide financial support to individuals who have reached retirement age, individuals with disabilities, and those with certain medical conditions. However, many taxpayers are unsure whether Social Security and Medicare are included in their federal tax rates. In this article, we will explore this topic in detail and provide a clear answer to this question.

Contents

- What is Social Security?

- What is Medicare?

- Are Social Security and Medicare Included in Federal Tax Rate?

- Benefits of Social Security and Medicare

- Social Security and Medicare vs. Other Retirement Plans

- Conclusion

- Frequently Asked Questions

- Is Social Security included in Federal Tax Rate?

- Is Medicare included in Federal Tax Rate?

- What is the Federal Tax Rate?

- Can I claim Social Security and Medicare taxes on my tax return?

- What is the difference between Social Security and Medicare?

- How To Calculate Federal Income Taxes – Social Security & Medicare Included

What is Social Security?

Social Security is a federal program that provides financial support to individuals who have reached retirement age, individuals with disabilities, and surviving family members of deceased individuals. The program is funded through payroll taxes, which are collected from both employees and employers. The Social Security tax rate is currently set at 6.2% for employees and 6.2% for employers, for a total of 12.4%. This tax is applied to the first $142,800 of an individual’s income for the year 2021.

It’s important to note that Social Security taxes are separate from federal income taxes. This means that the amount of Social Security taxes you pay does not directly impact your federal income tax rate. However, your Social Security benefits may be subject to federal income tax if your income is above a certain threshold.

What is Medicare?

Medicare is a federal program that provides healthcare coverage to individuals who are 65 years of age or older, as well as individuals with certain disabilities or medical conditions. Like Social Security, Medicare is funded through payroll taxes, which are collected from both employees and employers. The Medicare tax rate is currently set at 1.45% for employees and 1.45% for employers, for a total of 2.9%. Unlike Social Security taxes, there is no income cap for Medicare taxes.

Similar to Social Security taxes, Medicare taxes are separate from federal income taxes. This means that the amount of Medicare taxes you pay does not directly impact your federal income tax rate. However, if your income is above a certain threshold, you may be subject to an additional Medicare tax of 0.9%.

Are Social Security and Medicare Included in Federal Tax Rate?

The answer to this question is no. Social Security and Medicare taxes are separate from federal income taxes. This means that the amount of Social Security and Medicare taxes you pay does not impact your federal income tax rate.

However, it’s important to note that your Social Security benefits may be subject to federal income tax if your income is above a certain threshold. The amount of your Social Security benefits that is subject to federal income tax will depend on your total income, including any other sources of income you may have.

Benefits of Social Security and Medicare

Social Security and Medicare are essential programs that provide financial support and healthcare coverage to millions of Americans. Some of the benefits of these programs include:

– Retirement income: Social Security provides retirement income to individuals who have reached retirement age and have paid into the program through payroll taxes.

– Disability income: Social Security provides income to individuals with disabilities who are unable to work.

– Survivors benefits: Social Security provides benefits to surviving family members of deceased individuals.

– Healthcare coverage: Medicare provides healthcare coverage to individuals who are 65 years of age or older, as well as individuals with certain disabilities or medical conditions.

Social Security and Medicare vs. Other Retirement Plans

While Social Security and Medicare are essential programs, they are not the only sources of retirement income and healthcare coverage. Other retirement plans, such as 401(k)s and IRAs, can also provide income during retirement. Additionally, private healthcare insurance can provide coverage for medical expenses that are not covered by Medicare.

It’s important to consider all of your options when planning for retirement and healthcare coverage. Working with a financial advisor or healthcare professional can help you make informed decisions about your future.

Conclusion

Social Security and Medicare are essential programs that provide financial support and healthcare coverage to millions of Americans. While these programs are funded through payroll taxes, they are separate from federal income taxes. This means that the amount of Social Security and Medicare taxes you pay does not directly impact your federal income tax rate. However, your Social Security benefits may be subject to federal income tax if your income is above a certain threshold. It’s important to consider all of your options when planning for retirement and healthcare coverage.

Frequently Asked Questions

Is Social Security included in Federal Tax Rate?

Yes, Social Security is included in the Federal Tax Rate. Social Security is a government program that provides retirement, disability, and survivor benefits to eligible individuals. Employees and employers both contribute to the Social Security program through payroll taxes. The current Social Security tax rate is 6.2% for employees and 6.2% for employers, for a total of 12.4%.

Is Medicare included in Federal Tax Rate?

Yes, Medicare is included in the Federal Tax Rate. Medicare is a government-sponsored health insurance program for people who are 65 or older, as well as certain younger people with disabilities. Employees and employers both contribute to the Medicare program through payroll taxes. The current Medicare tax rate is 1.45% for employees and 1.45% for employers, for a total of 2.9%.

What is the Federal Tax Rate?

The Federal Tax Rate is the percentage of your income that you pay in federal taxes. The federal tax system is progressive, which means that the more you earn, the higher your tax rate. The federal tax rate varies depending on your income level and filing status. For example, in 2021, the federal tax rate for single filers earning between $9,951 and $40,525 is 12%, while the federal tax rate for single filers earning over $523,600 is 37%.

Can I claim Social Security and Medicare taxes on my tax return?

No, you cannot claim Social Security and Medicare taxes on your tax return. Social Security and Medicare taxes are considered payroll taxes, which are not deductible on your tax return. However, if you overpaid your Social Security or Medicare taxes during the year, you may be eligible for a refund when you file your tax return.

What is the difference between Social Security and Medicare?

Social Security and Medicare are both government programs that provide benefits to eligible individuals, but they serve different purposes. Social Security provides retirement, disability, and survivor benefits to eligible individuals, while Medicare provides health insurance to people who are 65 or older, as well as certain younger people with disabilities. Both programs are funded through payroll taxes, but the Social Security tax rate is higher than the Medicare tax rate.

How To Calculate Federal Income Taxes – Social Security & Medicare Included

In conclusion, Social Security and Medicare are funded through payroll taxes rather than federal income taxes. While both programs are part of the federal government, they are separate from the federal tax rate that individuals pay on their income. It is important to understand the distinction between payroll taxes and federal income taxes to accurately plan for retirement and taxes in the future.

It is also worth noting that the current funding for Social Security and Medicare is projected to run out within the next few decades. This highlights the importance of considering alternative sources of retirement income and healthcare coverage, such as personal savings and private insurance.

Overall, while Social Security and Medicare are not included in the federal tax rate, they are still essential components of retirement planning and healthcare coverage for millions of Americans. It is crucial to understand the intricacies of these programs and plan accordingly for a secure future.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts