Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you a resident of Oregon wondering if the Oregon Health Plan is equivalent to Medicare? With so many different healthcare options available, it can be confusing to determine which plan is right for you. In this article, we’ll explore the differences between the Oregon Health Plan and Medicare, and help you make an informed decision about your healthcare needs.

The Oregon Health Plan and Medicare both offer healthcare coverage, but they have distinct differences in terms of eligibility, benefits, and costs. Whether you’re a senior citizen or a low-income individual, understanding the nuances of each program is crucial to ensuring that you receive the healthcare coverage you need. Let’s dive deeper into the specifics of each plan and see how they compare.

No, Oregon Health Plan is not Medicare. The Oregon Health Plan is a state-sponsored health insurance program that provides coverage for low-income individuals and families who cannot afford private health insurance. Medicare, on the other hand, is a federal health insurance program primarily designed for people who are 65 years of age or older, or those with certain disabilities. While there may be some overlap in coverage, these are two separate programs with different eligibility requirements and benefits.

Is Oregon Health Plan Medicare?

If you’re living in Oregon and looking for affordable health coverage, you may have come across the Oregon Health Plan (OHP) and Medicare. Both programs provide health coverage, but they have different eligibility requirements, benefits, and costs. In this article, we’ll explore whether OHP is Medicare and how they differ.

What is the Oregon Health Plan?

The Oregon Health Plan is a state-sponsored health insurance program that provides coverage for low-income residents of Oregon. It covers a range of medical services, including doctor visits, hospital stays, prescription drugs, and mental health care. The program is funded by both federal and state governments, and it’s administered by the Oregon Health Authority.

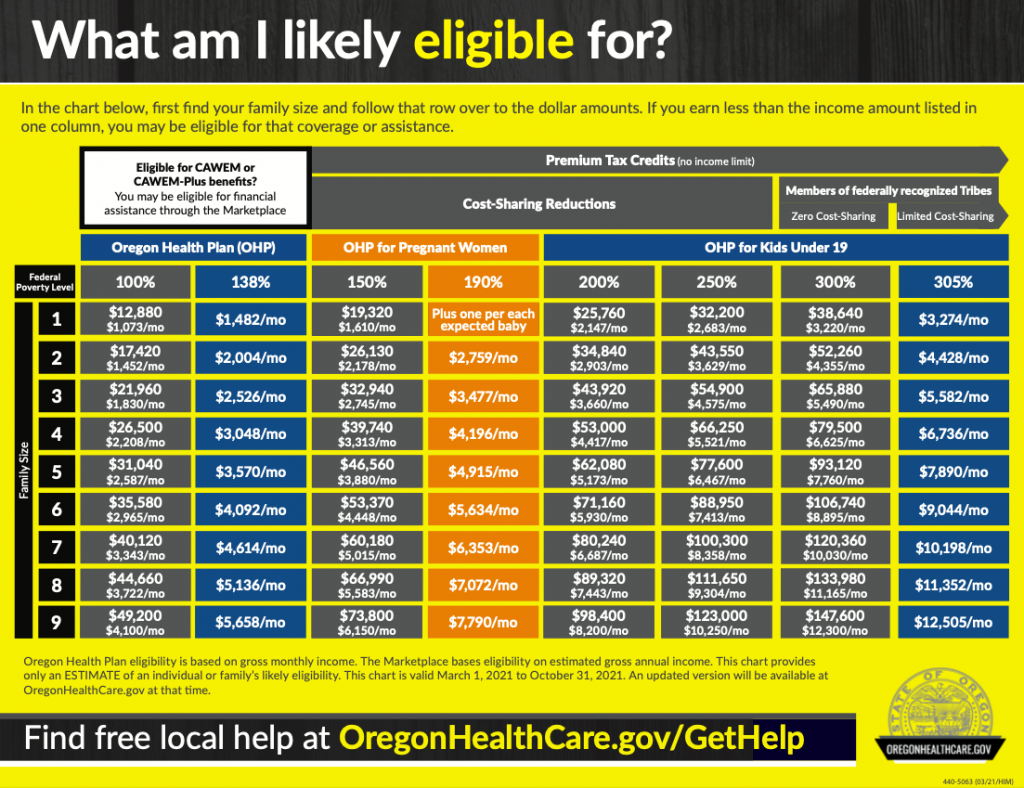

To be eligible for OHP, you must meet certain income requirements and other criteria. Generally, you must be an Oregon resident, a U.S. citizen or legal immigrant, and have an income that falls below a certain level. You can apply for OHP online, by mail, or in person at a local Community Action Agency or Department of Human Services office.

What is Medicare?

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, people with certain disabilities, and people with end-stage renal disease. It covers a range of medical services, including hospital stays, doctor visits, preventive care, and prescription drugs. Medicare is funded by the federal government and is administered by the Centers for Medicare and Medicaid Services.

To be eligible for Medicare, you must meet certain age or disability requirements. Most people become eligible for Medicare when they turn 65, but you can also qualify if you’re under 65 and have a disability or end-stage renal disease. You can apply for Medicare online, by phone, or in person at a Social Security office.

How are OHP and Medicare different?

Although both OHP and Medicare provide health coverage, they differ in several key ways:

| Factor | Oregon Health Plan | Medicare |

|---|---|---|

| Eligibility | Low-income Oregon residents | People 65 or older, people with certain disabilities, and people with end-stage renal disease |

| Cost | No or low cost for most enrollees | Premiums, deductibles, and coinsurance |

| Coverage | Doctor visits, hospital stays, prescription drugs, mental health care, and other medical services | Hospital stays, doctor visits, preventive care, prescription drugs, and other medical services |

| Administration | Oregon Health Authority | Centers for Medicare and Medicaid Services |

One of the biggest differences between OHP and Medicare is eligibility. OHP is designed for low-income Oregon residents, while Medicare is for people who are 65 or older, people with certain disabilities, and people with end-stage renal disease. OHP has no or low cost for most enrollees, while Medicare requires you to pay premiums, deductibles, and coinsurance.

Another difference between the two programs is coverage. OHP covers a range of medical services, including doctor visits, hospital stays, prescription drugs, and mental health care. Medicare also covers hospital stays, doctor visits, and prescription drugs, but it’s more focused on preventive care and chronic disease management.

Benefits of OHP

One of the biggest benefits of OHP is that it provides affordable health coverage to low-income Oregon residents who might not otherwise be able to afford it. OHP covers a wide range of medical services, including preventive care, prescription drugs, and mental health care. It also provides access to a network of providers who are committed to serving OHP enrollees.

Another benefit of OHP is that it can help you stay healthy. By providing access to preventive care and chronic disease management, OHP can help you catch and treat health problems before they become more serious. This can lead to better health outcomes and lower healthcare costs over time.

Benefits of Medicare

Medicare provides health coverage to millions of Americans who are 65 or older, people with certain disabilities, and people with end-stage renal disease. It covers a range of medical services, including hospital stays, doctor visits, preventive care, and prescription drugs. One of the biggest benefits of Medicare is that it provides guaranteed health coverage to people who might otherwise struggle to afford it.

Another benefit of Medicare is that it provides access to a wide range of medical providers. Medicare has a large network of doctors, hospitals, and other healthcare providers who accept Medicare patients. This can make it easier to find a provider who meets your healthcare needs.

Conclusion

In conclusion, OHP is not Medicare, but it provides affordable health coverage to low-income Oregon residents. Medicare, on the other hand, is a federal health insurance program that provides coverage to people who are 65 or older, people with certain disabilities, and people with end-stage renal disease. Both programs have different eligibility requirements, benefits, and costs. If you’re trying to decide which program is right for you, it’s important to consider your healthcare needs and financial situation.

Frequently Asked Questions

In this section, we have answered some of the most frequently asked questions about Oregon Health Plan and Medicare. Read on to learn more.

Is Oregon Health Plan Medicare?

No, Oregon Health Plan is not Medicare. It is a state-funded Medicaid program that provides health coverage to eligible low-income Oregonians. Medicare, on the other hand, is a federal health insurance program that provides coverage to individuals who are aged 65 and above, as well as those with certain disabilities and chronic conditions.

The Oregon Health Plan covers a wide range of services, including doctor visits, hospital stays, prescription drugs, and emergency care. It also provides coverage for preventive services such as screenings and immunizations. Medicare, on the other hand, covers hospital stays, doctor visits, and certain other services but does not cover prescription drugs in most cases.

Who is eligible for Oregon Health Plan?

Eligibility for Oregon Health Plan is based on income and other factors such as age, family size, and disability status. To be eligible, you must be an Oregon resident, a U.S. citizen, a permanent resident, or a legal immigrant. You must also meet income guidelines, which vary depending on your family size and other factors.

Individuals who are pregnant, under 19 years of age, or have certain medical conditions may also be eligible for the Oregon Health Plan. If you are unsure about your eligibility, you can contact the Oregon Health Authority or visit their website to learn more.

Can you have both Oregon Health Plan and Medicare?

Yes, it is possible to have both Oregon Health Plan and Medicare. This is known as “dual eligibility.” If you have both plans, Medicare will be your primary insurance, while Oregon Health Plan will be your secondary insurance. This means that Medicare will pay for most of your medical expenses, and Oregon Health Plan will cover any additional costs that Medicare does not cover.

If you have dual eligibility, it is important to make sure that your healthcare providers are aware of both plans. This will help ensure that your medical bills are processed correctly and that you receive the maximum benefits available to you under both plans.

Do I need to enroll in Medicare if I have Oregon Health Plan?

If you are eligible for Medicare, you should enroll in it even if you have Oregon Health Plan. Medicare provides important health coverage that may not be covered by Oregon Health Plan. Additionally, if you do not enroll in Medicare when you are first eligible, you may be subject to late enrollment penalties.

Enrolling in Medicare is easy. You can enroll online, by phone, or in person at your local Social Security office. If you have questions about Medicare enrollment, you can contact the Medicare program or visit their website for more information.

How do I apply for Oregon Health Plan?

You can apply for Oregon Health Plan online, by mail, or in person at your local Department of Human Services office. To apply, you will need to provide information about your income, household size, and other factors that determine your eligibility.

If you need assistance with your application or have questions about the eligibility requirements, you can contact the Oregon Health Authority or visit their website for more information. Once your application is processed, you will receive a notice of eligibility that will explain your benefits and how to access them.

Who Qualifies for Oregon Health Plan (OHP)?

In conclusion, while the Oregon Health Plan and Medicare share similarities, they are not the same program. The Oregon Health Plan is a state-based Medicaid program, while Medicare is a federal health insurance program for seniors and people with certain disabilities. While both programs provide healthcare coverage, their eligibility requirements, benefits, and cost-sharing structures differ significantly.

It is essential to understand the differences between these two programs when considering healthcare coverage options. If you are eligible for both programs, it is important to carefully compare their benefits and costs to determine which one best meets your needs. Additionally, it is worth exploring other healthcare coverage options, such as private insurance or employer-based plans, to ensure you are getting the most comprehensive coverage possible.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts