Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, healthcare becomes an increasingly important consideration. Medicare is a federal health insurance program that provides coverage for those 65 and older, but it doesn’t cover everything. Medicare supplemental insurance, also known as Medigap, is a policy that can help fill in the gaps left by traditional Medicare coverage.

However, many seniors wonder if Medigap is worth the additional cost. With so many different policies and coverage options available, it can be difficult to determine which plan is right for you. In this article, we’ll explore the pros and cons of Medigap insurance and help you make an informed decision about whether it’s worth it for your individual needs.

Is Medicare Supplemental Insurance Worth It?

When you turn 65, you become eligible for Medicare, which can be a great relief for many seniors. However, Medicare only covers certain medical expenses, leaving gaps that can be financially crippling for those on a fixed income. This is where Medicare Supplemental Insurance, also known as Medigap, comes in. But is it worth the extra cost? Let’s explore.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance is a type of health insurance that is designed to fill the gaps left by traditional Medicare coverage. These gaps can include deductibles, coinsurance, and copayments. Medigap policies are sold by private insurance companies and are regulated by the federal government.

Benefits of Medicare Supplemental Insurance

One of the biggest benefits of Medigap is that it can help protect you from high out-of-pocket costs. With traditional Medicare, you are responsible for paying deductibles, coinsurance, and copayments. These costs can add up quickly, especially if you require frequent medical care. Medigap can help cover these costs, potentially saving you thousands of dollars in the long run.

Another benefit of Medigap is that it allows you to choose your own healthcare providers. With traditional Medicare, you are limited to doctors and hospitals that accept Medicare. With Medigap, you can choose any healthcare provider that accepts Medicare patients.

Medigap vs. Medicare Advantage

Medicare Advantage, also known as Medicare Part C, is an alternative to traditional Medicare. It is a type of managed care plan that is offered by private insurance companies. Medicare Advantage plans often include additional benefits, such as dental, vision, and hearing coverage.

While Medicare Advantage plans can be a good option for some seniors, they may not be the best choice for everyone. Medicare Advantage plans often have restricted networks of healthcare providers and may require referrals to see specialists. Medigap, on the other hand, allows you to choose any healthcare provider that accepts Medicare patients.

How Much Does Medicare Supplemental Insurance Cost?

The cost of Medigap policies can vary widely depending on several factors, including your age, location, and health status. Generally, the older you are, the more you will pay for Medigap coverage. However, it’s important to remember that while Medigap may cost more upfront, it can save you money in the long run by helping to cover high out-of-pocket costs.

Medigap Plan Options

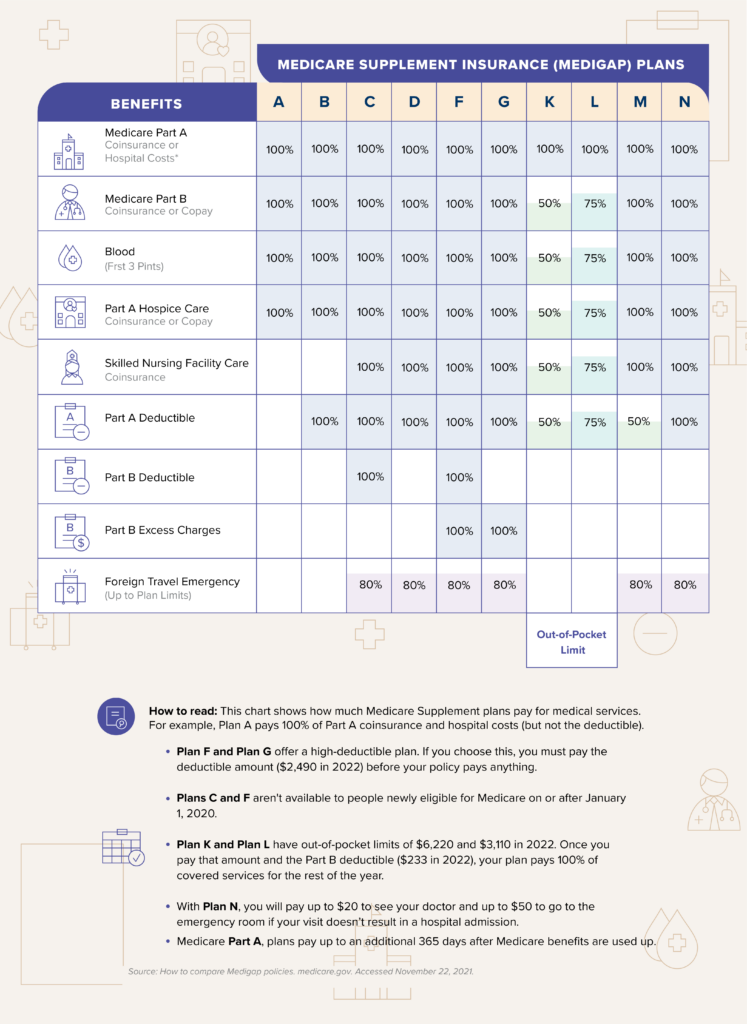

There are ten standardized Medigap plans available, labeled Plan A through Plan N. Each plan offers different levels of coverage, with Plan F offering the most comprehensive coverage. It’s important to carefully consider your healthcare needs and budget when choosing a Medigap plan.

How to Enroll in Medicare Supplemental Insurance

To enroll in Medigap, you must first be enrolled in Medicare Part A and Part B. You can then apply for Medigap coverage through a private insurance company. It’s important to enroll in Medigap during your initial enrollment period, which is the six-month period that begins on the first day of the month in which you turn 65. During this period, you cannot be denied coverage or charged more due to pre-existing conditions.

Conclusion

So, is Medicare Supplemental Insurance worth it? The answer depends on your individual healthcare needs and budget. For some seniors, the extra cost of Medigap is well worth the peace of mind that comes with knowing they are protected from high out-of-pocket costs. If you are considering Medigap, be sure to carefully consider your options and choose a plan that meets your needs.

Frequently Asked Questions

Medicare supplemental insurance is a type of insurance policy that is designed to pay for certain expenses that are not covered by traditional Medicare. It is important to understand whether or not these policies are worth the investment, as they can be expensive. Here are some frequently asked questions about Medicare supplemental insurance.

What is Medicare supplemental insurance?

Medicare supplemental insurance, also known as Medigap, is a type of insurance policy that is designed to pay for certain expenses that are not covered by traditional Medicare. These policies are sold by private insurance companies and are designed to help cover the costs of deductibles, copayments, and other expenses that are not covered by Medicare.

These policies can be expensive, but they can provide valuable coverage for those who need it. If you are considering purchasing a Medigap policy, it is important to carefully evaluate your needs and your budget to determine whether or not it is worth the investment.

What does Medicare supplemental insurance cover?

Medicare supplemental insurance policies can vary depending on the insurer and the specific plan. However, most policies are designed to cover some or all of the costs associated with deductibles, copayments, and other expenses that are not covered by traditional Medicare.

Some policies may also offer coverage for services that are not covered by Medicare at all, such as vision or dental care. It is important to carefully review the coverage options offered by each policy to determine which one is right for you.

How much does Medicare supplemental insurance cost?

The cost of a Medicare supplemental insurance policy can vary depending on a number of factors, including your age, health status, and the specific plan you choose. In general, these policies can be expensive, and it is important to carefully evaluate your budget and your needs before making a decision.

Some policies may offer lower premiums but higher out-of-pocket costs, while others may have higher premiums but lower out-of-pocket costs. It is important to carefully review the costs associated with each policy to determine which one is right for you.

Is Medicare supplemental insurance worth it?

Whether or not Medicare supplemental insurance is worth the investment depends on your individual needs and budget. If you have a lot of out-of-pocket expenses associated with your healthcare, a Medigap policy may be a good investment.

However, if you are generally healthy and do not have a lot of healthcare expenses, you may be able to save money by sticking with traditional Medicare. It is important to carefully evaluate your needs and your budget to determine whether or not a Medigap policy is worth the investment.

How do I choose a Medicare supplemental insurance policy?

Choosing a Medicare supplemental insurance policy can be a complicated process, as there are many different policies and insurers to choose from. It is important to carefully evaluate your needs and your budget to determine which policy is right for you.

Some factors to consider when choosing a policy include the cost, the coverage options, and the reputation of the insurer. It is also a good idea to talk to a licensed insurance agent who can help you navigate the complex world of Medigap policies and find the right one for your needs.

5 Reasons NOT to Get a Medicare Supplemental Plan? 😱

In conclusion, whether Medicare supplemental insurance is worth it depends on individual circumstances and needs. While Medicare covers many healthcare costs, it still leaves some gaps that can be expensive to fill. Supplemental insurance can help cover those gaps and provide peace of mind for those who want to ensure they have comprehensive coverage.

However, it is important to carefully consider the cost of supplemental insurance and weigh it against the potential benefits. Not everyone may need or benefit from supplemental insurance, especially if they have low healthcare costs or are enrolled in other insurance plans.

Ultimately, the decision to purchase Medicare supplemental insurance should be made after careful consideration of individual circumstances and needs, as well as a thorough understanding of the available options and associated costs. Consulting with a trusted healthcare provider or insurance agent can help individuals make an informed decision that is right for them.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts