Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, taking care of our health becomes increasingly important. Medicare is a government-funded health insurance program that provides coverage for older adults, but it may not cover all of our medical expenses. That’s where Medicare Supplemental Insurance comes into play.

But is it really necessary? Should you invest in supplemental insurance to ensure you have the best medical coverage possible? In this article, we’ll explore the benefits and drawbacks of Medicare Supplemental Insurance to help you make an informed decision about your health care coverage.

Yes, Medicare Supplemental Insurance, also known as Medigap, is necessary for individuals looking for additional coverage to fill the gaps in their Original Medicare plan. Medigap policies can cover expenses such as deductibles, copayments, and coinsurance that are not covered by Medicare. Without this additional coverage, individuals may be responsible for paying these expenses out of pocket, which can be costly. Therefore, it is highly recommended that individuals consider purchasing Medigap policies to supplement their Medicare coverage.

Contents

- Is Medicare Supplemental Insurance Necessary?

- Frequently Asked Questions

- Question 1: What is Medicare Supplemental Insurance?

- Question 2: What Does Medicare Supplemental Insurance Cover?

- Question 3: Who Needs Medicare Supplemental Insurance?

- Question 4: How Much Does Medicare Supplemental Insurance Cost?

- Question 5: How Do I Choose a Medicare Supplemental Insurance Plan?

- Do I need a Medicare Supplement Plan?

Is Medicare Supplemental Insurance Necessary?

Medicare is a federal insurance program that provides coverage to people who are 65 years and older, as well as those with certain disabilities. While Medicare covers most of the healthcare expenses, there are gaps in coverage that can result in significant out-of-pocket expenses. This is where Medicare Supplemental Insurance (also known as Medigap) comes in. In this article, we will explore whether Medicare Supplemental Insurance is necessary.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance is a policy that is sold by private insurance companies to help cover the gaps in Medicare coverage. These policies can help pay for deductibles, coinsurance, and copayments, which can add up to significant expenses over time.

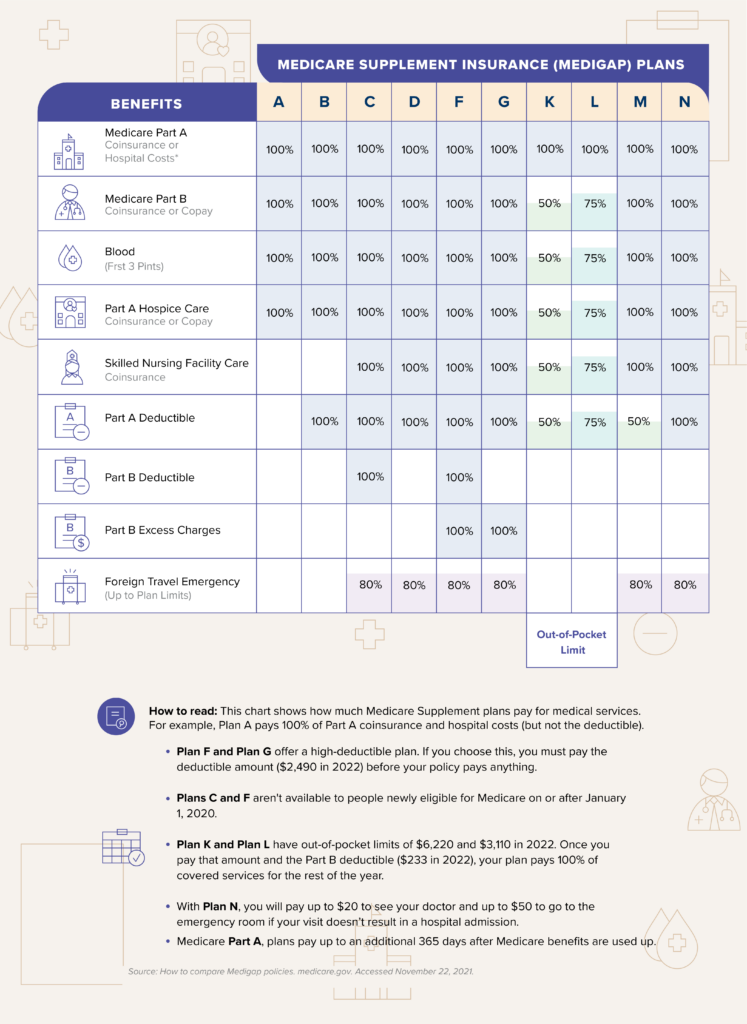

There are ten standardized Medigap plans available in most states, each offering a different level of coverage. These plans are labeled with letters, from A to N, and each plan offers a different set of benefits.

The Benefits of Medicare Supplemental Insurance

One of the main benefits of Medigap plans is that they can help cover the out-of-pocket expenses that Medicare does not cover. For example, if you have a Medigap plan, you may not have to pay any copayments or coinsurance for your hospitalization or doctor visits.

Another benefit of Medigap plans is that they provide predictable costs. Unlike Medicare Advantage plans, which can change their costs and benefits every year, Medigap plans are standardized and offer predictable costs.

Medigap Vs. Medicare Advantage Plans

While Medicare Supplemental Insurance can help cover the gaps in Medicare coverage, it is not the only option available. Another option is Medicare Advantage plans, which are offered by private insurance companies and provide all of your Medicare benefits in one plan.

Medicare Advantage plans often include extra benefits, such as dental and vision coverage, and may have lower out-of-pocket costs than Original Medicare. However, these plans may also have restrictions on which doctors and hospitals you can see, and may require referrals to see specialists.

Who Needs Medicare Supplemental Insurance?

Whether or not you need Medicare Supplemental Insurance depends on your individual healthcare needs and financial situation. If you have significant healthcare expenses, or are concerned about the potential for high out-of-pocket costs, then a Medigap plan may be a good option for you.

Additionally, if you travel frequently or spend significant time outside of the United States, then a Medigap plan may be necessary, as Medicare does not cover healthcare expenses incurred outside of the country.

How to Choose a Medigap Plan

If you have decided that a Medigap plan is necessary for you, the next step is to choose a plan that meets your needs. The first step is to determine which benefits are most important to you. For example, if you have a chronic condition that requires frequent doctor visits, then a plan that covers copayments and coinsurance for doctor visits may be a good option.

Once you have determined which benefits are most important to you, you can compare the different Medigap plans available in your area to find one that meets your needs and budget.

When to Enroll in Medicare Supplemental Insurance

The best time to enroll in a Medigap plan is during your Medicare Open Enrollment Period, which is the six-month period that starts the month you turn 65 and are enrolled in Medicare Part B. During this period, you have guaranteed issue rights, which means that insurance companies cannot deny you coverage or charge you more based on your health status.

If you miss your Open Enrollment Period, you may still be able to enroll in a Medigap plan, but you may be subject to medical underwriting, which could result in higher premiums or a denial of coverage.

The Cost of Medicare Supplemental Insurance

The cost of Medigap plans varies depending on the plan you choose, your age, and your location. However, it is important to remember that Medigap plans are standardized, which means that the benefits are the same regardless of which insurance company you choose.

When comparing Medigap plans, it is important to look at both the monthly premium and the out-of-pocket costs, such as deductibles and coinsurance. While a plan with a lower premium may seem like a good deal, it may have higher out-of-pocket costs that could add up over time.

In Conclusion

Medicare Supplemental Insurance can be a valuable tool for those who are concerned about the gaps in Medicare coverage. It can help cover out-of-pocket expenses and provide predictable costs, making it easier to budget for healthcare expenses.

While Medigap plans are not necessary for everyone, they may be a good option for those with significant healthcare expenses or who frequently travel outside of the country. If you are considering a Medigap plan, be sure to compare the different plans available in your area to find one that meets your needs and budget.

Frequently Asked Questions

Medicare supplemental insurance is a hotly debated topic among senior citizens. With so many opinions out there, it can be difficult to determine whether or not this type of insurance is necessary. Here are some commonly asked questions about Medicare supplemental insurance to help clear up any confusion.

Question 1: What is Medicare Supplemental Insurance?

Medicare supplemental insurance, also known as Medigap, is a type of insurance that is designed to cover the “gaps” in traditional Medicare coverage. These gaps can include things like deductibles, copayments, and coinsurance. Medicare supplemental insurance policies are sold by private insurance companies and can help beneficiaries save money on healthcare costs.

While Medicare supplemental insurance is not necessary for everyone, it can be a good option for those who have high medical expenses or want more comprehensive coverage than what traditional Medicare offers. It’s important to note that Medicare supplemental insurance is not the same as Medicare Advantage, which is an alternative to traditional Medicare.

Question 2: What Does Medicare Supplemental Insurance Cover?

Medicare supplemental insurance policies can cover a variety of healthcare costs, depending on the plan. Some common expenses that Medicare supplemental insurance can cover include deductibles, copayments, and coinsurance. Some plans may also cover things like emergency medical care when traveling outside of the country or skilled nursing facility care.

It’s important to note that Medicare supplemental insurance does not cover everything. For example, it typically does not cover long-term care, dental care, or vision care. It’s important to carefully review the details of any Medicare supplemental insurance plan before purchasing it to determine what is covered and what is not.

Question 3: Who Needs Medicare Supplemental Insurance?

Whether or not someone needs Medicare supplemental insurance depends on a variety of factors. For example, if someone has low medical expenses and is comfortable paying out of pocket for deductibles and copayments, they may not need Medicare supplemental insurance. However, if someone has high medical expenses or wants more comprehensive coverage than what traditional Medicare offers, Medicare supplemental insurance may be a good option for them.

It’s also worth noting that some states have their own rules regarding Medicare supplemental insurance. In some states, insurance companies are required to offer certain types of plans, while in other states, beneficiaries may have more options to choose from. It’s important to research the rules and regulations in your state before purchasing Medicare supplemental insurance.

Question 4: How Much Does Medicare Supplemental Insurance Cost?

The cost of Medicare supplemental insurance can vary depending on several factors, including the plan, the insurance company, and the location. Some plans may be more expensive than others, and some insurance companies may charge higher premiums than others.

It’s also worth noting that insurance companies can charge different rates based on several factors, including age, gender, and health status. It’s important to carefully review the costs of any Medicare supplemental insurance plan before purchasing it to determine if it fits into your budget.

Question 5: How Do I Choose a Medicare Supplemental Insurance Plan?

Choosing a Medicare supplemental insurance plan can be overwhelming, but there are several steps you can take to make the process easier. First, determine what type of coverage you need and what your budget is. Then, research different insurance companies and plans to find one that fits your needs and budget.

It’s also a good idea to talk to your doctor or other healthcare providers to get their recommendations. They may be able to provide insight into what types of coverage you need based on your health status and medical history. Finally, make sure to carefully review the details of any plan before purchasing it to ensure that it covers the healthcare costs you need it to.

Do I need a Medicare Supplement Plan?

In conclusion, the question of whether Medicare supplemental insurance is necessary is a complex one with no one-size-fits-all answer. It ultimately depends on your individual healthcare needs and budget. However, it is important to consider the potential costs of not having supplemental coverage, such as high deductibles and co-payments.

Furthermore, many individuals find peace of mind in knowing that they have additional coverage beyond what Medicare provides. This can alleviate stress and anxiety about potential healthcare expenses and allow for more focus on overall health and well-being.

Ultimately, it is important to carefully evaluate your healthcare needs and budget when deciding whether to enroll in Medicare supplemental insurance. With the right plan in place, you can ensure that you have comprehensive coverage and peace of mind when it comes to your healthcare.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts