Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a healthcare program that provides coverage for millions of Americans who are 65 years or older, as well as those with certain disabilities. However, many people are confused about whether Medicare is a private health insurance program or not. In this article, we will explore the details of Medicare and its status as either a private or government-run insurance program.

At its core, Medicare is a government-run health insurance program that provides coverage for certain medical services. However, there are also private companies that offer Medicare Advantage plans, which are an alternative way to receive Medicare benefits. The relationship between Medicare and private insurance can be complex, so it’s important to understand the nuances before making any decisions about your healthcare coverage.

No, Medicare is not private health insurance. It is a federal health insurance program for people 65 years and older, some younger people with disabilities, and people with End-Stage Renal Disease. Medicare is funded by payroll taxes, premiums, and federal funding, while private health insurance is purchased from insurance companies by individuals or provided by employers to their employees.

Is Medicare Private Health Insurance?

Medicare is a health insurance program in the United States, which is funded by the federal government and provides health coverage to people who are 65 years old or older, people with certain disabilities, and those who have end-stage renal disease. However, many people are confused about whether Medicare is private health insurance or not. In this article, we will explore the answer to this question in detail.

Medicare is a Public Health Insurance Program

Medicare is a public health insurance program, which means that it is funded by the federal government and is available to eligible individuals at little or no cost. The program is split into four parts – A, B, C, and D, which cover different aspects of healthcare.

Part A covers inpatient hospital care, skilled nursing facility care, hospice care, and home health care. Part B covers doctors’ services, outpatient care, medical supplies, and preventive services. Part C, also known as Medicare Advantage, is an alternative to Parts A and B and is provided by private insurance companies. Finally, Part D covers prescription drug coverage.

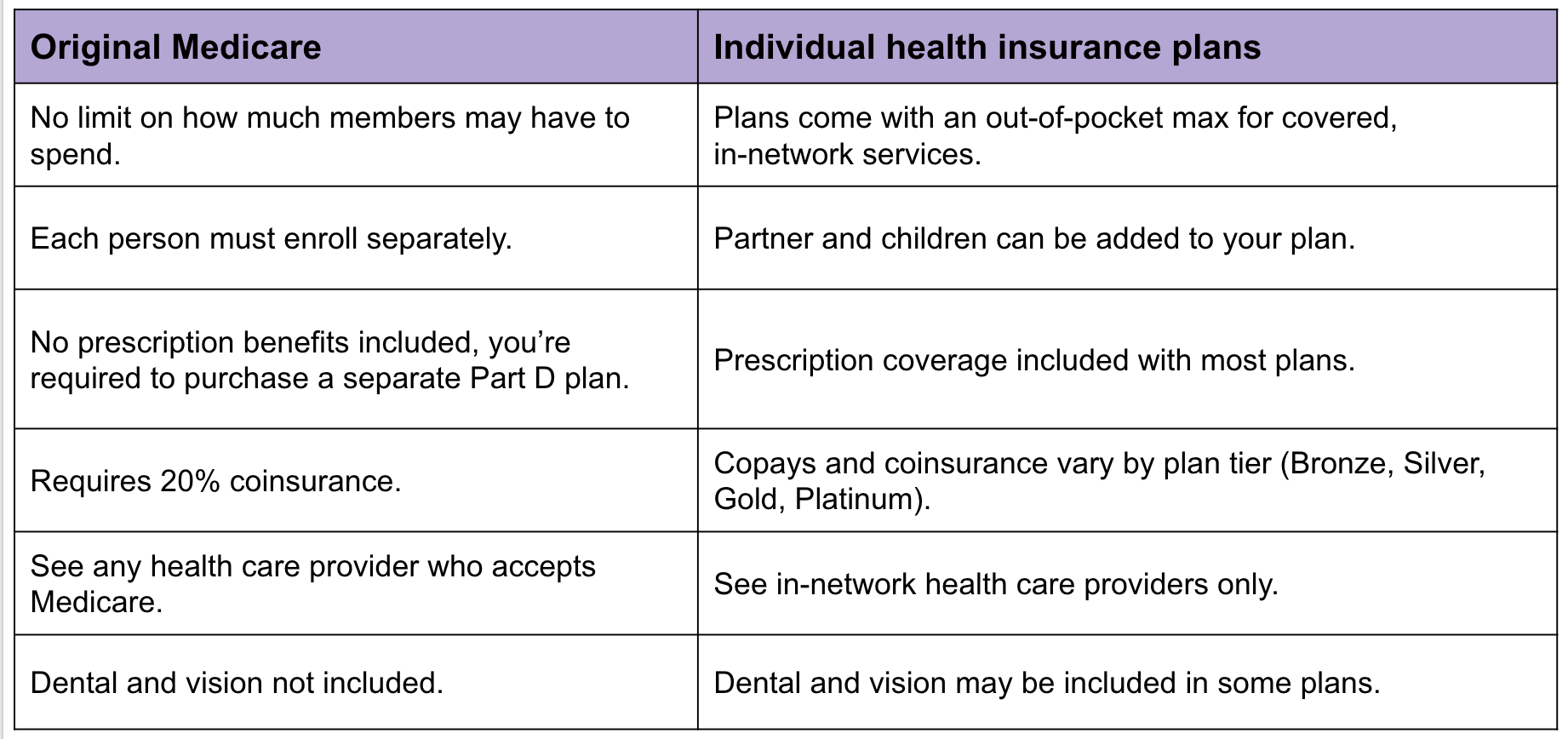

Medicare vs. Private Health Insurance

Medicare and private health insurance are two different types of insurance. Private health insurance is provided by private insurance companies and is available to individuals and families. It is typically purchased through an employer or directly from an insurance company.

There are several differences between Medicare and private health insurance. First, Medicare is available to people who are 65 years old or older, while private health insurance is available to people of all ages. Second, Medicare is funded by the federal government, while private health insurance is funded by individuals and their employers. Third, Medicare covers specific healthcare services, while private health insurance can cover a wider range of services.

Benefits of Medicare

One of the benefits of Medicare is that it provides health coverage to people who might not be able to afford private health insurance. Additionally, Medicare covers a range of healthcare services, including hospital care, doctor visits, and prescription drugs. Medicare is also available to people with pre-existing conditions, which means that they cannot be denied coverage.

Another benefit of Medicare is that it provides stable and consistent coverage. Once a person is enrolled in Medicare, they can rely on the program to provide coverage for their healthcare needs. Additionally, Medicare has lower administrative costs than private insurance companies, which means that more of the money is spent on healthcare services.

Drawbacks of Medicare

One of the drawbacks of Medicare is that it does not cover all healthcare services. For example, Medicare does not cover dental, vision, or hearing services, which means that people might need to purchase additional insurance to cover these services. Additionally, Medicare does not cover all prescription drugs, which means that people might need to pay out of pocket for some medications.

Another drawback of Medicare is that it can be confusing to navigate. The program is split into four parts, each with its own coverage rules and costs. Additionally, some doctors and hospitals might not accept Medicare, which can limit a person’s choice of healthcare providers.

Conclusion

In conclusion, Medicare is a public health insurance program that is funded by the federal government and provides health coverage to eligible individuals. While Medicare is not private health insurance, it does provide many benefits, including stable and consistent coverage, lower administrative costs, and coverage for people with pre-existing conditions. However, Medicare also has drawbacks, including limited coverage for certain services and a confusing program structure. Overall, Medicare is an important program that provides health coverage to millions of Americans and should be considered by anyone who is eligible.

Frequently Asked Questions

Is Medicare Private Health Insurance?

Medicare is a federal health insurance program in the United States that provides coverage for people who are 65 years old or older, as well as individuals with certain disabilities or medical conditions. Unlike private health insurance plans, Medicare is funded by taxes and premiums paid by beneficiaries, and is administered by the federal government.

Medicare is not considered a private health insurance plan because it is not sold by private insurance companies. Instead, it is provided by the government as a public service to eligible individuals who have paid into the system through taxes and premiums. While private insurance companies may offer supplemental plans to Medicare, the core benefits are provided by the government.

What Are the Benefits of Medicare?

Medicare provides a number of benefits to eligible individuals, including coverage for hospital stays, doctor visits, and prescription drugs. In addition, Medicare also offers preventive services such as mammograms, flu shots, and cancer screenings, as well as coverage for certain medical equipment and supplies.

One of the main benefits of Medicare is the peace of mind that comes with knowing that you have access to affordable health care coverage when you need it. Medicare can help you manage the costs of medical care, including hospitalizations, surgeries, and prescription medications, which can be very expensive without insurance.

How Do I Enroll in Medicare?

If you are eligible for Medicare, you can enroll in the program during designated enrollment periods, which typically occur in the fall of each year. You may also be eligible for special enrollment periods if you experience certain life events such as retirement, disability, or the loss of other health insurance coverage.

To enroll in Medicare, you will need to provide some basic information about yourself, including your name, date of birth, and Social Security number. You may also need to provide information about your current health insurance coverage, as well as any disabilities or medical conditions you have.

What Is the Difference Between Medicare Parts A, B, C, and D?

Medicare is divided into four different parts, each of which provides different types of coverage:

Medicare Part A: Covers hospital stays, skilled nursing facility care, hospice care, and some home health care services.

Medicare Part B: Covers doctor visits, outpatient care, preventive services, and medical equipment and supplies.

Medicare Part C: Also known as Medicare Advantage, this is an alternative to traditional Medicare that is offered by private insurance companies and often includes additional benefits such as dental, vision, and hearing care.

Medicare Part D: Covers prescription drug costs for eligible individuals who are enrolled in Medicare Part A and/or Part B.

Can I Have Other Health Insurance in Addition to Medicare?

Yes, it is possible to have other health insurance in addition to Medicare. Many people choose to enroll in supplemental insurance plans, also known as Medigap plans, which are sold by private insurance companies and help cover some of the costs that are not covered by Medicare. Others may have employer-sponsored health insurance or other types of private insurance plans.

It is important to note that if you have other health insurance in addition to Medicare, your coverage may be coordinated between the two plans. This means that one plan may pay for certain services while the other plan pays for other services, depending on the terms of your coverage.

Medicare vs Private Insurance – What makes more sense in 2022?

In conclusion, Medicare is not private health insurance. It is a government-funded program that provides health coverage to those who are 65 years old and above, as well as those with certain disabilities. While private health insurance plans can also provide coverage for medical expenses, they are not the same as Medicare.

One of the key differences between Medicare and private health insurance is that Medicare is a federal program, while private health insurance is typically provided by private companies. Private health insurance plans may have more flexibility in terms of coverage options and cost, but they may also have stricter eligibility requirements and higher premiums.

Overall, Medicare plays a crucial role in providing health coverage to millions of Americans. While it may not be the same as private health insurance, it is an important resource for seniors and those with disabilities who need access to medical care. As healthcare continues to evolve, it is important to understand the differences between Medicare and private health insurance and how they can impact your coverage options.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts