Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, one of our biggest concerns is the cost of healthcare. Many Americans rely on Medicare and Tricare for Life to cover their medical expenses, but is this coverage enough? With rising healthcare costs and gaps in coverage, it’s important to consider whether these programs provide sufficient protection for seniors and their families.

While Medicare and Tricare for Life offer comprehensive coverage for many medical services, there are still gaps in coverage that can leave seniors vulnerable to high out-of-pocket costs. From deductibles and copays to limitations on certain treatments, it’s important to understand the limitations of these programs and explore other options for additional coverage. Join us as we dive deeper into the question: Is Medicare and Tricare for Life enough coverage?

Medicare and Tricare for Life provide a good base of coverage for retirees and their dependents. However, they do not cover everything. For example, they do not cover dental, vision, or hearing care. They also have deductibles and copayments. It’s important to assess your specific healthcare needs and consider supplemental coverage options, such as Medigap or dental insurance, to ensure you have comprehensive coverage.

Is Medicare and Tricare for Life Enough Coverage?

Medicare and Tricare for Life are two of the most popular healthcare coverage options for retired military personnel and their dependents. While these programs offer comprehensive benefits, many people wonder if they provide enough coverage.

Understanding Medicare and Tricare for Life

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, have certain disabilities, or have end-stage renal disease. Medicare covers a wide range of services, including hospital stays, doctor visits, and prescription drugs.

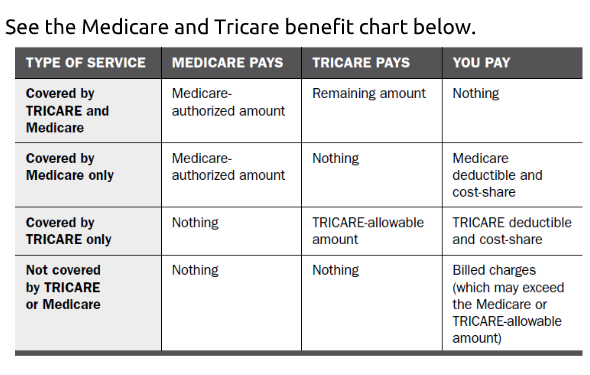

Tricare for Life is a supplemental insurance program that works with Medicare to provide additional coverage for retired military personnel and their dependents. Tricare for Life covers many of the same services as Medicare, as well as some additional benefits.

Benefits of Medicare and Tricare for Life

One of the biggest benefits of Medicare and Tricare for Life is that they offer comprehensive coverage for a wide range of healthcare services. This includes hospital stays, doctor visits, preventive care, and prescription drugs.

Another advantage of these programs is that they are relatively affordable. Medicare Part A is usually free, and Part B and Tricare for Life premiums are generally lower than those of private insurance plans.

Limitations of Medicare and Tricare for Life

While Medicare and Tricare for Life offer comprehensive coverage, there are some limitations to these programs. For example, Medicare does not cover long-term care, dental care, or vision care. Tricare for Life also has some limitations, such as restrictions on coverage for certain procedures and services.

Additionally, Medicare and Tricare for Life do not cover all healthcare costs. Patients are responsible for paying deductibles, copayments, and coinsurance for many services.

Comparing Medicare and Tricare for Life to Private Insurance

When comparing Medicare and Tricare for Life to private insurance plans, there are pros and cons to each option. Private insurance plans may offer more comprehensive coverage for certain services, such as dental and vision care. However, private insurance plans are often more expensive than Medicare and Tricare for Life.

It’s important to consider your healthcare needs and budget when deciding between Medicare and Tricare for Life and private insurance.

Conclusion

Overall, Medicare and Tricare for Life offer comprehensive coverage for a wide range of healthcare services. While there are some limitations to these programs, they are generally affordable and provide valuable benefits to retired military personnel and their dependents.

If you are considering Medicare and Tricare for Life, be sure to carefully review the benefits and limitations of these programs to determine if they provide enough coverage for your healthcare needs.

Contents

- Frequently Asked Questions

- Is Medicare and Tricare for Life Enough Coverage?

- What medical expenses are not covered by Medicare and Tricare for Life?

- Do I need supplemental insurance if I have Medicare and Tricare for Life?

- What are some other options for healthcare coverage?

- How do I know if Medicare and Tricare for Life are enough coverage for me?

- TRICARE For Life: Coverage Basics, Eligibility, and Costs (March 2021)

Frequently Asked Questions

Is Medicare and Tricare for Life Enough Coverage?

Medicare and Tricare for Life are two insurance programs that provide healthcare coverage to eligible individuals. While they do offer comprehensive coverage, some people may still find that they need more coverage for certain medical expenses. Here are some common questions and answers about whether Medicare and Tricare for Life are enough coverage:

Medicare is a federal health insurance program that provides coverage to people who are 65 years or older, younger people with disabilities, and people with End-Stage Renal Disease. Tricare for Life is a program that provides coverage to military retirees and their eligible family members who are also enrolled in Medicare. Together, these two programs provide comprehensive coverage for most medical expenses.

What medical expenses are not covered by Medicare and Tricare for Life?

While Medicare and Tricare for Life do cover many medical expenses, there are some services that are not covered. For example, cosmetic procedures and hearing aids are not covered by Medicare, and some services may require copayments or deductibles. Additionally, some prescription drugs may not be covered by Tricare for Life, or may require prior authorization.

If you have specific medical needs that are not covered by Medicare and Tricare for Life, you may want to consider supplemental insurance or other options to help cover those expenses.

Do I need supplemental insurance if I have Medicare and Tricare for Life?

While Medicare and Tricare for Life do provide comprehensive coverage for most medical expenses, some people may still want to consider supplemental insurance. Supplemental insurance, also known as Medigap insurance, can help cover copayments, deductibles, and other out-of-pocket expenses that are not covered by Medicare and Tricare for Life.

Additionally, if you have specific medical needs that are not covered by Medicare and Tricare for Life, such as prescription drugs or hearing aids, you may want to consider supplemental insurance or other options to help cover those expenses.

What are some other options for healthcare coverage?

If you feel that Medicare and Tricare for Life are not enough coverage for your medical needs, there are other options available. For example, you may be able to enroll in a Medicare Advantage plan, which provides additional benefits beyond what is covered by traditional Medicare. You may also be able to enroll in a private health insurance plan, either through your employer or through the Health Insurance Marketplace.

It’s important to carefully consider your healthcare needs and the options available to you when deciding on a healthcare plan.

How do I know if Medicare and Tricare for Life are enough coverage for me?

Whether Medicare and Tricare for Life are enough coverage for you will depend on your individual healthcare needs. It’s important to carefully review the benefits and limitations of these programs to determine if they will meet your needs. If you have specific medical needs that are not covered by Medicare and Tricare for Life, or if you are concerned about out-of-pocket expenses, you may want to consider supplemental insurance or other options.

If you are unsure whether Medicare and Tricare for Life are enough coverage for you, you may want to consult with a healthcare professional or insurance specialist to help you make an informed decision.

TRICARE For Life: Coverage Basics, Eligibility, and Costs (March 2021)

In conclusion, while Medicare and Tricare for Life provide valuable health coverage for seniors and military retirees, it may not be enough for everyone’s specific needs. Additional coverage options such as Medigap plans or private insurance may be necessary to fill in any gaps in coverage. It’s important to carefully evaluate your healthcare needs and budget to determine what coverage options are best for you.

Ultimately, having comprehensive healthcare coverage is vital for maintaining good health and financial stability in retirement. By taking the time to research and compare different coverage options, you can ensure that you have the peace of mind and protection you need to enjoy your golden years to the fullest.

In short, while Medicare and Tricare for Life are excellent starting points for healthcare coverage, they may not be enough for everyone. It’s important to explore all available options and make informed decisions that meet your unique healthcare needs and budget. With the right coverage in place, you can enjoy your retirement with confidence and security.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts