Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a government-funded health insurance program that provides coverage to millions of Americans. However, many people are confused about whether Medicare is a means-tested program or not. In this article, we will explore the definition of a means-tested program and examine whether Medicare fits the criteria.

A means-tested program is a type of government assistance that is only available to individuals who meet certain income or asset requirements. These programs are designed to provide support to those who are most in need and to ensure that government resources are being used effectively. So, the question remains, is Medicare a means-tested program? Let’s find out.

Yes, Medicare is a means-tested program. This means that eligibility for Medicare is based on income and assets. In general, individuals who have a lower income and fewer assets are more likely to qualify for Medicare than those with higher incomes and more assets. However, there are certain exceptions and nuances to this rule, and it’s important to consult with a qualified professional to determine your specific eligibility for Medicare.

Is Medicare a Means Tested Program?

Medicare is a health insurance program in the United States that provides coverage for people who are 65 years or older, as well as for those with certain disabilities or end-stage renal disease. While it is a government-funded program, many people wonder if it is a means-tested program.

What is a means-tested program?

A means-tested program is a type of government program that provides benefits to people based on their income and assets. These programs are designed to provide assistance to those who are considered low-income or have limited financial resources. Means-tested programs include Medicaid, Supplemental Nutrition Assistance Program (SNAP), and Temporary Assistance for Needy Families (TANF).

Medicare’s Eligibility Requirements

Unlike means-tested programs, Medicare does not have an income or asset requirement for eligibility. Individuals who are 65 years or older, have a qualifying disability, or have end-stage renal disease are eligible for Medicare coverage.

Medicare’s Cost Structure

While Medicare is not a means-tested program, it does have a cost structure that is based on income. Medicare premiums are based on an individual’s modified adjusted gross income (MAGI) from two years prior. Those with higher incomes pay more for their Medicare coverage.

Benefits of Medicare

Medicare offers a variety of benefits to eligible individuals, including hospital coverage, medical coverage, and prescription drug coverage. Hospital coverage includes inpatient care, skilled nursing facility care, and hospice care. Medical coverage includes doctor visits, outpatient care, and medical equipment. Prescription drug coverage is available through Medicare Part D.

Medicare Advantage Plans

In addition to traditional Medicare coverage, individuals may also choose to enroll in a Medicare Advantage Plan. These plans are offered by private insurance companies and provide the same benefits as traditional Medicare, along with additional benefits such as dental, vision, and hearing coverage.

Medicare vs. Medicaid

While Medicare is not a means-tested program, Medicaid is. Medicaid provides health coverage to individuals who are low-income or have limited financial resources. Medicaid is jointly funded by the federal government and the states, and eligibility requirements vary by state.

Conclusion

In conclusion, Medicare is not a means-tested program, as eligibility is based on age, disability, or end-stage renal disease, rather than income or assets. While Medicare does have a cost structure that is based on income, it is not considered a means-tested program. Medicare provides valuable health coverage to eligible individuals, and the availability of Medicare Advantage Plans offers additional benefits to those who choose to enroll.

Contents

Frequently Asked Questions

Is Medicare a Means Tested Program?

Medicare is a federal health insurance program that provides coverage for Americans who are 65 years of age or older, as well as those who have certain medical conditions. Unlike Medicaid, which is a means-tested program, Medicare is not based on income or financial need. Instead, the program is funded through payroll taxes and premiums paid by beneficiaries.

That being said, the cost of Medicare can vary depending on your income. Those with higher incomes may be subject to higher premiums for certain parts of Medicare, such as Part B and Part D. Additionally, some low-income individuals may be eligible for assistance with Medicare costs through programs like the Medicare Savings Program or Extra Help.

How does Medicare differ from Medicaid?

While both Medicare and Medicaid are federal healthcare programs, they serve different populations and have different eligibility requirements. Medicare is primarily for individuals who are 65 and older or who have certain medical conditions, while Medicaid is a means-tested program that provides coverage for low-income individuals and families.

Medicare is largely funded through payroll taxes and premiums paid by beneficiaries, while Medicaid is jointly funded by the federal government and individual states. Medicaid also covers a wider range of services than Medicare, including long-term care, dental care, and vision care, which are not covered by traditional Medicare.

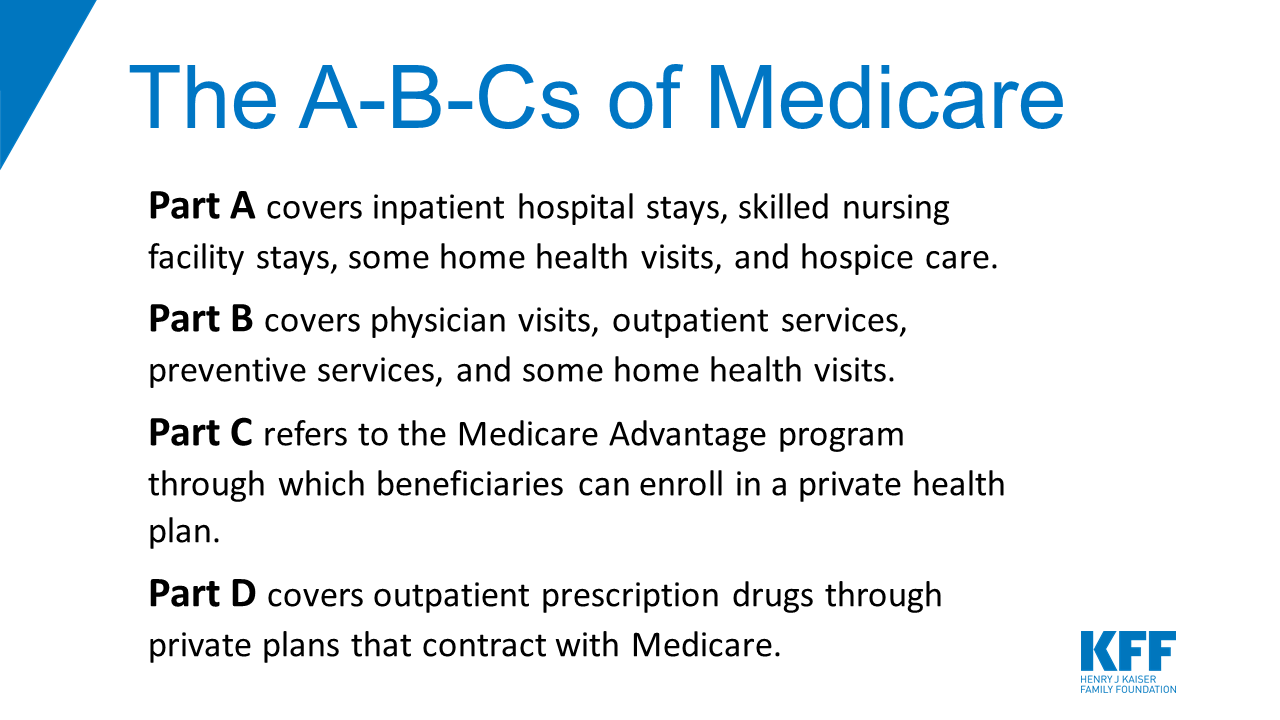

What are the different parts of Medicare?

Medicare is divided into several parts, each of which covers different types of healthcare services. Part A is hospital insurance, which covers inpatient hospital stays, skilled nursing facility care, and hospice care. Part B is medical insurance, which covers doctor visits, outpatient care, and some preventive services. Part C, also known as Medicare Advantage, is a type of private insurance plan that provides the same benefits as Parts A and B, as well as additional services like dental and vision care. Finally, Part D is prescription drug coverage, which helps pay for the cost of prescription drugs.

How do I enroll in Medicare?

Most individuals are automatically enrolled in Medicare when they turn 65 and are receiving Social Security or Railroad Retirement Board benefits. If you are not automatically enrolled, you can sign up for Medicare during the initial enrollment period, which begins three months before your 65th birthday and ends three months after. You can also enroll in Medicare during the annual enrollment period, which runs from October 15 to December 7 each year.

What are the costs associated with Medicare?

While Medicare is not means-tested, the cost of the program can vary depending on your income. Most beneficiaries do not pay a premium for Part A, but may pay a premium for Part B. The standard premium for Part B in 2021 is $148.50 per month, but higher-income beneficiaries may pay more. Part D premiums also vary depending on the plan you choose. Additionally, there may be out-of-pocket costs associated with Medicare, such as deductibles, copayments, and coinsurance.

Means Testing Social Security

In conclusion, Medicare is not considered a means-tested program. The program is available to all qualifying individuals regardless of their income or assets. However, there are some income-related adjustments that may affect the cost of premiums and out-of-pocket expenses.

While Medicare may not be means-tested, it is still important for individuals to understand their eligibility and options. This includes understanding the different parts of Medicare, such as Part A, B, C, and D, and how they may apply to their specific healthcare needs.

Overall, Medicare is a crucial program that provides access to healthcare for millions of Americans. It is important for individuals to stay informed and make informed decisions when it comes to their healthcare coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts