Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

If you or a loved one relies on medical oxygen therapy, you may be wondering if Inogen is covered by Medicare. Inogen is a popular brand of portable oxygen concentrators that can make a significant difference in the quality of life for those who need oxygen therapy.

Fortunately, the answer is yes – Inogen is covered by Medicare. However, the process of getting coverage can be confusing and overwhelming. In this article, we will break down everything you need to know about Inogen and Medicare, so you can make informed decisions about your oxygen therapy.

Yes, Inogen portable oxygen concentrators are covered by Medicare, but only under certain conditions. You need to have a medical need for oxygen therapy, and your doctor must prescribe it for you. In addition, Medicare only covers the cost of renting the equipment, not the purchase. You will also need to meet certain criteria to qualify for coverage. Contact your local Medicare office or healthcare provider for more information.

Contents

- Is Inogen Covered by Medicare?

- Frequently Asked Questions

- 1. Is Inogen covered by Medicare?

- 2. How do I qualify for Inogen through Medicare?

- 3. What is the process for getting Inogen through Medicare?

- 4. Are there any other options for getting Inogen besides Medicare?

- 5. What should I do if I have questions about Inogen and Medicare?

- Does Medicare Cover Inogen Oxygen Concentrators?

Is Inogen Covered by Medicare?

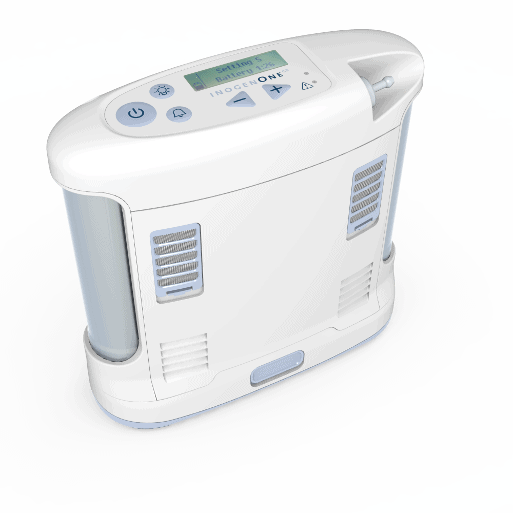

Inogen is a popular brand of portable oxygen concentrators that has been changing the lives of people with respiratory problems for over a decade. These devices are designed to help individuals with breathing difficulties get the oxygen they need, even when they’re on the go. Given their effectiveness and convenience, it’s natural to wonder if they’re covered by Medicare. In this article, we’ll explore whether Inogen is covered by Medicare and what you need to know about getting one.

What is Inogen?

Inogen is a company that specializes in creating portable oxygen concentrators. Their devices are designed to be lightweight and easy to carry, making them perfect for individuals who need oxygen therapy but don’t want to be confined to their homes. Unlike traditional oxygen tanks, Inogen’s concentrators use air to produce oxygen, making them more efficient and cost-effective.

Moreover, Inogen’s portable oxygen concentrators come in different sizes and capacities, making them suitable for different needs. Some models are designed for use during physical activities, while others are perfect for everyday use. Inogen also offers a range of accessories that can make using their devices more comfortable and convenient.

Does Medicare Cover Inogen?

Now, the big question: is Inogen covered by Medicare? The answer is yes, but with some caveats. Medicare Part B (medical insurance) covers oxygen therapy and equipment, including portable oxygen concentrators like Inogen. However, there are some criteria you need to meet to qualify for coverage.

Firstly, you need to have a diagnosed medical condition that requires oxygen therapy. Secondly, your doctor must prescribe oxygen therapy for you, and thirdly, your oxygen saturation levels must be below a certain threshold. You also need to get your portable oxygen concentrator from a Medicare-approved supplier who accepts assignment. This means that they agree to accept the Medicare-approved amount as full payment for the device.

It’s worth noting that Medicare coverage for oxygen therapy and equipment is subject to certain limits and restrictions. For instance, Medicare will only cover the cost of renting a portable oxygen concentrator for a maximum of 36 months. After that, you’ll need to pay for it out of pocket. Additionally, Medicare may not cover the cost of some accessories, such as extra batteries or carrying cases.

What are the Benefits of Inogen?

Now that we’ve established that Inogen is covered by Medicare, let’s take a closer look at the benefits of using their portable oxygen concentrators. Firstly, Inogen’s devices are much more convenient than traditional oxygen tanks. You don’t need to worry about running out of oxygen or refilling tanks, as the concentrators use air to produce oxygen continuously.

Moreover, Inogen’s portable oxygen concentrators are much lighter and more compact than traditional tanks, making them easy to carry around. This means that you can continue with your daily activities without feeling burdened by a heavy oxygen tank. Additionally, Inogen’s devices are designed to be quiet, so you won’t disturb others around you while using them.

Another benefit of Inogen’s portable oxygen concentrators is that they’re more cost-effective than traditional oxygen tanks. While the upfront cost of buying a concentrator may be higher than renting a tank, you’ll ultimately save money in the long run. With a concentrator, you won’t need to keep refilling tanks or pay for delivery and pickup fees, which can add up over time.

Inogen vs. Other Portable Oxygen Concentrator Brands

While Inogen is a popular choice for portable oxygen concentrators, it’s not the only option available. There are many other brands and models to choose from, each with their own unique features and benefits. Here’s a quick comparison of Inogen and some other popular portable oxygen concentrator brands:

| Brand | Pros | Cons |

|---|---|---|

| Inogen | Lightweight, compact, efficient | May be more expensive than some other brands |

| Respironics | Wide range of models, good battery life | Some models may be bulky or heavy |

| Invacare | Reliable, affordable | May not be as lightweight or efficient as some other brands |

Ultimately, the best portable oxygen concentrator for you will depend on your specific needs and preferences. It’s important to do your research and compare different brands and models before making a decision.

Conclusion

In conclusion, Inogen is covered by Medicare, but there are some criteria you need to meet to qualify for coverage. If you have a diagnosed medical condition that requires oxygen therapy, your doctor can prescribe a portable oxygen concentrator for you, and Medicare will cover the cost if you meet the eligibility criteria. Inogen’s portable oxygen concentrators offer many benefits over traditional oxygen tanks, including convenience, portability, and cost-effectiveness. However, there are many other brands and models to choose from, so it’s important to compare your options and choose the one that’s right for you.

Frequently Asked Questions

1. Is Inogen covered by Medicare?

Yes, Inogen is covered by Medicare as a durable medical equipment (DME) for patients with chronic obstructive pulmonary disease (COPD) and other respiratory conditions that require oxygen therapy. Medicare Part B covers 80% of the cost of Inogen portable oxygen concentrators (POCs) as long as the patient meets certain criteria.

However, patients are required to pay the remaining 20% of the cost, as well as any deductibles or co-payments that may apply. In addition, patients must have a prescription from their doctor stating that oxygen therapy is medically necessary for their condition.

2. How do I qualify for Inogen through Medicare?

To qualify for Inogen through Medicare, you must have a prescription from your doctor stating that oxygen therapy is medically necessary for your condition. You must also have a qualifying lung condition, such as COPD or pulmonary fibrosis, and meet certain oxygen saturation levels as determined by your doctor.

In addition, you must be enrolled in Medicare Part B and have a coverage plan that includes durable medical equipment (DME). Your doctor and supplier must also be enrolled in Medicare and meet all applicable state and federal requirements.

3. What is the process for getting Inogen through Medicare?

The process for getting Inogen through Medicare begins with a visit to your doctor, who will evaluate your condition and determine if oxygen therapy is necessary. If so, your doctor will provide you with a prescription for the therapy.

Next, you will need to find a supplier that is enrolled in Medicare and can provide you with the Inogen portable oxygen concentrator. The supplier will work with Medicare to verify your eligibility and coverage, and will handle all aspects of billing and payment.

Once your eligibility and coverage have been confirmed, the supplier will deliver the Inogen POC to your home and provide you with any necessary training and support.

4. Are there any other options for getting Inogen besides Medicare?

Yes, there are other options for getting Inogen besides Medicare. Patients can purchase Inogen POCs directly from the manufacturer or from a supplier that is not enrolled in Medicare. However, patients should be aware that they will be responsible for the full cost of the device, which can be quite expensive.

In addition, patients may be able to obtain Inogen through private insurance or Medicaid, depending on their coverage and eligibility.

5. What should I do if I have questions about Inogen and Medicare?

If you have questions about Inogen and Medicare, you can contact your doctor or supplier for more information. You can also contact Medicare directly by calling 1-800-MEDICARE (1-800-633-4227) or visiting their website at www.medicare.gov. The website provides a wealth of information about Medicare coverage, eligibility, and enrollment, as well as resources for finding suppliers and comparing costs.

Does Medicare Cover Inogen Oxygen Concentrators?

In conclusion, if you are a Medicare beneficiary who requires oxygen therapy, you may be wondering if Inogen is covered by Medicare. The answer is yes, but it depends on the specific plan you have. Inogen is covered by Medicare Part B, which covers durable medical equipment, including portable oxygen concentrators like Inogen. However, it is important to note that not all plans cover the full cost of Inogen, and you may be responsible for paying a portion of the cost out of pocket.

If you are considering using Inogen and have questions about coverage or costs, it is a good idea to talk to your healthcare provider and your Medicare plan provider. They can help you understand exactly what is covered and what your out-of-pocket costs may be. It is also worth doing some research on your own to compare different plans and find one that offers the coverage you need at a price you can afford.

Overall, Inogen can be a valuable tool for Medicare beneficiaries who require oxygen therapy, and it is great to know that it is covered by Medicare. With some careful planning and research, you can ensure that you are getting the most out of your coverage and getting the care you need to stay healthy and active.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts