Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

If you’re new to the world of taxes and payroll deductions, the terms FICA and Medicare might seem like a foreign language. But understanding what these terms mean is essential if you want to navigate the complex world of taxes and benefits. In this article, we’ll tackle the question of whether FICA and Medicare are the same thing and explain what each term means in plain English.

FICA stands for Federal Insurance Contributions Act, which is a tax that employers and employees must pay to fund Social Security and Medicare. Medicare, on the other hand, is a federal health insurance program that provides coverage for people over 65 and those with certain disabilities. While FICA and Medicare are related, they are not the same thing, and it’s important to understand the differences between the two.

FICA, or the Federal Insurance Contributions Act, is a payroll tax that funds both Medicare and Social Security programs. Though they are both funded by FICA, Medicare and Social Security are two distinct programs. Medicare provides health insurance to those over 65 and those with certain disabilities, while Social Security provides retirement and disability benefits.

Is FICA Medicare?

When it comes to payroll taxes, there are a lot of acronyms to keep track of. Two of the most common are FICA and Medicare. While they are often used interchangeably, they actually refer to different things. In this article, we’ll take a closer look at what FICA and Medicare are, and how they are related.

What is FICA?

FICA stands for Federal Insurance Contributions Act. It is a payroll tax that is paid by both employees and employers to fund Social Security and Medicare. FICA is made up of two parts: Social Security and Medicare.

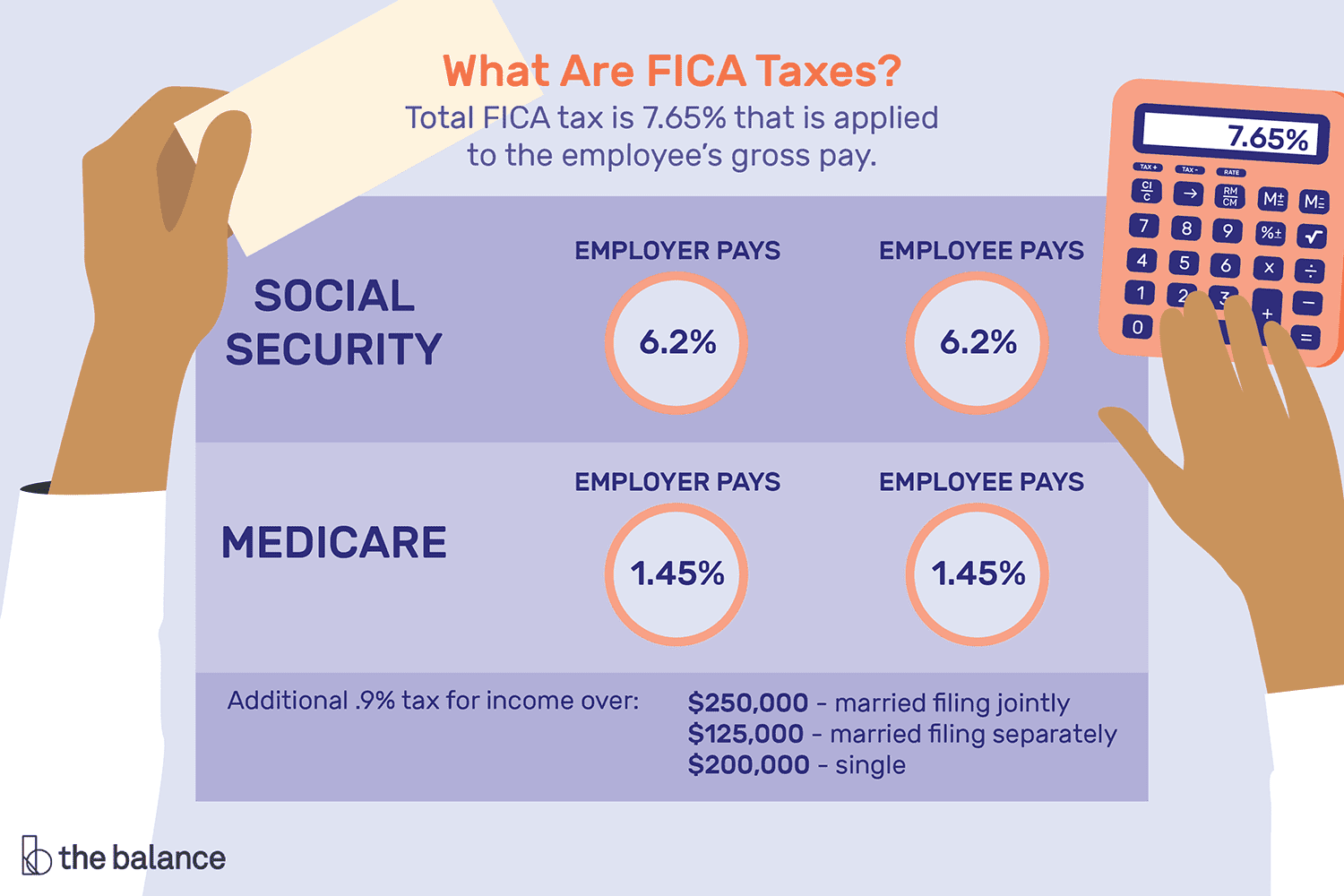

The Social Security portion of FICA is used to fund retirement benefits and disability insurance for workers and their families. It is calculated as a percentage of an employee’s gross wages, up to a certain cap. In 2021, the Social Security tax rate is 6.2% for employees and employers, up to a wage base of $142,800.

The Medicare portion of FICA is used to fund healthcare benefits for people over the age of 65 and those with certain disabilities. It is calculated as a percentage of an employee’s gross wages, with no cap. In 2021, the Medicare tax rate is 1.45% for employees and employers, with an additional 0.9% tax for high earners.

What is Medicare?

Medicare is a federal health insurance program that is available to people over the age of 65, as well as those with certain disabilities. It is funded by payroll taxes, premiums paid by beneficiaries, and general government revenue.

Medicare is divided into four parts: Part A, Part B, Part C, and Part D. Part A covers hospital insurance, while Part B covers medical insurance. Part C is also known as Medicare Advantage, and is a combination of Parts A and B, as well as additional benefits. Part D covers prescription drug coverage.

As mentioned earlier, FICA includes both Social Security and Medicare taxes. When you see FICA on your paycheck, it includes both of these taxes. So, in a sense, FICA is a part of Medicare, but it is not the same thing.

While FICA taxes fund both Social Security and Medicare, the two programs are separate. Social Security provides retirement and disability benefits, while Medicare provides healthcare benefits. However, both programs are funded by the same payroll tax, which is why they are often mentioned together.

Benefits of FICA and Medicare

The benefits of FICA and Medicare are numerous. Social Security provides a safety net for workers and their families in the event of retirement, disability, or death. Medicare provides healthcare coverage for millions of people, ensuring that they have access to the care they need when they need it.

By paying into FICA and Medicare, workers are also contributing to the overall health of the economy. These programs help to reduce poverty and improve the financial security of millions of Americans, which in turn helps to stimulate economic growth.

FICA and Medicare vs. Other Payroll Taxes

While FICA and Medicare are important payroll taxes, they are not the only ones that workers and employers need to be aware of. Other payroll taxes include federal and state unemployment taxes, as well as state disability insurance taxes.

Each of these taxes serves a specific purpose, and they are all important for funding various programs that benefit workers and their families. By understanding how these taxes work, workers and employers can ensure that they are complying with all applicable laws and regulations.

Conclusion

So, is FICA Medicare? While FICA is a part of Medicare, it is not the same thing. FICA is a payroll tax that is used to fund both Social Security and Medicare, while Medicare is a federal health insurance program that provides healthcare coverage to millions of people. By understanding how these programs work, workers and employers can ensure that they are contributing to the overall health of the economy, while also benefiting from the protections and benefits that these programs provide.

Frequently Asked Questions

Is FICA Medicare?

FICA stands for Federal Insurance Contributions Act. It is a payroll tax that is deducted from an employee’s paycheck to fund two federal programs: Social Security and Medicare. While FICA does fund Medicare, it is not Medicare itself.

Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. It is funded by a combination of premiums, general revenue, and taxes. So while FICA does contribute to the funding of Medicare, it is just one of the many sources of funding for the program.

What does FICA stand for?

FICA stands for Federal Insurance Contributions Act. It is a payroll tax that is deducted from an employee’s paycheck to fund two federal programs: Social Security and Medicare. The Social Security portion of FICA funds retirement, disability, and survivor benefits. The Medicare portion funds the federal health insurance program for people who are 65 or older and certain younger people with disabilities.

The amount of FICA tax that is deducted from an employee’s paycheck is based on their earnings. For 2021, the Social Security tax rate is 6.2% on earnings up to $142,800, and the Medicare tax rate is 1.45% on all earnings. Employers also contribute an equal amount to FICA for each employee.

Who pays for Medicare?

Medicare is funded by a combination of premiums, general revenue, and taxes. Most people who are eligible for Medicare do not have to pay a premium for Part A, which covers hospital stays, skilled nursing facility care, hospice care, and some home health care. However, they do have to pay a premium for Part B, which covers doctor visits, outpatient care, and some preventive services. The premium for Part B is based on income and ranges from $148.50 to $504.90 per month in 2021.

In addition to premiums, Medicare is funded by general revenue, which comes from income taxes, and taxes on Social Security benefits, investments, and certain goods and services. The Medicare portion of the FICA payroll tax also contributes to the funding of the program.

What is the difference between FICA and Medicare?

FICA stands for Federal Insurance Contributions Act. It is a payroll tax that is deducted from an employee’s paycheck to fund two federal programs: Social Security and Medicare. The Social Security portion of FICA funds retirement, disability, and survivor benefits. The Medicare portion funds the federal health insurance program for people who are 65 or older and certain younger people with disabilities.

So while FICA does contribute to the funding of Medicare, it is just one of the many sources of funding for the program. Medicare is a federal health insurance program for people who are 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. It is funded by a combination of premiums, general revenue, and taxes.

What is the Medicare tax rate?

The Medicare tax rate is 1.45% on all earnings. Employers also contribute an equal amount to FICA for each employee. So the total Medicare tax rate is 2.9%. However, there is an additional Medicare tax of 0.9% on earnings over $200,000 for individuals and $250,000 for married couples filing jointly. This additional tax is only paid by employees and not by employers.

The Medicare tax is part of the FICA payroll tax, which also includes the Social Security tax. The Social Security tax rate is 6.2% on earnings up to $142,800 in 2021. So the total FICA tax rate is 7.65% on earnings up to $142,800, and 1.45% on earnings over that amount.

Who Is FICA And Why Is He Getting All My Money?

In conclusion, it’s important to understand the distinction between FICA and Medicare. While FICA is a payroll tax that funds both Social Security and Medicare, Medicare is a federal health insurance program that provides coverage for individuals over the age of 65 and those with certain disabilities.

While FICA and Medicare are often discussed together, they serve different purposes and have different funding structures. Understanding the differences between the two can help you better plan for your retirement and healthcare needs.

Overall, it’s important to stay informed and up-to-date on changes to both FICA and Medicare. By understanding how these programs work, you can make informed decisions about your finances and healthcare.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts