Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, it’s not uncommon to require medical equipment to help with daily tasks and maintain independence. However, the cost of this equipment can quickly add up, leaving many seniors wondering if Medicare will help cover the expenses. In this article, we will explore whether durable medical equipment is covered by Medicare and what types of equipment may be eligible for reimbursement.

From wheelchairs to oxygen tanks, durable medical equipment can be a lifeline for many seniors. But with so many different types of equipment available, navigating the world of Medicare coverage can be daunting. By understanding what is and isn’t covered, seniors can make informed decisions about their health and financial wellbeing. Let’s dive into the world of durable medical equipment and Medicare coverage.

Yes, Medicare Part B covers durable medical equipment (DME) that is medically necessary for a patient’s treatment or recovery. This includes equipment such as walkers, wheelchairs, and oxygen tanks. However, certain conditions must be met for Medicare to cover the cost of DME, including a doctor’s prescription and the equipment being purchased or rented from a Medicare-approved supplier.

Is Durable Medical Equipment Covered by Medicare?

Medicare is a federal health insurance program that provides coverage to millions of Americans who are over 65 years old or who have certain disabilities. One of the benefits of Medicare is that it covers durable medical equipment (DME) that is medically necessary and prescribed by a doctor. However, there are specific rules and guidelines that must be followed in order to receive coverage for DME.

What is Durable Medical Equipment?

Durable medical equipment (DME) is equipment that is used for medical purposes, is able to withstand repeated use, and is appropriate for use in the home. Some examples of DME include wheelchairs, walkers, hospital beds, oxygen equipment, and prosthetic devices.

In order for DME to be covered by Medicare, it must be prescribed by a doctor, and the equipment must be necessary for the treatment of a medical condition or injury. Additionally, the equipment must be suitable for use in the home, and it must be expected to last for at least three years.

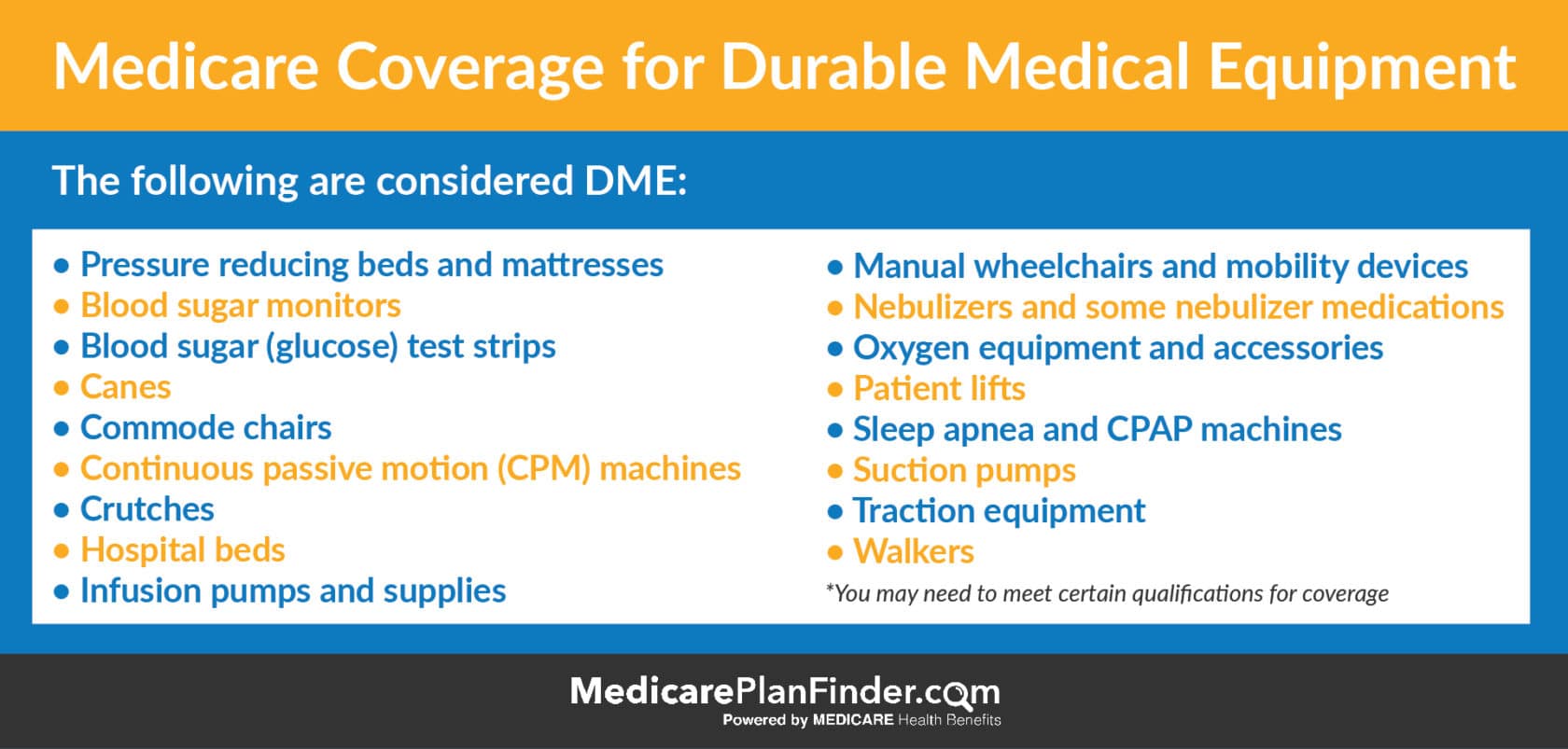

What Types of DME are Covered by Medicare?

Medicare covers a wide range of durable medical equipment that is prescribed by a doctor. Some of the most common types of DME that are covered by Medicare include:

- Wheelchairs and scooters

- Walkers and canes

- Hospital beds and bedpans

- Oxygen equipment and supplies

- C-PAP machines and accessories

- Prosthetic devices

- Orthotics and braces

It is important to note that Medicare only covers DME that is medically necessary and prescribed by a doctor. Additionally, there are specific rules and guidelines that must be followed in order to receive coverage for DME.

How Does Medicare Cover DME?

Medicare covers durable medical equipment in two ways: through Medicare Part B and through Medicare Advantage plans. Medicare Part B covers medically necessary DME that is prescribed by a doctor and used in the home.

Under Medicare Part B, beneficiaries typically pay 20% of the Medicare-approved amount for the DME, and Medicare pays the remaining 80%. However, there may be a deductible that must be met before Medicare will begin paying for the DME.

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies. These plans provide all of the same benefits as Medicare Part B, as well as additional benefits such as prescription drug coverage, dental and vision coverage, and wellness programs. Medicare Advantage plans may have different rules and guidelines for DME coverage, so it is important to check with your plan to see what is covered.

What Are the Requirements for Coverage?

In order for durable medical equipment to be covered by Medicare, there are specific requirements that must be met. These requirements include:

- The DME must be prescribed by a doctor

- The DME must be necessary for the treatment of a medical condition or injury

- The DME must be appropriate for use in the home

- The DME must be expected to last for at least three years

- The supplier of the DME must be enrolled in Medicare

- The supplier of the DME must be accredited by a Medicare-approved organization

If these requirements are not met, Medicare may not cover the cost of the DME.

What Are the Benefits of Medicare Coverage for DME?

There are many benefits to having Medicare coverage for durable medical equipment. Some of the most significant benefits include:

- Lower out-of-pocket costs for beneficiaries

- Access to high-quality medical equipment

- Increased independence and mobility for beneficiaries

- Better management of medical conditions and injuries

DME vs. Home Health Services

It is important to note that durable medical equipment is different from home health services. Home health services are services that are provided by a healthcare professional in the home, such as nursing care, physical therapy, and occupational therapy.

While Medicare does cover some home health services, these services are not considered durable medical equipment. If you are in need of home health services, you should contact your healthcare provider to discuss your options.

Conclusion

Durable medical equipment is an important benefit of Medicare that can help beneficiaries manage medical conditions and injuries, increase independence and mobility, and reduce out-of-pocket costs. If you are in need of durable medical equipment, it is important to talk to your doctor and supplier to make sure that you meet all of the requirements for coverage.

Frequently Asked Questions

In this section, we will answer some common questions about whether or not durable medical equipment is covered by Medicare.

1. What is durable medical equipment?

Durable medical equipment (DME) is any equipment that is used to serve a medical purpose. This can include things like wheelchairs, hospital beds, oxygen equipment, and more. In order to qualify as DME, the equipment must be able to withstand repeated use, be primarily used for a medical purpose, and be appropriate for use in the home.

Medicare covers a wide range of DME as long as it is considered medically necessary. However, there are some restrictions on what is covered and how much you will have to pay out of pocket.

2. What DME is covered by Medicare?

Medicare covers a wide range of DME including but not limited to:

- Wheelchairs and scooters

- Oxygen equipment

- Breast pumps

- Hospital beds

- CPAP machines

- Walkers and canes

- Blood sugar monitors

However, there are some restrictions on what is covered. For example, Medicare may only cover certain brands of equipment or may only cover equipment if it is rented rather than purchased outright.

3. How do I know if my DME is covered by Medicare?

In order to determine if your DME is covered by Medicare, you should first check with your doctor. Your doctor can help you determine what equipment is necessary for your medical condition and whether or not it is covered by Medicare. You can also check the Medicare website or call the Medicare hotline for more information.

It is important to note that even if your DME is covered by Medicare, you may still be responsible for paying a portion of the cost out of pocket.

4. How much will I have to pay for my DME?

The amount you will have to pay for your DME will depend on a variety of factors including what type of equipment you need, where you live, and whether or not you have additional insurance coverage. In general, Medicare will cover 80% of the cost of your DME and you will be responsible for paying the remaining 20%. However, if you have additional insurance coverage, your out-of-pocket costs may be lower.

It is important to talk to your doctor and your insurance provider to determine what your out-of-pocket costs will be before you purchase or rent any DME.

5. How do I purchase or rent DME?

In order to purchase or rent DME, you will need a prescription from your doctor. Your doctor can help you determine what equipment is necessary for your medical condition and can provide you with a prescription for the equipment. Once you have your prescription, you can work with a medical equipment supplier to purchase or rent the equipment you need.

It is important to shop around and compare prices from different suppliers in order to get the best deal. You should also check with your insurance provider to determine what equipment is covered and what your out-of-pocket costs will be.

Medicare Durable Medical Equipment

In conclusion, the question of whether durable medical equipment is covered by Medicare is one that requires a thorough understanding of the program’s policies. While some equipment may be covered, certain requirements must be met, and it is important to carefully review the guidelines to determine eligibility.

Despite the complexities of Medicare coverage, obtaining durable medical equipment can be a vital component of maintaining one’s health and independence. Whether it is a wheelchair, oxygen tank, or other necessary device, individuals should not hesitate to explore their options and seek assistance when necessary.

Ultimately, the goal of Medicare is to provide access to essential medical services and equipment to those who need it most. By staying informed and advocating for one’s own healthcare needs, individuals can make the most of this important program and ensure they receive the care and support they deserve.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts