Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you nearing the age of 65 and wondering how to qualify for Medicare Advantage? Medicare Advantage plans offer additional benefits beyond traditional Medicare, such as vision, dental, and hearing coverage. In this article, we’ll explore the eligibility requirements for Medicare Advantage and provide helpful tips for enrollment. So, let’s dive in!

Medicare Advantage plans can be a great option for those who want more comprehensive healthcare coverage. To qualify, you must be enrolled in Medicare Part A and Part B, live in the plan’s service area, and not have end-stage renal disease (ESRD). There are also certain enrollment periods to keep in mind, so it’s essential to stay informed and plan ahead. Let’s explore all the details you need to know to qualify for Medicare Advantage.

- Enroll in Medicare Part A and Part B.

- Reside in the service area of the Medicare Advantage plan you are interested in joining.

- Not have End-Stage Renal Disease (ESRD), except in certain circumstances.

To qualify for Medicare Advantage, you must first enroll in Medicare Part A and Part B. You must also live in the service area of the Medicare Advantage plan you want to join. Finally, you cannot have End-Stage Renal Disease (ESRD), unless you meet certain exceptions.

Contents

- How to Qualify for Medicare Advantage: A Comprehensive Guide

- Frequently Asked Questions

- What is Medicare Advantage?

- What are the different types of Medicare Advantage plans?

- How do I qualify for Extra Help with Medicare Advantage costs?

- Can I switch from Original Medicare to Medicare Advantage?

- What happens if I move out of my Medicare Advantage plan’s service area?

- What is Medicare Advantage? Medicare Advantage Plans Explained

How to Qualify for Medicare Advantage: A Comprehensive Guide

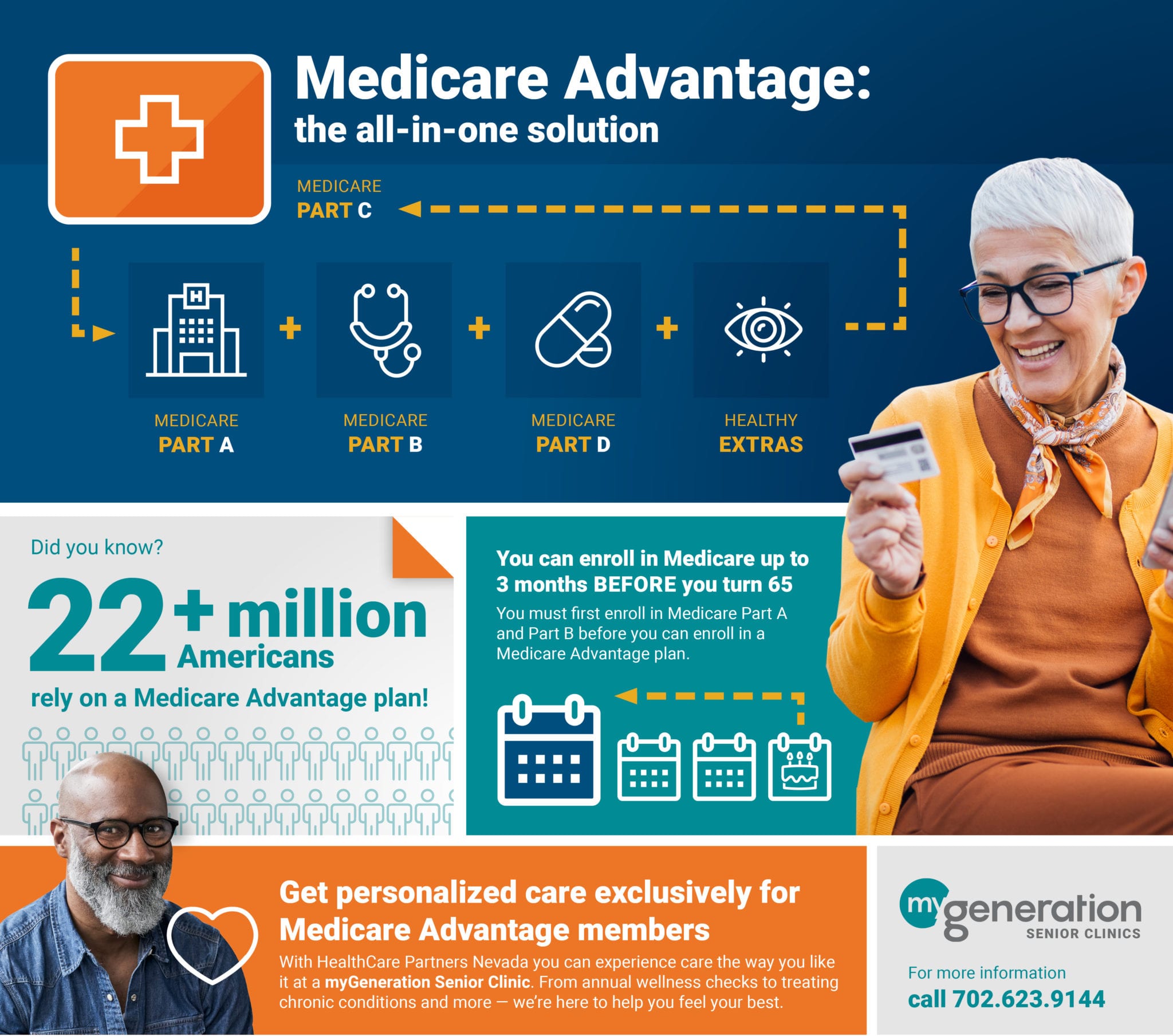

Medicare Advantage, also known as Medicare Part C, is a type of health insurance plan offered by private insurance companies. Medicare Advantage plans provide all the benefits of Original Medicare, but may also offer additional benefits such as dental, vision, and hearing coverage. In this article, we will discuss how to qualify for Medicare Advantage and what you need to know before enrolling.

Eligibility for Medicare Advantage

To be eligible for Medicare Advantage, you must meet the following criteria:

1. Enrollment in Medicare Part A and Part B: You must be enrolled in both Medicare Part A and Part B to be eligible for Medicare Advantage. Part A covers hospital stays, while Part B covers doctor visits, preventive services, and medical equipment.

2. Residency: You must live in the service area of the Medicare Advantage plan you want to enroll in. Service areas may vary by plan and by state.

To qualify for Medicare Advantage, you must also meet the following requirements:

1. No End-Stage Renal Disease (ESRD): If you have ESRD, you may still be eligible for Medicare Advantage if you are part of a Special Needs Plan (SNP) that covers this condition.

2. No other health insurance coverage: You cannot be enrolled in any other health insurance coverage, except for a Medigap policy, if you want to enroll in Medicare Advantage.

Enrollment Periods for Medicare Advantage

There are several enrollment periods for Medicare Advantage:

1. Initial Enrollment Period (IEP): The IEP is a seven-month period that begins three months before you turn 65, includes your birth month, and ends three months after your birth month.

2. Annual Enrollment Period (AEP): The AEP is from October 15 to December 7 each year. During this period, you can enroll in, switch, or disenroll from a Medicare Advantage plan.

3. Special Enrollment Period (SEP): You may qualify for a SEP if you experience certain life events, such as moving to a new service area, losing employer coverage, or being released from jail or prison.

Benefits of Medicare Advantage

Medicare Advantage plans offer several benefits that are not available with Original Medicare, including:

1. Additional benefits: Many Medicare Advantage plans offer additional benefits such as dental, vision, and hearing coverage.

2. Lower out-of-pocket costs: Medicare Advantage plans may have lower out-of-pocket costs than Original Medicare, including deductibles, copayments, and coinsurance.

3. Coordinated care: Medicare Advantage plans may offer coordinated care through a network of providers, which can help improve the quality of care you receive.

Medicare Advantage vs. Original Medicare

While Medicare Advantage plans offer additional benefits, they may not be the best option for everyone. Here are some key differences between Medicare Advantage and Original Medicare:

1. Provider network: Medicare Advantage plans may have a network of providers that you must use in order to receive coverage. With Original Medicare, you can go to any provider that accepts Medicare.

2. Cost: Medicare Advantage plans may have lower out-of-pocket costs, but may also have higher premiums than Original Medicare.

3. Coverage: Medicare Advantage plans may offer additional benefits, but may also have restrictions on coverage, such as prior authorization requirements.

Conclusion

Medicare Advantage can be a great option for those who are eligible and looking for additional benefits beyond what Original Medicare provides. To qualify for Medicare Advantage, you must meet certain criteria and enroll during one of several enrollment periods. When choosing between Medicare Advantage and Original Medicare, it’s important to consider your individual needs and preferences.

Frequently Asked Questions

What is Medicare Advantage?

Medicare Advantage is a type of health insurance plan offered by private insurance companies. It provides all the benefits of Original Medicare, Part A and Part B, and often includes additional benefits such as prescription drug coverage, vision, dental, and hearing services. Medicare Advantage plans are an alternative to Original Medicare and can offer cost savings and additional benefits.

To be eligible for Medicare Advantage, you must be enrolled in Medicare Part A and Part B and live in the service area of the Medicare Advantage plan you wish to join. You also cannot have end-stage renal disease (ESRD) unless you qualify for a Special Needs Plan (SNP) that specifically covers ESRD.

What are the different types of Medicare Advantage plans?

There are several types of Medicare Advantage plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), Private Fee-for-Service (PFFS) plans, Special Needs Plans (SNPs), Medical Savings Account (MSA) plans, and HMO Point of Service (HMOPOS) plans. Each type of plan has different rules and restrictions for accessing healthcare services, and may have different network requirements and costs.

To find the right Medicare Advantage plan for you, consider your healthcare needs and budget, and compare the benefits, costs, and network of different plans available in your area. You can use the Medicare Plan Finder tool on the Medicare website to compare plans and enroll in the plan of your choice.

How do I qualify for Extra Help with Medicare Advantage costs?

Extra Help, also known as the Low-Income Subsidy (LIS), is a program that helps people with limited income and resources pay for their Medicare prescription drug coverage. To qualify for Extra Help, you must have Medicare Part A and/or Part B, live in one of the 50 states or the District of Columbia, and meet certain income and asset requirements.

If you qualify for Extra Help, you may be eligible for $0 or reduced monthly premiums, deductibles, and co-payments for your Medicare Advantage plan. You will automatically qualify for Extra Help if you have Medicaid, get help from your state, or have Supplemental Security Income (SSI).

Can I switch from Original Medicare to Medicare Advantage?

Yes, you can switch from Original Medicare to a Medicare Advantage plan during the Annual Enrollment Period (AEP) which runs from October 15 to December 7 each year. During this time, you can enroll in a Medicare Advantage plan, switch from one Medicare Advantage plan to another, or switch from a Medicare Advantage plan back to Original Medicare.

Outside of the AEP, you may be able to switch to a Medicare Advantage plan during a Special Enrollment Period (SEP) if you have a qualifying life event, such as moving to a new service area or losing your employer-sponsored health coverage.

What happens if I move out of my Medicare Advantage plan’s service area?

If you move out of your Medicare Advantage plan’s service area, you may need to switch to a new plan or return to Original Medicare. Most Medicare Advantage plans have a service area that includes a specific geographic region, and if you move outside of that area, you may no longer be eligible for the plan’s benefits.

You will typically have a special enrollment period to switch to a new plan or return to Original Medicare when you move out of your plan’s service area. It’s important to notify your plan as soon as possible when you move to ensure that you have coverage that meets your healthcare needs in your new location.

What is Medicare Advantage? Medicare Advantage Plans Explained

In conclusion, qualifying for Medicare Advantage can be a great option for those looking for additional health coverage. By meeting certain eligibility requirements such as being enrolled in Original Medicare and living in a service area, you can explore a variety of plans offered by private insurance companies.

It’s important to understand the benefits and limitations of Medicare Advantage plans before enrolling. These plans often offer additional services such as dental and vision coverage, but may have restrictions on which doctors and hospitals you can visit.

If you’re interested in Medicare Advantage, take the time to research different plans and speak with a licensed insurance agent. With the right plan, you can have peace of mind knowing you have comprehensive health coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts