Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As you approach retirement age, you may be wondering about your healthcare coverage options. Medicare is a federal program that provides health insurance for those who are 65 and older, but it doesn’t cover everything. That’s where Medicare Supplement Insurance (also known as Medigap) comes in. In this guide, we’ll explain how to choose the right Medicare Supplement Insurance plan to meet your healthcare needs and budget.

With so many options available, choosing a Medicare Supplement Insurance plan can feel overwhelming. But don’t worry, we’ve got you covered. In this article, we’ll break down the different plans and coverage options, explain how to compare costs and benefits, and provide tips for selecting a plan that works best for you. By the end of this guide, you’ll feel confident in your ability to choose the right Medicare Supplement Insurance plan for your unique situation.

- Understand your healthcare needs and budget.

- Compare the benefits of different plans offered in your area.

- Check the insurance company’s financial stability and customer service ratings.

- Consider the cost of the plan, including premiums, deductibles, and co-pays.

- Review the plan’s network of healthcare providers and pharmacies.

- Enroll in a plan during the open enrollment period.

Contents

- How to Choose a Medicare Supplement Insurance Plan?

- Frequently Asked Questions

- What is a Medicare Supplement Insurance Plan?

- When should I enroll in a Medicare Supplement Insurance Plan?

- How do I choose the right Medicare Supplement Insurance Plan?

- Can I change my Medicare Supplement Insurance Plan?

- How much does a Medicare Supplement Insurance Plan cost?

- Best Medicare Supplement Plan 2023 – Which to Choose?

How to Choose a Medicare Supplement Insurance Plan?

Are you approaching retirement age or already retired? Then, you may be considering your healthcare options, including Medicare Supplement Insurance (Medigap). While Medicare covers many healthcare services, it doesn’t cover everything. That’s where Medigap comes in. Medigap is designed to fill gaps in Medicare coverage, such as deductibles, copayments, and coinsurance. In this article, we’ll discuss how to choose the right Medigap plan for you.

Understand Medigap Plans

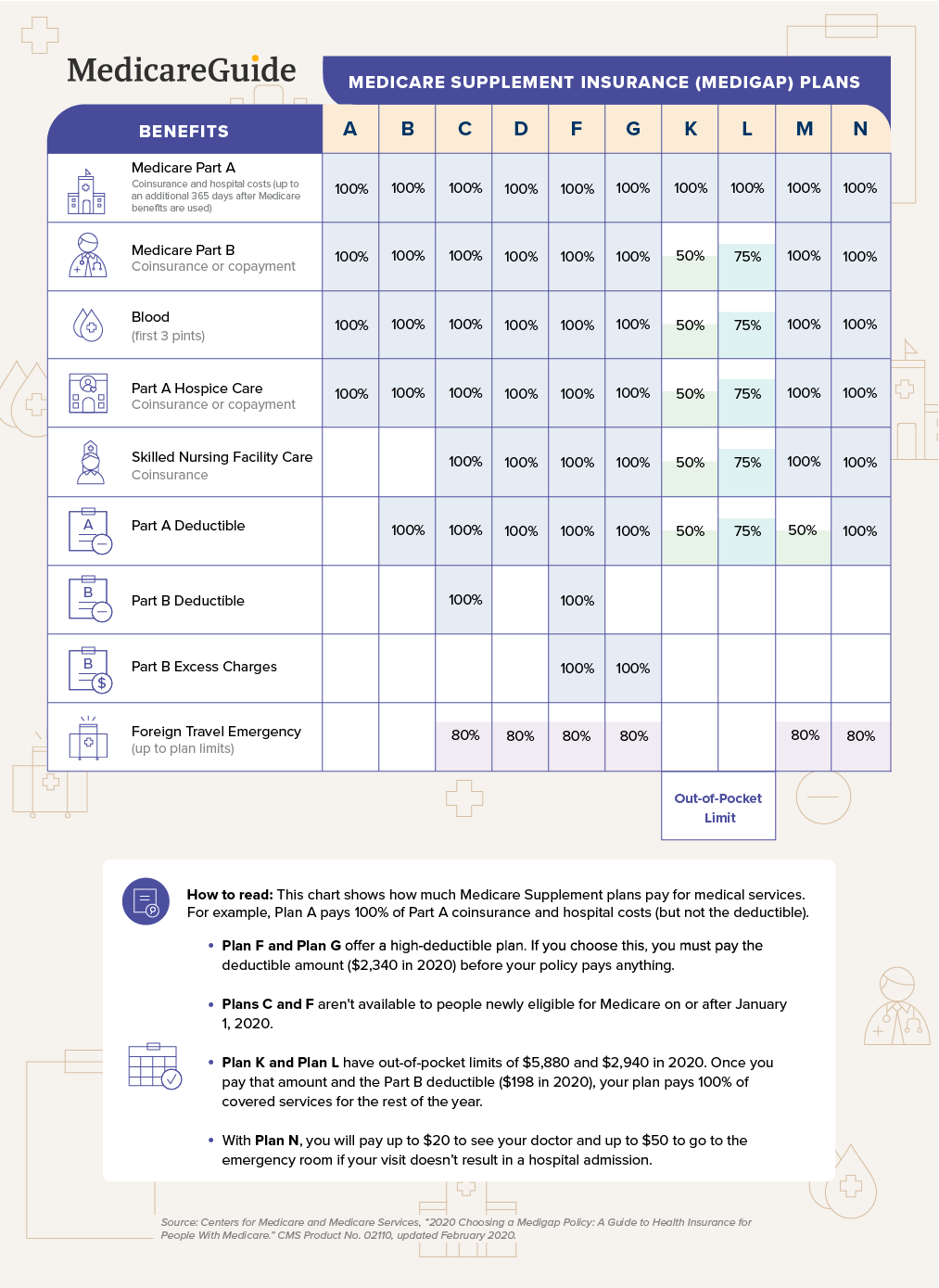

Medigap plans are standardized by the federal government and are identified by letters A-N. Each plan offers a different set of benefits, and all insurance companies must offer the same benefits for each plan. However, the cost of each plan can vary between insurance companies. So, it’s essential to understand the benefits of each plan before choosing one.

When comparing plans, consider the following:

1. Cost: How much does each plan cost, and what are the monthly premiums?

2. Benefits: What benefits does each plan offer, and how do they differ from other plans?

3. Coverage: Does each plan cover the services you need?

Consider Your Healthcare Needs

When selecting a Medigap plan, it’s crucial to consider your healthcare needs. Do you have a chronic condition that requires frequent medical care? Do you need prescription drug coverage? Consider your current and future healthcare needs when selecting a plan.

Benefits of Medigap Plans

Medigap plans offer several benefits, including:

1. Coverage for deductibles, copayments, and coinsurance

2. Access to any doctor or healthcare facility that accepts Medicare

3. Guaranteed renewable coverage for life

4. Coverage for medical care when traveling outside of the U.S.

Medigap Vs. Medicare Advantage

Medicare Advantage is another healthcare option for people with Medicare. Unlike Medigap, Medicare Advantage plans are offered by private insurance companies and often include additional benefits, such as prescription drug coverage, dental, and vision.

However, Medicare Advantage plans typically have restricted provider networks, meaning you may have to see specific doctors and healthcare facilities. Additionally, Medicare Advantage plans may have higher out-of-pocket costs than Medigap plans.

Compare Insurance Companies

Once you’ve determined which Medigap plan you need, it’s time to compare insurance companies. While the benefits of each plan are standardized, the cost can vary between insurance companies. So, it’s essential to shop around and compare prices.

When comparing insurance companies, consider the following:

1. Reputation: What is the company’s reputation, and how long have they been in business?

2. Financial stability: Is the company financially stable, and will they be able to pay claims?

3. Customer service: What is the company’s customer service like, and how easy is it to file a claim?

Enroll in a Medigap Plan

Once you’ve chosen a Medigap plan and insurance company, it’s time to enroll. You can enroll during the Medigap Open Enrollment Period, which begins when you turn 65 and enroll in Medicare Part B. This six-month period is the best time to enroll in a Medigap plan, as insurance companies cannot deny you coverage or charge you higher premiums due to pre-existing conditions.

In conclusion, selecting a Medigap plan can be a confusing and overwhelming process. However, by understanding the benefits of each plan, considering your healthcare needs, comparing insurance companies, and enrolling during the Medigap Open Enrollment Period, you can choose the right Medigap plan for you and ensure you have the healthcare coverage you need.

Frequently Asked Questions

What is a Medicare Supplement Insurance Plan?

A Medicare Supplement Insurance Plan, also known as Medigap, is a healthcare insurance policy that is designed to fill in the gaps of Original Medicare coverage. These gaps include things like deductibles, copayments, and coinsurance. Medigap policies are sold by private insurance companies and are standardized by the federal government.

There are several different Medigap plan options available, each with its own set of benefits and costs. It’s important to compare the different plans and choose one that meets your individual needs and budget.

When should I enroll in a Medicare Supplement Insurance Plan?

The best time to enroll in a Medigap policy is during your open enrollment period, which starts the month you turn 65 and are enrolled in Medicare Part B. During this time, you have a guaranteed right to purchase any Medigap policy sold in your state, regardless of your health status.

If you miss your open enrollment period, you may still be able to enroll in a Medigap policy, but you could be subject to medical underwriting, which means the insurance company can charge you a higher premium or deny you coverage based on your health history.

How do I choose the right Medicare Supplement Insurance Plan?

Choosing the right Medigap plan can be overwhelming, but there are a few factors to consider that can help you make an informed decision. First, think about your healthcare needs and how much coverage you require. Next, compare the benefits and costs of each plan option available in your area. It’s also a good idea to research the insurance companies offering the plans and read reviews from current customers.

Keep in mind that the lowest premium may not always be the best option, as it could come with higher out-of-pocket costs. Look for a plan that provides the right balance of coverage and affordability for your individual situation.

Can I change my Medicare Supplement Insurance Plan?

Yes, you can change your Medigap plan at any time, but there are certain rules to follow. If you want to switch to a different plan, you will need to apply for a new policy and go through medical underwriting, unless you are within your open enrollment period or have a guaranteed issue right due to certain life events.

It’s important to carefully consider your decision to switch plans and make sure the new policy meets your healthcare needs and budget. You should also be aware that if you cancel your old policy before your new policy is in effect, you may not be able to get it back.

How much does a Medicare Supplement Insurance Plan cost?

The cost of a Medigap policy varies depending on several factors, including your age, location, and the plan you choose. In general, the monthly premiums for Medigap policies are higher than other types of Medicare coverage, but they can provide more comprehensive coverage.

It’s important to compare the costs of each plan option and consider your budget when choosing a Medigap policy. Keep in mind that some insurance companies may offer discounts or other cost-saving options, such as paying annually instead of monthly.

Best Medicare Supplement Plan 2023 – Which to Choose?

In conclusion, choosing a Medicare supplement insurance plan can be a daunting task, but it doesn’t have to be. By understanding your needs, comparing plans, and considering the costs, you can make an informed decision that gives you the coverage you need without breaking the bank.

Remember to take the time to research and explore your options before making a final decision. Don’t be afraid to ask questions or seek guidance from a professional if you need it. With a little patience and persistence, you can find the Medicare supplement insurance plan that works best for you.

Overall, it’s important to prioritize your health and well-being by choosing a plan that offers the coverage you need. By making the right choice, you can enjoy peace of mind knowing that you’re covered for any unexpected health events that may arise.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts