Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As a healthcare provider, billing for Durable Medical Equipment (DME) can be a complex and time-consuming process. However, it is crucial to ensure that Medicare claims are submitted accurately and in a timely manner to receive proper reimbursement. In this guide, we will walk you through the steps of how to bill DME claims to Medicare and provide tips to help streamline the process. So, let’s get started and take the first step towards mastering Medicare billing for DME.

- Get a National Provider Identifier (NPI) number.

- Enroll in Medicare and select the Durable Medical Equipment (DME) option.

- Obtain a Medicare supplier billing number.

- Obtain a prescription from a qualified healthcare provider.

- Ensure the DME is medically necessary and meets Medicare’s coverage guidelines.

- Submit a claim using the correct HCPCS codes and modifiers.

- Include all necessary documentation and supporting medical records.

- Wait for payment, or appeal if necessary.

How to Bill DME Claims to Medicare?

Are you a healthcare provider looking to bill durable medical equipment (DME) claims to Medicare? If so, there are a few key steps you’ll need to follow to ensure your claims are processed and paid properly. In this article, we’ll walk you through the process step-by-step, from determining eligibility to submitting your claim.

Step 1: Determine Patient Eligibility

Before providing any DME to a patient, you’ll need to determine if they are eligible for Medicare coverage. Medicare Part B covers most medically necessary DME, but there are some restrictions and limitations. To be eligible, the patient must:

– Have Medicare Part B coverage

– Have a medical need for the DME

– Obtain the DME from a Medicare-approved supplier

Once you’ve confirmed the patient’s eligibility, you can move on to the next step.

Step 2: Obtain a Written Order

To bill Medicare for DME, you’ll need a written order from the patient’s treating physician or healthcare provider. This order must include:

– The patient’s name

– The item(s) of DME being ordered

– The length of time the DME is needed

– The treating physician’s signature and date

Keep in mind that some DME requires additional documentation, such as a detailed written order or a certificate of medical necessity. Make sure to check the specific requirements for the item(s) of DME you’ll be providing.

Step 3: Gather Necessary Documentation

In addition to the written order, you’ll need to gather some additional documentation before submitting your claim to Medicare. This includes:

– The patient’s Medicare information

– The supplier’s Medicare information

– The manufacturer’s information for the DME being provided

– Any additional required documentation (e.g. detailed written order, certificate of medical necessity)

Step 4: Submit Your Claim to Medicare

Once you’ve gathered all the necessary documentation, you can submit your claim to Medicare. The preferred method for submitting DME claims is electronically through the Medicare Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) system. This system allows for faster processing and fewer errors.

When submitting your claim, make sure to include all required documentation and double-check for accuracy. Any errors or missing information can delay or even prevent payment.

Step 5: Follow Up on Your Claim

After submitting your claim, you’ll need to follow up to ensure it is processed and paid properly. Medicare typically processes DME claims within 30 days, but it may take longer if additional documentation is required or if there are errors in the claim.

If your claim is denied or partially denied, you’ll receive an explanation of benefits (EOB) from Medicare. This will explain why the claim was denied and what you can do to appeal the decision.

Benefits of Billing DME Claims to Medicare

Billing DME claims to Medicare has several benefits for healthcare providers, including:

– Guaranteed payment for medically necessary DME

– Reduced financial burden on patients

– Improved patient outcomes through access to necessary equipment

– Increased revenue for healthcare providers

DME Claims to Medicare Vs. Private Insurance

While Medicare is the primary payer for most DME claims, some patients may have private insurance that covers DME. When billing private insurance, the process may differ slightly and may require additional documentation or follow-up.

It’s important to note that private insurance may have different coverage limitations or requirements than Medicare. Always check with the patient’s insurance provider to confirm coverage and requirements before providing DME.

Conclusion

Billing DME claims to Medicare can be a complex process, but by following these steps and ensuring all required documentation is in order, you can improve your chances of a successful claim. Remember to follow up on your claim and appeal any denials if necessary. By providing medically necessary DME to your patients, you can improve their outcomes and increase your revenue as a healthcare provider.

Contents

Frequently Asked Questions

Here are some commonly asked questions about how to bill DME claims to Medicare:

What is DME and what kind of equipment is covered?

DME stands for Durable Medical Equipment and it refers to medical equipment that is used for medical purposes at home. Medicare covers a wide range of DME equipment including wheelchairs, oxygen equipment, hospital beds, walkers, and more. However, not all DME is covered by Medicare, so it’s important to check with your supplier and Medicare to see what equipment is covered.

When billing DME claims to Medicare, you must use the appropriate HCPCS code for the equipment being provided. The HCPCS code is a standardized code used by Medicare and other insurance companies to identify the equipment being provided.

What are the requirements for billing DME claims to Medicare?

To bill DME claims to Medicare, you must be enrolled as a Medicare supplier and have a National Provider Identifier (NPI) number. You must also have a signed order from the patient’s physician that includes a diagnosis and the specific equipment being ordered. The order must be kept on file by the supplier for at least seven years.

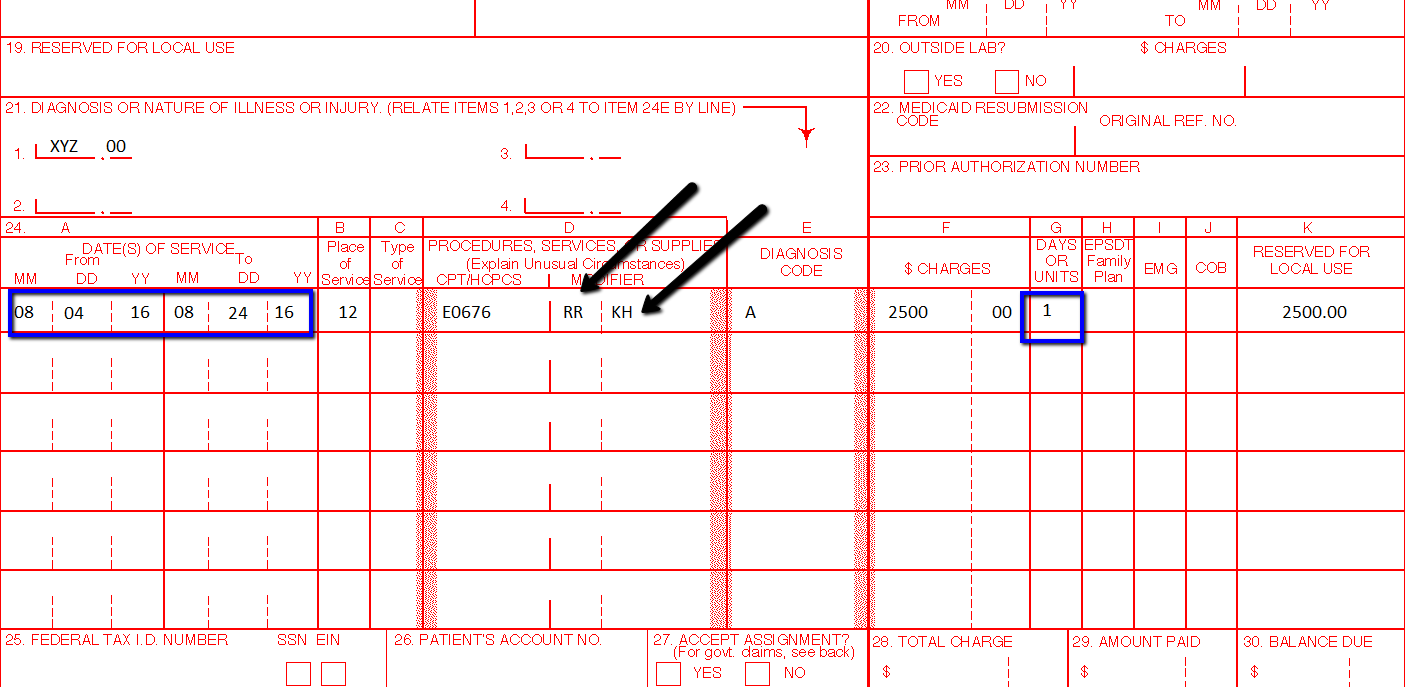

When submitting the claim to Medicare, you must include the HCPCS code for the equipment, the date of service, the amount charged, and the patient’s Medicare number. Claims can be submitted electronically or on paper.

How are DME claims paid by Medicare?

Medicare pays for DME on a rental basis, meaning that the supplier is paid a monthly rental fee for the equipment. Medicare will continue to pay the rental fee as long as the equipment is medically necessary and the patient continues to use it.

After a certain period of time, Medicare may consider purchasing the equipment instead of continuing to pay the rental fee. This is known as the capped rental period and typically lasts 13 months. Once the capped rental period is over, Medicare will pay for any necessary repairs or replacements to the equipment.

What should I do if a DME claim is denied by Medicare?

If a DME claim is denied by Medicare, the supplier can appeal the decision. The supplier must provide additional documentation to support the medical necessity of the equipment and the reason for the denial. The appeal process can take several months, so it’s important to keep the patient informed and provide any necessary interim equipment.

If the appeal is denied, the patient may be responsible for paying for the equipment out of pocket or finding another supplier that is willing to provide the equipment at a lower cost.

What are some common mistakes to avoid when billing DME claims to Medicare?

One common mistake is not obtaining the necessary documentation from the patient’s physician, such as a signed order or medical records. Another mistake is using the wrong HCPCS code or billing code for the equipment being provided. It’s also important to ensure that the equipment is medically necessary and that the patient meets all of the Medicare requirements for coverage.

Finally, it’s important to keep accurate records and documentation of all DME claims submitted to Medicare, including any appeals or denials. This will help ensure that claims are processed correctly and that the supplier is paid in a timely manner.

Before Billing Medicare

In conclusion, billing DME claims to Medicare can be a complex process, but it is essential to ensure timely and accurate reimbursement. By following the proper guidelines and ensuring all necessary documentation is included, providers can increase their chances of a successful claim submission.

It is also important to stay up-to-date on any changes or updates to Medicare billing regulations, as these can affect the reimbursement process. Providers can stay informed by regularly checking the Medicare website or consulting with a billing specialist.

Ultimately, taking the time to properly bill DME claims to Medicare can benefit both providers and patients by ensuring timely access to essential medical equipment and supplies. By following best practices and staying informed, providers can help ensure the best possible outcomes for all involved.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts