Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you a Texan approaching the age of 65? If so, it’s time to start thinking about Medicare. Medicare is a federal healthcare program that provides coverage for individuals aged 65 or older, as well as those with certain disabilities. Applying for Medicare in Texas can seem like a daunting task, but with the right information and preparation, it can be a smooth and straightforward process.

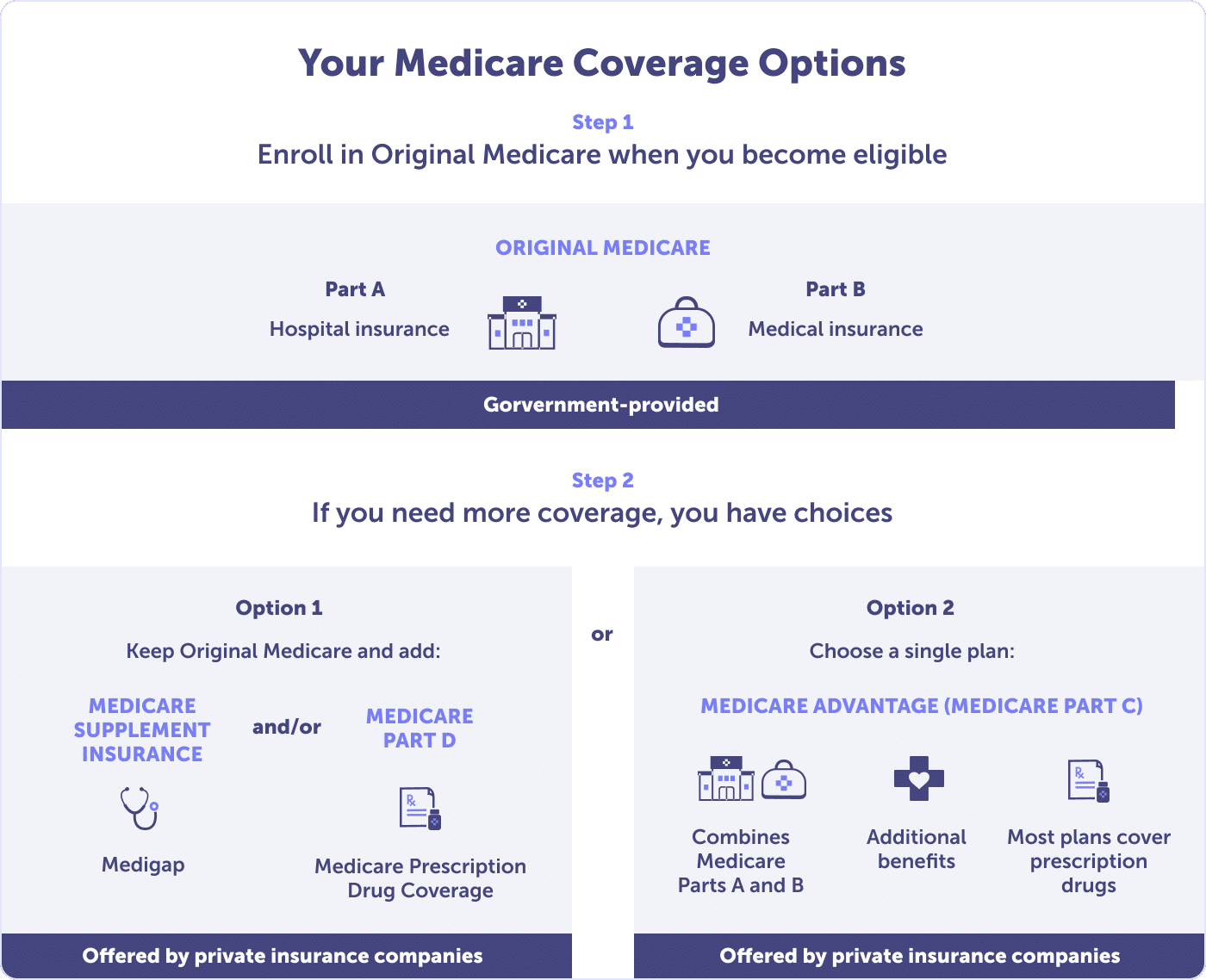

Firstly, it’s important to understand the different parts of Medicare and what they cover. Part A covers hospital stays and some skilled nursing facilities, while Part B covers doctor’s visits and preventative care. Part D covers prescription drugs. You can apply for Medicare online, by phone, or in person at your local Social Security office. Don’t wait until the last minute – start the process early to ensure you have the coverage you need when you need it.

- Visit the Medicare official website.

- Click on the ‘Apply for Medicare’ button.

- Fill out the application form with all the required information.

- Provide necessary documents such as birth certificate, social security card, and proof of residency.

- Submit your application online or by mail.

How to Apply for Medicare in Texas?

Are you reaching the age of 65 or have a disability and wondering how to apply for Medicare in Texas? Medicare is a federal health insurance program available to people above 65 years old, those with certain disabilities, and people with end-stage renal disease. In Texas, there are various ways to apply for Medicare, and this article will guide you through the process.

1. Understand the Different Parts of Medicare

Medicare has four parts: A, B, C, and D. Part A covers inpatient care, skilled nursing facility, hospice care, and home health care. Part B covers outpatient care, preventive services, and medical equipment. Part C, also known as Medicare Advantage, is an alternative to Parts A and B and covers additional benefits such as dental, vision, and hearing. Part D covers prescription drugs. Before applying for Medicare, it is important to understand which parts you need and which ones are optional.

To enroll in Parts A and B, visit the Social Security website or go to your local Social Security office. You can also call the Social Security Administration at 1-800-772-1213. If you prefer to enroll in Medicare Advantage or Prescription Drug plans, visit the Medicare website or contact a licensed insurance agent.

2. Eligibility Requirements

To be eligible for Medicare, you must be a U.S. citizen or a legal resident for at least five years and meet one of the following criteria:

– You are 65 years or older

– You have a disability and have been receiving Social Security Disability Insurance (SSDI) for at least 24 months

– You have end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS)

If you are already receiving Social Security benefits, you will be automatically enrolled in Medicare Parts A and B when you turn 65. If not, you must apply for Medicare during your Initial Enrollment Period (IEP), which is three months before your 65th birthday, the month of your birthday, and three months after your birthday.

3. Required Documents

When applying for Medicare, you will need to provide the following documents:

– Social Security card

– Proof of citizenship or legal residency

– W-2 forms or tax returns for the past two years

– Employer or union health insurance information

– Proof of disability (if applicable)

You can submit your application online, by phone, or in person at your local Social Security office.

4. Enrollment Periods

There are several enrollment periods for Medicare, and it is important to know which one applies to you:

– Initial Enrollment Period (IEP): This is the seven-month period around your 65th birthday. If you miss this period, you may have to pay a late enrollment penalty.

– General Enrollment Period (GEP): This period runs from January 1 to March 31 each year and is for people who did not enroll during their IEP.

– Open Enrollment Period (OEP): This period runs from October 15 to December 7 each year and allows you to make changes to your Medicare Advantage or Prescription Drug plan.

– Special Enrollment Period (SEP): This period is for people who experience certain life events, such as moving, losing their employer health insurance, or qualifying for Medicaid.

5. Medicare Costs

Medicare costs vary depending on the parts you enroll in and your income. Part A is usually free if you or your spouse paid Medicare taxes while working. Part B has a monthly premium, which can be higher if your income is above a certain threshold. Medicare Advantage and Prescription Drug plans also have premiums, deductibles, and copayments.

It is important to review your options carefully and compare costs before enrolling in any Medicare plan.

6. Benefits of Medicare

Medicare provides essential health insurance coverage to millions of Americans. Some of the benefits of Medicare include:

– Access to a wide range of healthcare providers and services

– Coverage for preventive care, such as annual wellness visits and screenings

– Protection from high medical bills and catastrophic expenses

– Flexibility to choose your doctors and hospitals

7. Medicare vs. Medicaid

Medicare is often confused with Medicaid, which is a joint federal-state program that provides healthcare coverage to people with low income. While both programs provide healthcare coverage, Medicaid has different eligibility requirements and covers different services.

If you are eligible for both Medicare and Medicaid, you may be enrolled in a Medicare-Medicaid Plan, which combines the benefits of both programs.

8. Medicare Supplement Insurance

Medicare Supplement Insurance, also known as Medigap, is a private insurance policy that helps pay for some of the out-of-pocket costs of Medicare, such as deductibles, copayments, and coinsurance. Medigap plans are standardized and sold by private insurance companies.

It is important to note that Medigap plans do not cover prescription drugs, so you will need to enroll in a separate Part D plan if you want prescription drug coverage.

9. Medicare Advantage

Medicare Advantage, also known as Part C, is an all-in-one alternative to Original Medicare (Parts A and B) and often includes additional benefits such as dental, vision, and hearing. Medicare Advantage plans are offered by private insurance companies and must cover all the same services as Original Medicare.

It is important to compare the costs and benefits of Medicare Advantage plans in your area before enrolling.

10. Conclusion

Applying for Medicare in Texas can seem daunting, but it doesn’t have to be. By understanding the different parts of Medicare, eligibility requirements, required documents, enrollment periods, costs, benefits, and options such as Medicare Supplement Insurance and Medicare Advantage, you can make an informed decision about your healthcare coverage.

Remember to apply for Medicare during your Initial Enrollment Period and compare your options carefully to ensure you have the coverage that best meets your needs.

Contents

Frequently Asked Questions

Medicare is a federal health insurance program that provides coverage to people aged 65 and older, as well as individuals under 65 with certain disabilities or illnesses. Applying for Medicare in Texas can seem overwhelming, but it’s important to understand the process to ensure you get the coverage you need. Here are some frequently asked questions and answers about how to apply for Medicare in Texas.

Q: When should I apply for Medicare in Texas?

The best time to apply for Medicare in Texas is during your Initial Enrollment Period (IEP), which begins three months before your 65th birthday and ends three months after. If you don’t sign up during your IEP, you may face penalties for late enrollment. If you’re under 65 and have a disability or certain medical conditions, you may be eligible for Medicare earlier than age 65.

To apply for Medicare in Texas, you can visit the Social Security Administration (SSA) website, call their toll-free number, or visit a Social Security office in person. You’ll need to provide some personal information, including your name, Social Security number, and date of birth, as well as information about your work history and current insurance coverage.

Q: What parts of Medicare do I need to enroll in?

There are several parts of Medicare, and you may not need to enroll in all of them. Part A covers hospital stays, while Part B covers doctor visits and other outpatient services. Part C, also known as Medicare Advantage, is an alternative to Original Medicare and may include additional benefits like prescription drug coverage. Part D provides prescription drug coverage. You can enroll in Parts A and B through the SSA, and you can enroll in Part C and Part D through private insurance companies.

When you apply for Medicare in Texas, you’ll have the option to enroll in Parts A and B, as well as Part D if you want prescription drug coverage. If you’re interested in Medicare Advantage, you’ll need to enroll in that separately through a private insurance company that offers those plans.

Q: How much does Medicare cost in Texas?

The cost of Medicare in Texas varies depending on which parts you enroll in and your income. Most people don’t pay a premium for Part A, but there is a monthly premium for Part B. The standard premium for Part B in 2021 is $148.50, but higher-income individuals may pay more. If you enroll in a Medicare Advantage plan or a Part D prescription drug plan, you’ll also pay a monthly premium.

It’s important to understand the costs associated with each part of Medicare when you apply for Medicare in Texas. You can visit the Medicare website or speak with a licensed insurance agent for more information about premiums, deductibles, and other out-of-pocket costs.

Q: What if I already have health insurance through my employer?

If you’re still working and have health insurance through your employer, you may not need to enroll in Medicare right away. You can delay enrollment in Part B without penalty as long as you have employer coverage. However, it’s important to understand the rules for delaying enrollment and to know when you need to enroll in Medicare to avoid penalties.

If you’re not sure whether you need to enroll in Medicare when you apply for Medicare in Texas, you can speak with a licensed insurance agent or contact the SSA for more information.

Q: What happens after I apply for Medicare in Texas?

After you apply for Medicare in Texas, you’ll receive a letter from the SSA confirming your enrollment and letting you know which parts of Medicare you’re enrolled in. If you’re enrolled in Original Medicare (Parts A and B), you can start using your benefits right away. If you’ve enrolled in a Medicare Advantage plan or a Part D prescription drug plan, you’ll need to wait for your plan to start before you can use those benefits.

It’s important to keep your Medicare information up to date and to understand how to use your benefits. You can speak with a licensed insurance agent or contact Medicare directly for more information about your coverage and how to get the care you need.

How to Apply for Medicare Step by Step 😉

In conclusion, applying for Medicare in Texas can be a straightforward process if you understand the requirements and follow the necessary steps. With the help of this guide, you can easily navigate the application process and ensure that you receive the benefits that you are entitled to.

It is important to remember that the eligibility criteria and application requirements may vary depending on your circumstances. If you have any doubts or questions, it is always best to seek guidance from a qualified professional.

By taking the time to understand the process and provide the necessary documentation, you can ensure that your application for Medicare in Texas is successful. Don’t hesitate to reach out to the Social Security Administration or other relevant agencies for assistance along the way.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts