Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare Advantage plans have been a popular alternative to traditional Medicare for many Americans. These plans, offered by private insurance companies, provide additional benefits such as dental and vision coverage, and often have lower out-of-pocket costs. But have you ever wondered how much the government pays these plans? In this article, we’ll explore the funding behind Medicare Advantage and what it means for both the government and beneficiaries. So, grab a cup of coffee and let’s dive into the world of Medicare Advantage funding!

Contents

- How Much Does the Government Pay Medicare Advantage Plans?

- Frequently Asked Questions

- What is Medicare Advantage?

- How much does the government pay Medicare Advantage plans?

- What factors affect how much the government pays Medicare Advantage plans?

- How are Medicare Advantage plans funded?

- Are Medicare Advantage plans more expensive than Original Medicare?

- Here is What Medicare Advantage Plans Cost

How Much Does the Government Pay Medicare Advantage Plans?

Medicare Advantage plans are a popular option for many seniors looking for more comprehensive coverage than Original Medicare. These plans are offered by private insurance companies approved by Medicare and can offer additional benefits such as vision, dental, and hearing coverage. But how much does the government pay Medicare Advantage plans?

Understanding Medicare Advantage Plan Payments

Medicare Advantage plans are paid a set amount from the government for each person enrolled in the plan. This amount is called the capitated rate and is determined annually by the Centers for Medicare and Medicaid Services (CMS). The capitated rate is based on the cost of providing care to a beneficiary under Original Medicare.

The actual amount paid to a Medicare Advantage plan varies depending on several factors, including the health status of the plan’s enrollees and the plan’s overall quality rating. Plans with higher quality ratings receive bonus payments from the government, while plans with lower ratings may receive less than the capitated rate.

How Much Does the Government Pay for Medicare Advantage Plans?

The average capitated rate for Medicare Advantage plans in 2021 is $1,063 per month per beneficiary. This amount varies by county and is adjusted based on factors such as the cost of living and health care utilization in the area.

In addition to the capitated rate, Medicare Advantage plans may receive bonus payments based on their quality ratings. Plans with a rating of four stars or higher receive bonus payments, which can increase the amount paid by the government to the plan.

Benefits of Medicare Advantage Plans

Medicare Advantage plans offer several benefits that are not available under Original Medicare. These benefits may include coverage for vision, dental, and hearing services, as well as wellness programs and prescription drug coverage.

In addition, many Medicare Advantage plans have lower out-of-pocket costs than Original Medicare, making them a more affordable option for seniors. Some plans also offer additional services such as transportation to medical appointments and home-delivered meals.

Medicare Advantage Plans vs. Original Medicare

While Medicare Advantage plans offer additional benefits, they also have some limitations compared to Original Medicare. One of the biggest limitations is that Medicare Advantage plans often have a network of providers that enrollees must use to receive care.

In addition, Medicare Advantage plans may have higher out-of-pocket costs for certain services, such as hospital stays. Enrollees may also need to get prior authorization for certain procedures or treatments.

Choosing the Right Medicare Plan for You

When choosing between Medicare Advantage and Original Medicare, it’s important to consider your individual health needs and budget. If you have specific health conditions or need to see specialists frequently, Original Medicare may be a better option.

On the other hand, if you’re looking for more comprehensive coverage and lower out-of-pocket costs, a Medicare Advantage plan may be a good choice. It’s important to research different plans in your area and compare costs and benefits before making a decision.

Conclusion

Medicare Advantage plans are paid a set amount from the government for each person enrolled in the plan. The actual amount paid varies based on several factors, including quality ratings and health status of enrollees. These plans offer additional benefits such as vision, dental, and hearing coverage, but may have limitations compared to Original Medicare. When choosing a Medicare plan, it’s important to consider your individual health needs and budget before making a decision.

Frequently Asked Questions

What is Medicare Advantage?

Medicare Advantage is a type of health insurance plan offered by private companies that contract with Medicare to provide Part A and Part B benefits. These plans often include additional benefits, such as prescription drug coverage, dental, vision, and hearing services. Medicare Advantage plans are an alternative to Original Medicare and are required to provide at least the same level of coverage as Original Medicare.

How much does the government pay Medicare Advantage plans?

The government pays Medicare Advantage plans a set amount per person, based on the county in which the person resides. This amount is known as the benchmark. In 2021, the national average benchmark is $11,300 per person. However, the actual amount paid to the plan may vary, depending on the plan’s bid. If the plan’s bid is lower than the benchmark, the plan receives a rebate, and the member may receive additional benefits or a lower premium.

What factors affect how much the government pays Medicare Advantage plans?

Several factors can affect how much the government pays Medicare Advantage plans. The biggest factor is the plan’s bid. The bid is the amount the plan requests to provide Medicare benefits to a member. If the plan’s bid is higher than the benchmark, the member may need to pay an additional premium to make up the difference. Other factors that can affect payments to Medicare Advantage plans include the demographics of the members, the health status of the members, and the geographic location of the plan.

How are Medicare Advantage plans funded?

Medicare Advantage plans are funded through a combination of government payments and member premiums. The government pays the plan a set amount per person, based on the county in which the person resides. The plan may also receive additional funding if the member’s health status is worse than average or if the plan serves a high percentage of low-income members. Members of Medicare Advantage plans also pay a monthly premium, which varies depending on the plan and the services provided.

Are Medicare Advantage plans more expensive than Original Medicare?

The cost of Medicare Advantage plans varies depending on the plan and the services provided. In some cases, Medicare Advantage plans may be more expensive than Original Medicare, especially if the plan offers additional benefits such as prescription drug coverage, dental, vision, and hearing services. However, in other cases, Medicare Advantage plans may be less expensive than Original Medicare, especially if the member has high healthcare costs. It’s important to compare the costs and benefits of different plans before enrolling in a Medicare Advantage plan.

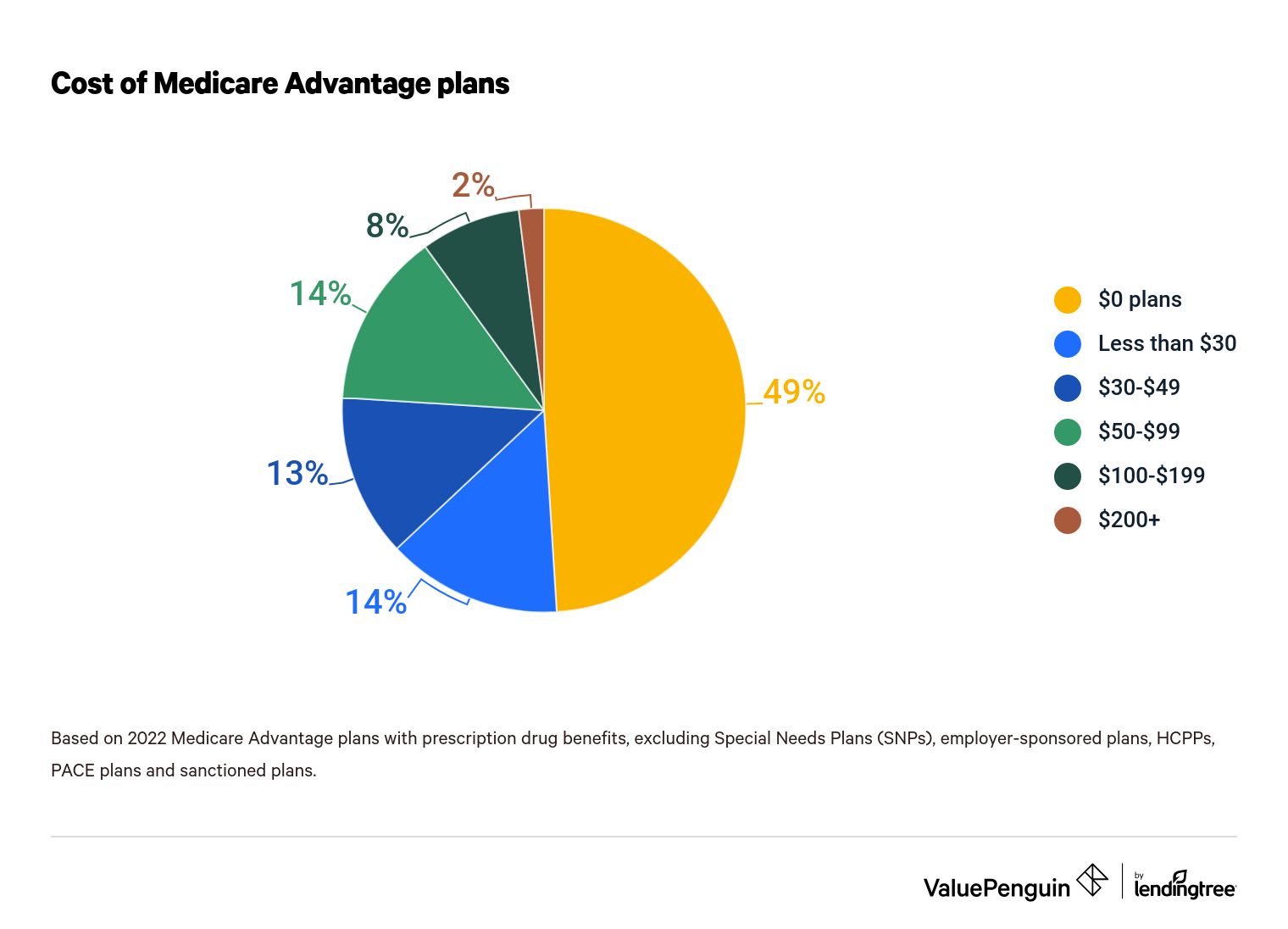

Here is What Medicare Advantage Plans Cost

In conclusion, understanding how much the government pays Medicare Advantage plans is crucial to make informed decisions about healthcare coverage. Despite the complexities involved, it’s important to note that the government reimburses these plans based on a variety of factors, including the location of the plan and the health status of its enrollees. While some argue that these payments are too high, others believe they are necessary to ensure that seniors have access to high-quality care.

Overall, it’s clear that the government’s payments to Medicare Advantage plans play a significant role in the healthcare industry. As the healthcare landscape continues to evolve, it’s likely that there will be ongoing debates about the fairness and efficacy of these payments. However, by staying informed and asking questions, seniors can make the best decisions for their unique healthcare needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts