Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program for those who are 65 years or older or have certain disabilities. As we age, healthcare becomes more crucial, and it is essential to understand how much it will cost to ensure that we have access to the medical care we need. In this article, we will discuss the cost of Medicare insurance, including premiums, deductibles, copayments, and out-of-pocket expenses.

With the cost of healthcare on the rise, it is essential to have a clear understanding of the expenses associated with Medicare insurance. Many factors can impact the cost of Medicare, such as income, health status, and the specific plans chosen. By the end of this article, you will have a better understanding of the costs associated with Medicare insurance and how to choose the best plan that suits your needs and budget.

How Much Does Medicare Insurance Cost?

Medicare insurance is a government-funded program that provides health insurance coverage to eligible individuals. The cost of Medicare insurance can vary depending on several factors, including the type of coverage you choose and your income level. In this article, we will discuss the various costs associated with Medicare insurance.

Part A Costs

Part A of Medicare insurance covers hospital stays, skilled nursing facility care, hospice care, and some home health care. Most people do not have to pay a monthly premium for Part A coverage, as they or their spouse have paid Medicare taxes while working. However, there are still some costs associated with Part A coverage.

For inpatient hospital stays, there is a deductible of $1,484 per benefit period in 2021. There are also copayments for extended hospital stays and for skilled nursing facility care. These copayments can add up quickly, so it’s important to understand what your Part A coverage includes.

Part B Costs

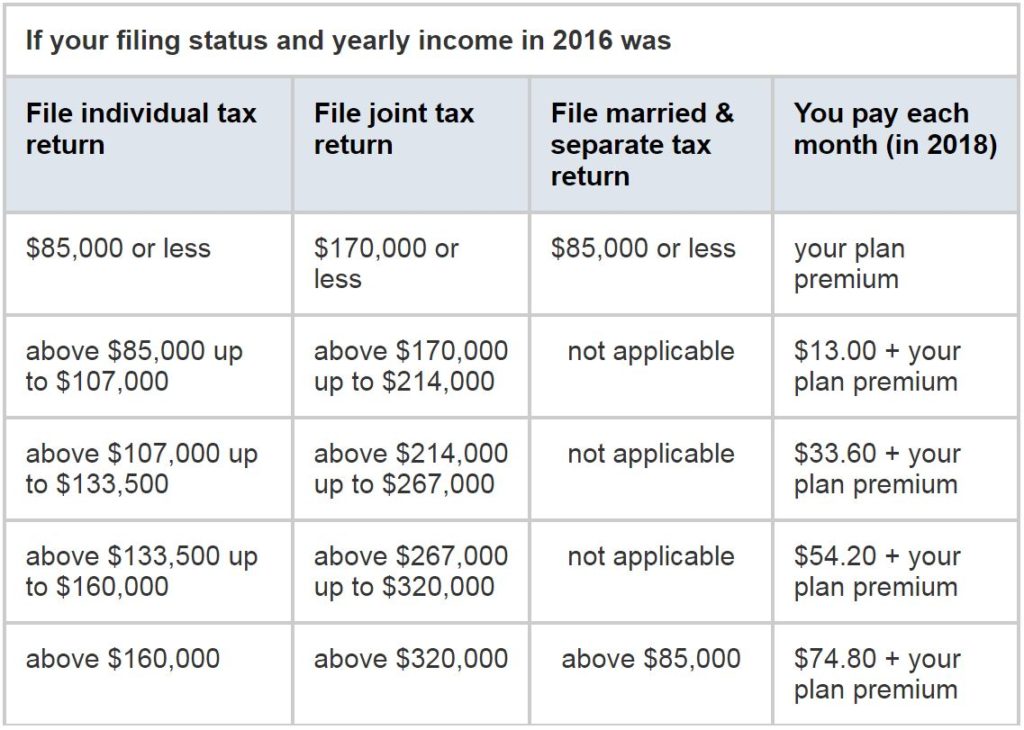

Part B of Medicare insurance covers doctor visits, outpatient services, and some preventive care. There is a monthly premium for Part B coverage, which is based on your income level. In 2021, the standard monthly premium for Part B is $148.50, but higher-income individuals may pay more.

There is also an annual deductible for Part B coverage, which is $203 in 2021. After you meet the deductible, you typically pay 20% of the Medicare-approved amount for most services covered by Part B. This can add up quickly, so it’s important to budget for these costs if you have Part B coverage.

Part C Costs

Part C, also known as Medicare Advantage, is an alternative to traditional Medicare coverage. Medicare Advantage plans are offered by private insurance companies and provide all the benefits of Parts A and B, as well as additional benefits like prescription drug coverage and dental and vision care.

The cost of Medicare Advantage plans varies depending on the plan you choose. Some plans have low monthly premiums but higher copayments and deductibles, while others have higher premiums but lower out-of-pocket costs. It’s important to compare plans carefully to find the one that best meets your needs and budget.

Part D Costs

Part D of Medicare insurance covers prescription drugs. Like Part C, Part D coverage is offered by private insurance companies. The cost of Part D coverage varies depending on the plan you choose, and there are many plans to choose from.

Most Part D plans have a monthly premium, which can range from less than $20 to more than $100. There is also an annual deductible, which can be up to $445 in 2021. After you meet the deductible, you typically pay a copayment or coinsurance for each prescription drug you receive. It’s important to review your medication needs and compare Part D plans carefully to find the one that best meets your needs and budget.

Benefits of Medicare Insurance

- Provides access to affordable healthcare for eligible individuals

- Covers many healthcare services, including hospital stays, doctor visits, and prescription drugs

- Offers a variety of plans to choose from, including traditional Medicare, Medicare Advantage, and Part D prescription drug plans

- Provides peace of mind knowing that you have health insurance coverage as you age

Medicare Insurance vs. Other Types of Insurance

Medicare insurance is designed specifically for individuals who are 65 or older, as well as individuals with certain disabilities or illnesses. Other types of insurance, like employer-sponsored health insurance or individual health insurance, may be more appropriate for younger individuals or those who do not qualify for Medicare.

Medicare insurance also has some limitations, such as limited coverage for dental and vision care. Supplemental insurance, like Medigap, can help fill in these gaps in coverage, but it comes at an additional cost. It’s important to consider all your healthcare needs and budget when deciding what type of insurance to purchase.

Conclusion

Medicare insurance is an important program that provides healthcare coverage to millions of eligible individuals. The cost of Medicare insurance can vary depending on several factors, including the type of coverage you choose and your income level. Understanding the costs and benefits of Medicare insurance can help you make an informed decision about your healthcare coverage as you age.

Frequently Asked Questions

Medicare is a federal health insurance program that provides coverage to people who are aged 65 and older, as well as some younger individuals with certain disabilities or medical conditions. One of the most common questions people have about Medicare is how much it costs. Here are some frequently asked questions and answers about Medicare insurance costs.

1. How much does Medicare Part A cost?

Medicare Part A is usually free for most people. If you or your spouse have worked and paid Medicare taxes for at least 10 years, you can get Part A without having to pay a monthly premium. However, if you don’t qualify for premium-free Part A, you may have to pay up to $471 per month in 2021. Additionally, there are deductibles and coinsurance costs associated with Part A coverage.

If you’re not sure whether you qualify for premium-free Part A, you can contact the Social Security Administration or visit the Medicare website for more information. It’s important to enroll in Part A when you’re first eligible, as there may be penalties for late enrollment.

2. How much does Medicare Part B cost?

Medicare Part B is not free and requires you to pay a monthly premium. The standard Part B premium amount in 2021 is $148.50 per month, but it may be higher depending on your income. Some people may also be eligible for help paying their Part B premiums through programs like Medicare Savings Programs.

In addition to the monthly premium, there are also deductibles and coinsurance costs associated with Part B coverage. It’s important to enroll in Part B when you’re first eligible, as there may be penalties for late enrollment.

3. How much does Medicare Part C (Medicare Advantage) cost?

Medicare Part C, also known as Medicare Advantage, is offered by private insurance companies that contract with Medicare to provide all-in-one coverage that includes Parts A and B, and often additional benefits like prescription drug coverage, vision, and dental. The costs of Medicare Advantage plans vary depending on the plan you choose, but you may still need to pay the monthly Part B premium in addition to any premium charged by the private insurance company.

You should carefully review the costs and benefits of different Medicare Advantage plans before enrolling, as not all plans are created equal and some may have higher out-of-pocket costs than others.

4. How much does Medicare Part D (prescription drug coverage) cost?

Medicare Part D is offered by private insurance companies that contract with Medicare to provide prescription drug coverage. The costs of Part D plans vary depending on the plan you choose, but there are some standard costs that you should be aware of. In 2021, the average monthly premium for a Part D plan is $33.06, but this can vary widely depending on the plan.

In addition to the monthly premium, there may be deductibles, copayments, and coinsurance costs associated with Part D coverage. It’s important to review the costs and coverage of different Part D plans before enrolling, as not all plans cover the same drugs.

5. Can I get help paying for my Medicare costs?

Yes, there are several programs available to help people with limited incomes and resources pay for their Medicare costs. These programs include:

- Medicaid

- Medicare Savings Programs

- Extra Help with Medicare Prescription Drug Coverage

You can check your eligibility for these programs and learn how to apply by contacting your local Medicaid office or visiting the Medicare website.

2022 Medicare Costs

In conclusion, Medicare insurance costs can vary depending on various factors such as income, age, health status, and location. It is important to understand the different Medicare plans available to you and the costs associated with each plan. While some individuals may qualify for premium-free Part A coverage, others may have to pay a monthly premium for Part B and other additional coverage. It is advisable to compare plans and costs before making a decision, and to seek guidance from a trusted healthcare professional or Medicare specialist.

Overall, investing in Medicare insurance can provide peace of mind and access to necessary healthcare services. It is important to factor in the costs associated with Medicare when planning for retirement and healthcare needs in the future. With a bit of research and understanding, you can find the right Medicare plan to fit your needs and budget. Remember, Medicare insurance costs may change from year to year, so it is important to stay informed and regularly review your coverage.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts