Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you curious about the cost of Medicare Supplements? As you approach the age of 65, healthcare costs become a major concern for most Americans. With so many different options available, it’s important to understand the costs associated with Medicare Supplements and how they can help you cover your medical expenses. In this article, we’ll explore the factors that affect the cost of Medicare Supplements and give you a better understanding of what to expect when it comes to your healthcare expenses. So, let’s dive in and explore the world of Medicare Supplements!

How Much Are Medicare Supplements?

The cost of Medicare supplements, also known as Medigap plans, varies depending on several factors such as your location, age, gender, and health status. On average, the monthly premiums range from $50 to $300. However, some high-end plans may cost even more. It’s crucial to compare the benefits and costs of different plans to find the one that suits your needs and budget.

How Much Are Medicare Supplements?

If you’re approaching your 65th birthday, you’re likely starting to think about Medicare and the various options available to you. One of those options is a Medicare supplement plan, also known as Medigap. While Medicare covers most medical expenses, it doesn’t cover everything, which is why many people choose to enroll in a Medigap plan to help cover the gaps. But how much do these plans cost? Let’s take a closer look.

Factors that Affect the Cost of Medicare Supplements

The cost of Medigap plans can vary depending on a variety of factors. The three major factors that affect the cost of your plan are your age, location, and the type of plan you choose.

First, your age can impact the cost of your Medigap plan. The older you are when you enroll, the higher your premiums will be. This is because older individuals tend to have more health problems and therefore use their Medigap coverage more often.

Second, your location can also affect the cost of your Medigap plan. Insurance companies use different pricing systems based on where you live, so it’s important to shop around to find the best rates in your area.

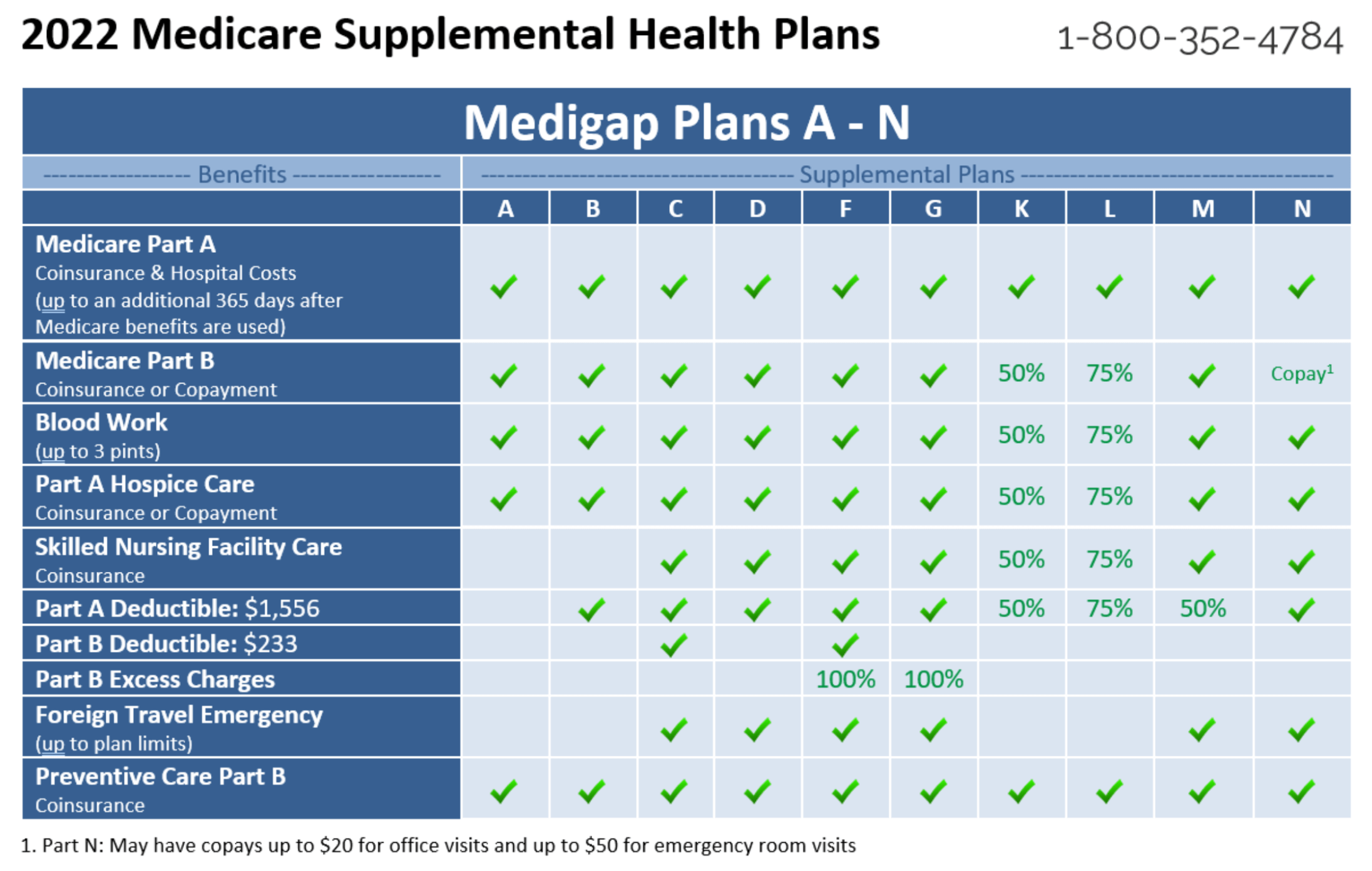

Finally, the type of plan you choose will impact your monthly premiums. There are ten different Medigap plans available, each with different levels of coverage. Plans that cover more medical expenses will typically have higher premiums.

Medicare Supplement Plan Cost Comparison

To give you a better idea of how much Medigap plans cost, let’s take a look at a cost comparison chart for plans in a few different states. Keep in mind that these are just example prices and your actual premiums may vary.

| State | Plan F | Plan G | Plan N |

|---|---|---|---|

| California | $150 – $300 | $130 – $250 | $100 – $200 |

| Florida | $150 – $250 | $130 – $210 | $100 – $180 |

| Texas | $150 – $275 | $130 – $225 | $100 – $200 |

As you can see, the cost of Medigap plans varies significantly based on the state and plan type. However, it’s important to keep in mind that while some plans may have lower monthly premiums, they may not cover as many medical expenses as other plans.

Benefits of Medicare Supplements

While Medigap plans can be costly, they do offer a number of benefits. First, they can help cover the gaps in Original Medicare coverage, including deductibles, copayments, and coinsurance. This can help reduce your out-of-pocket expenses for medical care.

Second, Medigap plans are accepted by any healthcare provider that accepts Medicare. This means you can see any doctor or specialist who accepts Medicare without worrying about whether they accept your insurance.

Finally, Medigap plans offer a level of predictability when it comes to medical expenses. With a Medigap plan, you’ll know exactly how much you’ll be paying for medical care each month. This can help you budget for healthcare expenses and avoid unexpected medical bills.

Medicare Supplements Vs. Medicare Advantage

While Medigap plans have many benefits, they’re not the only option available to Medicare beneficiaries. Another option is a Medicare Advantage plan, which is a type of health insurance plan offered by private insurance companies.

Medicare Advantage plans often have lower monthly premiums than Medigap plans, but they may not cover as many medical expenses. Additionally, you may be limited in your choice of healthcare providers with a Medicare Advantage plan.

Ultimately, the decision between a Medigap plan and a Medicare Advantage plan will depend on your individual healthcare needs and budget.

The Bottom Line

Medicare supplements can be a valuable tool for reducing your out-of-pocket expenses for medical care. While the cost of these plans can vary depending on your age, location, and plan type, they offer a number of benefits that can make them worth the investment. If you’re approaching your 65th birthday, it’s important to start researching your options and finding the plan that’s right for you.

Contents

- Frequently Asked Questions

- 1. How much do Medicare supplements typically cost?

- 2. What factors affect the cost of Medicare supplements?

- 3. Can I change my Medicare supplement plan if the cost is too high?

- 4. Are there any ways to reduce the cost of Medicare supplements?

- 5. Do Medicare supplements cover prescription drugs?

- Medicare Supplement Plans Cost

Frequently Asked Questions

Medicare supplements are an important consideration for many seniors who rely on Medicare. Here are some common questions about how much Medicare supplements cost.

1. How much do Medicare supplements typically cost?

Medicare supplement insurance plans vary in cost depending on several factors. These factors include your age, where you live, and the type of plan you select. In general, the average cost of a Medicare supplement plan is around $150 per month. However, some plans may be more expensive or less expensive than this average.

It’s important to shop around and compare plans from different insurance providers to find the best coverage and price for your needs. Keep in mind that the cheapest plan may not be the best option if it doesn’t provide the coverage you need.

2. What factors affect the cost of Medicare supplements?

Several factors can impact the cost of Medicare supplement insurance plans. These include your age, location, gender, and health status. In addition, the type of plan you select can also impact the cost. For example, a plan with more comprehensive coverage may cost more than a plan with less coverage.

It’s important to consider these factors when selecting a Medicare supplement plan. You may also want to consider working with an insurance agent or broker who can help you compare plans and find the best coverage and price for your needs.

3. Can I change my Medicare supplement plan if the cost is too high?

Yes, you can change your Medicare supplement plan if the cost is too high or if you’re not satisfied with the coverage. However, there are certain times when you can make changes to your plan. For example, you can switch to a different plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year.

It’s important to compare plans and costs carefully before making any changes to your coverage. You may also want to speak with an insurance agent or broker who can help you find a plan that meets your needs and budget.

4. Are there any ways to reduce the cost of Medicare supplements?

There are several strategies you can use to reduce the cost of Medicare supplement insurance plans. One option is to compare plans from different insurance providers to find the most affordable coverage. You may also want to consider a plan with less comprehensive coverage, which may be less expensive.

In addition, some insurance providers offer discounts or special rates for certain groups, such as non-smokers or couples. You may also be able to save money by paying your premiums annually rather than monthly.

5. Do Medicare supplements cover prescription drugs?

No, Medicare supplement insurance plans do not cover prescription drugs. However, you can enroll in a Medicare Part D plan to get coverage for prescription drugs. Medicare Part D plans are offered by private insurance companies and can be added to your Medicare coverage for an additional cost.

It’s important to consider your prescription drug needs when selecting a Medicare supplement plan and to ensure that you have adequate coverage for your medications.

Medicare Supplement Plans Cost

In conclusion, understanding the costs and benefits of Medicare supplements is crucial for seniors who want to ensure their medical expenses are covered. While the monthly premiums for these plans can vary based on several factors, including location and age, the peace of mind and financial protection they provide are invaluable.

It’s important to do your research and compare different plans from various providers to find the best fit for your needs and budget. Consider factors such as deductibles, copayments, and coverage limitations when evaluating your options.

Ultimately, investing in a Medicare supplement plan can provide you with the security and peace of mind you need as you age. Don’t wait until it’s too late to start thinking about your healthcare coverage – explore your options and find the right plan for you today.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts