Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage to people aged 65 or older, as well as to those who have certain disabilities or illnesses. While Medicare is a vital resource for millions of Americans, many people are left wondering how the program determines the cost of premiums. In this article, we’ll explore the factors that go into determining Medicare premiums and help you understand how these costs are calculated.

Medicare premiums can be a source of confusion and frustration for many beneficiaries, especially those who are new to the program. Understanding the factors that influence the cost of your Medicare coverage can help you make informed decisions about your health care and ensure that you’re getting the coverage you need at a price you can afford. So, let’s dive into the world of Medicare premiums and explore how these costs are determined.

How is Medicare Premium Determined?

Medicare is a federal health insurance program that provides coverage to people over 65 years of age, people with certain disabilities, and people with end-stage renal disease. The program is funded through payroll taxes, premiums, and general revenue. Medicare premiums are determined based on various factors, including income, enrollment period, and plan type.

Factors that Affect Medicare Premiums

Medicare premiums are calculated based on several factors, including income, enrollment period, and plan type.

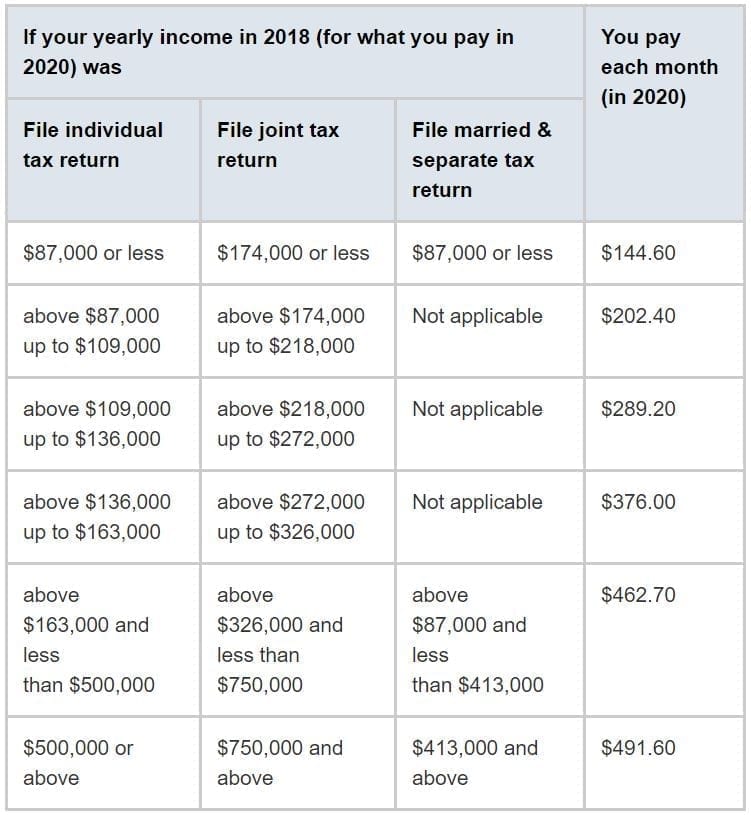

Income: Higher-income individuals pay higher Medicare premiums. The income thresholds change annually and are based on the individual’s tax return from two years prior. For example, in 2021, individuals with an income of $88,000 or more will pay higher premiums.

Enrollment Period: The time at which you enroll in Medicare can also affect your premiums. If you enroll during the initial enrollment period, which is the seven-month period surrounding your 65th birthday, you may pay lower premiums. If you enroll after the initial enrollment period, your premiums may be higher.

Plan Type: Medicare has several different plan types, including Original Medicare (Part A and Part B), Medicare Advantage (Part C), and Medicare prescription drug coverage (Part D). The premiums for each plan type can vary.

Medicare Premiums for Original Medicare (Part A and Part B)

Original Medicare is the traditional fee-for-service program offered by the government. The program includes Part A, which covers hospital stays, and Part B, which covers doctor visits and other outpatient services.

The premium for Part A is typically free for most people who have worked and paid Medicare taxes for at least 10 years. If you haven’t paid enough Medicare taxes, you may have to pay a monthly premium.

The premium for Part B is determined based on income. In 2021, the standard monthly premium is $148.50. However, higher-income individuals may pay more, up to $504.90 per month.

Medicare Premiums for Medicare Advantage (Part C)

Medicare Advantage plans are offered by private insurance companies that contract with Medicare to provide benefits. These plans include all the benefits of Original Medicare, as well as additional benefits such as vision, hearing, and dental coverage.

The premiums for Medicare Advantage plans can vary widely, depending on the plan and the insurance company. Some plans may have no monthly premium, while others may have premiums that are higher than the premiums for Original Medicare.

Medicare Premiums for Medicare Prescription Drug Coverage (Part D)

Medicare prescription drug coverage is offered through private insurance companies that contract with Medicare. These plans help cover the cost of prescription drugs.

The premiums for Part D plans can vary widely, depending on the plan and the insurance company. The average premium for a basic Part D plan in 2021 is $33.06 per month.

Benefits of Medicare

Medicare provides a wide range of benefits to eligible individuals, including:

- Hospital coverage (Part A)

- Doctor visits and other outpatient services (Part B)

- Prescription drug coverage (Part D)

- Additional benefits such as vision, hearing, and dental coverage (Medicare Advantage)

Medicare vs. Private Insurance

Private insurance plans may offer more flexibility and additional benefits, but they are often more expensive than Medicare. Medicare is a cost-effective way for eligible individuals to access comprehensive healthcare coverage.

Conclusion

Medicare premiums are determined based on income, enrollment period, and plan type. Original Medicare, Medicare Advantage, and Medicare prescription drug coverage all have different premiums and benefits. Medicare provides a wide range of benefits to eligible individuals, and is a cost-effective way to access comprehensive healthcare coverage.

Frequently Asked Questions

Medicare premium is determined by several factors, including the type of coverage you choose, your income, and the year in which you enroll. The most common type of Medicare coverage is Part A, which is provided free of charge to most Americans. Part B, which covers outpatient and preventive services, has a monthly premium that is based on your income.

The income used to determine your monthly premium is based on your tax return from two years ago. If you had a significant drop in income since then, you can request that your premium be adjusted. Additionally, if you enroll in Part B late, you may have to pay a penalty that increases your monthly premium.

2. What are the different types of Medicare coverage?

There are four main types of Medicare coverage: Part A, Part B, Part C, and Part D. Part A covers hospital stays and some skilled nursing care. Part B covers outpatient and preventive services. Part C, also known as Medicare Advantage, is a combination of Part A and Part B coverage provided by private insurance companies. Part D covers prescription drugs.

The type of coverage you choose will affect your monthly premium, copayments, and deductibles. It is important to choose the coverage that best meets your healthcare needs and budget.

3. Can I change my Medicare coverage?

Yes, you can change your Medicare coverage during the annual open enrollment period, which runs from October 15 to December 7 each year. During this time, you can switch from Original Medicare to a Medicare Advantage plan, switch from one Medicare Advantage plan to another, or change your prescription drug coverage.

Outside of the open enrollment period, you can make changes to your coverage if you experience a qualifying life event, such as a move to a new state or the loss of employer-sponsored health insurance.

4. How do I enroll in Medicare?

You can enroll in Medicare online, by phone, or in person at your local Social Security office. If you are already receiving Social Security benefits, you will automatically be enrolled in Medicare Parts A and B when you turn 65.

If you are not receiving Social Security benefits, you will need to enroll in Medicare during your initial enrollment period, which starts three months before your 65th birthday and ends three months after your birthday.

5. What if I have other health insurance?

If you have other health insurance, such as through your employer or a spouse’s employer, you may be able to delay enrolling in Medicare without penalty. However, it is important to talk to your insurance provider to determine if you should enroll in Medicare now or wait until your other coverage ends.

If you do enroll in Medicare while you have other coverage, Medicare will be the primary payer for your healthcare expenses, and your other coverage will be secondary. This means that Medicare will pay first, and your other coverage will pay second.

Giving You the Knowledge about Medicare Premium Payments

In conclusion, understanding how Medicare premium is determined is essential for every senior citizen. The cost of Medicare premium varies based on several factors such as income, age, and health status. It is important to note that Medicare premiums are not set in stone and can change from year to year.

To ensure that you are not overpaying for your Medicare coverage, it is crucial to review your plan each year during the open enrollment period. This will help you to choose the best plan that suits your health needs and budget.

In summary, being proactive and informed about Medicare premiums can save you hundreds or even thousands of dollars in healthcare costs. So, take the time to understand your options and make the right choice for your health and financial well-being.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts