Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare Advantage is a popular health insurance program in the United States that offers additional benefits beyond traditional Medicare coverage. However, recent reports have shown that some insurers have been taking advantage of the program, leading to increased costs for taxpayers and reduced benefits for beneficiaries.

In this article, we will explore how insurers have exploited the Medicare Advantage program, the impact it has had on both taxpayers and beneficiaries, and the actions being taken to address this issue. Whether you are a Medicare beneficiary, a taxpayer, or simply interested in healthcare policy, understanding the complexities of Medicare Advantage and the ways in which it has been manipulated is crucial for making informed decisions about the future of healthcare in America.

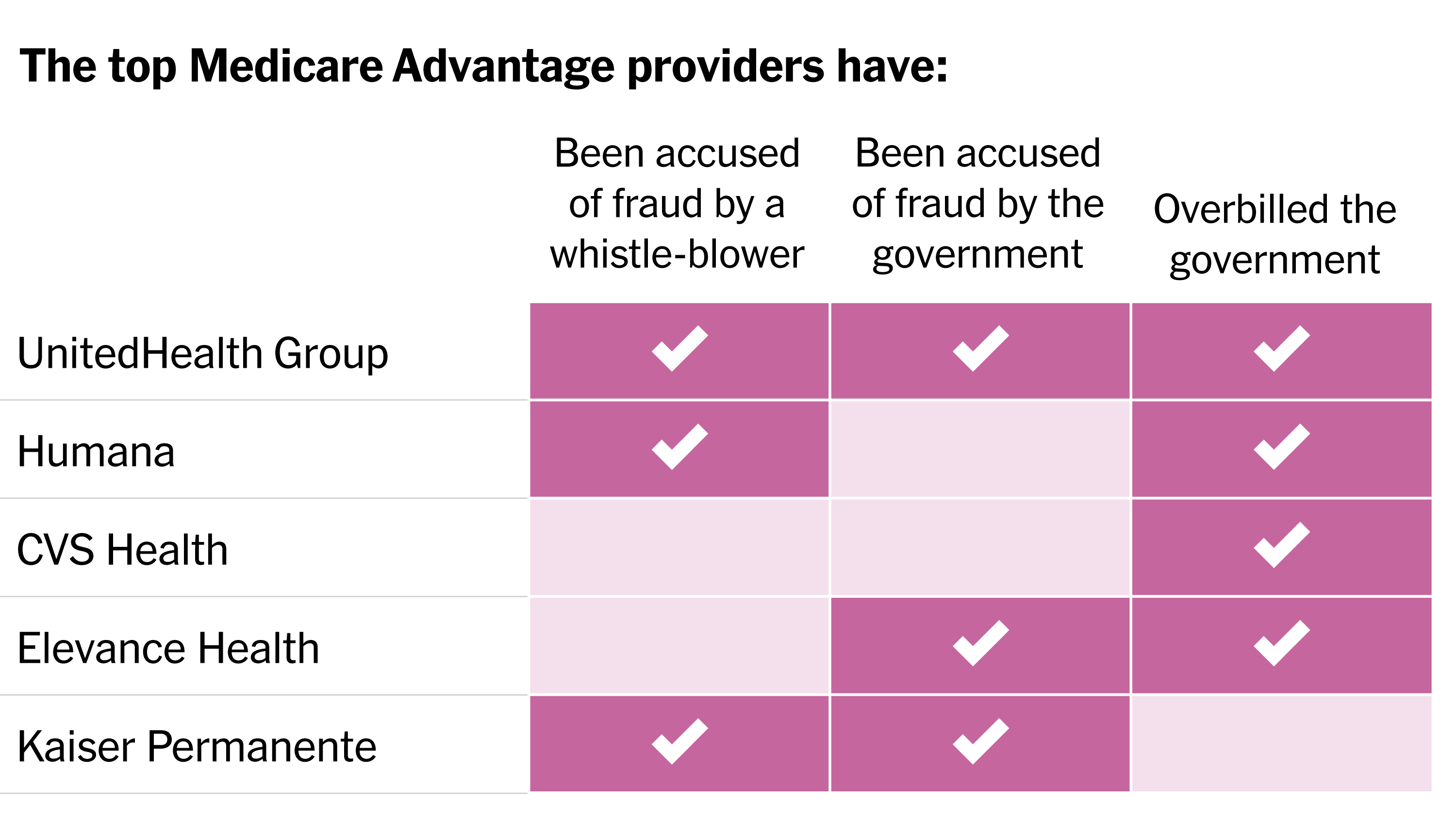

Insurers exploited Medicare Advantage by overcharging the government for treating patients and denying them necessary medical services. The insurers were caught by the Department of Justice and were forced to pay millions of dollars in settlements. This exploitation caused harm to the patients and the taxpayers who fund Medicare Advantage. It is important to hold insurers accountable for their actions and ensure that Medicare Advantage is used for the benefit of patients and not for the profits of insurers.

Contents

- How Insurers Exploited Medicare Advantage?

- Frequently Asked Questions

- What is Medicare Advantage?

- How have insurers exploited Medicare Advantage?

- What is the impact of these practices on Medicare Advantage beneficiaries?

- What steps have been taken to address these practices?

- What can Medicare Advantage beneficiaries do to protect themselves?

- The Dark Side of Medicare Advantage Plans! How Al is Used to Deny Your Care 😲

How Insurers Exploited Medicare Advantage?

Medicare Advantage is a type of health insurance plan offered by private insurance companies to people who are eligible for Medicare. These plans are designed to provide additional benefits that are not covered by Medicare. However, some insurance companies have been exploiting the Medicare Advantage program to make more profits. In this article, we will discuss how insurers have been exploiting Medicare Advantage.

1. Overcharging the Government

One of the ways that insurers have been exploiting Medicare Advantage is by overcharging the government for services that are not provided. The insurers have been submitting inflated bills to the government to get more money. This has resulted in the government paying more money for Medicare Advantage plans than it should.

Insurers have been overcharging the government by submitting bills for services that were not provided or were not medically necessary. For example, some insurers have been submitting bills for services that were not actually performed by doctors or other healthcare providers.

To prevent overcharging, the government has implemented strict regulations for Medicare Advantage plans. Insurers must provide accurate information about the services provided and the costs involved.

2. Cherry-Picking Healthy Patients

Another way that insurers have been exploiting Medicare Advantage is by cherry-picking healthy patients. Insurers are more likely to enroll healthy patients because they are less likely to need expensive medical treatments. This allows insurers to make more profits by paying out fewer claims.

To cherry-pick healthy patients, insurers use marketing tactics to target healthy individuals. They offer attractive benefits and low premiums to attract healthy patients. This practice has resulted in Medicare Advantage plans having healthier enrollees than traditional Medicare.

The government has implemented rules to prevent cherry-picking. Insurers are required to accept all patients who are eligible for Medicare Advantage. They cannot deny coverage based on pre-existing conditions or health history.

3. Misrepresenting Benefits

Insurers have also been exploiting Medicare Advantage by misrepresenting benefits. They have been misrepresenting benefits to make them appear more attractive than they actually are. This has resulted in enrollees signing up for plans that do not provide the benefits they were promised.

To misrepresent benefits, insurers use deceptive marketing practices. They use fine print and confusing language to make benefits appear more attractive than they actually are. This practice has resulted in enrollees paying more for Medicare Advantage plans than they should.

To prevent misrepresentation, the government has implemented rules for Medicare Advantage marketing. Insurers must provide clear and accurate information about the benefits provided by their plans.

4. Limiting Access to Care

Insurers have also been exploiting Medicare Advantage by limiting access to care. They have been limiting access to care to reduce costs and increase profits. This has resulted in enrollees being denied necessary medical treatments.

To limit access to care, insurers use tactics such as requiring prior authorization for medical treatments. This can delay or prevent enrollees from receiving necessary medical treatments. This practice has resulted in enrollees paying more for healthcare than they should.

To prevent limiting access to care, the government has implemented rules for Medicare Advantage plans. Insurers must provide access to necessary medical treatments without delay or denial.

5. Lack of Transparency

Insurers have also been exploiting Medicare Advantage by lack of transparency. They have been hiding information about their plans to prevent enrollees from understanding the costs and benefits involved. This has resulted in enrollees paying more for healthcare than they should.

To prevent lack of transparency, the government has implemented rules for Medicare Advantage plans. Insurers must provide clear and accurate information about the costs and benefits involved in their plans.

6. Overuse of Risk Adjustment

Insurers have also been exploiting Medicare Advantage by overusing risk adjustment. Risk adjustment is a tool used to adjust payments to insurers based on the health status of enrollees. Insurers have been using risk adjustment to increase payments from the government.

To overuse risk adjustment, insurers have been diagnosing enrollees with more health conditions than they actually have. This results in higher payments from the government. This practice has resulted in the government paying more money for Medicare Advantage plans than it should.

To prevent overuse of risk adjustment, the government has implemented rules for Medicare Advantage plans. Insurers must provide accurate information about the health status of their enrollees.

7. Inadequate Networks

Insurers have also been exploiting Medicare Advantage by having inadequate networks. Inadequate networks can limit access to healthcare providers and result in enrollees paying more for healthcare than they should.

To have inadequate networks, insurers limit the number of healthcare providers available to enrollees. This can result in enrollees not having access to necessary medical treatments. This practice has resulted in enrollees paying more for healthcare than they should.

To prevent inadequate networks, the government has implemented rules for Medicare Advantage plans. Insurers must provide adequate networks of healthcare providers to enrollees.

8. Lack of Coordination of Care

Insurers have also been exploiting Medicare Advantage by lack of coordination of care. Lack of coordination of care can result in enrollees receiving unnecessary medical treatments and paying more for healthcare than they should.

To lack coordination of care, insurers do not communicate with healthcare providers to ensure that enrollees are receiving necessary medical treatments. This can result in enrollees receiving duplicate tests or unnecessary medical treatments. This practice has resulted in enrollees paying more for healthcare than they should.

To prevent lack of coordination of care, the government has implemented rules for Medicare Advantage plans. Insurers must coordinate care with healthcare providers to ensure that enrollees are receiving necessary medical treatments.

9. Lack of Accountability

Insurers have also been exploiting Medicare Advantage by lack of accountability. Lack of accountability can result in enrollees receiving poor quality care and paying more for healthcare than they should.

To lack accountability, insurers do not hold themselves accountable for the quality of care provided to enrollees. This can result in enrollees receiving poor quality care. This practice has resulted in enrollees paying more for healthcare than they should.

To prevent lack of accountability, the government has implemented rules for Medicare Advantage plans. Insurers must hold themselves accountable for the quality of care provided to enrollees.

10. Inadequate Oversight

Insurers have also been exploiting Medicare Advantage by inadequate oversight. Inadequate oversight can result in insurers not following rules and guidelines set by the government, resulting in enrollees paying more for healthcare than they should.

To have inadequate oversight, the government does not monitor insurers to ensure that they are following rules and guidelines set by the government. This can result in insurers not following rules and guidelines set by the government. This practice has resulted in enrollees paying more for healthcare than they should.

To prevent inadequate oversight, the government has implemented rules for Medicare Advantage plans. The government monitors insurers to ensure that they are following rules and guidelines set by the government.

Frequently Asked Questions

What is Medicare Advantage?

Medicare Advantage is a type of health insurance plan offered by private insurance companies that provide Medicare benefits to its members. These plans typically offer additional benefits such as vision, dental, and prescription drug coverage that are not covered by Original Medicare. Medicare Advantage plans have become increasingly popular in recent years, with over 22 million beneficiaries enrolled in 2020.

However, the profitability of these plans has led to some insurers exploiting loopholes in the system to increase their profits at the expense of taxpayers and beneficiaries.

How have insurers exploited Medicare Advantage?

Insurers have exploited Medicare Advantage in a number of ways, including:

- Upcoding: submitting claims for more expensive medical services than were actually performed

- Cherry-picking: enrolling healthier beneficiaries and avoiding those with chronic illnesses or disabilities

- Overbilling: charging for services not actually provided or inflating the cost of services provided

These practices have resulted in billions of dollars in overpayments to insurers at the expense of taxpayers and beneficiaries.

What is the impact of these practices on Medicare Advantage beneficiaries?

These practices have a significant impact on Medicare Advantage beneficiaries, as they result in higher costs and reduced access to care. When insurers overcharge the government, it reduces the funds available to provide services to beneficiaries. Additionally, when insurers avoid enrolling beneficiaries with chronic illnesses or disabilities, it limits the pool of beneficiaries and increases costs for those who need more extensive medical care.

Furthermore, these practices undermine the integrity of the Medicare program and erode public trust in the government’s ability to manage it effectively.

What steps have been taken to address these practices?

The Centers for Medicare and Medicaid Services (CMS) has taken steps to address these practices by increasing oversight of Medicare Advantage plans and imposing penalties for noncompliance. CMS has also implemented risk adjustment, which adjusts payment to plans based on the health status of their beneficiaries, to discourage cherry-picking.

Additionally, the Department of Justice has pursued legal action against insurers for fraudulent practices, resulting in billions of dollars in settlements.

What can Medicare Advantage beneficiaries do to protect themselves?

Medicare Advantage beneficiaries can protect themselves by being informed consumers and carefully reviewing their plan’s benefits and costs. Beneficiaries should also report any suspicious activity to CMS or the Office of Inspector General. It is also important for beneficiaries to stay up-to-date on changes to their plan’s network of providers and coverage.

By being vigilant and informed, beneficiaries can help ensure that they receive the care they need and that the Medicare program remains sustainable for future generations.

The Dark Side of Medicare Advantage Plans! How Al is Used to Deny Your Care 😲

In conclusion, the exploitation of Medicare Advantage by insurers is a complex issue that has far-reaching consequences for millions of Americans. While some insurers have engaged in unethical and illegal practices to maximize their profits, others have worked to provide high-quality care to their beneficiaries. It is crucial that policymakers and regulators take steps to address these issues and ensure that Medicare Advantage remains a viable and affordable option for seniors.

One potential solution is to increase oversight and enforcement of existing regulations, such as the Medicare Marketing Guidelines, which are designed to prevent misleading or deceptive marketing practices. Additionally, policymakers could consider implementing new regulations or incentives to encourage insurers to provide high-quality care and invest in preventive services.

Ultimately, the goal should be to create a healthcare system that puts patients first and ensures that all Americans have access to affordable, high-quality care. By working together to address the challenges facing Medicare Advantage, we can help ensure that this vital program continues to serve seniors for years to come.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts