Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare Part A is a health insurance program administered by the federal government to help cover the costs of hospitalization, skilled nursing, hospice care, and home health care. However, there are instances when people with Medicare Part A may need additional coverage, which can be provided through private insurance. In this article, we will discuss how Medicare Part A works with private insurance, and how it can benefit seniors who need more comprehensive coverage than what is offered by Medicare alone.

For those enrolled in Medicare Part A, understanding how private insurance works can be daunting. However, with the right information, you can make informed decisions about your healthcare coverage to ensure that you have access to the services you need. So, let’s dive into the details of how Medicare Part A works with private insurance and explore the various options available to you.

Contents

- Understanding How Medicare Part A Works With Private Insurance

- Frequently Asked Questions

- What is Medicare Part A?

- Can I have both Medicare Part A and private insurance?

- How does Medicare Part A work with private insurance?

- Do I need private insurance if I have Medicare Part A?

- What should I consider when choosing private insurance to supplement Medicare Part A?

- Medicare & Employer Health Insurance

Understanding How Medicare Part A Works With Private Insurance

What is Medicare Part A?

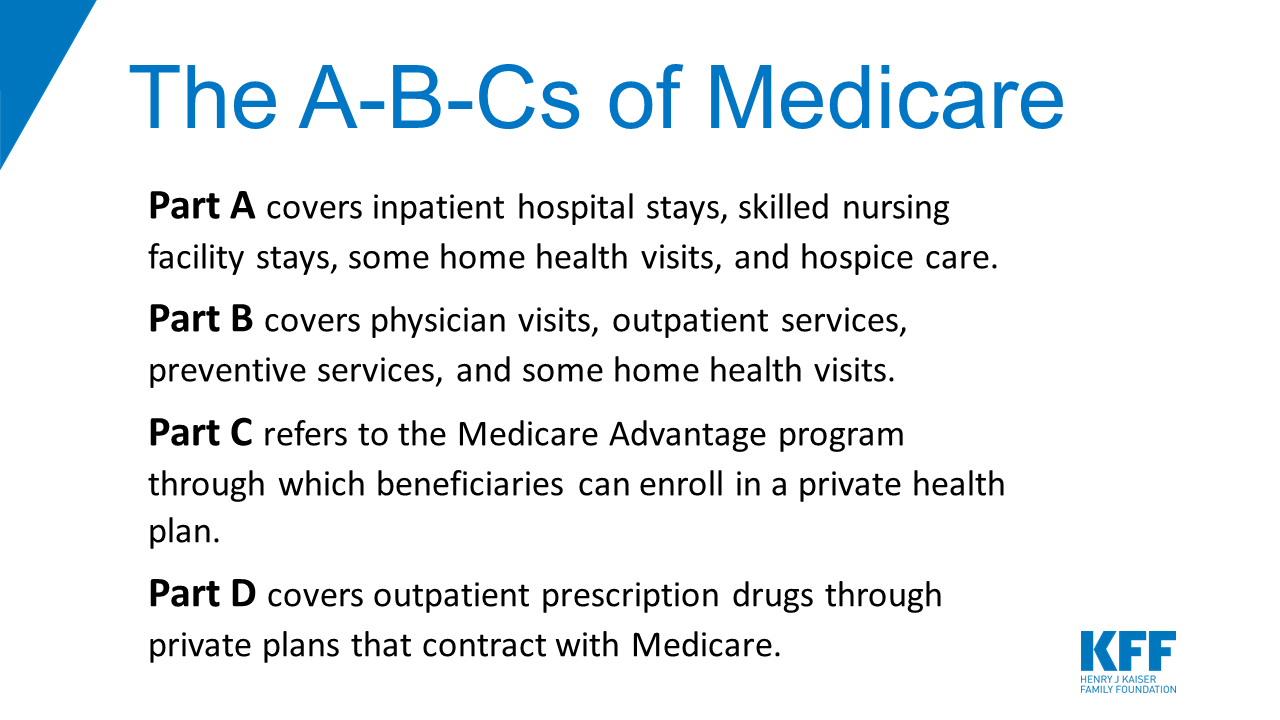

Medicare Part A is a federal program that provides coverage for hospitalizations, skilled nursing facilities, hospice care, and some home health care services. It’s available to individuals who are 65 years of age or older, people with certain disabilities, and those with end-stage renal disease.

What Does Medicare Part A Cover?

Medicare Part A covers the following services:

- Inpatient hospital care

- Skilled nursing facility care

- Hospice care

- Home health care services

What is Private Insurance?

Private insurance is health insurance that is provided by private companies. It can be purchased by individuals or provided by employers as part of a benefits package. Private insurance can help cover the costs of medical care and services that are not covered by Medicare.

How Does Medicare Part A Work with Private Insurance?

Medicare Part A is the primary payer for hospitalizations and skilled nursing facility care. Private insurance can be used to help cover the costs of medical care and services that are not covered by Medicare.

Benefits of Having Private Insurance with Medicare Part A

Having private insurance with Medicare Part A can provide additional benefits, such as:

- Lower out-of-pocket costs

- Additional coverage for medical services and supplies

- Access to a wider network of healthcare providers

- Prescription drug coverage

Private Insurance Vs Medicare Advantage

Medicare Advantage plans are another option for individuals who are eligible for Medicare. These plans are offered by private insurance companies and provide coverage for all of the services covered by Medicare Parts A and B, as well as additional benefits like vision, dental, and hearing.

However, it’s important to note that if you have a Medicare Advantage plan, you cannot use private insurance to help cover the costs of medical care and services.

How to Enroll in Private Insurance with Medicare Part A

To enroll in private insurance with Medicare Part A, you can either purchase a plan directly from a private insurance company or through the Medicare Advantage program.

Things to Consider When Choosing Private Insurance with Medicare Part A

When choosing private insurance with Medicare Part A, it’s important to consider the following factors:

- Coverage and benefits

- Costs and premiums

- Network of healthcare providers

- Prescription drug coverage

- Customer service and support

Conclusion

In conclusion, having private insurance with Medicare Part A can provide additional benefits and help cover the costs of medical care and services that are not covered by Medicare. It’s important to carefully consider your options and choose a plan that meets your healthcare needs and budget.

Frequently Asked Questions

What is Medicare Part A?

Medicare Part A is a component of the federal health insurance program for individuals over the age of 65 or those with certain disabilities. It covers inpatient hospital stays, skilled nursing facility care, hospice care, and limited home health care services. Medicare Part A is funded through payroll taxes paid by individuals and their employers during their working years.

Can I have both Medicare Part A and private insurance?

Yes, you can have both Medicare Part A and private insurance. Private insurance can supplement Medicare Part A by covering services that are not covered by Medicare, such as prescription drugs, vision, and dental care. You can also use private insurance to pay for your share of the costs that Medicare Part A does not cover.

How does Medicare Part A work with private insurance?

Medicare Part A is considered the primary insurance for hospital and inpatient services, and private insurance is considered secondary. When you receive care that is covered by both Medicare Part A and your private insurance, Medicare will pay its share first, and your private insurance will pay its share second. If you have a Medicare Advantage plan, your private insurance will be provided by the plan, and it will work with Medicare to pay for your covered services.

Do I need private insurance if I have Medicare Part A?

While Medicare Part A covers many healthcare services, it does not cover everything. Private insurance can help cover the costs of services that are not covered by Medicare, such as prescription drugs and dental care. Additionally, private insurance can help pay for your share of the costs that Medicare Part A does not cover. Whether you need private insurance depends on your individual healthcare needs and financial situation.

What should I consider when choosing private insurance to supplement Medicare Part A?

When choosing private insurance to supplement Medicare Part A, you should consider the cost of the insurance, what services it covers that are not covered by Medicare, and whether your healthcare providers accept the insurance. You should also consider whether the insurance has any limitations, such as a maximum benefit amount or restrictions on when and where you can receive care. It is important to choose insurance that meets your individual healthcare needs and fits within your budget.

Medicare & Employer Health Insurance

In conclusion, Medicare Part A is a valuable benefit for many Americans who need healthcare coverage. However, it’s important to understand that it does not cover all medical expenses. Private insurance can be used to supplement Medicare coverage and provide additional benefits. This can include coverage for prescription drugs, vision, dental, and hearing services, among other things.

It’s important to note that private insurance plans can vary widely in terms of coverage and cost. It’s important to carefully evaluate your options and choose a plan that meets your specific needs and budget. In some cases, it may be necessary to work with a licensed insurance agent or broker to help you navigate the complex world of insurance.

Ultimately, the key to getting the most out of your healthcare coverage is to stay informed and proactive. This means staying up-to-date on changes to Medicare and private insurance plans, understanding your benefits and limitations, and taking steps to stay healthy and prevent illness whenever possible. With the right combination of Medicare and private insurance coverage, you can enjoy peace of mind knowing that you are protected against the high cost of medical care.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts