Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare insurance is a government program that provides healthcare coverage to millions of Americans. With the rising cost of healthcare, it’s important to understand how Medicare works and what benefits it provides. In this article, we will explain the basics of Medicare insurance and help you navigate the complexities of the program. Whether you are approaching retirement age or simply want to learn more about healthcare coverage, this article will provide you with the information you need to understand how Medicare works.

Medicare insurance is divided into several parts, each covering different aspects of healthcare. From hospital stays to prescription drugs, Medicare insurance provides a range of benefits to eligible individuals. In this article, we will outline the different parts of Medicare and explain how they work together to provide comprehensive healthcare coverage. Whether you are new to Medicare or have been a recipient for years, understanding the nuances of the program can be challenging. Read on to learn more about the ins and outs of Medicare insurance.

Medicare is a federal health insurance program that covers individuals who are 65 years or older, as well as those with certain disabilities or chronic conditions. Medicare consists of four parts: Part A, B, C, and D. Part A covers hospital stays, Part B covers doctor visits and outpatient services, Part C offers Medicare Advantage plans, and Part D covers prescription drugs. Individuals pay into Medicare through payroll taxes and are eligible to enroll during specific enrollment periods.

Contents

- Understanding Medicare Insurance

- What is Medicare Insurance?

- Who is Eligible for Medicare Insurance?

- What are the Benefits of Medicare Insurance?

- Medicare vs. Private Health Insurance

- How Does Medicare Pay for Healthcare Services?

- What are the Costs of Medicare Insurance?

- How to Enroll in Medicare Insurance?

- How to Choose the Right Medicare Plan?

- Conclusion

- Frequently Asked Questions

Understanding Medicare Insurance

Medicare insurance is a government healthcare program that provides health coverage for those who are 65 years or older, as well as for those who have certain disabilities or health conditions. This program is designed to help individuals cover the costs of medical treatment, hospital stays, and prescription drugs.

What is Medicare Insurance?

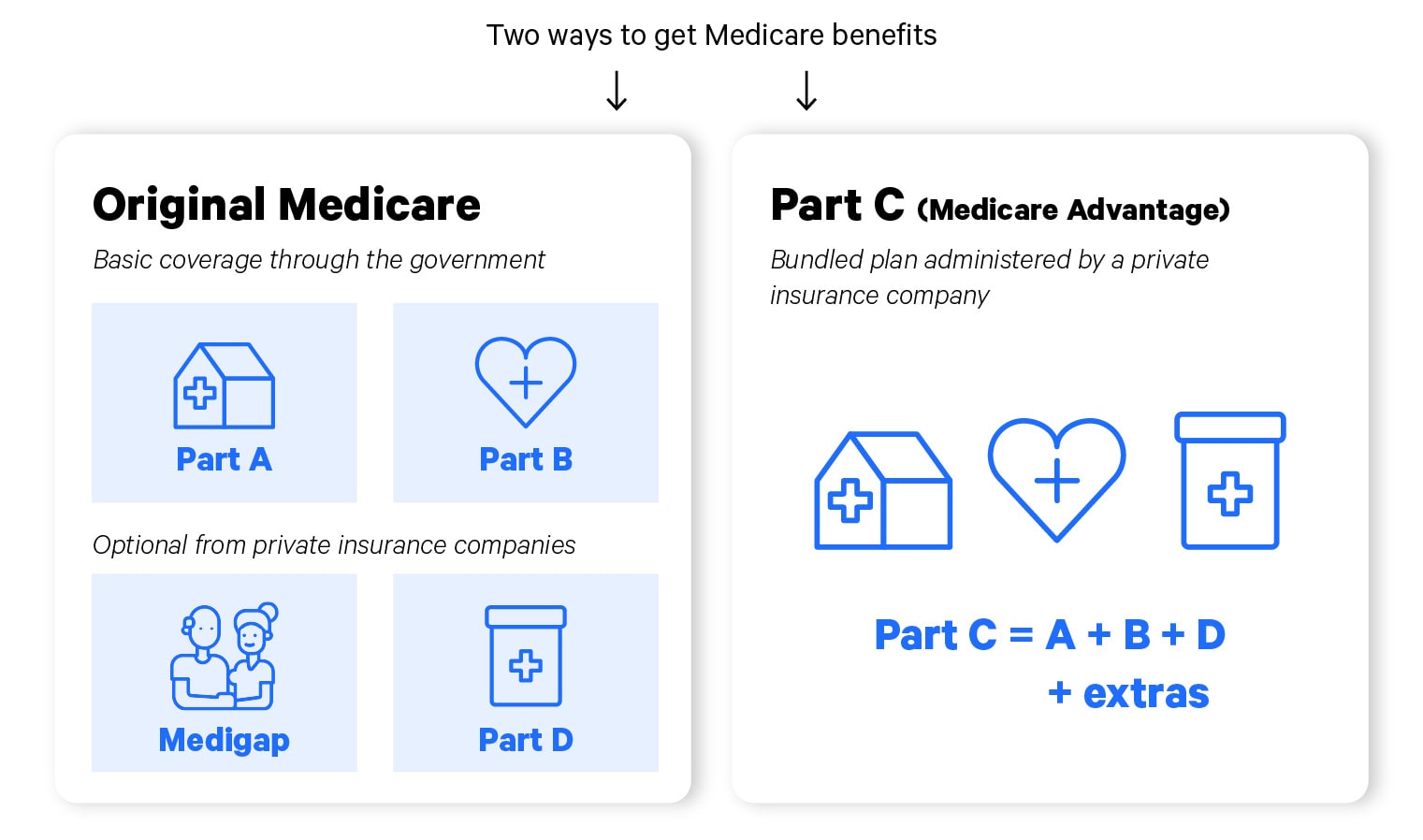

Medicare is a federally funded health insurance program that provides coverage for individuals who meet certain eligibility requirements. This program is divided into four different parts: Part A, Part B, Part C, and Part D.

Part A provides coverage for hospital stays, skilled nursing facility care, home health care, and hospice care. Part B covers doctor visits, outpatient services, and medical equipment. Part C is also known as Medicare Advantage and provides coverage through private insurance companies. Part D covers prescription drugs.

Who is Eligible for Medicare Insurance?

To be eligible for Medicare, you must be 65 years or older, a U.S. citizen or a legal permanent resident for at least five continuous years, and have worked and paid into the Medicare system for at least 10 years. Individuals who have certain disabilities or health conditions may also be eligible for Medicare.

What are the Benefits of Medicare Insurance?

One of the biggest benefits of Medicare is that it helps to cover the costs of medical treatment, which can be extremely expensive. Additionally, Medicare provides individuals with the peace of mind of knowing that they have access to healthcare when they need it.

Another benefit of Medicare is that it provides coverage for preventive care services, such as annual wellness visits, mammograms, and colonoscopies. This can help individuals catch health issues early, before they become more serious and more expensive to treat.

Medicare vs. Private Health Insurance

While Medicare provides valuable coverage for individuals who are eligible, it is important to understand that it may not cover all of your healthcare needs. Private health insurance plans may offer more comprehensive coverage, but they can also be more expensive.

One of the biggest differences between Medicare and private health insurance is that Medicare is a government-funded program, whereas private health insurance is provided by private insurance companies. Additionally, Medicare has certain eligibility requirements that must be met, whereas private health insurance plans may be available to anyone who is willing to pay the premiums.

How Does Medicare Pay for Healthcare Services?

Medicare pays for healthcare services in a few different ways. For Part A services, such as hospital stays, Medicare pays a fixed amount per day for a certain number of days. For Part B services, such as doctor visits and medical equipment, Medicare pays a percentage of the cost of the service.

For Part C services, such as Medicare Advantage plans, the private insurance company is paid a fixed amount per enrollee by Medicare. For Part D services, such as prescription drugs, Medicare pays a percentage of the cost of the drug.

What are the Costs of Medicare Insurance?

While Medicare provides valuable coverage for individuals who are eligible, it is important to understand that it does come with certain costs. For example, Part A services may require a deductible and coinsurance, and Part B services require a monthly premium and may also require a deductible and coinsurance.

Additionally, Medicare Advantage plans and Part D plans may have premiums, deductibles, and copayments. It is important to carefully review the costs of each plan before choosing one.

How to Enroll in Medicare Insurance?

To enroll in Medicare, you must first be eligible for the program. If you are automatically enrolled in Medicare, you will receive a card in the mail three months before your 65th birthday. If you are not automatically enrolled, you can enroll during the initial enrollment period, which is three months before your 65th birthday, your birthday month, and three months after your birthday month.

How to Choose the Right Medicare Plan?

Choosing the right Medicare plan can be a daunting task, but there are a few things that can help make the process easier. First, consider your healthcare needs and the costs associated with each plan.

Additionally, consider the network of doctors and hospitals associated with each plan, as well as the prescription drug coverage. You may also want to consider any additional benefits, such as dental or vision coverage.

Conclusion

Medicare is a valuable program that provides healthcare coverage for millions of Americans. While it may not cover all of your healthcare needs, it can help to ease the financial burden of medical treatment. By understanding the different parts of Medicare and the costs associated with each plan, you can make an informed decision about which plan is right for you.

Frequently Asked Questions

What is Medicare Insurance?

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, younger people with disabilities, and those with End-Stage Renal Disease (ESRD). The program has four parts, each of which provides different types of coverage:

- Part A: Hospital insurance

- Part B: Medical insurance

- Part C: Medicare Advantage plans

- Part D: Prescription drug coverage

Medicare is funded through payroll taxes, premiums, and general revenue from the federal government. Eligible individuals can enroll in Medicare during certain enrollment periods and may be subject to late enrollment penalties if they do not enroll when first eligible.

How does Medicare Part A work?

Medicare Part A is also known as hospital insurance and covers inpatient hospital stays, skilled nursing facility care, hospice care, and certain home health care services. Most people do not have to pay a premium for Part A if they or their spouse paid Medicare taxes while working. However, there are deductibles and coinsurance costs associated with Part A services.

To use Part A benefits, you must be admitted to a hospital as an inpatient or receive care in a skilled nursing facility that is certified by Medicare. Home health care services must also be provided by a Medicare-certified home health agency to be covered under Part A.

How does Medicare Part B work?

Medicare Part B is also known as medical insurance and covers doctor visits, outpatient services, preventive services, and some medical equipment and supplies. Most people pay a monthly premium for Part B, which is based on their income. There is also a deductible and coinsurance costs associated with Part B services.

To use Part B benefits, you must receive care from a healthcare provider who accepts Medicare. You can see any provider who accepts Medicare, but you may pay more if they do not accept assignment, which means they agree to accept Medicare’s approved amount as full payment for services.

What are Medicare Advantage plans?

Medicare Advantage plans are offered by private insurance companies and provide all the benefits of Original Medicare (Parts A and B) plus additional benefits, such as prescription drug coverage, vision, dental, and hearing services. These plans may also have different rules for how you receive services, such as requiring referrals to see specialists.

Most Medicare Advantage plans require you to use providers within their network, but emergency care is covered anywhere. You may also have to pay a monthly premium for Medicare Advantage plans in addition to your Part B premium.

How does Medicare Part D work?

Medicare Part D is prescription drug coverage offered by private insurance companies. You must have Part A or Part B to enroll in Part D, and there is a monthly premium for the coverage. Part D plans have formularies that list the drugs they cover and may require you to pay a deductible, copayment, or coinsurance for prescriptions.

Part D plans can vary in their coverage and costs, so it’s important to compare plans based on your specific medication needs. You can change your Part D plan during the annual enrollment period, which runs from October 15 to December 7 each year.

What is Medicare? | How Does Medicare Work | Medicare Explained

In conclusion, Medicare insurance is a vital program that provides healthcare coverage to millions of Americans who are 65 years and older, as well as those with certain disabilities and chronic conditions. Understanding how Medicare works can be complicated, but it’s essential to make informed decisions about your healthcare coverage.

One of the most important things to remember is that Medicare has different parts, and each part covers different services. Part A covers hospitalization and some skilled nursing care, while Part B covers doctor visits and outpatient services. Part C, also known as Medicare Advantage, is an alternative to Original Medicare and typically includes additional benefits such as dental and vision care. Finally, Part D covers prescription drugs.

It’s crucial to enroll in Medicare during your initial enrollment period to avoid any late enrollment penalties. Additionally, you may want to consider supplemental insurance plans, also known as Medigap policies, to help cover out-of-pocket costs. By taking the time to understand Medicare and your coverage options, you can ensure that you receive the healthcare you need when you need it.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts