Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you eligible for Medicare benefits and wondering how to file a claim? Filing a claim with Medicare can seem confusing at first, but it doesn’t have to be. In this article, we’ll explore the step-by-step process of filing a claim with Medicare, so you can get the benefits you’re entitled to without any unnecessary stress or confusion.

Whether you’re filing a claim for medical services, prescription drugs, or durable medical equipment, understanding the process is key to ensuring your claim is processed quickly and accurately. So, let’s dive in and explore the details of how to file a claim with Medicare.

How To File A Claim With Medicare?

If you are a Medicare beneficiary, you may need to file a claim for reimbursement of your healthcare services. Filing for a claim can be a confusing process, but it is essential to ensure that you receive the proper reimbursement for your healthcare expenses. Here is a step-by-step guide on how to file a claim with Medicare.

Step 1: Collect Your Information

Before filing a claim, you must have all the necessary information. This includes your Medicare card, the date of service, and the name and address of the healthcare provider who provided the service. You should also have a detailed receipt or bill that shows the services you received and the amount you paid.

It is essential to keep a record of all your healthcare services and expenses. This will help you to keep track of your healthcare costs and ensure that you receive the proper reimbursement.

Step 2: Submit Your Claim

Once you have collected all the necessary information, you can submit your claim. You can submit your claim online, by mail, or in person at your local Social Security office.

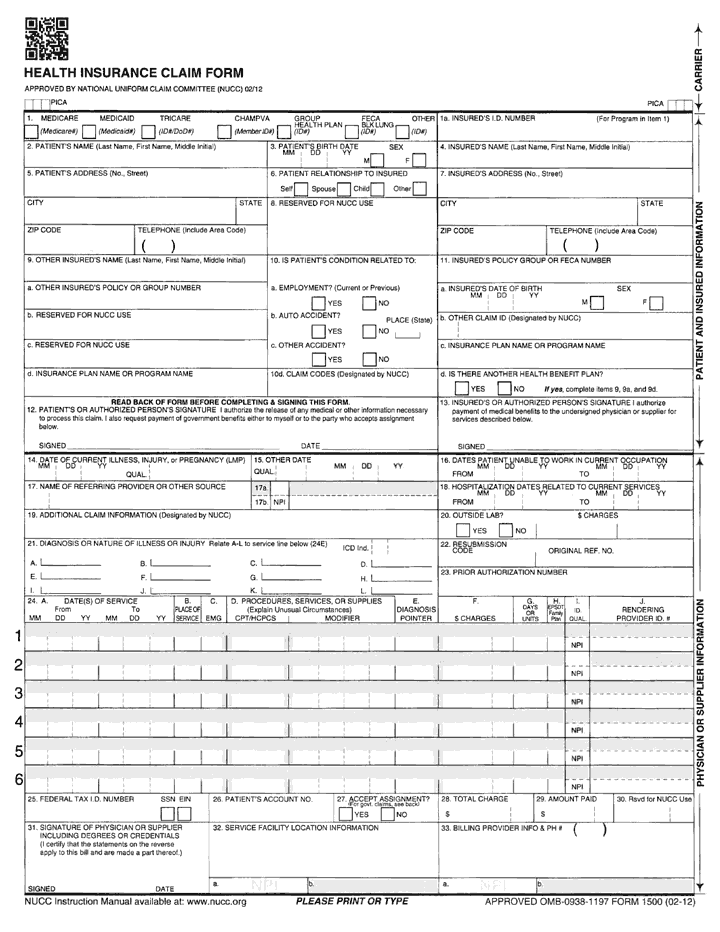

If you choose to submit your claim online, you can use the Medicare website to file your claim. If you prefer to submit your claim by mail, you can download the appropriate form from the Medicare website and mail it to the address on the form.

Step 3: Wait for Your Claim to Be Processed

After submitting your claim, you will need to wait for it to be processed. The processing time can vary, but it typically takes around 30 days. Once your claim has been processed, you will receive an explanation of benefits (EOB) that will detail the services that were covered and the amount that Medicare paid.

If there are any discrepancies in your EOB, you should contact Medicare immediately to address the issue.

Step 4: Appeal if Necessary

If your claim is denied, or if you receive a lower reimbursement than expected, you have the right to appeal. You can appeal the decision by filing a request for redetermination with Medicare.

To file an appeal, you will need to provide additional information that supports your claim. You can also request a hearing with an administrative law judge if your redetermination is denied.

Benefits of Filing a Claim with Medicare

Filing a claim with Medicare can provide many benefits, including:

– Reimbursement for your healthcare expenses

– Keeping track of your healthcare costs

– Ensuring that you receive the proper reimbursement

– The ability to appeal if necessary

Conclusion

Filing a claim with Medicare can be a complicated process, but it is essential to ensure that you receive the proper reimbursement for your healthcare expenses. By following these steps, you can file your claim with ease and receive the reimbursement that you deserve. Remember to keep a record of all your healthcare services and expenses, and don’t hesitate to appeal if necessary.

Contents

Frequently Asked Questions

Medicare is a federal health insurance program that provides coverage for people who are over 65 years old or have certain disabilities. If you are a Medicare beneficiary and need to file a claim, there are specific steps you need to follow. Here are some frequently asked questions about how to file a claim with Medicare.

1. How do I file a claim with Medicare?

There are two ways to file a claim with Medicare. The first is to file a claim yourself. You can do this online by logging into your Medicare account or by filling out a paper claim form and mailing it to Medicare. The second way is to have your healthcare provider file the claim for you. If your provider is a participating provider, they will submit the claim directly to Medicare on your behalf.

It is important to note that you must file your claim within one calendar year of the date of service. If you fail to file your claim within this timeframe, Medicare may deny your claim.

2. What information do I need to file a claim with Medicare?

When filing a claim with Medicare, you will need to provide certain information. This includes your name, Medicare number, the date of service, the name of the healthcare provider or facility, the services or items provided, and the amount charged for each service or item. If you are filing the claim yourself, you will also need to provide your mailing address and signature.

If your healthcare provider is filing the claim on your behalf, they will need to provide all of the same information, as well as their own information, such as their National Provider Identifier (NPI) number.

3. How long does it take to process a Medicare claim?

The amount of time it takes to process a Medicare claim can vary. In general, Medicare will process a claim within 30 days of receiving it. However, if additional information is needed or if the claim is more complex, it may take longer to process. If your claim is denied, you will receive an explanation of why it was denied and instructions on how to file an appeal.

If you are filing your claim yourself, you can check the status of your claim online using your Medicare account. If your healthcare provider is filing the claim on your behalf, they should be able to provide you with updates on the status of your claim.

4. Can I file a claim with Medicare if I have other insurance?

If you have other insurance, such as a private insurance plan or Medicaid, you may still be able to file a claim with Medicare. However, Medicare is considered the secondary payer in these situations, which means that your other insurance will be billed first. Medicare will then pay its portion of the bill, up to the amount allowed by Medicare.

It is important to note that if you have other insurance, you will need to provide information about your other insurance when filing your Medicare claim. This will ensure that your claims are processed correctly and that you are not responsible for paying more than your share of the bill.

5. What should I do if my Medicare claim is denied?

If your Medicare claim is denied, you have the right to appeal the decision. To do this, you will need to follow the instructions provided in the denial notice. There are several levels of appeal, each with its own requirements and deadlines.

If you are unsure about how to file an appeal or need assistance with the appeals process, you can contact your State Health Insurance Assistance Program (SHIP) for help. SHIPs provide free, unbiased Medicare counseling and can help you understand your rights and options.

Can I File a Medicare Claim?

In conclusion, filing a claim with Medicare may seem daunting at first, but it is a straightforward process that can be done online, by phone, or by mail. It is important to have all necessary information and documents ready before submitting the claim to ensure a smoother process.

Remember to keep track of any communications and follow up with Medicare if needed. It is also beneficial to understand your coverage and benefits to avoid any unexpected charges or denials.

Overall, filing a claim with Medicare is an important step in accessing healthcare services and benefits. By being prepared and informed, you can navigate the process with ease and peace of mind.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts