Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As you approach retirement, healthcare is one of the most significant expenses you’ll face. Medicare Part B is the standard insurance plan that covers outpatient visits, but did you know that some providers can charge more than what Part B covers? These extra fees are called “excess charges” and can quickly add up if you’re not careful. In this article, we’ll explore just how common these charges are and what you can do to protect yourself from unexpected healthcare expenses.

Medicare Part B excess charges occur when healthcare providers charge more than the Medicare-approved amount. Excess charges are not very common. In 2015, only 5% of Medicare beneficiaries had excess charges. However, it’s important to note that not all healthcare providers accept Medicare. If you see a provider who doesn’t accept Medicare, you may be subject to excess charges.

How Common Are Medicare Part B Excess Charges?

If you are a Medicare beneficiary, you may have heard of Medicare Part B excess charges. These are the charges that some doctors and healthcare providers may bill you for services that exceed the Medicare-approved amount. Although not all healthcare providers are allowed to charge for excess amounts, it is important to understand how common these charges are and how they affect your healthcare costs.

What are Medicare Part B Excess Charges?

Medicare Part B is the part of Medicare that covers medical services such as doctor visits, outpatient care, and preventive services. Medicare sets the approved amount that healthcare providers can charge for these services. If a healthcare provider accepts Medicare, they agree to accept the approved amount as full payment.

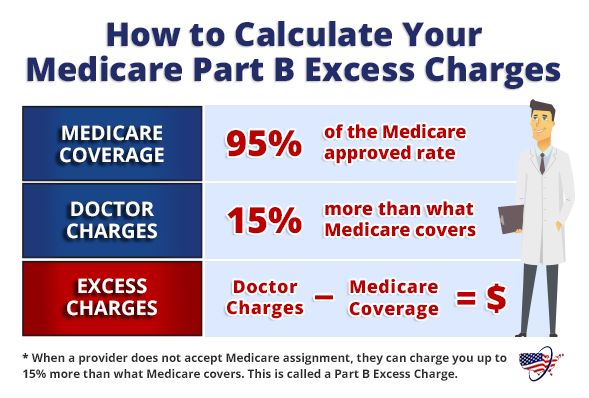

However, some healthcare providers are not enrolled in Medicare and are not bound by these limits. These providers can charge up to 15% more than the Medicare-approved amount, which is called a Medicare Part B excess charge.

How Common are Medicare Part B Excess Charges?

While not all healthcare providers charge excess amounts, it is important to know that these charges are relatively common. According to a study by the Kaiser Family Foundation, in 2019, about 7% of Medicare beneficiaries were charged excess amounts.

It is also worth noting that certain healthcare providers are more likely to charge excess amounts than others. For example, specialists such as surgeons and anesthesiologists are more likely to charge excess amounts than primary care physicians.

How Do Medicare Part B Excess Charges Affect Your Healthcare Costs?

Medicare Part B excess charges can significantly increase your healthcare costs. For example, if your healthcare provider charges an excess amount for a $100 service, you would have to pay the Medicare-approved amount of $80 plus the excess charge of $15, for a total of $95. This means that you would be responsible for paying $15 out-of-pocket.

It is important to note that Medigap policies can help cover Medicare Part B excess charges. If you have a Medigap policy, your policy will cover the excess charges up to the full amount of the Medicare-approved amount.

The Benefits of Knowing About Medicare Part B Excess Charges

Knowing about Medicare Part B excess charges can help you make informed decisions about your healthcare. By understanding which healthcare providers are more likely to charge excess amounts, you can make sure to choose providers who accept Medicare and do not charge excess amounts.

Additionally, if you do get charged an excess amount, you can take steps to appeal the charge or negotiate with your healthcare provider to reduce the amount.

Medicare Part B Excess Charges vs. Balance Billing

It is important to differentiate between Medicare Part B excess charges and balance billing. Balance billing is when a healthcare provider bills a patient for the difference between the Medicare-approved amount and the provider’s actual charge. This is only allowed in certain situations, such as when a patient receives emergency care from an out-of-network provider.

Medicare Part B excess charges, on the other hand, are charges that exceed the Medicare-approved amount and are only allowed for healthcare providers who do not accept Medicare.

In Conclusion

Although Medicare Part B excess charges are relatively common, there are ways to avoid them and minimize their impact on your healthcare costs. By choosing healthcare providers who accept Medicare and do not charge excess amounts, you can ensure that you are not responsible for paying out-of-pocket for excess charges.

If you do get charged an excess amount, you can take steps to appeal the charge or negotiate with your healthcare provider to reduce the amount. Additionally, if you have a Medigap policy, your policy will cover Medicare Part B excess charges up to the full amount of the Medicare-approved amount.

Contents

- Frequently Asked Questions

- What are Medicare Part B excess charges?

- How common are Medicare Part B excess charges?

- Do all healthcare providers accept Medicare assignment?

- Can beneficiaries be balance billed for Medicare Part B excess charges?

- How can beneficiaries avoid Medicare Part B excess charges?

- Medicare Part B Excess Charges – Should You Worry?

Frequently Asked Questions

Medicare Part B excess charges are a common concern among beneficiaries when seeking medical services. Below are some frequently asked questions and answers about this topic.

What are Medicare Part B excess charges?

Medicare Part B excess charges are the additional fees charged by healthcare providers who do not accept Medicare assignment. Providers who participate in Medicare agree to accept the approved amount as full payment for services rendered. However, providers who do not accept assignment can charge up to 15% more than the Medicare-approved amount.

Beneficiaries who receive medical services from non-participating providers may be responsible for paying these excess charges out of pocket.

How common are Medicare Part B excess charges?

According to the Kaiser Family Foundation, about 7% of Medicare beneficiaries were charged excess fees in 2016. The frequency of excess charges varies by state and provider. In some areas, it may be more common for providers to not accept Medicare assignment, which increases the likelihood of excess charges.

Beneficiaries can avoid excess charges by seeking medical services from participating providers or by purchasing a Medicare Supplement plan that covers these charges.

Do all healthcare providers accept Medicare assignment?

Not all healthcare providers accept Medicare assignment. Providers who do not accept assignment can charge up to 15% more than the Medicare-approved amount for services rendered. Beneficiaries who receive medical services from these providers may be responsible for paying these excess charges out of pocket.

Beneficiaries can check with their healthcare providers to see if they accept Medicare assignment and participate in the Medicare program.

Can beneficiaries be balance billed for Medicare Part B excess charges?

Yes, beneficiaries who receive medical services from non-participating providers may be balance billed for Medicare Part B excess charges. The healthcare provider can bill the beneficiary for the additional amount, and the beneficiary is responsible for paying this amount out of pocket.

However, some states have laws that limit or prohibit balance billing for Medicare beneficiaries. Beneficiaries should check with their state’s department of insurance to see if these laws apply in their state.

How can beneficiaries avoid Medicare Part B excess charges?

Beneficiaries can avoid Medicare Part B excess charges by seeking medical services from participating providers who accept Medicare assignment. Participating providers agree to accept the Medicare-approved amount as full payment for services rendered, which eliminates the need for beneficiaries to pay excess charges out of pocket.

Beneficiaries can also purchase a Medicare Supplement plan that covers excess charges. These plans can help reduce or eliminate the out-of-pocket costs associated with excess charges.

Medicare Part B Excess Charges – Should You Worry?

In conclusion, Medicare Part B excess charges are not as common as some may think, but they can still have a significant impact on seniors’ healthcare costs. It’s important for beneficiaries to understand the potential for excess charges and to be proactive in choosing healthcare providers who accept Medicare assignment.

By doing so, beneficiaries can avoid the risk of excess charges and ensure that they receive the highest quality care available. Additionally, beneficiaries should always review their Medicare Summary Notices carefully to ensure that they are not being charged for any excess charges that they did not actually receive.

Ultimately, while excess charges may not be a major concern for all Medicare beneficiaries, it’s still important to be aware of the potential risks and to take steps to protect oneself. By staying informed and educated about Medicare Part B, seniors can make the most of their benefits and enjoy the peace of mind that comes with knowing that their healthcare needs are being met.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts