Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare taxes can be a confusing topic for many individuals, especially for those who are new to the workforce. However, understanding how these taxes are calculated is essential for anyone who wants to make informed decisions about their finances. In this article, we will break down the basics of Medicare taxes and provide you with the information you need to better understand how these taxes are calculated.

From the percentage of your income that is subject to Medicare taxes to the role of your employer in calculating and withholding these taxes, we will cover everything you need to know. So, whether you’re a new employee or a seasoned professional, read on to learn more about how Medicare taxes are calculated and how they impact your paycheck.

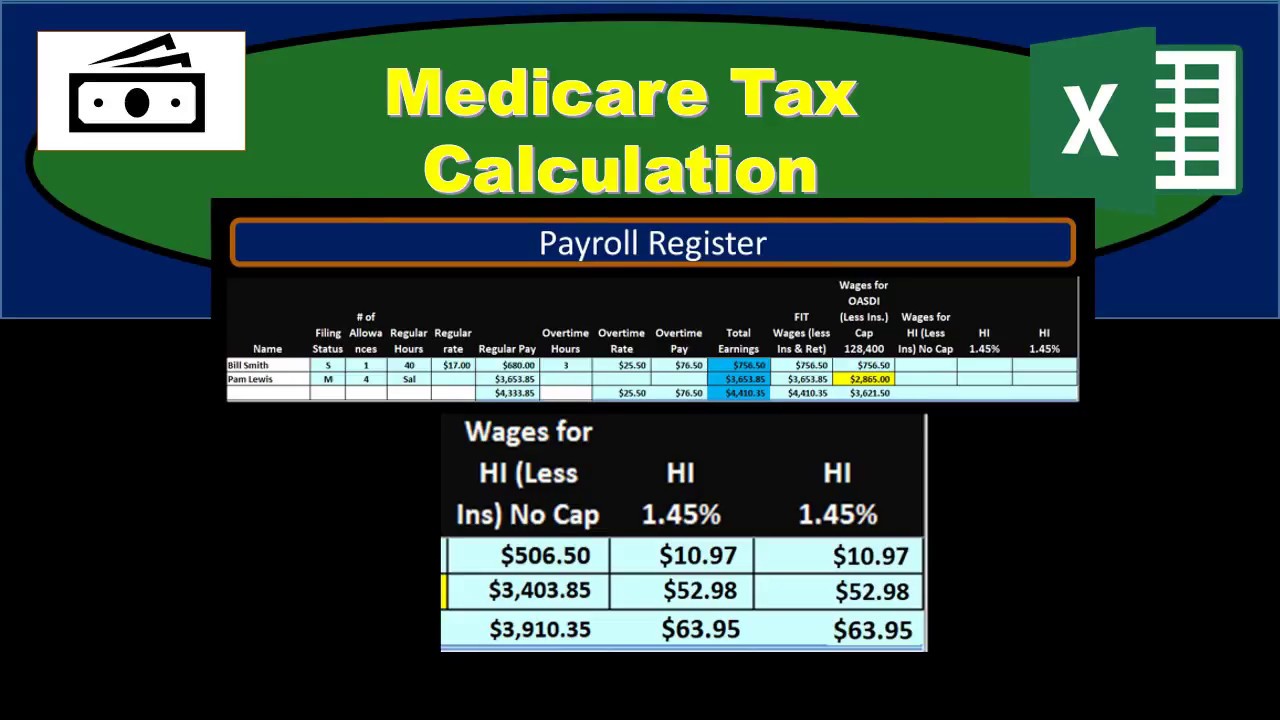

Medicare taxes are calculated based on a fixed percentage of your income. The current rate for Medicare tax is 1.45% of your wages, and your employer is required to match this amount. However, if you’re self-employed, you’re responsible for paying both the employee and employer portions of the Medicare tax, which comes to a total of 2.9% of your net earnings. Additionally, if you earn over a certain amount, you may be subject to an additional Medicare tax of 0.9%.

How Are Medicare Taxes Calculated?

Medicare is a federal health insurance program that provides coverage to over 60 million Americans. It is funded by taxes that are deducted from employees’ paychecks, as well as contributions from employers and the government. In this article, we will discuss how Medicare taxes are calculated and what factors can affect the amount you pay.

What is Medicare Tax?

Medicare tax is a payroll tax that is used to fund the Medicare program. It is made up of two parts: the Medicare Hospital Insurance (HI) tax, and the Medicare Supplementary Medical Insurance (SMI) tax. The HI tax is also known as the Medicare tax, while the SMI tax is also known as the Medicare Part B tax.

The Medicare tax is a percentage of your income, and the rate varies depending on your earnings. For employees, the Medicare tax rate is 1.45% of your gross wages. Employers also contribute to the Medicare tax, and they are required to match the employee’s contribution, making the total tax rate 2.9%.

What Are the Wage Limits for Medicare Tax?

There is no income limit for the Medicare tax, which means that you will be subject to the tax regardless of how much you earn. However, there is a wage limit for the Social Security tax, which is also deducted from your paycheck. In 2021, the wage limit for Social Security tax is $142,800. Once you earn above this amount, you will no longer be subject to the Social Security tax, but you will still be subject to the Medicare tax.

What is the Additional Medicare Tax?

The Additional Medicare Tax is an extra tax that is imposed on high-income earners. It was introduced as part of the Affordable Care Act (ACA) in 2013 and is designed to help fund the Medicare program. The Additional Medicare Tax is a 0.9% tax on wages above a certain threshold.

For employees, the threshold is $200,000 for single filers and $250,000 for married couples filing jointly. For self-employed individuals, the threshold is based on their net earnings from self-employment. If you earn above these thresholds, you will be subject to the Additional Medicare Tax.

How Are Medicare Taxes Calculated for Self-Employed Individuals?

Self-employed individuals are responsible for paying both the employer and employee portions of the Medicare tax. This means that they are required to pay the full 2.9% tax rate themselves. In addition, they may also be subject to the Additional Medicare Tax if their net earnings from self-employment exceed the threshold.

However, self-employed individuals are allowed to deduct half of their Medicare tax as a business expense when calculating their income tax. This deduction helps to offset the cost of the tax.

What Are the Benefits of Paying Medicare Taxes?

Medicare provides essential health insurance coverage to millions of Americans, including seniors, people with disabilities, and those with chronic health conditions. By paying Medicare taxes, you are helping to fund this critical program and ensure that it remains sustainable for future generations.

In addition to providing health insurance coverage, Medicare also helps to keep healthcare costs down by negotiating with healthcare providers to lower the cost of medical services and treatments.

Medicare Taxes Vs. Social Security Taxes

Medicare taxes and Social Security taxes are both payroll taxes that are deducted from your paycheck. However, they are used to fund different programs. Medicare taxes are used to fund the Medicare program, while Social Security taxes are used to fund the Social Security program.

The tax rates for Medicare and Social Security are different, with the Social Security tax rate being higher at 6.2% for employees and employers each. Additionally, there is a wage limit for the Social Security tax, while there is no income limit for the Medicare tax.

Conclusion

Medicare taxes are an essential source of funding for the Medicare program, which provides health insurance coverage to millions of Americans. The tax rate for Medicare is 1.45% for employees and 2.9% for employers and the self-employed. There is no income limit for the Medicare tax, but there is a wage limit for the Social Security tax. Additionally, high-income earners may be subject to the Additional Medicare Tax. By paying Medicare taxes, you are helping to ensure that this critical program remains sustainable for future generations.

Contents

Frequently Asked Questions

1. How Are Medicare Taxes Calculated?

Medicare taxes are calculated based on the employee’s wages or salary. The tax rate for Medicare is currently 1.45% for both the employer and the employee, which means that the total tax rate is 2.9%. If you are self-employed, you will have to pay both the employer and employee portion of the tax, which means that the total tax rate is 2.9% on all of your self-employment income.

It’s important to note that there is no cap on the amount of wages subject to Medicare tax. This means that all of your wages or self-employment income is subject to the tax, regardless of how much you earn. However, if you earn above a certain amount, you may also be subject to an additional Medicare tax.

2. What is the Additional Medicare Tax?

The Additional Medicare Tax is a tax that is imposed on high-income earners. The tax rate for the Additional Medicare Tax is 0.9% and it applies to wages, compensation, and self-employment income that exceed certain thresholds. For individuals, the threshold is $200,000 and for married couples filing jointly, the threshold is $250,000.

If you earn above the threshold, your employer will withhold the Additional Medicare Tax from your wages or salary. If you are self-employed, you will have to pay the tax as part of your self-employment taxes. It’s important to note that the Additional Medicare Tax applies only to the employee portion of the Medicare tax.

3. Who Pays Medicare Taxes?

Medicare taxes are paid by both the employer and the employee. The current tax rate for Medicare is 1.45% for both the employer and the employee, which means that the total tax rate is 2.9%. If you are self-employed, you will have to pay both the employer and employee portion of the tax, which means that the total tax rate is 2.9% on all of your self-employment income.

It’s important to note that there is no cap on the amount of wages subject to Medicare tax. This means that all of your wages or self-employment income is subject to the tax, regardless of how much you earn.

4. What is the Medicare Wage Base?

The Medicare Wage Base is the maximum amount of wages or self-employment income that is subject to the Medicare tax. The Medicare Wage Base is adjusted annually to account for inflation. For 2021, the Medicare Wage Base is $142,800.

This means that if you earn more than $142,800 in wages or self-employment income, you will only pay Medicare taxes on the first $142,800. Any income above that amount is not subject to the Medicare tax.

5. What Happens if I Overpay Medicare Taxes?

If you overpay Medicare taxes, you can claim a refund when you file your tax return. To claim the refund, you will need to fill out Form 1040 and indicate the amount of the overpayment on line 17. The overpayment will then be applied to any taxes that you owe for the current year or it will be refunded to you if you do not owe any taxes.

It’s important to note that if you are self-employed and you overpay Medicare taxes, you can claim the overpayment as a credit on your tax return. The credit can be applied to your self-employment taxes for the current year or it can be refunded to you if you do not owe any taxes.

Medicare Tax Calculation – How to Calculate Medicare Payroll Taxes

In conclusion, understanding how Medicare taxes are calculated is crucial for anyone who receives a paycheck. The process is straightforward, and employers are responsible for withholding the necessary amount from each paycheck. Knowing how much you’ll need to contribute can help you plan your finances and budget accordingly.

It’s important to note that Medicare taxes are just one part of your overall tax obligation. There may be additional taxes you’re responsible for, depending on your income and other factors. Be sure to consult with a tax professional if you have questions or concerns about your tax situation.

Ultimately, paying Medicare taxes is an important part of being a responsible citizen and contributing to the greater good. By investing in the health care system, we help ensure that everyone has access to the care they need, regardless of their financial situation. So the next time you see Medicare taxes on your paycheck, remember that you’re making a valuable contribution to society.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts