Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare is a federal health insurance program that provides coverage for millions of Americans who are 65 years of age and older. While Medicare is a great benefit, many people wonder how premiums are calculated. In this article, we will explore the factors that determine Medicare premiums and help you understand how much you can expect to pay for your coverage.

Understanding how Medicare premiums are calculated can be complicated. However, it is essential to know how the process works so that you can make informed decisions about your healthcare. Whether you are new to Medicare or have been enrolled for years, this article will provide valuable insights into how your premiums are determined and what you can do to manage your costs.

Medicare premiums are calculated based on several factors, including income, age, and enrollment dates. The standard premium for Medicare Part B is $148.50 per month in 2021, but higher-income earners may pay more through income-related monthly adjustment amounts (IRMAA). Medicare Advantage and Prescription Drug plans also have varying premiums, deductibles, and out-of-pocket costs. It’s important to review your options and costs annually during the Medicare Annual Enrollment Period (AEP).

How Are Medicare Premiums Calculated?

Medicare is a federal health insurance program that provides medical coverage to people who are 65 years or older, younger people with disabilities, and those with End-Stage Renal Disease (ESRD). Medicare premiums are the monthly fees paid by enrollees to participate in the program. But how are these premiums calculated? In this article, we will explore the factors that determine Medicare premiums.

Part A Premiums

Part A of Medicare covers inpatient hospital care, skilled nursing care, hospice care, and home health care. Most people are eligible for Part A premium-free. If you or your spouse paid Medicare taxes while working for at least 10 years, you will not have to pay any premium for Part A.

However, if you don’t have sufficient work history, you may have to pay a premium for Part A. The premium for 2021 is up to $471 per month. The amount you pay for Part A premium depends on the number of quarters you or your spouse paid Medicare taxes while working.

Part B Premiums

Part B of Medicare covers medical services such as doctor visits, outpatient care, preventive services, and medical equipment. Unlike Part A, everyone who enrolls in Part B has to pay a monthly premium.

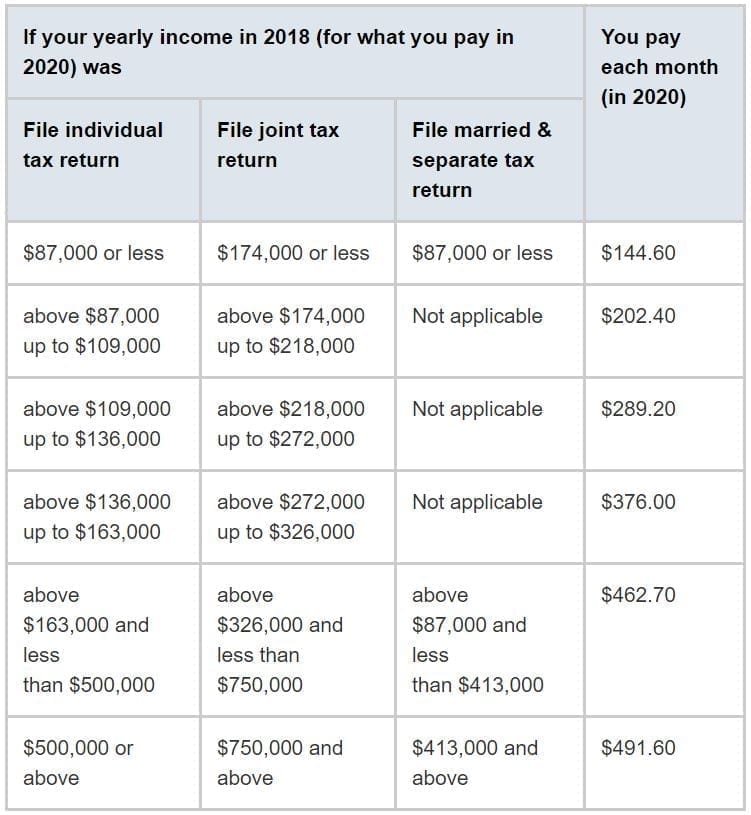

The standard Part B premium for 2021 is $148.50 per month. However, if you have a higher income, you may have to pay a higher premium. The amount you pay for Part B premium is based on your Modified Adjusted Gross Income (MAGI) from two years ago.

Part C Premiums

Part C of Medicare, also known as Medicare Advantage, is an alternative way to receive Medicare benefits. These plans are offered by private insurance companies that contract with Medicare.

The premium for Part C varies depending on the plan you choose. Some plans may have a $0 premium, while others may charge a monthly premium in addition to the Part B premium. The cost of Part C premium also depends on the benefits provided by the plan and the network of healthcare providers.

Part D Premiums

Part D of Medicare covers prescription drugs. Like Part C, Part D is offered by private insurance companies that contract with Medicare.

The premium for Part D also varies depending on the plan you choose. The average Part D premium for 2021 is about $33 per month. However, the actual cost of Part D premium depends on the plan you choose, the drugs you take, and the pharmacy you use.

Other Factors That Affect Medicare Premiums

Apart from the type of Medicare plan you choose, there are other factors that can affect your Medicare premiums. For example:

- Late enrollment penalties: If you don’t enroll in Medicare when you’re first eligible, you may have to pay a penalty that increases your premiums.

- Income-related monthly adjustment amount (IRMAA): If you have a higher income, you may have to pay an additional amount on top of your Medicare premiums.

- State buy-in programs: Some states offer programs that pay for some or all of the Medicare premiums for eligible individuals.

Benefits of Medicare

Despite the premiums, Medicare provides many benefits to those who enroll. Some of the benefits include:

- Access to preventive services such as mammograms, flu shots, and screenings for cancer and cardiovascular disease.

- Coverage for medically necessary services such as hospital stays, doctor visits, and diagnostic tests.

- Coverage for prescription drugs, which can help manage chronic conditions and reduce healthcare costs.

- Flexibility to choose the healthcare providers and services that best meet your needs.

Medicare vs. Other Health Insurance

When choosing health insurance, it’s important to consider the benefits and costs of each option. Compared to other types of health insurance, Medicare has some unique features:

| Medicare | Private Health Insurance |

|---|---|

| Available to people 65 years or older, younger people with disabilities, and those with ESRD | Available to anyone who meets eligibility requirements |

| Standardized benefits and costs across the country | Benefits and costs vary by plan and location |

| No annual or lifetime limits on coverage | May have annual or lifetime limits on coverage |

| Covers pre-existing conditions | May not cover pre-existing conditions |

In conclusion, Medicare premiums are calculated based on several factors, including the type of plan you choose and your income level. Despite the premiums, Medicare provides many benefits to those who enroll, including access to preventive services and coverage for medically necessary services and prescription drugs. When choosing health insurance, it’s important to consider the benefits and costs of each option and choose the one that best meets your needs.

Frequently Asked Questions

What is Medicare?

Medicare is a federal health insurance program for people who are 65 or older, people with certain disabilities, and people with end-stage renal disease. Medicare helps pay for many healthcare services, including hospital stays, doctor visits, and prescription drugs.

Medicare premiums are calculated based on a number of different factors, including your income, the type of coverage you have, and the amount of coverage you need. Most people pay a monthly premium for Medicare Part B, which covers doctor visits and other outpatient services. The amount you pay for this premium depends on your income. If you have Medicare Advantage or Medicare Part D coverage, you may also have to pay an additional premium.

The Medicare Part B premium is the monthly fee that you pay to receive coverage for doctor visits and other outpatient services. The amount of this premium varies depending on your income. If your income is below a certain level, you may be eligible for assistance in paying your premium.

Medicare premiums can change from year to year, and they can change more frequently if there are changes to the law or changes to the program itself. If your premium is going to change, you will receive a notice from Medicare at least 30 days before it takes effect.

If you have a low income, you may be eligible for assistance in paying your Medicare premiums. There are several programs available that can help you cover the cost of your premiums, including the Medicare Savings Program and the Extra Help program for prescription drug coverage. You can contact your local Social Security office or visit the Medicare website for more information on these programs.

Giving You the Knowledge about Medicare Premium Payments

In conclusion, understanding how Medicare premiums are calculated is essential for anyone who is eligible for this government-funded healthcare program. The premiums are determined based on a variety of factors, including income, enrollment period, and type of coverage. By taking the time to learn about the different aspects of Medicare and how premiums are calculated, you can make informed decisions about your healthcare coverage and ensure that you are getting the most out of the program.

It’s important to note that while Medicare premiums can be expensive, there are options available to help lower the cost. For example, individuals with lower incomes may be eligible for financial assistance programs, such as the Medicare Savings Program or Extra Help. Additionally, some Medicare Advantage plans may offer lower premiums, as well as additional benefits, such as prescription drug coverage and vision and dental care.

Overall, understanding how Medicare premiums are calculated can help you make informed decisions about your healthcare coverage and ensure that you are getting the most out of the program. Whether you are just starting to explore your options or have been enrolled in Medicare for years, taking the time to learn about the different factors that impact your premiums can help you save money and get the care you need.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts