Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Tricare for Life and Medicare are two healthcare programs that are popular among retirees and their families. Many beneficiaries wonder if Tricare for Life covers Medicare deductibles, and this topic has been a subject of debate for some time. In this article, we will explore the relationship between Tricare for Life and Medicare deductibles to help you understand what you can expect from these programs.

Tricare for Life is a supplemental insurance program that provides coverage for military retirees who are eligible for Medicare. While the program covers a wide range of medical expenses, there are some limitations to what it will cover. One of the most common questions asked by beneficiaries is whether Tricare for Life covers Medicare deductibles. In the following paragraphs, we will delve deeper into this topic and provide you with the information you need to make informed decisions about your healthcare coverage.

Tricare for Life and Medicare Deductibles: What You Need to Know

Understanding Tricare for Life

Tricare for Life is a health insurance program designed for military retirees and their eligible dependents. It is a secondary insurance plan that works in conjunction with Medicare. In other words, if you are eligible for Tricare for Life, you will have Medicare as your primary insurance and Tricare for Life as your secondary. Tricare for Life provides coverage for medical expenses that are not covered by Medicare, such as copayments, deductibles, and coinsurance.

What is a Medicare Deductible?

A Medicare deductible is the amount you pay for healthcare services before Medicare begins to pay its share. The deductible amount varies depending on the type of Medicare plan you have. For example, the deductible for Medicare Part A, which covers hospital stays and inpatient care, is $1,484 per benefit period in 2021. The deductible for Medicare Part B, which covers doctor visits and outpatient care, is $203 per year in 2021.

Does Tricare for Life Cover Medicare Deductibles?

Yes, Tricare for Life does cover Medicare deductibles. Tricare for Life will pay your Medicare Part A and Part B deductibles, as well as any coinsurance or copayments that you may owe. This means that if you have Tricare for Life, you will not have to pay anything out of pocket for your Medicare deductibles.

What are the Benefits of Having Tricare for Life?

One of the biggest benefits of having Tricare for Life is that it provides comprehensive coverage for healthcare expenses. In addition to covering Medicare deductibles, Tricare for Life also covers services that are not covered by Medicare, such as prescription drugs and certain types of medical equipment. Tricare for Life also has a worldwide network of providers, so you can receive care no matter where you are in the world.

Tricare for Life vs. Other Insurance Plans

Compared to other insurance plans, Tricare for Life offers some unique advantages. For example, Tricare for Life has no network restrictions, which means that you can see any provider who accepts Medicare. Tricare for Life also has low out-of-pocket costs, which makes it an affordable option for retirees on a fixed income.

How to Enroll in Tricare for Life

To enroll in Tricare for Life, you must first be eligible for Medicare. Once you are enrolled in Medicare, you will automatically be enrolled in Tricare for Life if you are a retired service member or the spouse of a retired service member. If you are the dependent of a retired service member, you must enroll in Tricare for Life separately.

Conclusion

Tricare for Life is an excellent insurance option for military retirees and their eligible dependents. It provides comprehensive coverage for healthcare expenses, including Medicare deductibles, and has a worldwide network of providers. If you are eligible for Tricare for Life, it is definitely worth considering as your secondary insurance plan.

Contents

Frequently Asked Questions:

Does Tricare for Life Cover Medicare Deductible?

Tricare for Life (TFL) is a health care program for retired service members and their families. TFL is designed to supplement Medicare coverage and provide additional benefits to eligible individuals. Medicare Part A and B are the primary insurance for TFL beneficiaries. So, the answer to the question is YES, Tricare for Life does cover Medicare deductible.

Medicare Part A and B have different deductibles which are subject to change every year. TFL covers the Part A and B deductibles, coinsurance, and copayments for eligible beneficiaries. However, TFL does not cover the Medicare Part D prescription drug deductible, which is a separate deductible that beneficiaries must pay out of pocket.

What is the Annual Medicare Part B Deductible?

The annual Medicare Part B deductible is the amount that Medicare beneficiaries must pay out of pocket before their Part B coverage begins. The deductible amount is subject to change every year, and the current deductible amount for 2021 is $203. So, if you have Tricare for Life (TFL), then you do not have to worry about paying this deductible because TFL covers it.

TFL is a secondary payer to Medicare Part B, meaning that it pays after Medicare has paid its share of the bill. TFL covers the remaining costs, including the Part B deductible, coinsurance, and copayments for eligible beneficiaries. This makes TFL a valuable benefit for retired service members and their families who are eligible for both Medicare and TFL.

What is the Medicare Part A Deductible?

The Medicare Part A deductible is the amount that beneficiaries must pay out of pocket before Medicare Part A coverage begins. The deductible amount is subject to change every year, and the current deductible amount for 2021 is $1,484. If you have Tricare for Life (TFL), then you do not have to worry about paying this deductible because TFL covers it.

TFL is a secondary payer to Medicare Part A, meaning that it pays after Medicare has paid its share of the bill. TFL covers the remaining costs, including the Part A deductible, coinsurance, and copayments for eligible beneficiaries. This makes TFL a valuable benefit for retired service members and their families who are eligible for both Medicare and TFL.

What is Tricare for Life (TFL)?

Tricare for Life (TFL) is a health care program for retired service members and their families. TFL is designed to supplement Medicare coverage and provide additional benefits to eligible individuals. TFL is available to beneficiaries who are eligible for Medicare and are entitled to receive Medicare Part A and B benefits.

TFL is a secondary payer to Medicare, meaning that it pays after Medicare has paid its share of the bill. TFL covers the remaining costs, including deductibles, coinsurance, and copayments for eligible beneficiaries. TFL also covers some services that are not covered by Medicare, such as overseas care and emergency care.

What is Medicare Part D Deductible?

The Medicare Part D deductible is the amount that beneficiaries must pay out of pocket before their prescription drug coverage begins. The deductible amount is subject to change every year, and the current deductible amount for 2021 is $445. Tricare for Life (TFL) does not cover the Medicare Part D deductible, which is a separate deductible that beneficiaries must pay out of pocket.

However, TFL does cover prescription drug costs that are not covered by Medicare Part D. TFL has its own prescription drug benefit, which provides coverage for a limited number of prescription drugs. TFL beneficiaries can also use the TRICARE Pharmacy Program to fill their prescriptions at a reduced cost.

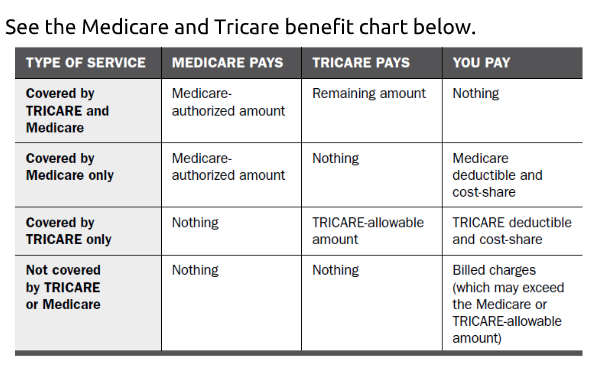

How Medicare Works with TRICARE for Life

In conclusion, Tricare for Life is a comprehensive healthcare coverage plan that offers a range of benefits to military retirees and their families. However, when it comes to Medicare deductibles, Tricare for Life does not cover them. This means that beneficiaries will need to pay the deductible out of their own pocket before Tricare for Life will start covering their healthcare costs.

While this may seem like a downside, it’s important to remember that Tricare for Life still provides a significant amount of coverage to its beneficiaries. With its extensive network of providers and comprehensive benefits, Tricare for Life is an excellent choice for military retirees who want to ensure that they have access to quality healthcare.

In the end, the decision to enroll in Tricare for Life is ultimately up to the individual and their unique healthcare needs. However, if you’re a military retiree looking for a reliable and comprehensive healthcare coverage plan, Tricare for Life is definitely worth considering.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts