Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you wondering if Medicare supplemental insurance covers prescription drugs? With so many insurance options available, it can be tough to know what’s covered and what’s not. Luckily, we’ve got all the information you need to make an informed decision about your healthcare coverage.

Medicare supplemental insurance, also known as Medigap, is designed to help pay for out-of-pocket expenses not covered by traditional Medicare. While it can cover a wide range of costs, prescription drugs may or may not be included in your plan. Keep reading to learn more about how Medicare supplemental insurance works when it comes to prescription coverage.

Yes, Medicare Supplemental Insurance (also known as Medigap) may cover prescription drug costs, depending on the plan you choose. Medigap plans C and F provide coverage for prescription drugs. However, if you are enrolled in Medicare Part D, which is a standalone prescription drug plan, you cannot also enroll in a Medigap plan that covers prescription drugs. It’s important to review your options and choose a plan that best suits your healthcare needs and budget.

Contents

- Does Medicare Supplemental Insurance Cover Prescriptions?

- Frequently Asked Questions

- 1. Does Medicare Supplemental Insurance Cover Prescription Drugs?

- 2. Can I Get Prescription Drug Coverage with My Medicare Supplemental Insurance?

- 3. Are There Any Medicare Supplemental Insurance Plans That Cover Prescription Drugs?

- 4. What Should I Do If I Need Prescription Drug Coverage?

- 5. How Can I Find the Right Medicare Part D Plan?

- Medicare Supplement Plans and Prescription Drug Coverage

Does Medicare Supplemental Insurance Cover Prescriptions?

If you are approaching the age of 65, you are probably familiar with Medicare and its benefits. However, Medicare coverage does not include all medical expenses, such as prescription drugs. This is where Medicare Supplemental Insurance comes in. In this article, we’ll explore whether Medicare Supplemental Insurance covers prescriptions or not.

Understanding Medicare Supplemental Insurance

Medicare Supplemental Insurance, also known as Medigap, is a type of insurance policy that covers the “gaps” in traditional Medicare coverage. These gaps include deductibles, co-payments, and coinsurance. There are ten standard Medigap plans available, and each provides different levels of coverage.

Benefits of Medicare Supplemental Insurance

One of the main benefits of Medicare Supplemental Insurance is that it can provide coverage for prescription drugs. Unlike traditional Medicare, which only covers prescription drugs in limited circumstances, some Medigap plans cover prescription drugs under certain conditions, such as during hospital stays.

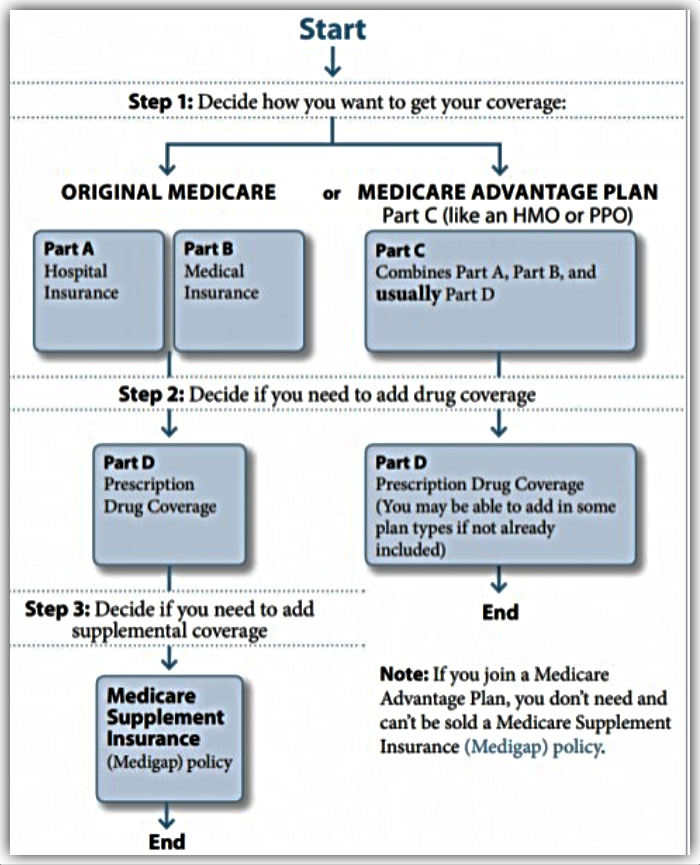

Medicare Supplemental Insurance Vs. Medicare Advantage

It is important to note that Medicare Supplemental Insurance is different from Medicare Advantage plans. Medicare Advantage plans are an alternative to traditional Medicare and offer a comprehensive package that typically includes prescription drug coverage. However, Medicare Advantage plans can have restrictions, such as limited provider networks and prior authorization requirements.

Understanding Prescription Drug Coverage under Medigap Plans

As mentioned earlier, some Medigap plans provide coverage for prescription drugs. However, this coverage is not automatic and must be chosen as an add-on to your plan.

Medigap Plans That Cover Prescription Drugs

Medigap plans that cover prescription drugs are Plans C, D, F, G, M, and N. These plans cover prescription drugs in different ways. For example, Plan D covers prescription drugs through a stand-alone prescription drug plan, while Plans C and F cover prescription drugs through their plans.

Medigap Plans That Do Not Cover Prescription Drugs

Medigap plans that do not cover prescription drugs are Plans A, B, K, L, and high-deductible Plan F. If you have one of these plans and need prescription drug coverage, you can enroll in a stand-alone prescription drug plan (Part D) through Medicare.

Understanding Medicare Part D

Medicare Part D is a prescription drug coverage plan that is available to all Medicare beneficiaries. It is offered by private insurance companies and requires a monthly premium.

Benefits of Medicare Part D

Medicare Part D provides comprehensive coverage for prescription drugs, including brand-name and generic drugs. It also includes a coverage gap, known as the “donut hole,” which is a temporary limit on what the plan will cover for prescription drugs.

Choosing a Medicare Part D Plan

When choosing a Medicare Part D plan, it is important to consider the cost and coverage of the plan. Each plan has a different premium, deductible, and co-payments. You should also consider the formulary, which is a list of drugs that the plan covers.

Conclusion

In conclusion, some Medigap plans provide coverage for prescription drugs, while others do not. If you need prescription drug coverage, it is important to choose a plan that provides this coverage or enroll in a stand-alone prescription drug plan through Medicare. Understanding your options and choosing the right plan can help you save money on your prescription drug costs and ensure that you have the coverage you need.

Frequently Asked Questions

Medicare Supplemental Insurance is an essential part of healthcare for many seniors. It helps to pay for expenses that Medicare does not cover. One question that many people have about Medicare Supplemental Insurance is whether it covers prescription medications. Here are 5 questions and answers about whether Medicare Supplemental Insurance covers prescriptions.

1. Does Medicare Supplemental Insurance Cover Prescription Drugs?

No, Medicare Supplemental Insurance does not cover prescription drugs. Prescription drug coverage is only available through a separate Medicare Part D plan. However, some Medicare Supplemental Insurance plans may offer discounts on prescription medications.

If you need prescription drug coverage, you will need to enroll in a Medicare Part D plan. These plans are offered by private insurance companies and provide coverage for prescription medications. You can enroll in a Medicare Part D plan during the annual enrollment period or when you first become eligible for Medicare.

2. Can I Get Prescription Drug Coverage with My Medicare Supplemental Insurance?

No, you cannot get prescription drug coverage with your Medicare Supplemental Insurance. You will need to enroll in a separate Medicare Part D plan to get coverage for prescription medications.

It is important to remember that if you do not enroll in a Medicare Part D plan when you are first eligible, you may have to pay a penalty when you do enroll. The penalty is added to your monthly premium and can be significant, so it is important to enroll in a Part D plan as soon as you become eligible.

3. Are There Any Medicare Supplemental Insurance Plans That Cover Prescription Drugs?

No, there are no Medicare Supplemental Insurance plans that cover prescription drugs. Prescription drug coverage is only available through a separate Medicare Part D plan.

However, some Medicare Supplemental Insurance plans may offer discounts on prescription medications. It is important to check with your plan to see if they offer any prescription drug discounts.

4. What Should I Do If I Need Prescription Drug Coverage?

If you need prescription drug coverage, you should enroll in a Medicare Part D plan. These plans are offered by private insurance companies and provide coverage for prescription medications.

You can enroll in a Medicare Part D plan during the annual enrollment period or when you first become eligible for Medicare. It is important to remember that if you do not enroll in a Part D plan when you are first eligible, you may have to pay a penalty when you do enroll.

5. How Can I Find the Right Medicare Part D Plan?

To find the right Medicare Part D plan, you should compare plans based on the medications you take and the costs associated with each plan. You can use the Medicare Plan Finder tool on the Medicare website to compare plans in your area.

It is important to remember that the cost of a Medicare Part D plan can vary based on the medications you take and the pharmacy you use. You should review the plan’s formulary and network to make sure that the medications you need are covered and that the pharmacy you use is in the plan’s network.

Medicare Supplement Plans and Prescription Drug Coverage

In conclusion, it’s important to understand that Medicare Supplemental Insurance, also known as Medigap, does not cover prescription drugs. However, beneficiaries can enroll in a standalone Medicare Part D plan to obtain coverage for their prescription medications. It’s important to review the different Part D plans available to ensure that it covers the medications you need at an affordable cost.

Additionally, some Medicare Advantage plans offer prescription drug coverage, so it’s important to compare the benefits and costs of both options. Ultimately, it’s up to each individual to determine the best option for their unique healthcare needs and budget.

In summary, while Medigap plans don’t include prescription drug coverage, beneficiaries have options to obtain coverage through a standalone Part D plan or a Medicare Advantage plan. It’s important to carefully review and compare these options to ensure that you have the coverage you need to manage your healthcare expenses.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts