Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Medicare Part B is a critical source of healthcare coverage for millions of Americans above the age of 65. However, there are still many questions about what is and isn’t covered by the program. One of the most common questions people ask is whether Medicare Part B covers vision services.

The answer to this question isn’t as straightforward as you might think. While Medicare Part B does cover some vision-related services, such as annual eye exams for people with diabetes, it doesn’t cover routine eye exams or the cost of eyeglasses or contact lenses. In this article, we’ll explore what is and isn’t covered by Medicare Part B when it comes to vision, so you can better understand your coverage options.

Medicare Part B typically only covers vision care in certain situations, such as if you have diabetes or are at high risk for glaucoma. Routine eye exams and eyeglasses are generally not covered by Part B. However, some Medicare Advantage plans may offer additional vision benefits. It’s important to review your plan’s coverage and speak with your doctor to determine your specific needs.

Does Medicare Part B Cover Vision?

If you’re a Medicare beneficiary and you’re wondering if your Medicare Part B coverage includes vision services, then you’ve come to the right place. Medicare Part B is a health insurance plan that covers a wide range of medical services, but many people are unsure if vision care is included.

What is Medicare Part B?

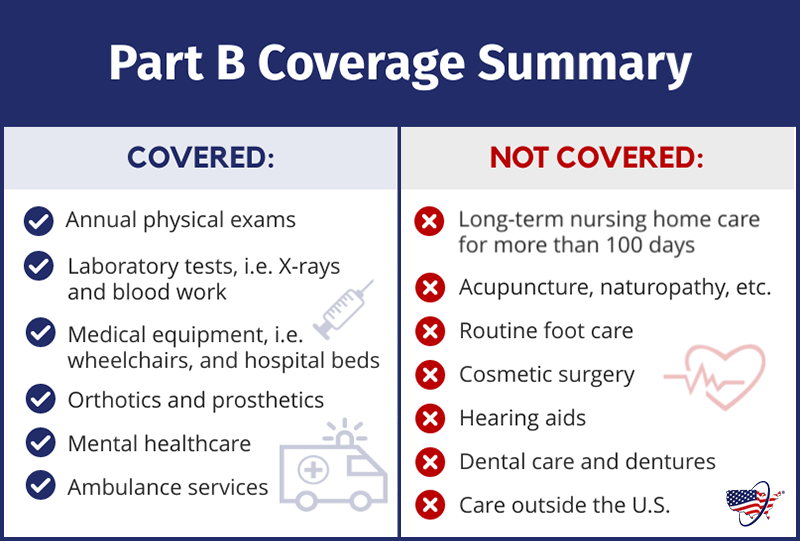

Medicare Part B is one of the two main parts of Original Medicare. It’s a health insurance plan that covers medically necessary services and supplies, such as doctor visits, outpatient care, preventive services, and medical equipment. Medicare Part B is available to anyone who is eligible for Medicare and pays a monthly premium.

What Vision Services Are Covered by Medicare Part B?

While Medicare Part B does not cover routine eye exams, eyeglasses, or contact lenses, it does cover some vision services that are deemed medically necessary. These services include:

- Annual eye exams for people with diabetes

- Glaucoma screenings for people at high risk

- Diagnostic tests and treatments for eye diseases and conditions

It’s important to note that these services must be provided by a Medicare-approved provider and must be deemed medically necessary.

How Much Does Medicare Part B Cover for Vision Services?

Medicare Part B covers 80% of the Medicare-approved amount for medically necessary vision services, after you’ve met your Part B deductible. You’ll be responsible for paying the remaining 20% coinsurance, unless you have a Medicare Supplement plan that covers this cost.

What Are the Benefits of Medicare Part B Coverage for Vision Services?

Having Medicare Part B coverage for medically necessary vision services can provide peace of mind for beneficiaries who have eye diseases or conditions that require ongoing care. It can also help to reduce out-of-pocket costs for these services, which can be significant for people on a fixed income.

What Are the Alternatives to Medicare Part B for Vision Coverage?

If you need routine eye exams, eyeglasses, or contact lenses, Medicare Part B is not the best option for coverage. Instead, you may want to consider enrolling in a Medicare Advantage plan or a standalone vision plan. These plans offer more comprehensive coverage for routine vision care and may include discounts on eyewear.

Medicare Advantage Plans

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies that contract with Medicare. These plans provide all the benefits of Original Medicare, including medically necessary vision services covered by Part B, and often include additional benefits like routine vision care, dental, and hearing services.

Standalone Vision Plans

Standalone vision plans are also offered by private insurance companies and provide coverage specifically for routine vision care, such as eye exams, eyeglasses, and contact lenses. These plans may have a monthly premium and may require a copayment or coinsurance for services.

Conclusion

In summary, Medicare Part B does cover some medically necessary vision services, but it does not cover routine eye exams, eyeglasses, or contact lenses. If you need routine vision care, you may want to consider enrolling in a Medicare Advantage plan or a standalone vision plan. It’s important to review your options and choose the plan that best meets your needs and budget.

Contents

Frequently Asked Questions

Does Medicare Part B Cover Vision?

Medicare Part B provides coverage for many types of medical services, but it does not typically cover routine eye exams or eyeglasses. However, there are some exceptions to this rule. Here are a few things to keep in mind:

First, if you have diabetes, Medicare Part B may cover an annual eye exam to check for diabetic retinopathy. This exam must be performed by an eye doctor who accepts Medicare assignment. If you are at high risk for glaucoma, Medicare Part B may also cover an annual glaucoma screening. Again, this screening must be performed by an eye doctor who accepts Medicare assignment. In addition, if you have had cataract surgery, Medicare Part B may cover one pair of eyeglasses or contact lenses after the surgery.

What Other Vision Services Does Medicare Cover?

While Medicare Part B does not cover routine eye exams or eyeglasses, other parts of Medicare may provide coverage for certain vision services. For example, Medicare Part A (hospital insurance) may cover certain eye surgeries that are performed on an inpatient basis. Medicare Part C (Medicare Advantage) plans may also offer additional vision benefits, such as coverage for routine eye exams and eyeglasses. However, these benefits vary depending on the plan.

If you are enrolled in a Medicare Advantage plan, you should check with your plan to see what vision services are covered. Keep in mind that if you choose to receive care from a provider who is not in your plan’s network, you may be responsible for paying more out of pocket.

Can I Purchase Vision Insurance to Supplement My Medicare Coverage?

Yes, you can purchase vision insurance to supplement your Medicare coverage. There are several types of vision insurance plans available, including standalone plans and plans that are bundled with other types of insurance (such as dental or hearing insurance). These plans may offer coverage for routine eye exams, eyeglasses, and contact lenses, as well as other services like LASIK surgery.

If you are considering purchasing vision insurance, be sure to carefully review the plan’s benefits and costs. Some plans may have restrictions on which providers you can see, or may require you to pay a deductible before coverage kicks in. In addition, not all vision insurance plans are created equal – some may offer more comprehensive coverage than others.

How Can I Find an Eye Doctor Who Accepts Medicare?

If you are looking for an eye doctor who accepts Medicare, you can use Medicare’s provider directory to search for providers in your area. Simply enter your zip code and the type of provider you are looking for (in this case, “ophthalmologist” or “optometrist”) and the directory will provide you with a list of providers who accept Medicare assignment.

It’s important to note that just because a provider accepts Medicare assignment does not necessarily mean that they will accept all Medicare Advantage plans. If you are enrolled in a Medicare Advantage plan, you should check with your plan to see which providers are in-network.

Does Medicare Cover Vision Services? Learn about Medicare Vision Coverage at Medicare on Video

In conclusion, Medicare Part B does cover some vision-related services, but not all. It covers certain diagnostic tests, such as glaucoma and macular degeneration tests, as well as some preventive services like yearly eye exams for people with diabetes. However, it does not cover routine eye exams, eyeglasses, or contact lenses, unless they are medically necessary.

It is important to understand what Medicare Part B covers when it comes to vision, so you can plan and budget accordingly. If you need vision services that are not covered under Part B, you may want to consider alternative options such as vision insurance or out-of-pocket expenses.

Ultimately, it is up to you to take charge of your vision health and make informed decisions about your coverage and care. Be sure to consult with your healthcare provider and Medicare representative to fully understand your options and make the best decisions for your individual needs.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts