Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching retirement age and wondering about the cost of Medicare Part B? You’re not alone. Many Americans are unclear about what they’ll have to pay for Medicare coverage, particularly when it comes to Part B. In this article, we’ll explore the question “does Medicare Part B cost anything?” and break down what you can expect to pay for this essential coverage.

Yes, Medicare Part B comes with a monthly premium. The standard premium amount for 2021 is $148.50 per month. However, if your income is above a certain threshold, you may have to pay more. Additionally, there may be other costs such as deductibles, copayments, and coinsurance. It’s important to review your plan’s details to understand all the costs associated with Medicare Part B.

Understanding the Cost of Medicare Part B

Medicare is a federal health insurance program that provides coverage to individuals aged 65 and older, as well as those with certain disabilities. Medicare Part B is an important component of the program, covering a wide range of medical services. However, many people are unsure about how much Medicare Part B costs, and whether or not they have to pay for it. In this article, we’ll explore the ins and outs of Medicare Part B costs, so you can make informed decisions about your healthcare coverage.

What is Medicare Part B?

Medicare Part B is the portion of the Medicare program that covers outpatient medical services. This includes doctor visits, lab tests, and other medical services that are not covered by Medicare Part A (hospital insurance). Part B also covers preventive services such as screenings for cancer and other chronic diseases. Unlike Part A, which is generally provided at no cost to eligible individuals, there is a monthly premium for Part B coverage.

How Much Does Medicare Part B Cost?

The cost of Medicare Part B can vary depending on a few different factors. In 2021, the standard premium for Part B is $148.50 per month. However, if your income is above a certain threshold, you may be required to pay a higher premium. The amount you pay for Part B can also be affected by whether or not you enrolled during your initial enrollment period, or if you delayed enrollment.

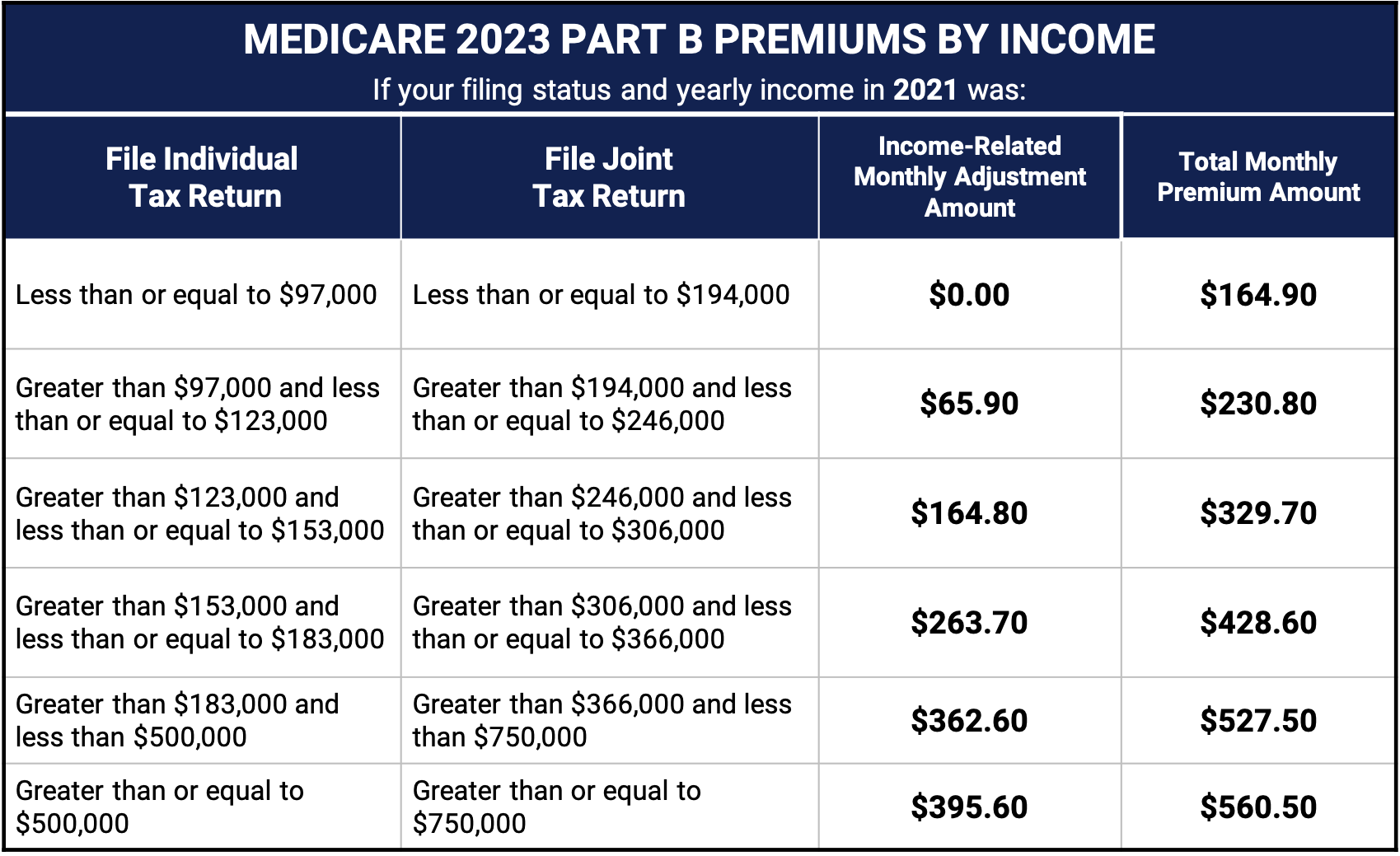

If you are required to pay a higher premium due to your income, the amount you pay will depend on your modified adjusted gross income (MAGI). Your MAGI is your total income, plus any tax-exempt interest you earned. For 2021, the income thresholds for determining Part B premiums are as follows:

-Individuals with a MAGI of $88,000 or less ($176,000 or less for couples filing jointly) pay the standard premium of $148.50 per month.

-Individuals with a MAGI between $88,000-$111,000 ($176,000-$222,000 for couples) pay a premium of $207.90 per month.

-Individuals with a MAGI between $111,000-$138,000 ($222,000-$276,000 for couples) pay a premium of $297.00 per month.

-Individuals with a MAGI between $138,000-$165,000 ($276,000-$330,000 for couples) pay a premium of $386.10 per month.

-Individuals with a MAGI above $165,000 (above $330,000 for couples) pay a premium of $475.20 per month.

Other Costs Associated with Medicare Part B

In addition to the monthly premium, there may be other costs associated with Medicare Part B. For example, there is an annual deductible, which is $203 in 2021. This means that you will need to pay $203 out of pocket before your Part B coverage kicks in. After you meet your deductible, you will typically pay 20% of the Medicare-approved amount for most services.

There is also a Part B excess charge, which is the amount a doctor or healthcare provider can charge you for services that exceed the Medicare-approved amount. However, this charge is only applicable for providers who do not accept assignment (which means they do not accept the Medicare-approved amount as full payment). Most providers do accept assignment, so this charge is not typically a concern for most Medicare beneficiaries.

Is Medicare Part B Worth the Cost?

Ultimately, the decision of whether or not to enroll in Medicare Part B will depend on your individual healthcare needs and budget. However, for most people, the benefits of Part B coverage outweigh the costs. With Part B, you will have access to a wide range of medical services, including preventive care that can help you stay healthy and catch potential health problems early.

Additionally, if you delay enrollment in Part B and do not have other health insurance coverage, you may face penalties and gaps in coverage. It’s important to carefully consider your options and weigh the costs and benefits before making a decision about Medicare Part B.

The Benefits of Medicare Part B

There are many benefits to enrolling in Medicare Part B, including:

-Access to a wide range of medical services, including doctor visits, lab tests, and preventive care.

-Ability to see any doctor who accepts Medicare, without needing a referral.

-Coverage for many preventive services, such as mammograms, colonoscopies, and flu shots.

-Protection against high medical costs, as Part B covers 80% of the Medicare-approved amount for most services.

-The option to enroll in a Medicare Advantage plan (Part C), which can provide additional benefits such as vision and dental coverage.

Medicare Part B vs. Other Insurance Options

If you have other health insurance coverage, such as through an employer or union, you may wonder whether or not you need Medicare Part B. In most cases, if you have other coverage, you can delay enrollment in Part B without facing penalties. However, it’s important to carefully review your options and compare the costs and benefits of each plan.

If you have retiree health coverage, for example, it may be more cost-effective to enroll in Medicare Part B as well. This can provide you with additional coverage and help protect against high medical costs. If you have questions about your options, you can consult with a Medicare counselor or insurance agent to get more information.

In Conclusion

Medicare Part B is an important component of the Medicare program, providing coverage for a wide range of medical services. While there is a monthly premium for Part B coverage, the benefits of the program often outweigh the costs. By carefully considering your options and reviewing the costs and benefits of different plans, you can make informed decisions about your healthcare coverage and ensure that you have access to the care you need.

Contents

Frequently Asked Questions

In this section, we have listed the most commonly asked questions about Medicare Part B and its cost.

Does Medicare Part B Cost Anything?

Yes, Medicare Part B comes with a monthly premium cost. The amount of premium you pay may vary depending on your income level. The standard Part B premium amount for 2021 is $148.50 per month. However, if your income is above a certain threshold, you may have to pay more than the standard premium amount. The income thresholds are calculated based on your tax return from two years ago.

It’s worth noting that if you are receiving Social Security benefits, your Part B premium will be deducted from your monthly benefit payment. If you are not receiving Social Security benefits, you will receive a bill for your Part B premium every three months. It’s important to pay your premium on time to avoid any late enrollment penalties.

Can I Get Help Paying for Medicare Part B?

Yes, some people may be eligible for assistance with paying their Medicare Part B premium. The most common program that provides assistance is called the Medicare Savings Program. This program helps pay for Medicare premiums, deductibles, and coinsurance for people with limited income and resources. You may also be eligible for extra help with your prescription drug costs through the Medicare Extra Help program.

To find out if you are eligible for any assistance programs, you can contact your state Medicaid office or your local Social Security office. They can help you determine if you qualify for any programs and assist you with the application process.

What Happens if I Don’t Enroll in Medicare Part B?

If you are eligible for Medicare Part B and do not enroll when you are first eligible, you may have to pay a late enrollment penalty. The penalty is added to your monthly premium for as long as you have Part B coverage. The amount of the penalty depends on how long you went without Part B coverage and can be as much as 10% of the standard premium amount.

In some cases, you may be able to delay enrolling in Part B without penalty. For example, if you have coverage through an employer or union, you may be able to delay enrolling in Part B until your coverage ends. However, it’s important to understand the rules around delaying enrollment and to make sure you enroll in Part B when you are first eligible to avoid any penalties.

When Can I Enroll in Medicare Part B?

You can enroll in Medicare Part B during your Initial Enrollment Period (IEP), which is the seven-month period that begins three months before the month you turn 65, includes the month you turn 65, and ends three months after the month you turn 65. If you are not automatically enrolled in Part B, you will need to sign up during your IEP.

You can also enroll in Part B during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. However, if you enroll during the GEP, your coverage will not start until July 1 of that year. It’s generally recommended that you enroll during your IEP to avoid any gaps in coverage.

What Does Medicare Part B Cover?

Medicare Part B covers a wide range of medical services and supplies, including doctor visits, outpatient care, preventative services, and medical equipment. Some specific services that are covered include:

- Doctor visits

- Outpatient surgery

- Laboratory tests

- Diagnostic imaging

- Preventative services (such as flu shots and cancer screenings)

- Durable medical equipment (such as wheelchairs and oxygen equipment)

It’s important to note that while Part B covers a lot of services, it does not cover everything. For example, it does not cover most prescription drugs, dental care, or vision care. You may need to purchase additional insurance to cover these services.

The Cost Of Medicare Part B in 2023: You Should Expect THESE Bills 💵

In conclusion, Medicare Part B is a critical component of healthcare for millions of Americans. It provides coverage for essential medical services, including doctor visits, preventive care, and outpatient care. While there is a monthly premium for Part B, many beneficiaries qualify for assistance to help cover the cost. It’s important to understand the different factors that can affect your Part B premium, such as your income and the year you enroll. Overall, Medicare Part B is an invaluable resource for seniors and those with disabilities who need access to quality healthcare.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts