Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

Are you approaching the age of 65 or already enrolled in Medicare? If so, you might be wondering if Medicare Part B has a deductible. Medicare Part B covers outpatient services such as doctor visits, lab tests, and preventive care. In this article, we will explore whether Part B has a deductible, how it works, and what you can expect to pay out of pocket.

Understanding Medicare benefits can be overwhelming, especially when it comes to deductibles and out-of-pocket costs. That’s why we’ve compiled all the information you need to know about Medicare Part B deductibles. Keep reading to learn more about how this deductible works and what it means for your healthcare expenses.

Does Medicare Have a Deductible for Part B?

Medicare is a federal health insurance program that provides coverage for people who are 65 or older, as well as for younger people with certain disabilities. Medicare is divided into several parts, including Part A, Part B, Part C, and Part D. While Part A covers hospital stays and some skilled nursing care, Part B covers doctor visits, outpatient services, and preventive care. One question that many Medicare beneficiaries have is whether or not there is a deductible for Part B. In this article, we will explore this topic in detail.

What is a Deductible?

Before we dive into whether or not there is a deductible for Medicare Part B, it’s important to understand what a deductible is. A deductible is the amount of money you have to pay out of pocket before your insurance coverage kicks in. For example, if you have a $1,000 deductible and you need to have a medical procedure that costs $2,000, you would have to pay $1,000 out of pocket before your insurance would cover the remaining $1,000.

Is There a Deductible for Medicare Part B?

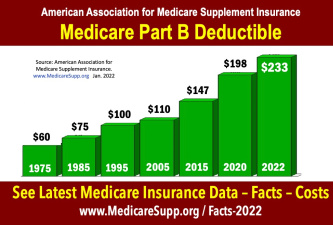

The answer is yes, there is a deductible for Medicare Part B. In 2021, the Part B deductible is $203. This means that you will have to pay the first $203 of your medical expenses out of pocket before Medicare will begin to cover your costs. It’s important to note that this deductible only applies to Part B services, not to Part A services.

What Services Does the Part B Deductible Apply To?

The Part B deductible applies to a wide range of services, including doctor visits, outpatient care, and preventive services. Some of the specific services that are subject to the deductible include:

- Doctor visits

- Laboratory tests

- X-rays

- Durable medical equipment (DME)

- Outpatient surgeries

It’s important to note that some services, such as screenings for certain cancers and flu shots, are not subject to the Part B deductible.

What Happens After I Meet the Deductible?

Once you meet the Part B deductible, Medicare will begin to cover your costs. However, it’s important to understand that you will still be responsible for paying co-insurance and/or co-payments for some services. For example, you may have to pay 20% of the Medicare-approved amount for doctor visits and other services. In addition, if you receive services from a provider who does not accept Medicare assignment, you may be responsible for paying the difference between the Medicare-approved amount and the provider’s actual charge.

Are There Any Exceptions to the Part B Deductible?

There are a few exceptions to the Part B deductible. For example, if you receive services from a provider who accepts Medicare assignment, the provider cannot charge you more than the Medicare-approved amount for the service. In addition, if you are enrolled in a Medicare Advantage plan, your plan may have different rules regarding deductibles and cost-sharing.

What are the Benefits of Having a Part B Deductible?

While it may seem like a disadvantage to have to pay a deductible for Part B services, there are actually some benefits to this system. For one, having a deductible can help to discourage overuse of medical services, which can help to reduce overall healthcare costs. In addition, having a deductible can make Medicare more sustainable over the long term by ensuring that beneficiaries have some skin in the game.

Part B Deductible vs. Part A Deductible

It’s important to note that the Part B deductible is different from the Part A deductible. The Part A deductible applies to hospital stays and is a separate cost from the Part B deductible. In 2021, the Part A deductible is $1,484 per benefit period. This means that if you are hospitalized and released, and then are re-hospitalized within 60 days, you will not have to pay the deductible again.

Conclusion

In summary, yes, there is a deductible for Medicare Part B. The deductible in 2021 is $203, and it applies to a wide range of services. Once you meet the deductible, Medicare will begin to cover your costs, but you may still be responsible for paying co-insurance and/or co-payments. While having a deductible may seem like a disadvantage, it can actually help to reduce overall healthcare costs and make Medicare more sustainable over the long term.

Contents

- Frequently Asked Questions

- 1. Does Medicare Part B have a deductible?

- 2. Are there any services that are exempt from the Part B deductible?

- 3. Can I get help paying for the Part B deductible?

- 4. When do I need to pay the Part B deductible?

- 5. How does the Part B deductible differ from the Part A deductible?

- How Do You Pay the Part B Deductible?

Frequently Asked Questions

Medicare Part B is a medical insurance program that covers medically necessary services and supplies. Many people wonder if it has a deductible. Here are some frequently asked questions and their answers:

1. Does Medicare Part B have a deductible?

Yes, Medicare Part B does have a deductible. The deductible amount can change each year and is set by the government. In 2021, the Part B deductible is $203. This means that you will need to pay the first $203 of your medical expenses each year before Medicare starts to pay its share.

It is important to note that the Part B deductible is an annual deductible. This means that you will need to meet it once per year, regardless of how many times you use your Medicare benefits during that year.

2. Are there any services that are exempt from the Part B deductible?

Yes, there are some services that are exempt from the Part B deductible. These services include preventive services such as flu shots, screenings for cancer, and other services that are considered to be medically necessary. These services are covered by Medicare without you having to pay the Part B deductible.

It is important to note that while these services may be exempt from the Part B deductible, you may still be responsible for paying a copayment or coinsurance for them.

3. Can I get help paying for the Part B deductible?

Yes, there are some programs that can help you pay for the Part B deductible. These programs are designed to assist people who have limited income and resources. One such program is the Medicare Savings Program. This program can help you pay for your Part B deductible as well as other Medicare costs.

To qualify for the Medicare Savings Program, you must meet certain income and asset requirements. If you are eligible, the program can help you pay for your Part B deductible, as well as other Medicare costs such as premiums and coinsurance.

4. When do I need to pay the Part B deductible?

You will need to pay the Part B deductible each year before Medicare will start to pay its share of your medical expenses. This means that if you have a medical appointment or procedure early in the year, you will need to pay the deductible before Medicare will start covering your costs.

It is important to note that if you have a Medigap policy, it may cover some or all of your Part B deductible. If you have a Medicare Advantage plan, your plan may have its own deductible that you will need to pay.

5. How does the Part B deductible differ from the Part A deductible?

While both Medicare Part A and Part B have deductibles, they are different. The Part A deductible is for hospital stays and is a per-benefit period deductible. This means that you will need to pay the deductible each time you are admitted to the hospital.

The Part B deductible, on the other hand, is an annual deductible. This means that you will only need to pay it once per year, regardless of how many times you use your Medicare benefits during that year.

How Do You Pay the Part B Deductible?

In conclusion, Medicare Part B does have a deductible that beneficiaries must pay each year before their coverage begins. This deductible amount can change annually and is set by the government. While the deductible may seem daunting, it is important to remember that Medicare Part B covers a wide range of medical services and can provide essential healthcare coverage for seniors and people with disabilities.

It is also important to note that there are options for individuals who may struggle with the cost of the Part B deductible. Some beneficiaries may qualify for assistance programs that can help cover the cost of the deductible and other medical expenses. Additionally, some Medicare Advantage plans may offer lower deductibles or even no deductibles at all.

Overall, while the Medicare Part B deductible may seem like an additional expense, it is an important aspect of the program that helps ensure beneficiaries have access to necessary medical care. By understanding the deductible and exploring potential options for assistance, beneficiaries can make informed decisions about their healthcare coverage and ensure they receive the care they need to stay healthy and well.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts