Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify...Read more

As we age, our health becomes increasingly important, and many of us may require medication to manage chronic conditions. If you have diabetes, you may have heard of Jardiance, a popular medication used to control blood sugar levels. But what about the cost? Does Medicare cover Jardiance, or will you need to pay out of pocket? Let’s explore this topic in more detail and find out what options are available to you.

Medicare is a critical health insurance program for millions of Americans, but it can be confusing to navigate, especially when it comes to prescription drug coverage. With the rising cost of medication, it’s essential to understand whether Jardiance is covered under your plan. In this article, we’ll break down the details of Medicare coverage for Jardiance, so you can make an informed decision about your healthcare.

Does Medicare Cover Jardiance?

If you are a Medicare beneficiary who is currently taking or considering taking the medication Jardiance, you may be wondering if it is covered by your Medicare plan. Jardiance is a medication used to treat type 2 diabetes, and it works by helping to lower blood sugar levels. Let’s take a closer look at whether or not Medicare covers Jardiance.

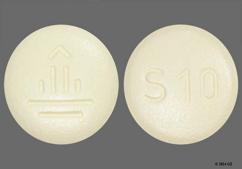

What is Jardiance?

Jardiance is a prescription medication used to treat type 2 diabetes. It belongs to a class of drugs called SGLT2 inhibitors, which work by blocking the reabsorption of glucose in the kidneys, allowing it to be eliminated from the body through urine. Jardiance is typically prescribed in combination with diet and exercise to help lower blood sugar levels in people with type 2 diabetes.

Does Original Medicare Cover Jardiance?

Original Medicare, which includes Medicare Part A and Part B, typically does not cover prescription medications that are taken at home, like Jardiance. However, there are some exceptions to this rule. If you receive Jardiance as part of your treatment during a hospital stay, it may be covered by Medicare Part A. Additionally, if you have Original Medicare and are enrolled in a Medicare Part D prescription drug plan, you may be able to get coverage for Jardiance through that plan.

Does Medicare Advantage Cover Jardiance?

Medicare Advantage plans, also known as Medicare Part C, are offered by private insurance companies and are required to provide at least the same level of coverage as Original Medicare. Many Medicare Advantage plans also offer additional benefits, like prescription drug coverage. If you are enrolled in a Medicare Advantage plan that includes prescription drug coverage, you may be able to get coverage for Jardiance through that plan.

How Much Does Jardiance Cost?

The cost of Jardiance can vary depending on a number of factors, including your insurance coverage, the pharmacy you use, and the dosage prescribed. Without insurance, Jardiance can be quite expensive. The average retail price for a 30-day supply of Jardiance is around $500. However, if you have insurance coverage, your out-of-pocket costs may be significantly lower.

What Are the Benefits of Jardiance?

Jardiance has been shown to be effective in helping to lower blood sugar levels in people with type 2 diabetes. In addition, it has been shown to have other health benefits, including reducing the risk of heart attack, stroke, and kidney disease. Jardiance is generally well-tolerated and has a low risk of causing hypoglycemia (low blood sugar).

How Does Jardiance Compare to Other Diabetes Medications?

There are many different medications available to treat type 2 diabetes, and Jardiance is just one of them. Some other common diabetes medications include metformin, sulfonylureas, and insulin. Jardiance is often used in combination with other diabetes medications to help lower blood sugar levels. Your healthcare provider can help you determine which diabetes medication or combination of medications is right for you.

What Are the Side Effects of Jardiance?

Like all medications, Jardiance can cause side effects. Some common side effects of Jardiance include urinary tract infections, yeast infections, and increased urination. In rare cases, Jardiance can also cause serious side effects like dehydration, ketoacidosis (a serious complication of diabetes), and kidney problems. If you experience any side effects while taking Jardiance, be sure to talk to your healthcare provider.

Should You Take Jardiance?

Whether or not you should take Jardiance depends on a number of factors, including your overall health, your current medications, and your personal preferences. Jardiance can be an effective option for people with type 2 diabetes who are looking to lower their blood sugar levels and reduce their risk of complications. However, it may not be the right choice for everyone.

Conclusion:

In conclusion, Medicare coverage for Jardiance depends on the type of Medicare plan you have. If you have Original Medicare, you may be able to get coverage for Jardiance through a Medicare Part D prescription drug plan. If you have a Medicare Advantage plan that includes prescription drug coverage, you may be able to get coverage for Jardiance through that plan. Regardless of your insurance coverage, it’s important to talk to your healthcare provider about whether or not Jardiance is the right choice for you.

Contents

Frequently Asked Questions

Does Medicare Cover Jardiance?

Jardiance is a medication that is mainly used to treat type 2 diabetes. It is designed to help lower blood sugar levels in the body. If you have Medicare coverage, you may be wondering if this medication is covered by your plan. The answer is yes, but there are certain conditions that need to be met.

Jardiance is covered by Medicare Part D, which is the prescription drug coverage. However, you need to have a prescription from your doctor in order for it to be covered. Additionally, your doctor needs to show that Jardiance is medically necessary for your condition.

In order to get the most coverage for Jardiance, you should make sure that you are enrolled in a Medicare Part D plan that covers the medication. You should also talk to your doctor about your options and whether Jardiance is the best medication for your type 2 diabetes.

What are the Costs of Jardiance with Medicare Coverage?

If you have Medicare coverage and are prescribed Jardiance, you may be wondering about the costs associated with the medication. The cost will depend on the specific Medicare Part D plan that you are enrolled in.

The cost of Jardiance with Medicare coverage can vary widely depending on your plan. You may be responsible for paying a deductible, copayment, or coinsurance for the medication. However, there may be programs available to help you with the cost of the medication.

If you are concerned about the cost of Jardiance with Medicare coverage, you should talk to your doctor or pharmacist. They can help you understand your options and find programs that may be able to help you with the cost of the medication.

Does Medicare Cover Prescription Medications?

In conclusion, Medicare does cover Jardiance, but it depends on the specific plan and circumstances of the individual. It is important for Medicare beneficiaries to understand their coverage options and consult with their healthcare provider to determine if Jardiance is the right medication for them.

For those who are covered by Medicare Part D, Jardiance is typically covered as a prescription drug. However, it is important to note that the cost may vary depending on the specific plan and the pharmacy where it is purchased.

Overall, it is important for Medicare beneficiaries to stay informed about their coverage options and to work closely with their healthcare providers to ensure they are receiving the appropriate care and medications for their specific health needs. With the right knowledge and support, individuals can receive the treatment they need to maintain their health and well-being.

Introducing Roger Clayton, a healthcare maestro with two decades of unparalleled experience in medical insurance. As the visionary behind Medinscoverage, Roger's mission is to demystify the labyrinth of healthcare coverage, empowering individuals to make well-informed decisions about their well-being. His profound industry knowledge has been the cornerstone in crafting the website's exhaustive resources, offering users indispensable guidance and tools for their healthcare needs.

More Posts